Buy The F * cking Dip. Estimation and forecast from Willie Wu.

This is a very short update, covering the mainfundamental factors underlyingcurrent decline. In a previous post just four days ago, I expected sideways consolidation. Since then, the price of BTC has dropped from $64.3k to a low of $55.4k before rebounding to $58k at the time of writing. This move appears to define a consolidation range.

Brief summary as of 19 November 2021:

- Macro perspective:practically unchanged from the previous post.Retail investors continue to buy into declines, which is a strong sign of a continuation of the upward macrotrend. And I still expect the bull market to continue into at least the first quarter of 2022.

- Short term:Hodlers buy this decline, creating strong support at current price levels.

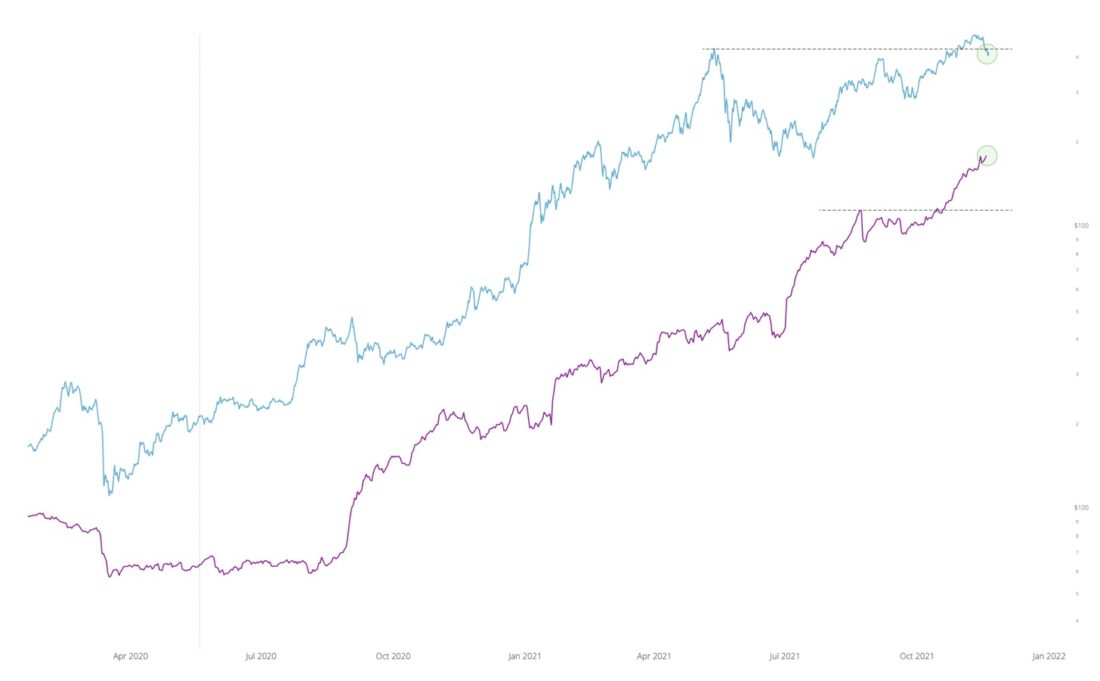

- Ethereum:ETH's drop is simply due to correlation with BTC. Meanwhile, on-chain fundamentals continue to strengthen. I am very optimistic about the prospects for the ETH/BTC exchange rate.

- Price Expectations:bullish.

- Confidence level:high.

Macro Perspective: Retail Investors Continue To Buy Back Decline

Retail investors, defined as hodlers withwith a balance of 1 BTC or less, continue to buy back the decline as the price declines. Experience shows that retail demand has a major impact on the macrocycle: bull markets end when retail investors stop buying. This is not what is happening now. In fact, the level of retail demand provides a very strong signal that the current decline is consolidation and not the start of a bear market.

Shrimp Buy / Sell Heatmap. Heatmap of net buy / sell by hodlers with a balance of less than 1 BTC

Short term: retail investors continue to buy back the decline

The diagram below shows that the hodlers are on the currentdownward buying, while speculative swing traders are reluctant to part with their bitcoins. This is the first significant buying impulse from hodlers since early October.

Bitcoin Supply Shock

The heatmap below presents virtually the same data in a different way: shoppers are active.

Long Term Investors: Buy / Sell Heatmap

Comment on ETH

On-chain demand for Ethereum continues to updaterecords despite even a drop in price due to the correlation with bitcoin. Fundamental on-chain metrics continue to show the relative strength of ETH versus BTC.

Ethereum Supply Shock

All charts are made at charts.woobull.com

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.