One of the world's largest mainstream publications, Bloomberg, presented its own report on the state of affairs inBitcoin ecosystem, according to which everyone says that the first cryptocurrency will be bullish rally in the style of 2017.

According to the authors, a collapse in the stock markets will temporarily affect Bitcoin. The end result, however, will be more reminiscent of what happened to gold after the 2008 financial crisis.

Data: goldprice.org

Born in 2009, the cryptocurrency, althoughconsidered a high-risk and volatile asset, in comparison with other market instruments, for example, the S&P 500, is showing good results this year.

In 2020, when the world is embraced by a relatedThe COVID-19 pandemic is a crisis, and states are printing huge amounts of paper money to support the economy, Bitcoin is waiting for a key test in the process of becoming a quasi-currency like gold. And with this test, the researchers believe, it will successfully cope.

“Bitcoin and gold will benefit most from the unprecedented monetary stimulus, accompanied by a fall in the stock markets.”— the report says.

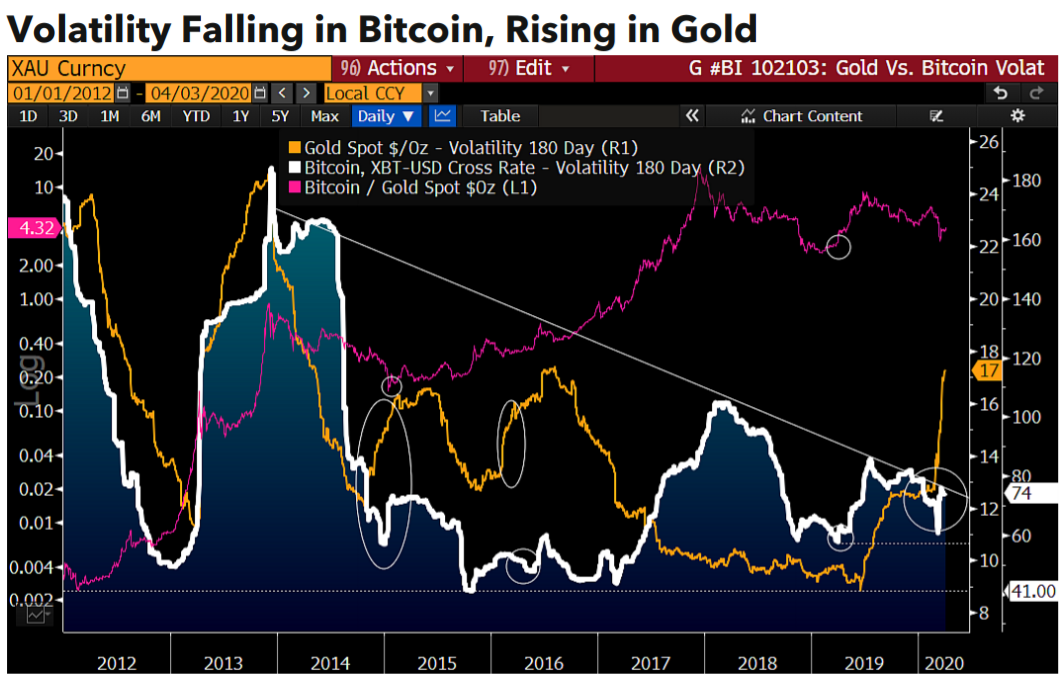

The appearance of Bitcoin futures tamed the bull2017 rally. However, growth in open positions, decreasing volatility and comparative outperforming dynamics, which can be observed against the backdrop of falling stock markets, indicate that bitcoin is entering the maturity stage and is becoming more and more a digital version of gold than an asset for speculation.

Authors Expect Bitcoin Volatility to Bedecline, and this is an extremely important observation: it is the historically lowest level of volatility that was observed in October 2015 that marked the beginning of a bull rally, the culmination of which with the cryptocurrency price reaching historic highs in December 2017.

Recall, on the eve of the price of bitcoin went sharplyup, rising in the moment to $ 7,750, which amounted to 100% growth from a minimum of March 13. This growth was preceded by an increase in network activity, which may indicate that new investors are entering the market.