Bitcoin bulls are finally retreating. After the cryptocurrency skyrocketed to $42,000 in early 2021year, the price today fell below $29,000.And since BTC is one of the most popular assets these days, experts were quick to give their opinions. Analysts J.P. Morgan said $40K is a “key battleground” that bulls must re-use to continue the uptrend. The Bloomberg report says much the same thing. Well, we would be very impressed if JPM and Bloomberg identified $40k as a key level when BTCUSD was $20k or $30k. But what's the point of stating the obvious when there is already resistance at $40k for everyone to see? You don't need to be an expert to do this. We at EWM Interactive also had no idea that the $42K top would form. With the price rising by thousands of dollars every day, it was anyone's guess how much it could go up. However, we knew that no trend lasts forever, and Bitcoin is unlikely to either. As BTCUSD continued to rise, we urged subscribers not to chase it. Fortunately, even if an accurate forecast is not always possible, traders can always be prepared if they have the right mindset. The following charts show how the Elliott Wave principle helped us prepare for a reversal. Moreover, how could one take advantage of the situation when the market's intentions became clearer.

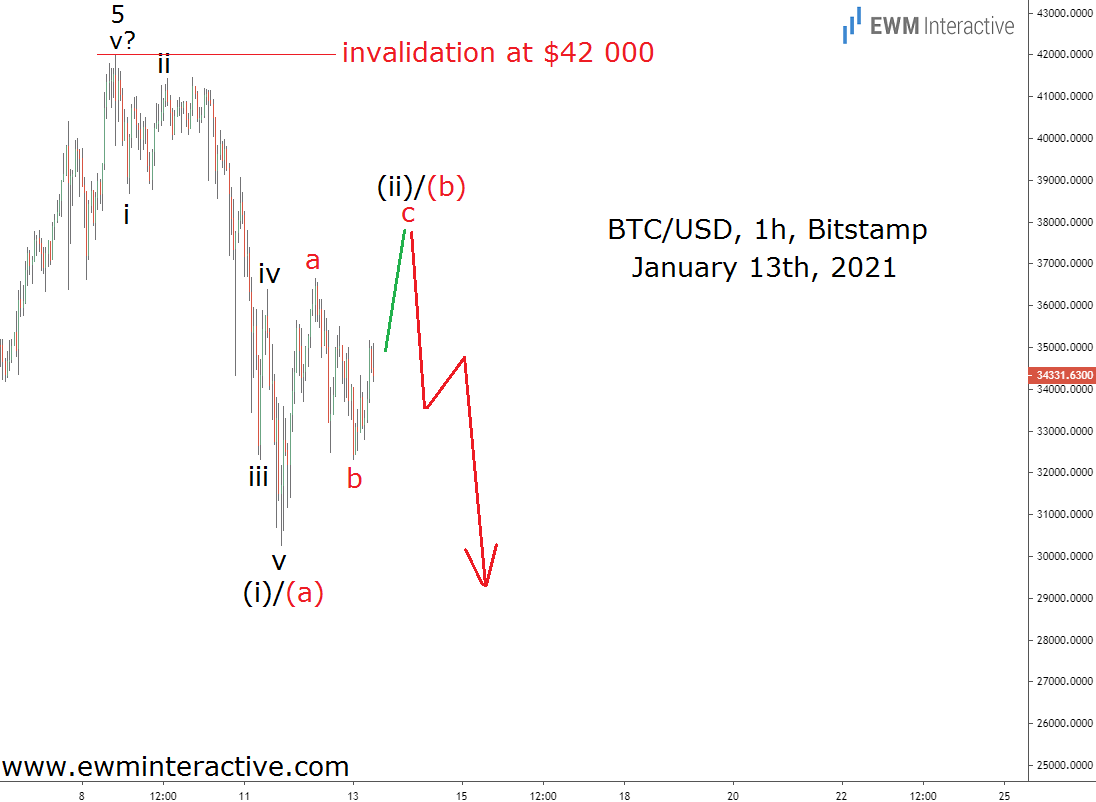

It was January 10th and the price was just under 40one thousand dollars. Bitcoin's 4-hour chart showed a clear five-wave impulse from $ 16,218 to $ 42,000. Of course, such a picture did not arise out of nowhere. It found its place in our big picture, which we shared with our subscribers that day. This was not easy either, since we are always against catching peaks. It was just a suggestion that it was better to stay out of the way as the correction follows each impulse. Three days later, when it came time to send updates to customers on Wednesdays, Bitcoin had already dropped to $ 34,300.

BTCUSD fell to $ 30,261 on Monday 11January. The decline, although not very clear, can be viewed as an impulse pattern denoted by i-ii-iii-iv-v. This meant that the ensuing recovery was most likely part of a three-wave correction in wave (ii) / (b). As long as $ 42,000 remained intact, another sell-off was expected to occur in wave (iii) / ©. A week later, it was already in the process.

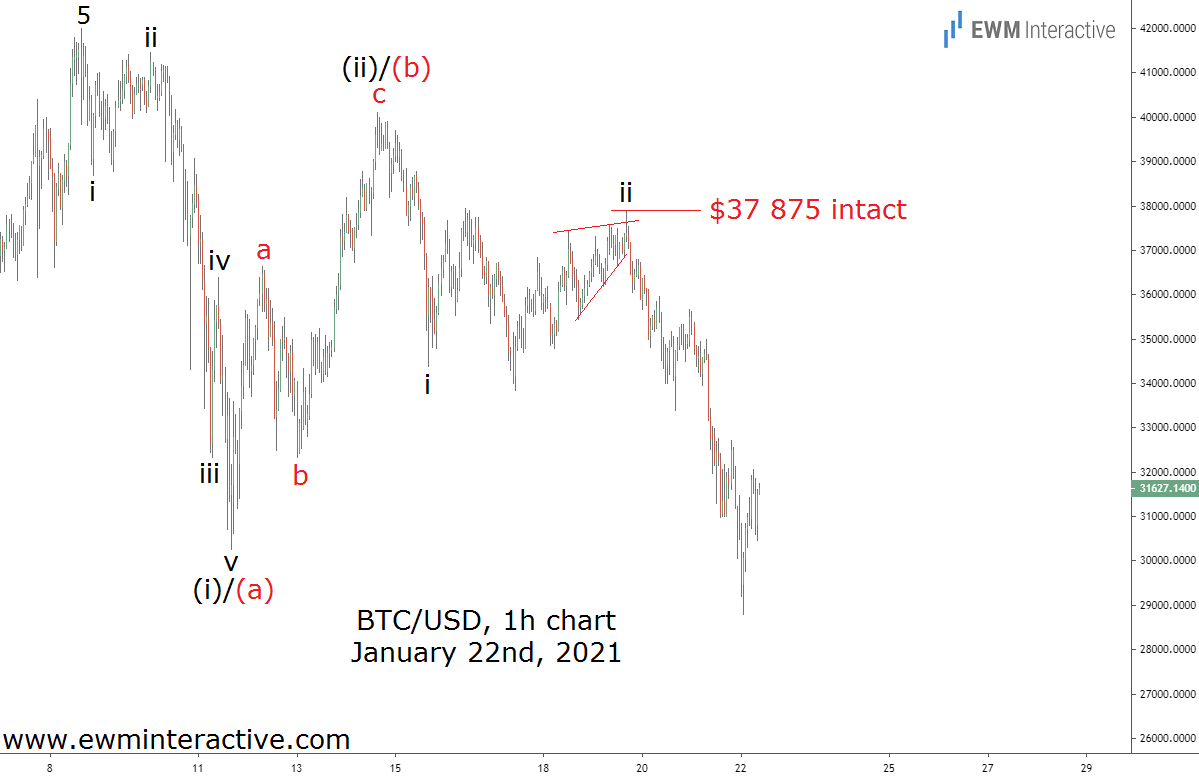

Wave (ii) / (b) ended on January 14 at level 40113 dollars. However, the rest of the development should be part of wave (iii) / ©. And since the initial targets of the bears were below the bottom of wave (i) / (a), it made sense to expect more weakness below $ 30K. This chart also allowed us to shift the cancellation rate from $ 42K to $ 37,875. With Bitcoin at $ 35,500, the risk / reward ratio was not bad at all.

The price of Bitcoin continued to decline.Today, the bears crossed the $30,000 mark and even reached $28,800. From a peak of $42 thousand, that is, 31.4% less than in two weeks. In our opinion, this extreme volatility makes the adoption of Bitcoin as a widely accepted form of payment highly impractical. Imagine if Apple, Coca-Cola or Unilever risked losing 30% of the value of their sales in a matter of days simply because of an unstable currency …

translation from here

Free access to US market analytics at elliottwave com

This is why Bitcoin "rejected" the $ 42,000 mark

Crypto Trading Guide: 5 Simple Strategies To Watch Out For New Opportunity

Now the handbook for wave enthusiasts, “The Elliott Wave Principle,” can be found in free access here

And don’t forget to subscribe to my telegram channel and YouTube channel

Free Guide “How to Find High Potential Trading Opportunities Using Moving Averages”

If you find the article interesting, put pluses and add to favorites.