Due to the increasing chaos and global panic in the markets, Bitcoin continues to rapidly lose its position and is already trading at $5,000.

After yesterday's collapse to $6000 to the bullsIt was only possible to stabilize the situation for a short time, since another decline occurred tonight, during which the BTC rate was below $4,000 for some time. However, then the price rebounded and at the time of publication, the price of Bitcoin is $5088, having lost 32.05% over the past 24 hours.

EXANTE analyst Viktor Argonov believes thatThe final phase of the fall below $5800 was price manipulation on the part of large players, but the rebound from $3800 is most likely due to the breaking of the mining profitability limit. When the BTC rate is below $4,000, coin mining becomes unprofitable almost everywhere, which reduces the number of sellers. Since most large traders know this, they do not expect Bitcoin to fall significantly below this level, and a breakout for them is a clear signal to buy.

Despite apparent oversold, currentindicators do not portend dramatic changes in the short term. A confident rebound can be expected only after the recession of macroeconomic panic and the stock market out of the free fall mode. Prior to this, the cryptocurrency market will follow a general trend. Currently, even gold has begun to lose ground.

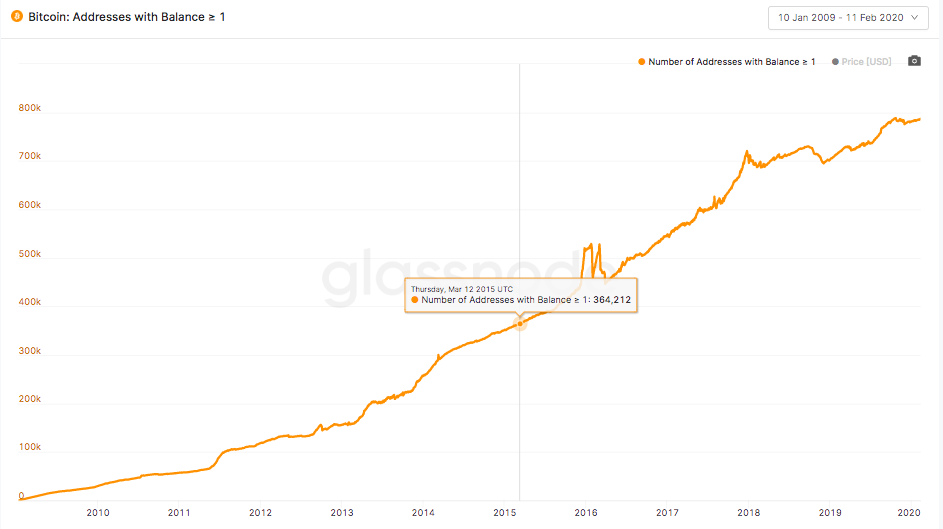

However, massive sales attractedthe attention of retail investors to the low price of Bitcoin. According to Glassnode, the number of wallets containing more than 1 BTC continues to grow, and during the sale period increased to a record 795 630 units. The number of users who have more than 10 coins in their hands also continues to grow steadily.

Company experts say that such a dynamicmay indicate an increase in interest on the part of retail investors who decided to take advantage of the collapse in anticipation of halving and purchase cryptocurrency at a low rate.

</p>