Today, March 12, the price of Bitcoin hit the level of $ 7,000, and then $ 6,000, at some point reaching $ 5,900 on the Bitstamp exchange.

UPDATE:Bitcoin price dropped below $ 6,000:

TradingView BTC / USD chart from TradingView

The chart below shows that the price drop was sudden, amid an impressive surge in trading volumes:

TradingView BTC / USD chart from TradingView

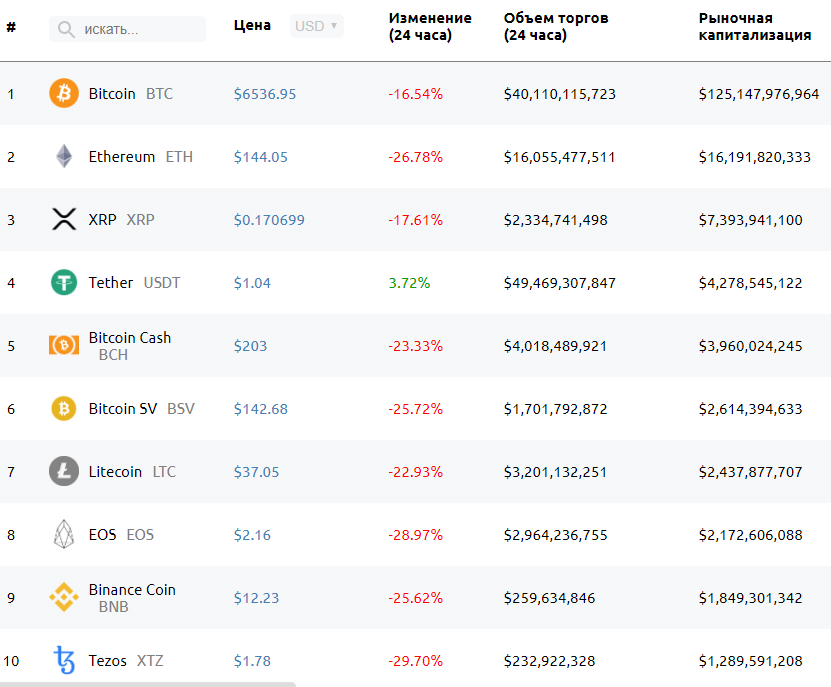

The top ten most capitalized assets now look like this:

As you can see, many of the top ones fell by almost 30%. The stablecoin Tether has lost parity with the underlying dollar.

The head of the popular exchange Binance Changpeng Zhaoreported delays and malfunctions in the spot and futures platforms. According to him, the load on the system today was 5 times higher than previous peak values.

</p>According to trader Alex Krueger, the chainlink ismonet (LINK) at some point collapsed 99.9%, to the level of $ 0.0001.

</p>The panic sale lowered the price of bitcoin to around $ 5,550 on the Binance futures platform. In the moment, the market value dropped even to $ 5200.

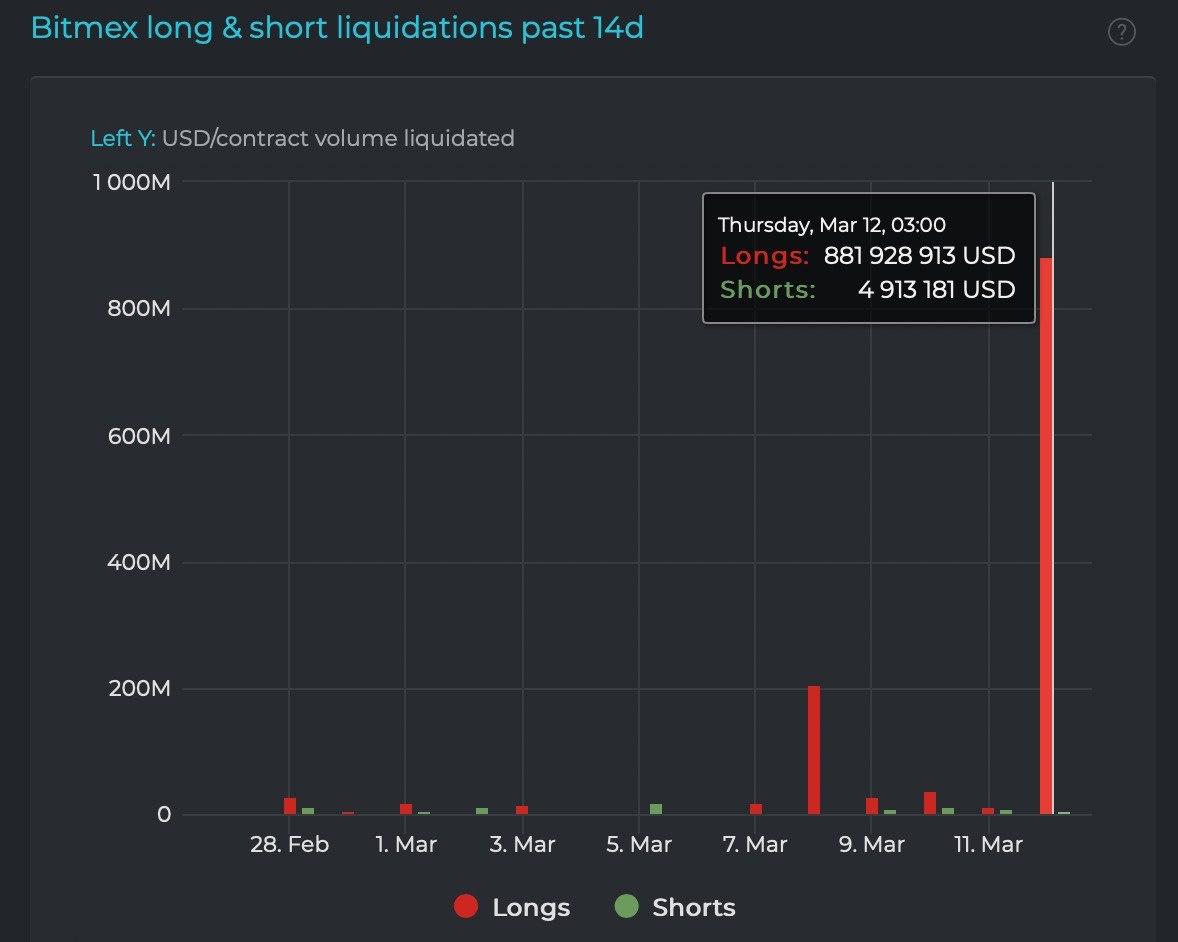

Almost $ 900 million of bitcoin positions were liquidated on the BitMEX crypto-derivative exchange. Thus, the September 2019 record of $ 710 million was broken.

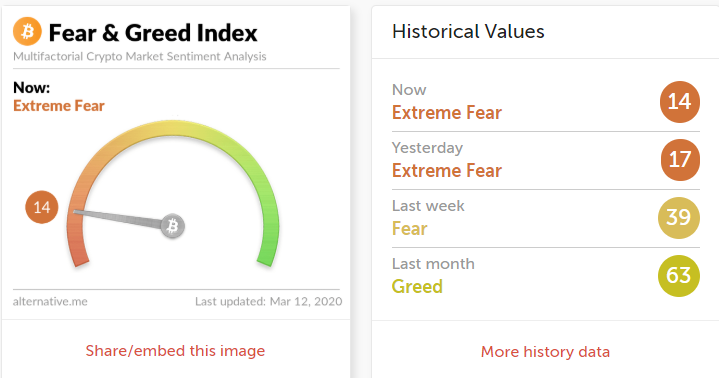

Against the background of what is happening, the cryptocurrency “index of fear and greed” has reached a new low of 14 (“extreme degree of fear”):

The total capitalization of the cryptocurrency market decreased by about a quarter, to the level of $ 152 billion.

A sharp drop in the price of Bitcoin occurs against the backdrop ofcontinued collapse of traditional markets. Thus, the key European stock indices, the German DAX, the French CAC and the British FTSE 100, are declining by 6%. S&P 500 index futures are signaling the US stock market will open with a drop of more than 4.5%. The value of traditionally safe assets - gold, the Japanese yen and US Treasuries - is rising slightly.

The impetus for a new round of stock salesThe World Trade Organization acknowledged the outbreak of the coronavirus as a global pandemic, as well as the introduction by the American President Donald Trump of a ban on entering the United States from Europe. Investors continue to raise interest rates on the approaching crisis in the global economy.

</p>Earlier, ForkLog reported a decline in the activity of institutional investors on the CME exchange amid the collapse of traditional markets.