Have you ever heard from a financial advisor?(or maybe even from parents)what your money owesgrow? This idea has become so ingrained in the minds of working people around the world that it has become almost inextricably linked to the very idea of work.

</p>These words were repeated so often that they are now virtually part of the work culture. Get a paid position, set maximum contributions for your pension plan(your employer may be contributing 3%!), pick a couple of mutual funds with loudnames and watch your money grow. Most follow this path on autopilot without thinking about the meaning and without realizing the risks. After all, this is what "smart people" do. Many people now associate this activity with savings, but in fact, financialization has turned pension plan participants into eternal risk carriers, and, as a result, financial investments for many, if not for most, have become a second permanent job.

Financialization has become so normal by distortingthe perception that the line between saving (risk-free) and investing (risk-taking) has blurred to the point where most people think they are one and the same. The conventional wisdom that financial engineering is a must-have route to a happy retirement doesn't make sense.

Over the past decades, economies around the world, but especially in developed countries(particularly in the USA)became increasingly financialized.Increasing financialization has become a constant companion to the idea that your money should grow. But this idea itself arose in the mass consciousness only when everyone got used to the sad fact that money loses its value over time.

Money loses value → Money must grow → For money to grow, financial products are needed → Repeat

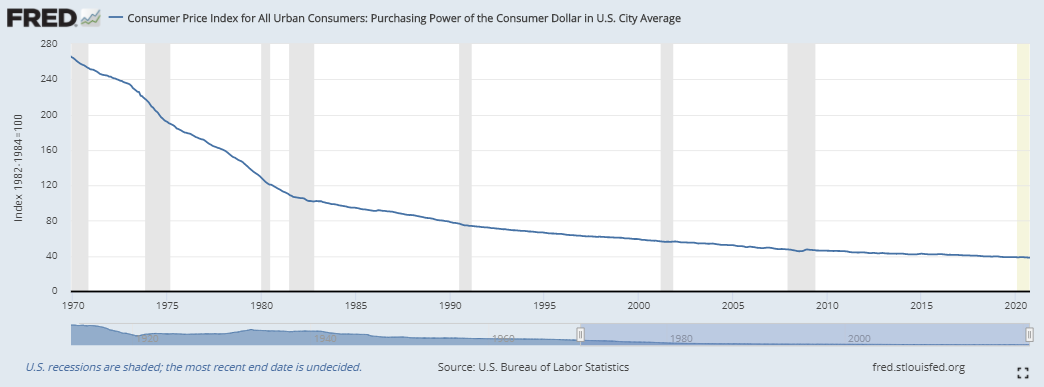

The purchasing power of the US dollar in dynamics (from 1970 to 2020). : FRED

This need is largelyexists precisely because money is gradually depreciating. This is the starting point, and the saddest thing is that central banks are deliberately creating this situation. Most central banks in the world seek to devalue their national currencies by about 2% per year, and for this they increase the money supply. How or why is not so important; the main thing is that it is a fact that has its consequences. Rather than just saving for a rainy day, pension funds invest at constant risk, often just to keep up with inflation generated by central banks.

Central banks artificially create demand forsuch an investment, devaluing money. An over-financialized economy is a logical consequence of monetary inflation, which encourages constant risk taking and makes saving unattractive. A system that makes saving unattractive and forces people to take risks creates instability, which is unproductive and unreasonable. It should be obvious even to the common man that behind the trend towards financialization and financial engineering in general is the disordered motivational structure of the money on which all economic activity relies.

At a fundamental level in shareholdersThere is nothing necessarily wrong with societies, bond issues or any collective investment vehicles. While individual investment vehicles may have structural weaknesses, collective investment and capital allocation can generate(and often bring)income.The problem is not the sharing of risks or the existence of financial assets. The fundamental problem is the extent to which the economy has become financialized, and that this is increasingly a by-product of a completely rational reaction to a disordered and manipulated monetary structure.

: American Express

What happens when hundreds of millions of participantsthe market realizes that their money is artificially, deliberately deprived of 2% of its value annually? They either accept inevitable depreciation or try to keep pace with inflation by taking on additional risks. And what does it mean? Money needs to be invested, that is, to risk losing it. As the monetary depreciation continues unabated, this cycle continues. Basically, people take risks in their “main” job, and then they are taught to risk the money they manage to save just to keep up with inflation. It looks like a squirrel in a wheel. Run as hard as you can just to stay where you are. It may sound crazy, but this is the current reality. And this has its consequences.

Savings and risks

Although the relationship between savings and risks is oftenmisunderstood, those who want to accumulate savings must take risks. This risk takes the form of investing time and energy in something that others value.(and must continue to appreciate)to receive payment(and keep getting it)... It all starts with studies, internships and, finally, perfecting a craft that others value.

This is the risk:spend time and energy trying to make a living and produce something of value for others, while implicitly accepting a high degree of future uncertainty. If successful, you end up with a full audience of students, a product on a shelf, a world-class performance, a full day of hard manual labor, or anything else appreciated by others. People take risks in the hope and expectation that someone will compensate them for their time and value.

As a rule, compensation takes the form of money,because money, as an economic commodity, allows people to convert their own value into the value created by others. In a world where money is not manipulated, saving money can be described as the difference between the value you have produced for others and the value that others have created and consumed by you. Savings are simply deferred consumption or investments. In other words, it is a surplus in the form of what you have produced but not yet consumed. However, today's world is not like that. Modern money contains a fly in the ointment.

Central banks create more and moremoney, which leads to a permanent depreciation of savings. The entire motivational structure of money is manipulated, including the accounting of who created and consumed what value. The value created today is guaranteed to buy less in the future, as central banks randomly allocate new units of currency. Money must save value, not lose it, and when central banks manipulate the monetary economy, everyone is involuntarily in a position where they take risks to offset depreciating savings. The endless depreciation of money savings forces the participants in the economy to take unwanted and unjustified risks. Instead of simply reaping the benefits of the risks already taken, everyone is forced to take additional risks.

: Unsplash

Forcing almost everyone to take risksparticipants in the economic system - this is unnatural and insignificant for the functioning of the economy. On the contrary, it harms the stability of the system as a whole. As an economic function, risk taking is in itself productive, necessary, and inevitable. The unhealthy thing here is that people are forced to take risks because central banks create more money, so that money loses value, regardless of whether people are aware of causality. Risk taking is productive when it is purposeful, voluntary and occurs with the aim of accumulating capital. While the line between productive investments and those encouraged by monetary inflation is thin, it is still clear. Productive investments occur naturally when market participants strive to improve their own lives and those of those around them. The free market initially contains incentives to take risks. In the event of central bank intervention, nothing can be gained, but a lot can be lost.

Risk taking is counterproductive whenoccurs rather in a forced situation, and not on their own. It should be intuitive, and this is what it looks like when monetary depreciation pushes an investment. It should be recognized that 100% of all future investment (and consumption) comes from savings. The manipulation of monetary incentives, and especially the creation of barriers to savings, simply distorts the timing and conditions of future investments. This puts pressure on the participants in the economy and makes them use their savings faster. Inevitably, there is a hot potato game where no one wants to keep money because they lose value when it should be the other way around. What kind of investments can there be in such a world? Rather than creating proper incentives for saving, the melting ice cube of central bank currency creates a cycle of perpetual risk taking, where most of the savings are almost immediately put back at risk and invested in financial assets, either directly by individuals or indirectly by depository financial institutions. Worse yet, because of the confusion and misconception, most people view investments, particularly in financial assets, as savings.

Investments(whether in financial assets or anything else)definitely do not equate to savings, and inThe risk-taking that central banks encourage by making savings unattractive is nothing normal or natural. This is clear to anyone with common sense and real experience. However, this does not change the fact that money loses value every year, and knowledge of this fact dictates behavior - which is quite rational. Everyone is forced to accept an artificial dilemma. The idea that your money should grow is one of the greatest lies in history. This is completely false. Central banks have created this false dilemma. The main trick of central banks is that they have convinced people that they must constantly take risks in order to preserve the already created(and accumulated)price.This is madness, and the only practical solution is to find a better form of money that eliminates the negative asymmetries inherent in the systemic devaluation of money. This is what Bitcoin is: a better form of money that allows all people to stop being a squirrel in the wheel.

Great financialization

No matter if you consider this gamedishonest or simply admitting the reality of constant monetary depreciation, economies around the world are forced to adapt to conditions when money loses its value. While the goal is to encourage investment and spur growth in “aggregate demand,” when external forces manipulate economic incentives, there are always unwanted consequences. Even the greatest cynic would probably like printing money to solve the world's problems, but again, only children believe in fairy tales. Instead of the problems magically disappearing by printing money, their solution is only endlessly delayed. The constant creation of money has changed the structure of the economy.

Possibly the US Federal Reserve System (FRS)thought that by printing money, it could stimulate productive investment, but in the end it led to inefficient investment and an over-financialized economy. Over-financialization is a direct consequence of monetary depreciation and how it affects the cost of the loan. One must be blind not to see the inevitable causal relationship between the creation of money losing value, the unattractiveness of savings, and the rapid expansion of financial assets, including in the credit system.

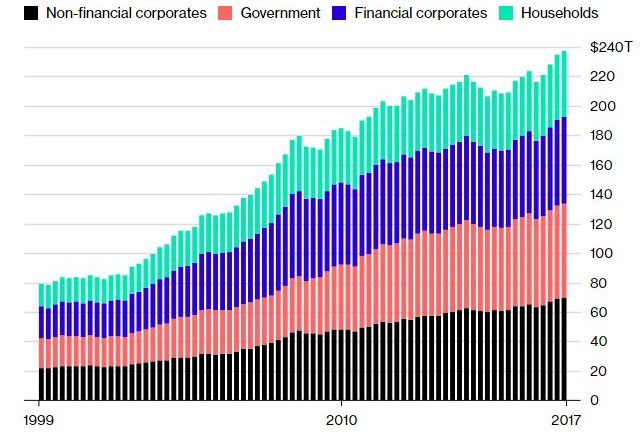

National debt at the level of $ 237 trillion.In the 4th quarter of the 2010-2020 decade, global debt increased by 42% compared to the previous decade. : Institute of International Finance

The banking and investment industries have grownfor the same reason. It can be compared to a drug dealer creating his own market, giving the first dose for free. Drug dealers create demand for their product by putting people on it. This is exactly what the Fed and the financialization of the economies of developed countries through monetary inflation look like. When new money is created and it loses value, markets emerge for financial products that would not otherwise exist. Products have emerged that allow people to get out of the hole created by the Fed. There was a need to take risks and try to generate income in order to compensate for the losses due to monetary inflation.

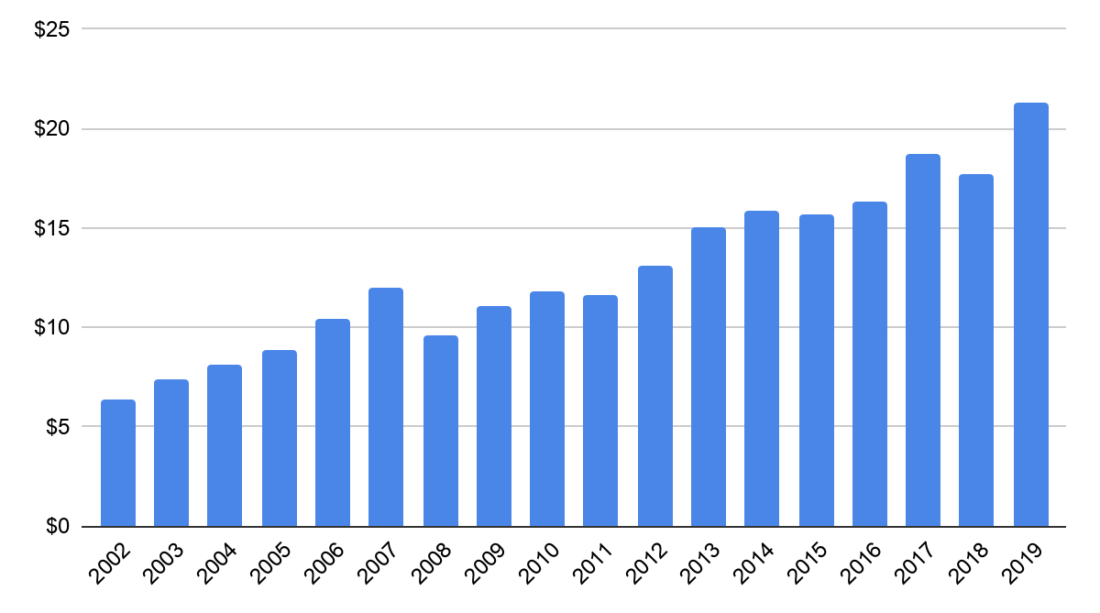

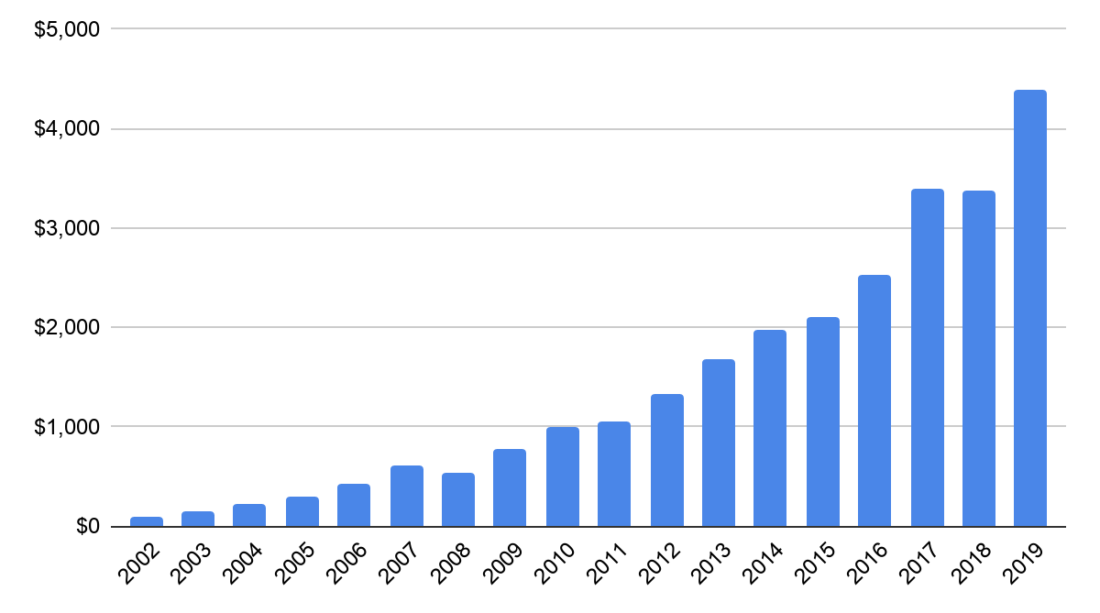

Net assets in mutual funds in the United States (2002-2019 in trillion $). : Statistica

Net assets in ETFs in the US (2002-2019 in trillion $). : Statistica

Interesting read: From fiat money to cryptocurrencies

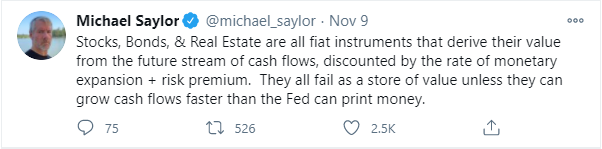

The financial sector accounts for more and morepercentage of the economy, because in a world where money is constantly depreciating, the demand for financial services is growing. Stocks, corporate and government bonds, mutual funds, equity and bond index funds (ETFs), shoulder ETFs, triple leverage ETFs, fractional stocks, mortgage-backed securities, collateralized debt obligations (CDO), secured credit obligations (CLO), credit default swaps (CDS), credit default swap (CDX) indices, synthetic CDS / CDX, etc. All of these products represent the financialization of the economy, and they become more relevant (and in demand) when the monetary function is upset.

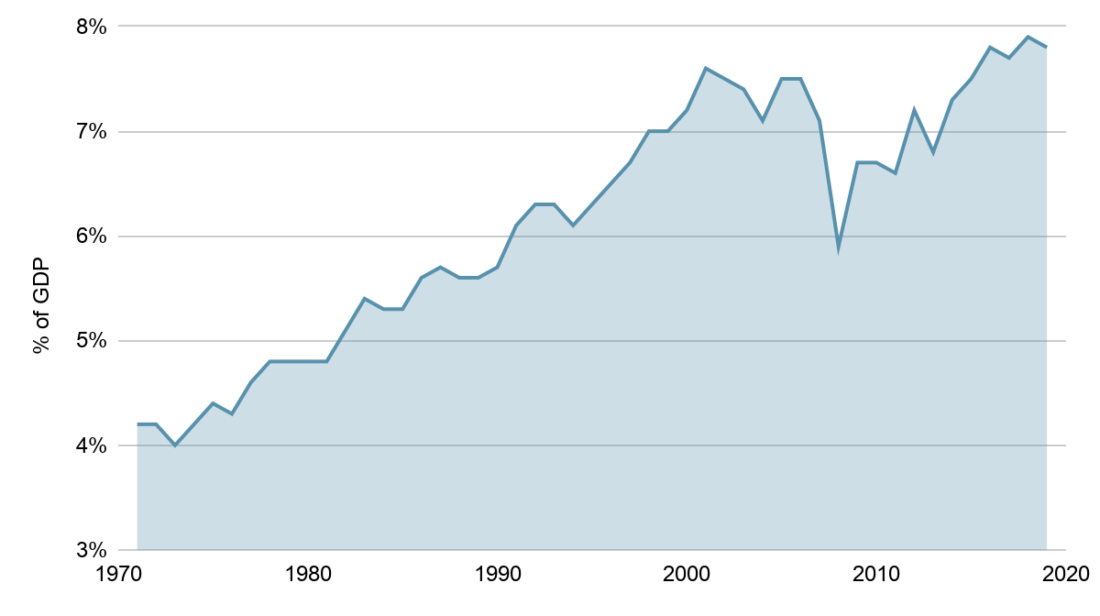

Finance and insurance sectors in the United States (share of GDP). : Statistica

Commitment to pooling and redistributing riskscaused by the frustrated motivational structure of the money on which the economy rests, and the artificial need to multiply money. Again, this does not mean that certain financial products or structures do not create something of value, but the problem is that the scale of use of financial products and the layering of risks is to a large extent a consequence of the purposefully disordered motivational structure of money.

Although the vast majority of market participantslost vigilance when the Fed normalized its annual inflation target at 2%, think about the consequences of such a policy in 10 or 20 years. The total loss of cash savings will be 20% and 35%, respectively. What to expect if everyone - all of society - finds themselves in a position where they need to compensate 20-35% of their savings just to stay put?

The general consequence is massive unproductiveinvestments that would not exist if people were not forced to take unreasonable risks just to compensate for the expected future losses of current savings. On an individual level, a doctor, nurse, engineer, teacher, butcher, salesman, builder, etc., turn into investors who put the bulk of their savings in Wall Street financial products that carry risks, even if they don't seem to be ... As time goes on, stock and real estate prices only rise, and interest rates - fall.

How and why is a mystery to traders, and it is notimportant because the world just seems to work that way and everyone acts accordingly. Of course, this will all end badly, but most people think that investing in financial assets is simply the best(and necessary)type of savings, and this dictates behavior.A “diversified portfolio” has become synonymous with savings and is therefore considered risk-free. Although nothing could be further from the truth, people are faced with a choice: take risks through investments or keep savings in cash that will definitely buy less and less in the future. From the point of view of savings as such, both are bad. It's a demoralizing game that everyone is forced to either play or just watch and still lose.

Personal stories: Confession of a failed crypto millionaire

The Consequences of Unattractive Savings

When everyone is forced to live in a world where money islose value, it generates negative feedback. When the very possibility of saving money as a winning option is ruled out, all the results collectively become much more negative. When money is artificially deprived of value, just holding it is irrational. People do it anyway, but it's a losing hand by default. But the same goes for the constant risk-taking as a forced substitute for saving. Basically, when there is no option to win by holding the money, any alignment becomes a losing one. Don't forget that everyone with money has already risked to get it. A positive incentive to save (rather than invest) is not the same as rewarding people for not taking risks; just the opposite. It is a reward for those who have already taken the risk in the form of an option to simply keep money without a clear promise that their purchasing power will decline in the future.

In a free market, money can grow orfall in value over a given period, but the guaranteed loss of value in money leads to an extremely negative result when the majority of economic participants do not have real savings. As money loses value, there seems to be only one alternative: spend money today because it will buy less tomorrow. The very thought of holding cash(what used to be called savings), in mainstream financial circles it is considered a littlecrazy, because everyone knows that money loses value. But isn't that just crazy? While money has to store value, no one wants to hold it, because the major currencies in use today behave in exactly the opposite way. And instead of looking for the best form of money, everyone is just investing!

"I still believe that cash is rubbish compared to other alternatives, in particular those that will maintain or increase their value during reflationary periods." - Ray Dalio (April 2020)

Even the most venerable Wall Street investors canget infected with madness and act like fools. Taking risks from inflation is no better than buying lottery tickets, only because savings are made unattractive. When monetary incentives are frustrated, opportunity cost becomes more difficult to measure and assess. Because of frustrated incentives, decisions are being justified today. Investment decisions are made and financial assets are often bought simply because the dollar is expected to lose value. But the repercussions go far beyond savings and investments. When money does not fulfill its intended purpose of saving value, it affects all economic decisions.

When money is constantly losing value, everyonedecisions about whether to spend or save, including daily consumption, are skewed. If a clearer alternative to spending money (ie incentives to save) is brought back, risk assessment will inevitably change. When money properly fulfills the function of saving value, all economic decisions will become more accurate. When money is expected to retain, if not increase, its value, all decisions about whether to spend or save will become clearer and ultimately weighted due to a more consistent motivational structure.

"One of the greatest mistakes is judging policies and programs by their intentions, not by their results." - Milton Friedman

Keynesian economists are afraid of such a world,believing that if there is an incentive to save, there will be no investment. According to their erroneous theory, if people are motivated to “save” money, no one will spend it and there will be no investments deemed “necessary”. If no one spends money and makes risky investments, unemployment will rise! This economic theory can truly be believed only by those who have not left the university classrooms. While this may seem counterintuitive to Keynesians, in a world where saving is encouraged, people will take risks.

In addition, the quality of the investment will be higher asboth consumption and investment will benefit from undistorted price signals and a clearer account of the opportunity cost of money by the free market. When all spending decisions are made against the backdrop of expectations of potentially greater (rather than lesser) future purchasing power, investment will tend to be more productive, and day-to-day consumption will be more discerning.

Conversely, when on investment decisionsreluctance to hold dollars is strongly influenced, we get financialization. Likewise, when consumer preferences are influenced by the expectation that money will lose rather than add value, investments are made to satisfy those distorted preferences. Ultimately, short-term incentives outweigh long-term incentives; veterans outperform newcomers and the economy stagnates, fueling more financialization, centralization, and financial engineering instead of productive investment. This is cause and effect; desired behavior with undesirable but predictable consequences.

When money loses value, people will dostupidity, because stupidity becomes more rational, if not encouraged at all. Those who would otherwise hold on to savings take on additional risks because their savings lose value. In such a world, savings are financialized. And if savings are unattractive, you shouldn't be surprised that few people have them. This is proven by real facts, and as astonishing as it may be to economics professors, the lack of savings because of their unattractiveness is very predictably the main source of the inherent fragility of the current financial system.

The fixed money paradox

Lack of savings and economicvolatility caused by upset base currency incentives is the main problem that Bitcoin solves. Since the possibility of monetary depreciation is eliminated, the incentives that were upset are equalized. There will only be 21 million bitcoins, and this alone is enough to start the reverse process of financialization. Although each Bitcoin is divided into 100 million units (8 decimal places), the nominal supply is fixed at 21 million coins. Bitcoin can be divided into even smaller units as more people accept it as a monetary standard, but no one can arbitrarily create more Bitcoins. Imagine the end state when there are 21 million coins in circulation. Technically, no more than 21 million bitcoins can be saved, but the consequence is that 100% of the coins are saved by someone at any time. Bitcoins(including their shares)will be passed from person to person or from company to company, but the overall supply will be static(and perfectly inelastic).

In a world where the money supply is fixed, soWhile the population cannot save more or less, the incentives and propensity to save at the individual level increase markedly. This is a paradox: if more money cannot be saved in general, then at the individual level more people will save. On the one hand, this may seem to be merely a description of how individuals value rarity. But this is really more of an explanation that incentives to save produce savers even though more money may not be saved in the aggregate. And for someone to save, someone else must spend existing savings. After all, all consumption and all investment come from savings; incentives to save create savers, and the existence of more savers, in turn, increases the number of people with the means to consume and invest. At the individual level, if one expects the currency to increase its purchasing power, one may justifiably postpone consumption or investment until the future(the key word here is "postpone")... That is, the incentive to save generates savers.It does not exclude consumption or investment, but only ensures that when future purchasing power is expected to be greater, not less, the decision will be more balanced. Imagine that everyone simultaneously adheres to such a motivational mechanism instead of its opposite that exists today.

Bitcoin supply / demand graph. : Medium

Whereas Keynesians are concerned that growing invalue, the currency will make savings more attractive than consumption and investment, which will harm the economy as a whole; in practice, the free market works better than from the point of view of Keynesian theory. In practice, a rising currency will be used daily for consumption and investment precisely because there is an incentive to save, and not in spite of it. High demand for consumption and investment in the present is dictated by positive time preference and the presence of a clear incentive to save. Everyone is always trying to make others' money, and everyone needs to consume goods every day.

The concept of time preference is described in detail in the book by Seyfedin Ammous"A Brief History of Money"... Although the book is required reading and the summary does not convey the whole point, people may have low(the future outweighs the present)or high(the present outweighs the future)temporary preference, but everyone has itpositive time preference. As a tool, money merely helps coordinate economic activity to produce goods that people value and consume in everyday life. Since time is by its nature scarce and the future uncertain, even those who plan and save for the future(low time preference), may collectively value the present more than the future. Taking it to the extreme for argument's sake, if you made money and literally don't spend a penny(or no satoshi)then it won't end well.So even if money grows in value over time, consumption or investment in the present is, on average, outweighed by the future due to positive temporary consumption and daily consumption needs that must be met in order to survive.

Now imagine that this principlesimultaneously applicable to everyone in the world of bitcoin with a fixed money supply. More than 7 billion people and only 21 million bitcoins. Everyone has an incentive to save at the same time, because the amount of money is finite, and a positive time preference, as well as daily consumption needs. In such a world, there will be fierce competition for money. Everyone will have to produce something valuable enough to entice someone to part with their hard earned money, but they will be motivated to do so because they will then switch roles. These are the conditions that Bitcoin provides.

There is an incentive to save, but existencesavings necessarily requires producing something valuable that is in demand by others. If you don't succeed right away, try again and again. The interests and incentives of those who hold the currency and those who provide the goods and services are perfectly aligned, particularly because they switch roles after each exchange. Paradoxically, in a world where it is technically impossible to save more money, everyone will be motivated to “save more.” Over time, everyone on average will hold less and less currency in nominal terms, but the purchasing power of each nominal unit will be greater and greater (not vice versa). Opportunity to delay consumption or investment and receive rewards(or just not be punished)is the cornerstone that aligns all economic incentives.

Bitcoin and the Great Definancealization

The main incentive to save bitcoins isthe fact that they represent the immutable right to perpetual ownership of a fixed percentage of all the money in the world. There is no central bank that arbitrarily increases the supply of currency and devalues savings. With programmed rules that no human can change, Bitcoin will become a catalyst to reverse the trend towards financialization. The scale of the financialization of the world's economies is a direct consequence of frustrated monetary incentives, and Bitcoin is returning the proper incentives to encourage savings. To put it more bluntly, the depreciation of savings was the main reason for financialization. When the dynamics that gave rise to this phenomenon is corrected, it should not be surprising that the opposite process will naturally begin.

If monetary depreciation provokedfinancialization, it should be logical that a return to a solid monetary standard should have the opposite effect. The wave of financialization has already begun to move in the opposite direction, but this process has not yet gained momentum, since most people do not yet see the inevitable. For decades, it was believed that you need to invest most of your savings, and that won't change overnight. But as the world learns more about bitcoin, while central banks are creating trillions of dollars and anomalies like $ 17 trillion in negative yields continue to exist, people will begin to see more.

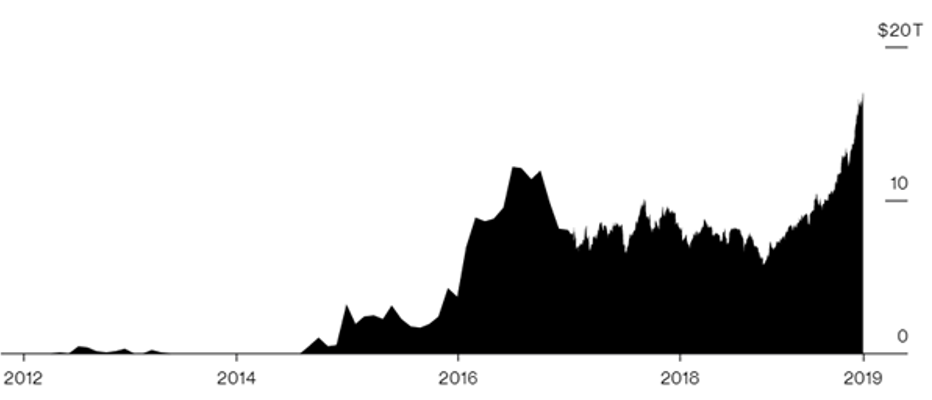

Market value of negative yield bonds in the Bloomberg Barclays Aggregate Index. : Bloomberg

"Market Capitalization of the Global Debt Indexwith negative Bloomberg returns, Barclays surged to $ 17.05 trillion [November 2020] - the highest ever level - exceeding the $ 17.04 trillion achieved in August 2019. ” - Bloomberg News

People will increasingly begin to question the idea ofinvesting retirement savings in risky financial assets. Bonds with negative yields are absurd, as is the creation of trillions of dollars by central banks in a matter of months. People around the world are beginning to question the very design of the financial system. This may be a well-established belief, but what if it doesn't have to be this way? What if everything went wrong all this time and instead of buying stocks and bonds with savings and accumulating financial risks, what was really needed was a better form of money?

If everyone, instead of going onendless risks, had access to a form of money that was not programmed to lose value, common sense would finally return to the world, and the result would be better economic stability. Do a simple thought experiment. How rational is it that almost everyone invests in large public companies, bonds or structured financial products? To what extent has this always been the result of frustrated monetary incentives? To what extent was the risky pension game a response to the need to keep pace with monetary inflation and dollar devaluation? Financialization has led to a worldwide financial crisis. Although there were other reasons, the economy became heavily financialized due to the distorted incentives of the monetary system. Frustrated incentives increased credit risk and led to massive lack of savings, a major source of fragility and volatility. Few had savings for a rainy day, and in the midst of the liquidity crisis, everyone began to understand the significant difference between monetary and financial assets. The same dynamics played out in early 2020, when the liquidity crisis repeated itself.

People are stepping on the same rake.It all comes down to monetary insolvency and the moral hazard posed by the financial system generated by distorted monetary incentives. Do not indulge yourself in illusions: the instability of the economic system as a whole is caused by the monetary system, and the more such episodes are played out, the more people will look for a better, more reliable way. Now that bitcoin is gaining more and more attention, a market mechanism has emerged that can definance and heal the economic system. When the wealth stored in financial assets is converted into bitcoins, and when each market participant increasingly favors a more reliable form of money instead of risky assets, definancialization will occur. The signs of definancing will be mainly the increasing adoption of bitcoin, the rise in the value of the cryptocurrency relative to all other assets, and the deleveraging of the financial system as a whole. When Bitcoin becomes the global monetary standard, almost everything will lose purchasing power relative to it. First of all, bitcoin will take a share from the financial assets that replaced the store of value. It is quite logical that assets that have long been acting as monetary surrogates are increasingly being converted into bitcoins. As part of this process, the financial system will shrink in size relative to the purchasing power of the Bitcoin network. Bitcoin's existence as a more solid monetary standard will not only cause an outflow from financial assets, but will also affect future demand for these assets. Why buy near-zero government bonds, illiquid corporate bonds, or risky stocks when you can hold the rarest asset (and form of money) in history?

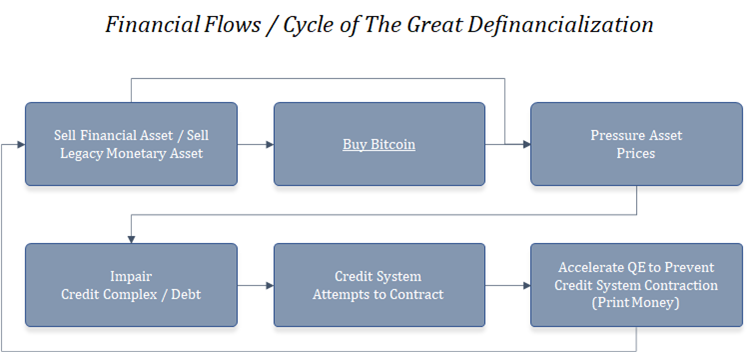

It can all start with the most overratedfinancial assets, such as government bonds with negative yields, but everything will fall under the distribution. During the process of outflows, asset prices will be subject to downward pressure, which will result in similar pressure on the debt instruments backed by those assets. The demand for credit will fall sharply, which will lead to a reduction in(or trying to shorten)the entire credit system. This, in turn, will increase the need for quantitative easing(increasing the money supply)to support credit markets, what elsemore will accelerate the outflow from financial assets to bitcoin. The process of definancing will reinforce and accelerate itself due to the inverse relationship between the value of financial assets, the credit system, and quantitative easing.

Cycle of the Great Definancealization. : unchained-capital.com

But the main thing is that gradually, as knowledge spreads, people will increasingly prefer the simplicity of Bitcoin(and his fixed offer of 21 million)complexities of financial investment andstructural financial risks. Financial assets come with operational and counterparty risks, while Bitcoin is a bearer asset with a perfectly fixed supply, highly divisible and easily moved. The functions of money are fundamentally different from the functions of financial assets. A financial asset represents the right to a stream of income from a productive asset, expressed in some form of money. The holder of a financial asset takes risks in order to earn more money in the future. If you hold money, then you simply hold money; they are valuable because they can be exchanged in the future for goods and services. In short, money can buy food, but your favorite stocks or bonds cannot, and that's for a reason.

There is and always has been a fundamentalthe difference between saving and investing. Savings are held in the form of monetary assets, and investments are savings at risk. The financialization of the economic system may have blurred this line, but Bitcoin will make it clear again and the difference will be obvious. Money with the right motivational structure will outweigh the demand for complex financial assets and debt instruments. The average person will overwhelmingly and intuitively prefer the security provided by fixed-supply cash. When people move from financial assets to bitcoin, the economy will be definanced. The balance of power will naturally shift in favor of the common people, not Wall Street.

The banking sector will no longer be at the epicentereconomy as rent-oriented activity, but will be on an equal footing with other industries and more directly compete for capital. Today, money capital is largely hostage to the banking system, but in a bitcoin world it won't be. During the transition, cash flows will become less and less dependent on the intermediation of the banking sector. Money will flow more freely and directly between participants in the economy who are actually producing something of value.

Functions of credit and stock markets and financialintermediaries are not going anywhere, but they will no longer be exaggerated. When a financialized economy uses fewer and fewer resources, and monetary incentives are better aligned with those who create real economic value, Bitcoin will fundamentally restructure the economy. The deprivation of attractiveness for savings had social consequences, but now the ship is on the right course to a brighter future. In this future, no one else will think about their stock and bond portfolios, and more time will be devoted to the basic questions of life and what really matters.

Savings in bitcoins (no risk) and financialinvestments (with risks) are as different as day and night. There is some relief in saving in the form of money that works for you, not against you. It can be compared to getting rid of a heavy burden that you never knew existed. It may not be immediately obvious, but over time, saving money with the right incentives will allow you to think less and worry about money and not be obsessed with it. Imagine a world where billions of people using a common currency can focus more on creating something of value for those around them, instead of worrying about making money and financial investments. No one knows exactly what this future will look like, but bitcoin will definance the economy and then a renaissance will surely begin.

</p>You can always thank the translator for the work done:BTC:3ECjCH5tPoyDCqHGCXfiiiLZQ3tVGzCSxBETH:0xf45a9988c71363b717E48645A412D1eDa0342e7E