Limited emission is one of the main features of Bitcoin (BTC), which distinguishes it from fiat currencies. Sheendows it with powerful deflationary characteristics, which is important in an environment where central banks print money uninterruptedly, provoking inflation.

Bitcoin (BTC) was intended to be decentralizeda hedging tool against the imperfections of the banking system that emerged during the last economic crisis in 2008. Ten years have passed since then, and now problems are brewing in the world economy again, and central banks are trying to keep their economies on the edge of the financial abyss and are printing money under the motto “after us there will be a flood.”

More than 88% of bitcoins have already been mined

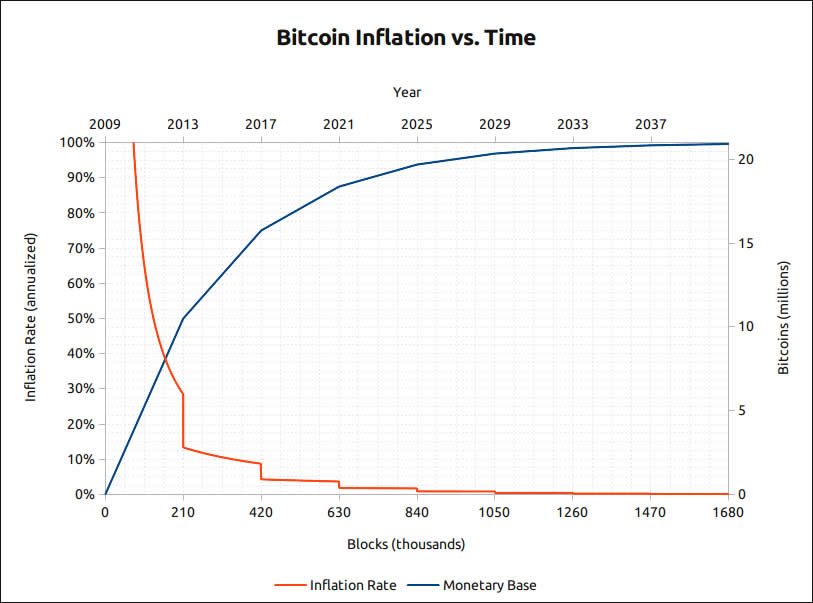

Almost 90% of all Bitcoins have already been mined.Most of them are in circulation, and some have already been lost forever (from 10% to 30%). This graph shows, in a simplified form, the projected rate of issuance and monetary base of Bitcoin:

To understand why Bitcoin has a limited supply, you need to go back a few years to its origins.

A Brief History of Bitcoin

The enigmatic Satoshi Nakamoto began developing Bitcoin in 2008. In October of the same year, he published a white paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

On nine pages he outlined the principle of operationand the purpose of a digital currency, which was supposed to be the first anonymous, decentralized currency in history that did not require the participation of intermediaries. Quote from the Bitcoin white paper:

“We need an electronic payment system,based not on trust, but on cryptographic proof, allowing any two parties to transact directly with each other without involving a third party as an intermediary or guarantor.”

Satoshi was not a fan of modern bankingsystems, especially the principles of fractional reserve banking. The idea is that a bank accepts deposits and uses that money to make loans to other people or invest it in projects. At the same time, he is obliged to maintain reserves in his accounts equal to only part of his obligations on deposits.

At first, people sent each other bitcoins for the sake ofinterest and just to test how it works. The new coin was first used for purchase in 2010. Then Laszlo Hanyec bought a pizza for 10,000 bitcoins. For his bitcoins he received pizzas worth $25. This is how the first exchange of BTC for tangible assets in history took place.

There was no Bitcoin in the first year of its existence.cryptocurrency exchanges where you could exchange BTC for fiat or vice versa. This need was soon filled by Jed McCaleb, who turned his domain mtgox.com into the world's first Bitcoin exchange - Mt. Gox. Initially, the platform, which appeared in 2007, was engaged in the exchange of Magic the Gathering game cards. Hence the name: The Magic: The Gathering Online Exchange.

By 2014, Mt.Gox processed 70% of all Bitcoin transactions, and its infrastructure began to crack, unable to cope with growing cash flows. The exchange closed in 2014 after a hack cost it 744,000 bitcoins.

However, the popularity of cryptocurrency grew, along withWith it, the number of trading platforms allowing the exchange of digital coins also increased. Bitcoin turned ten years old on January 3, 2019. By then, it had evolved into a recognized digital asset worth $3,870.

How many BTC coins are left to mine?

At the time of writing, the circulation is 18.6million bitcoins, or 88.57% of the maximum supply size, pre-set at 21 million coins. This means that there are only 2.4 million BTC left to be mined. Due to the mathematical model that governs the issuance of Bitcoin, it will take about 119 years to mine the remaining 11.5%.

According to the release chart and the hard-coded blockchain, the process will end in 2140. Every four years, the number of bitcoins produced by mining a block is halved.

Now one block costs 6,250 BTC, it costs to minetakes an average of ten minutes. In 2024, this value will drop to 3.125 BTC per block. After another four years, the reward will again be halved, and so on until all the bitcoins have been mined. Currently, about 900 BTC are mined per day.

This halving function led to the appearance ofdifferent pricing models such as stock-to-flow (S2F) ratio. The number of coins in circulation - the supply - is divided by the flow, that is, by the number of new coins being generated. This concept makes Bitcoin a “hard currency” that increases in value over time.

Scarcity also stimulates demand, and this is clearEvidenced by the behavior of institutional funds in 2020, which bought assets in unprecedented quantities. If Bitcoin is used as a hedge against money printing policies or liquidity injections into the economy, then such institutional players are more likely to hold it in anticipation of price increases in the long term. This further enhances the scarcity property of the asset.

Lost Bitcoins — 20% of all emissions

In 2018, industry experts estimated that at least 4 million BTC were “lost” and 2 million coins were stolen.

An estimated 4m BTC lost, 2m BTC stolen. @lopp at #BuildingOnBitcoin pic.twitter.com/xsXayfKiaP

- Willy Woo (@woonomic) July 4, 2018

Thus, in circulation there is actuallyapproximately 14.5 million coins available for trading and use. The Wall Street Journal estimates that about 20% of all existing coins have been “lost” and are unlikely to return to circulation.

There are also other data.For example, Timothy Peterson, manager of Cane Island Alternative Advisors, conducted a study in April 2020 and found that 1,500 bitcoins are lost every day, which means that it is unlikely that there will ever be more than 14 million coins in circulation.

Significance of 1337

The number 1337 is widely used on the Internet fordesignation of the term "LEET", which means "Elite". It is often associated with bitcoin on the assumption that owning as little as 0.1337 BTC will make you part of the global investment elite of investors if the asset reaches seven figures over the next decade.

There's currently a dip happening in #Bitcoin.

This is the best time to buy 0.1337 BTC to hold for 2030! # 1337Bitcoin

That should be your minimum target amount of Bitcoin to hold for 10 years minimum.

If you hold 0.1337 BTC until 2030, you’ll be part of the global elite.

- Brad Mills ✍️? (@bradmillscan) January 10, 2021

At a record high near $42,000, this amountwould be equal to approximately $5,600. Nowadays, few people can afford to buy a whole Bitcoin. It's too expensive for the average working-age person who doesn't have tens of thousands of dollars in savings.

Who are Bitcoin Whales?

The Bitcoin market is experiencing highconcentration of wealth. This means that the majority of coins are concentrated in a few addresses. Lately, the situation has been aggravated by the fact that huge institutional funds such as Grayscale and MicroStrategy have been buying up thousands of coins. Additionally, Bitcoin creator Satoshi Nakamoto is reported to have mined about 1 million BTC, and none of these coins have moved in the last decade.

According to the list of the largest Bitcoin addresses, 14%All coins in circulation are stored at 101 addresses. That's about $90 billion at current exchange rates. Another 30% of all bitcoins are stored in whale addresses with a balance of 1,000 to 10,000 coins.

Another interesting fact:about half of all addresses contain less than 0.001 BTC. Thus, more than 85% of all bitcoins currently in circulation are stored in addresses containing more than ten coins.

If this trend continues, and the whales show no intention of getting rid of their savings, the amount of coins available to the average person will be negligible.

Supply and demand

Finally,over the next 119 years, only 2.4 million bitcoins remain to be mined... Since almost 90% of all BTC that has ever existed is already in circulation or lost forever, these new coins will be in demand.

January 2021

137m users, 18.6m BTC, 3.8m lost

=> 0.11 BTC per personJanuary 2025

1b users (estimated), 19.8m BTC, 3.8m lost

=> 0.016 BTC per personAt full global adoption:

8b+ users, 21m BTC, 3.8m lost

=> 0.002 BTC per personThat’s how early you are.

- Willy Woo (@woonomic) January 4, 2021

The current market cycle suggests that institutions are buying coins in unprecedented quantities and given the economic conditions in the world, this trend is unlikely to change anytime soon.

Over the course of twelve years of Bitcoin's liferegularly updated highs, forming rising lows in bear markets. Bulls and bears have formed four distinct market cycles, but overall the long-term trend remains upward.

In the future, this trend is unlikely to change in the future, unless, of course, the Internet as we know it ceases to exist.

Where is it more profitable to buy bitcoin?

For the safe and convenient purchase of cryptocurrencies, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support the deposit and withdrawal of funds in rubles, hryvnias, dollars and euros.

The most reliable sites with the highest turnoverfunds, for several years the largest cryptocurrency exchange in the world has been Binance. The Binance platform is the most popular crypto-exchange in the CIS as well, since it has the maximum trading volumes and supports transfers in rubles from Visa / MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

| # | Cryptocurrency exchange | Official site | Site evaluation |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | Yobit | https://yobit.net | 6.3 |

| 5 | OKEx | https://okex.com | 6.1 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication