Summing up the results of the past week in the cryptocurrency industry, we recall the loud statements of the Ethereum developers,tighter regulation in Switzerland, news of Justin Sun meeting with Warren Buffett and, of course, impressive market growth, where bitcoin has traditionally played a major role.

Bitcoin price

Sunday, February 9, the price of the firstcryptocurrencies updated its new annual high, steadily rising above the $ 10,000 mark. The last time at these levels Bitcoin was trading more than three months ago - at the end of October 2019.

The start of a new rally was given on Monday, 3February, when the price of bitcoin rose a certain moment to the level of $ 9615. This growth occurred against the backdrop of the resumption of trading on the Chinese stock exchanges after a 10-day holiday break, accompanied by the largest collapse of leading stocks and indices in the last five years. Investors' expectations for the continuation of the rally, however, did not materialize - almost immediately the first cryptocurrency fell to levels near $ 9250.

Nevertheless, during the week the first cryptocurrencycontinued growth, pulling up the rest of the market. So, by the evening of Wednesday, February 5, the new price maximum of 2020 ($ 9775) was updated, and the total market capitalization was close to $ 275 billion - the level that was last observed in August 2019.

At the same time, Ethereum's second largest cryptocurrency by capitalization for the first time since September last year, the price of ether exceeded the psychological mark of $ 200.

The upward movement continued in subsequentdays, the culmination of which was the breakdown of $ 10,000 on Sunday. At the same time, the total market capitalization grew to $ 286 billion - the last time such figures were observed in July last year.

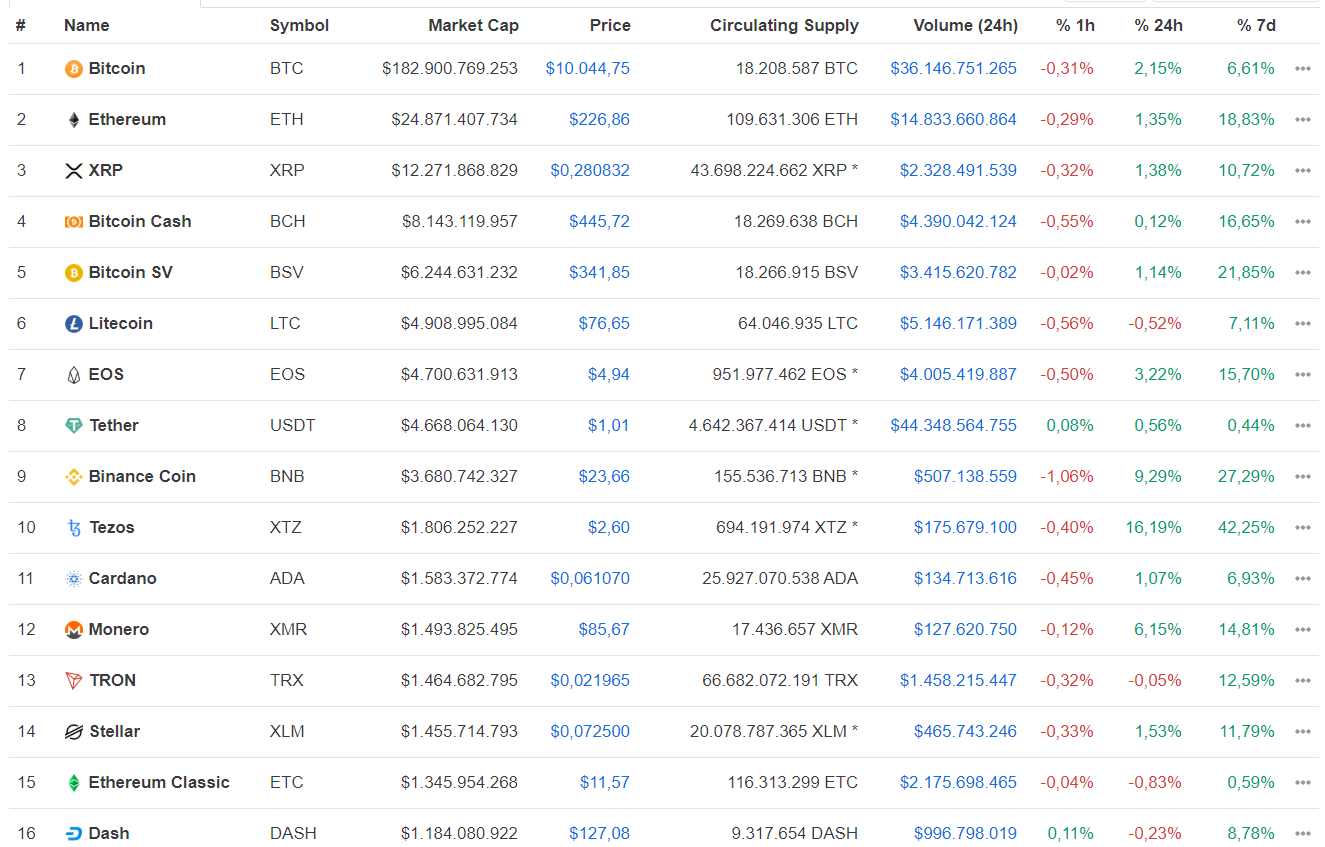

A small correction on Sunday evening is notprevented the first cryptocurrency from staying above this psychological level, thereby setting a good tone for the new week. This applies equally to most of the leading altcoins, the growth of which over the past 7 days was even more impressive:

Leading Infrastructure Solutions Provider Lightning Network Raises $ 10 Million

Wednesday, February 5, Lightning Labsreported raising $ 10 million in the round of financing of series A. The round is closed or not - it is not specified, however, at this stage it was headed by Craft Ventures.

Lightning Labs is a leading developer and provider of infrastructure solutions for the Lightning Network.

“Bitcoin will do for money what it didInternet for communications. Lightning Labs builds critical infrastructure to make this possible. We are proud to support the Lightning Labs team and community as we move on to the next chapter in BTC history. ”— said managing director Brian Murray.

At the same time, Lightning Labs announcedrelease of the beta version of Lightning Loop — the company's first flagship paid product. The solution is designed to help startups, node operators and end users more efficiently send and receive funds on the Lightning Network while managing liquidity.

Developers: Ethereum 2.0 will be launched in 2020

Vitalik Buterin, Justin Drake, Danny Ryan andOther Ethereum developers during the Q&A session this week expressed confidence that the new version of the network (ETH 2.0) will work this year.

According to them, before the full launch of the new network, it is necessary that the test, supported by three Ethereum clients, work for at least eight weeks.

Initially, the launch of Eth 2.0 was scheduled for January, then it was moved to the second quarter of 2020. Now developers do not exclude that the event expected by many can happen on July 30, on the fifth anniversary of the launch of Ethereum.

“Phase zero will definitely start in 2020. Audits are being carried out and test networks are becoming more reliable every week,said Danny Ryan. —I see no reason why the zero phase might not start this year. ”

According to him, work on the zero phase is completedby 99%, and above the first - by 90%. However, some elements of the system, as well as the Nimbus-developed light client for Android smartphones, still require audit and testing.

Somewhat earlier it became known that the Ethereum 2.0 deposit contract was successfully audited and verified. Its launch is expected in the spring at one of the developer conferences.

Switzerland tightens anti-money laundering measures

Swiss Financial Supervision AuthorityMarkets (FINMA) has announced new amendments aimed at combating money laundering. Now, when carrying out cryptocurrency transactions on the exchange for the amount of a thousand francs (about $ 1,024), it will be necessary to pass identification.

Previously, this threshold was five thousand francs.($ 5123). Thus, FINMA intends to bring the regulation in line with the recommendations of the Financial Action Task Force on Money Laundering (FATF), developed last June.

The regulator also emphasized that this stepdictated by the increased risks of money laundering in the cryptocurrency industry. FINMA previously stated that blockchain and cryptocurrencies increased the risk of money laundering through Switzerland, which became a threat to the country's reputation.

Enter cryptomom

Commissioner of the Commission on ValuableUS Securities and Exchange Commission (SEC) Hester Pier aka "Cryptomama" made an official proposal, according to which, for startups that attract financing through the sale of tokens, regulatory holidays are introduced for a period of three years.

According to the Commissioner, this time should be enough for startups to develop their decentralized networks and communities, without being distracted by regulatory issues.

Only after this time, Pierce stated,Regulators, primarily the SEC, should determine whether certain tokens belong to the category of securities. We are talking about the notorious Howie test.

At the same time, developers will have to prove during this time that they are really creating open source networks, as well as provide relevant reports.

It is assumed that the token may havecharacteristics of the security at the time of launch, but develop to a level where it no longer falls under the corresponding definition. Ethereum and EOS projects are the most striking examples, Pierce noted.

If the proposal will be supported by othersSEC commissioners, a strict set of rules will be established according to which startups will have to conduct their tokensales. This includes requirements for disclosing information about project participants, source code, and a number of other factors.

Justin Sun had a meeting with Warren Buffett

Tron Foundation CEO Justin Sun announced that a meeting with billionaire Warren Buffett, which was planned last year, was a success.

Buffett previously predicted a cryptocurrency crashindustry, he called cryptocurrency “a real bubble”, and speaking about bitcoin, he used terms such as “rat poison squared” and “illusion without a unique value”.

A charity dinner for which Sun paidA record $ 4.5 million was held on January 23 at a club in the US state of Nebraska. It was also attended by Litecoin creator Charlie Lee, head of eToro investment platform Yoni Assia, Huobi chief financial officer Chris Lee and head of the Binance Charity Foundation Helen Hai.

“This is a real honor, and I am grateful to Mr.Buffett for lunch, his wisdom and views. I will always remember his kindness and support, and I will use his advice and instructions to improve the TRON ecosystem and business relations with all partners in the blockchain space and beyond, ”- San's statement says.

Warren Buffett received his first bitcoin as a gift, as well as 1,930,830 Tron coins - a number that corresponds to his birthday.

A million bitcoins from Craig Wright will not be

Posing as the creator of Bitcoin SatoshiNakamoto, an Australian entrepreneur, Craig Wright, in an ongoing lawsuit with the family of his late business partner Dave Kleiman, said he would not be able to provide the court with the necessary documents about companies previously associated with him.

According to him, over 11 thousand requesteddocuments for more than a dozen companies are protected by the principle of maintaining confidentiality of information. In addition, Wright said that he does not have access to these papers.

Craig Wright said that contact with the courier,who supposedly had to give him private keys for accessing wallets with 1.1 million BTC (more than $ 10 billion at the current price) are not subject to disclosure, since he is a lawyer.

It is noteworthy that the owner of the bitcoin address withwith the current balance of 160,595 BTC, which Craig Wright had previously attributed to himself, signed the following message two weeks ago with his private key: “The address 16cou7Ht6WjTzuFyDBnht9hmvXytg6XdVT does not belong to Satoshi or Craig Wright. Craig is a liar and a scammer. ”

In January, Craig Wright notified the court that he receivedinformation that allows you to unlock access to wallets with 1.1 million BTC, but in fact the file turned out to be a list of 16,404 bitcoin addresses supposedly belonging to it.

ForkLog on YouTube

This week on exclusive ForkLogPavel Kravchenko, co-founder and CEO of Distributed Lab blockchain startup, expressed his point of view on a very burning topic: does the world need bitcoin “tamed” by the establishment, or does it need cryptocurrency in the world where the system won.