Bloomberg Intelligence analyst Mike McGlon has published an analytical report that allows investors to evaluatethe advantages of bitcoin over other financial assets and, above all, gold.

The expert points out a favorable factor,awaiting major cryptocurrency in May. The approaching halving will be able to hold back the offer amid rising prices, which distinguishes the asset from fiat currencies, the mass of which is “aggressively” growing by each central bank. He also claims that BTC volatility is down compared to stocks.

Bitcoin dominance in the cryptocurrency marketreaches almost 70% (66.2% today), which leads to a similarity to the gold standard in the industry, which will exist for a long time. This, according to McGlone, is facilitated by the "macroeconomic environment and the growing adoption of cryptocurrencies."

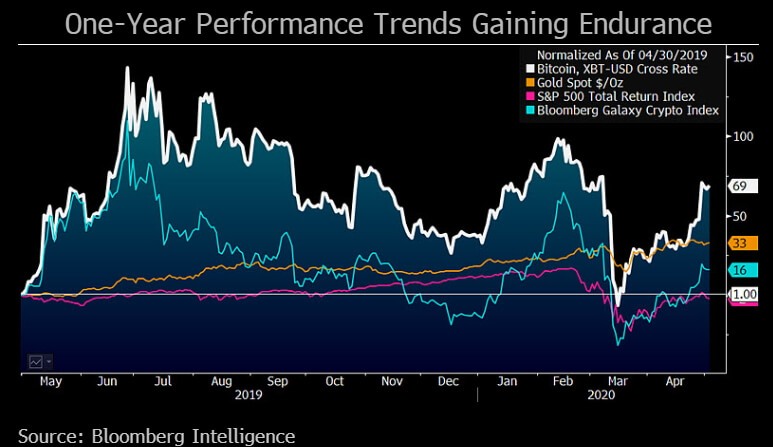

“Bitcoin will regain an advantage overmost assets during the current critical year. The coronavirus crisis revealed the benefits of gold and bitcoin against the backdrop of the unprecedented monetary stimulus of the central bank. ”- says the analyst.

Among the favorable for BitcoinMacroeconomic factors McGlone points to increasing stock volatility, declining bond yields and "the unprecedented liquidity generated by central banks around the world." This is a "tailwind for bitcoin."

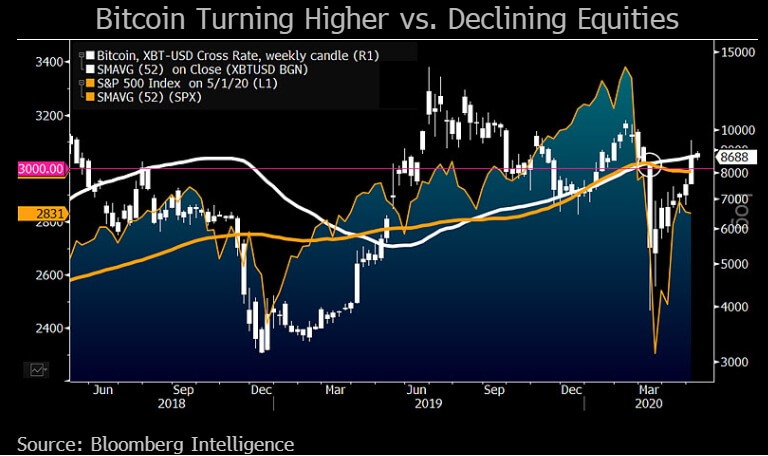

The report indicates technical factors that indicate the advantage of bitcoin over the stock market.In particular, the 52-week moving average for bitcoin has already been reversed upwards, while for the S&P 500 it indicatesdownwards to continue falling.

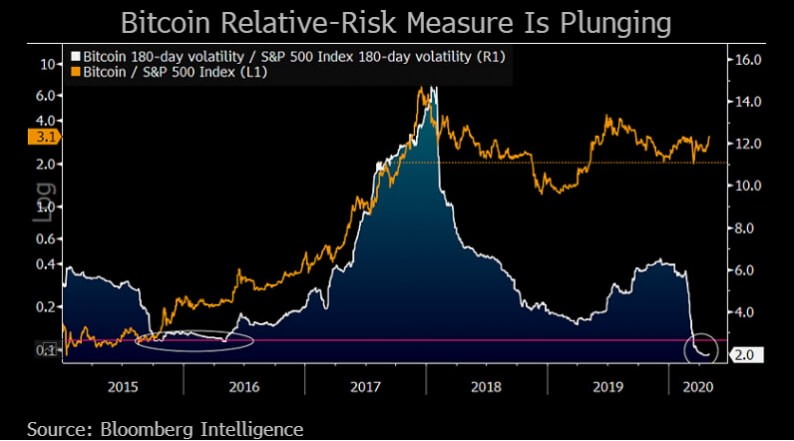

The charts also show a decrease in the relative risk of investing in bitcoin compared to the stock market.Bitcoin's volatility has never been lower when compared to the stock market.The chart shows the ratio of Bitcoin's volatility over 180 days to the same S&P 500 scale, which has reached a new low.

Recall that the approach of halving encourages miners to use the last chance to get a high reward for the mined block, which leads to an increase in the hash of the network to historical highs.

</p>Rate this publication