Experts at fund manager VanEck Global have concluded that in the short term, Bitcoin willmore correlated with gold amid the crisis caused by the COVID-19 pandemic. This strengthens the status of cryptocurrency as a safe haven asset.

A study report by a team of specialists at the firm, led by Gabor Gurbach, director of digital asset strategy, said:

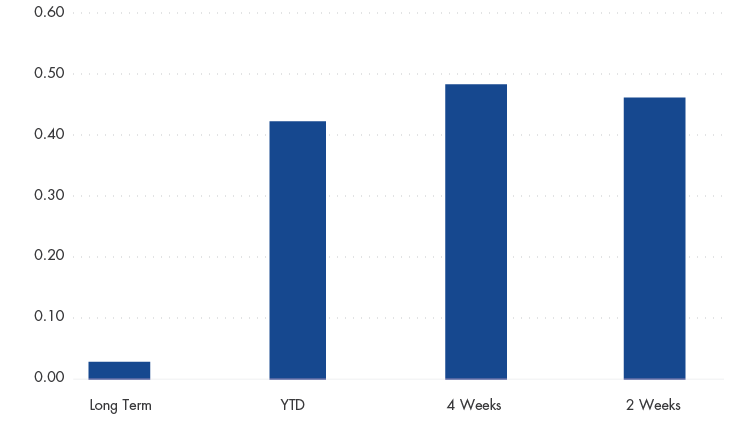

«Bitcoin's correlation with gold has reachedto a previously unseen level. We believe this could further strengthen its relevance to what are typically seen as safe-haven assets and enhance its potential as digital gold.

Moreover, in the long term, the indicator remains low.

The correlation of bitcoin and gold. Source: VanEck

Also, experts also stressed that increasedcorrelation of price movements of the first cryptocurrency and the value of American bonds, traditionally serving as a safe haven for investors during stock market sales.

In terms of investment attractiveness of bitcoinVanEck analysts noted that adding a digital asset to a portfolio with 60% of shares and 40% of bonds can significantly reduce its volatility. However, for this, there are currently no available exchange-traded funds (ETFs) based on leading cryptocurrencies in the US, they recalled.

VanEck previously tried to get SEC approval onlaunch of Bitcoin ETF in conjunction with SolidX. Last year, companies filed a second application, but in September it withdrew it amid uncertainty on the part of the regulator.

Recall, according to Gabor Gurbach, the upcoming era of negative bond rates bodes well for Bitcoin.