At the end of March, the Bitcoin exchange Binance removed the credit tokens of the FTX platform from its listing. Then Changpeng CZ Zhaoemphasized that users do not understand these tools, so Binance is forced to protect them. On May 12, she added similar tokens under her brand to the listing.

Shortly before delisting, the Binance customer group lost over $ 1 million in liquidation of credit tokens. Users believe that the problem was on the side of the site.

ForkLog figured out what credit tokens are, what happened on Binance and why the exchange eventually changed its position.

«We're sorry to hear about your loss»

FTX Derivative Exchange OperatorFTX Trading LTD, a company registered in Antigua and Barbuda (an offshore zone in which online gambling is allowed). Its founder is Sam Bankman-Fried, a former Jane Street Capital trader. In 2017, he founded the cryptocurrency firm Alameda Research, which currently manages a portfolio of digital assets of more than $ 100 million. FTX also has an American branch, but credit tokens are not represented there.

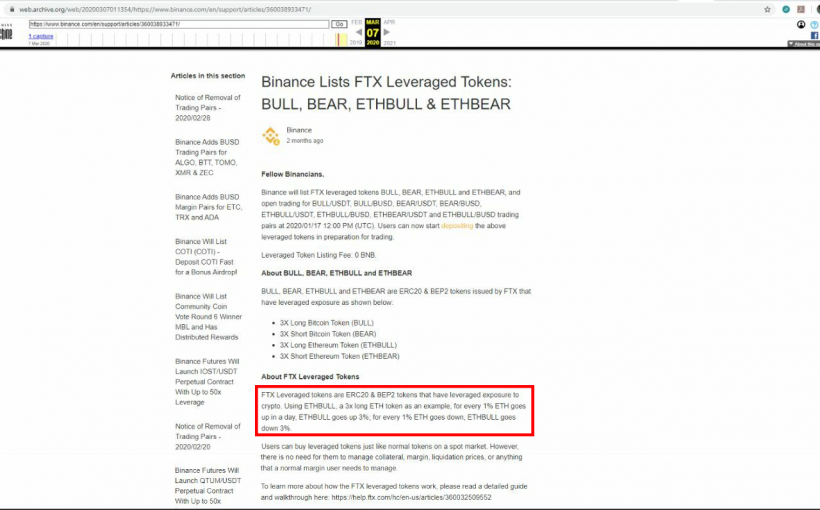

Credit tokens BULL, BEAR, ETHBULL and ETHBEAR fromFTX appeared on the Binance listing in January 2020. They allowed you to earn triple X on the rise or fall of the Bitcoin and Ethereum rates. For example, for every 1% increase / decrease in BTC, the BULL / BEAR rate correspondingly grew by 3%. Later, similar tokens for EOS and XRP were added.

However, on March 13 at about 3:00 p.m. Moscow time, tokens ceased to correlate with BTC, ETH, EOS and XRP in the x3 ratio and fell in price from 30% to 65%, which led to the liquidation of positions among a number of clients.

They told ForkLog that with the growth of EOSBEAR with$ 32 to $ 177 (5.5 times), EOSBULL fell 46 times from $ 72 to $ 1.57. At the same time, the price of the underlying asset of EOS has changed only 2.4 times - from $ 3.60 to $ 1.50. Similar messages can be found on Twitter.

</p>BULL / USDT fell more than 40% when the baseBTC's asset has changed by only a couple percent. ETHBULL declined by more than 65% with a change in the price of ETH by 9%. XRPBULL lost more than 31% while lowering the price of XRP by less than 2%.

Affected users created a Telegram chat inwhich discusses ways to solve the problem and the possibility of obtaining compensation. At the time of publication, it consists of 96 users. According to the owner of the Telegram chat, at least 200 users lost more than $ 1 million.

«In most cases, many lost an average of $5000-6000. I lost about $30 thousand. There are people whose damage amounted to $86 thousand, $100 thousand»,– he said in a comment to ForkLog.

Following user complaints, Binance pinnedwarning messages for each pair with FTX, focusing on the dangers of trading in these markets. Also, the mention of the clear following of FTX tokens behind the price of the underlying asset in the ratio of x3 has disappeared from the site’s site.

Users managed to make a screen copylisting messages in the online archive, but this snapshot is not available at the moment. Binance probably got it removed. If we compare the text in the image and the current version of the ad, then the latter does not contain a paragraph on the price movement in the strict ratio of x3.

Screenshot of the page version dated March 7, 2020

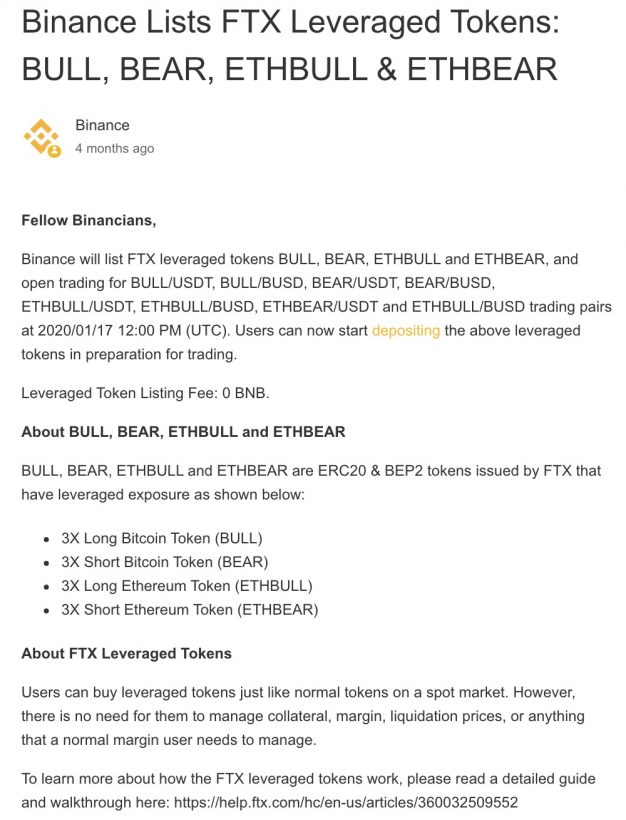

Screenshot of current page version

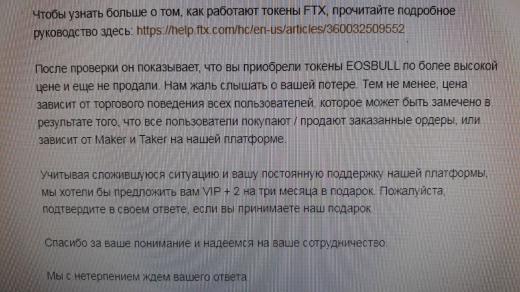

Customer service representative in response toAn appeal from one of the victims stated that the price of credit tokens depends on the «trading behavior of all users», and not on the movement of the price of the underlying asset, as was initially stated.

A letter from a Binance representative to one of the exchange customers

«We are sorry to hear about your loss.However, the price depends on the trading behavior of all users, which can be seen as a result of them buying/selling ordered orders, or depends on the Maker and Taker on our platform.

On March 28, two weeks after what happened, Binance delisted all FTX tokens. Changpeng Zhao explained the decision by saying that users do not understand how the asset works.

</p>«We found that many users do notunderstand the specifics of these tokens and do not pay attention to pop-up warning windows. FTX tokens are among the most actively traded, but user protection comes first.

CZ added that while these tokens «rarely result in liquidation, they depreciate in value over time and are therefore not intended for long-term storage».

In response to a request from victims, FTX technical supportreported that credit tokens do not work as a static leverage x3 and sometimes their price ceases to correlate with the underlying asset rate. FTX noted that they had known about the problem since 2019.

FTX explained that to hold a loanshoulder and to avoid elimination need rebalancing. If ETH grows by 10%, then the credit token will grow 2.53 times. If ETH drops by 10%, then the credit token will drop 3.85 times. For rebalancing, purchases / sales of ETH are made, this allows you to control the risk and return to a threefold leverage, representatives of the exchange emphasized.

Rebalancing occurs daily at 00:02 UTC or during the day if the leverage exceeds x4. Thus, depending on the moment of the last rebalancing, the movements of credit tokens may deviate from the declared leverage.

New or well forgotten old?

On May 12, Binance announced the launch of its own BTCUP and BTCDOWN credit tokens. These tools are not available on Binance US.

</p>«Binance Leveraged Tokens (BLVT) weredeveloped after careful consideration of user requests and evaluation of existing credit products. They provide lower risks and fees compared to other leveraged tokens.

The new cryptocurrency publication of The Block, Larry Chermak, drew attention to new tokens:

</p>«We won’t talk about the fact that BinanceListed your own credit tokens a month and a half after the delisting of FTX credit tokens? And what does CZ claim was done to protect users?»

Chermak noted that the BLVT listing was completed on May 11, the day of halving.

</p>«Tokens were quietly released on the day of halving to avoid unnecessary talk, and CZ was ashamed to even tweet about it»,– noted Chermak.

According to Binance, BTCUP and BTCDOWN tokens are notmaintain a fixed leverage, and adjust to changes in the nominal value of perpetual contract positions in the range of values between x1.5 and x3. This property of the asset supposedly allows “to reduce the influence of a sideways trend and does not allow its price to exceed market fluctuations.”

“The target leverage is constantly changing and hidden from external observation,”– stated in the company’s press release.

On the day of the launch of Binance credit tokens, FTX representatives condemned the non-transparent exchange mechanisms:

</p>«Preserving an open financial ecosystem withcompetitive markets and transparent products are critical to their effectiveness. Nothing is perfect, but sometimes it can mean the difference between a product that sells for a reasonable price and one that is overpriced, or the difference between a product that you can take advantage of and one that doesn't.

This point of view was supported by the famous researcher Su Zhu:

</p>«Newly Launched Binance Lending Tokenshave vague rebalancing rules and this can be a recipe for disaster. A third party company will not be able to arbitrate whether the rebalancing was done correctly or incorrectly,– Zhu pointed out.

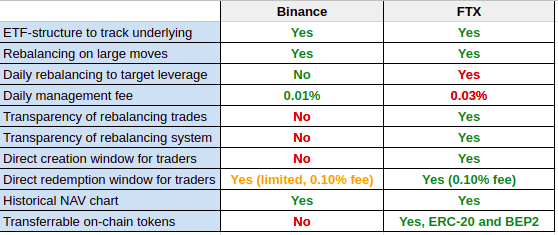

Administrator of Whalepool.io conducted a comparative analysis of Binance and FTX credit tokens. He noted that every time a rebalancing occurs in the base fund, a commission for financing is charged from the position, which reduces the net asset value (NAV) for its holder.

</p>The expert added that due to the opaque rebalancing methodology, it is impossible to verify the correct tracking of the net asset value, which makes it difficult for traders.

Binance and FTX Credit Token Comparison Chart

«The worst thing about Binance credit tokens is thatyou're just depending on the algorithm. You can't check if Binance charges hidden fees - you just have to trust the algorithm. Binance is the only issuer of BLVT, which makes you wonder: are the low management fees due to the fact that the exchange makes money from market making and opaque rebalancing?»

Compensation and non-disclosure agreement

In response to a ForkLog request, Binance representativesreported that on March 12, strong market volatility provoked rebalancing of the BULL / BEAR tokens: they deviated from their fair value and adjusted to the correct value with a delay.

The exchange claims that due to significantEthereum network congestion liquidity providers could not timely transfer Binance credit tokens, so the demand for some trading pairs was not satisfied.

«FTX Exchange agreed to paya certain amount to Binance users who held or traded BULL/BEAR tokens that day. In accordance with this decision, within 14 days, Binance credited user accounts with BUSD tokens in an amount equivalent to the value of credit tokens in the accounts at the time of delisting.– reported in Binance.

They also added that they had repeatedly warned customers about the high risk of transactions with credit tokens.

«We always inform users aboutthe need for careful transactions. However, users must understand the risks and take responsibility for their losses that result from their trading strategy and changes in the market price of the underlying asset.

Telegram chat owner for affected traderstold ForkLog that users received a proposal from Binance for compensation in the amount of 10% -30% of losses and the provision of VIP access to the exchange services for one to two months.

Binance later sent victims itsrepresentative, supposedly to resolve problems. Customers were asked to fill out a form with ticket details, the amount of loss, mail address and nickname in Telegram. According to the interlocutor of ForkLog, they were promised a 100% refund.

«Binance set conditions,that we must sign a non-disclosure agreement (NDA) after accepting the compensation amount. Many participants began to fall silent, many asked to remove their ticket number from our list - we realized that they had signed agreements».

Gleb Kostarev, Binance representative in the Russian Federation, confirmed to ForkLog the presence of NDA-agreements:

«Yes, users were asked to sign an NDA to confirm their agreement with the settlement of the situation and the amount of compensation».

Later, the owner of the Telegram chat found out that many of the signatories were not paid. As explained by Gleb Kostarev, such a situation could arise among users who violated the Binance Terms of Use:

«Yes [the user who signed the NDA did notreceived compensation], if during the inspection it was discovered that the user had violated our terms of use, for example, he registered an account not for himself, but for a third party»,– he explained in a comment to ForkLog.

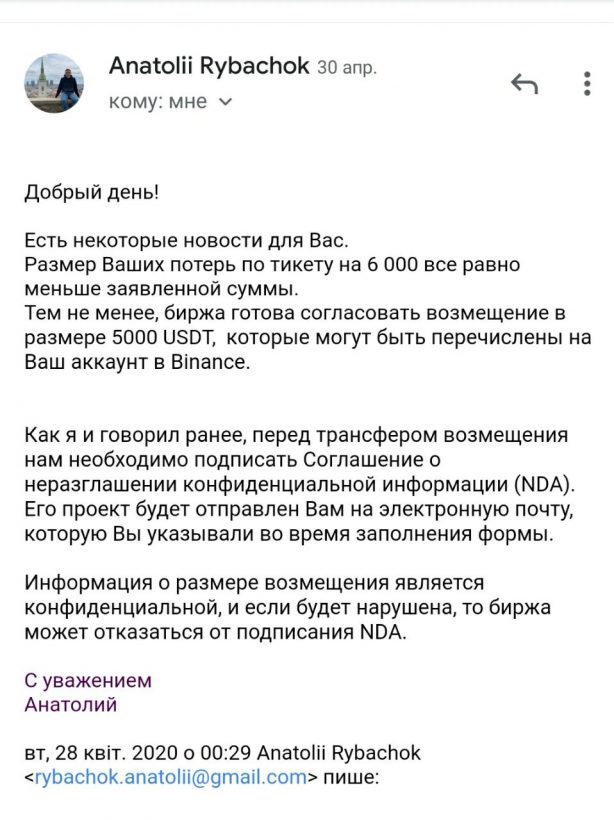

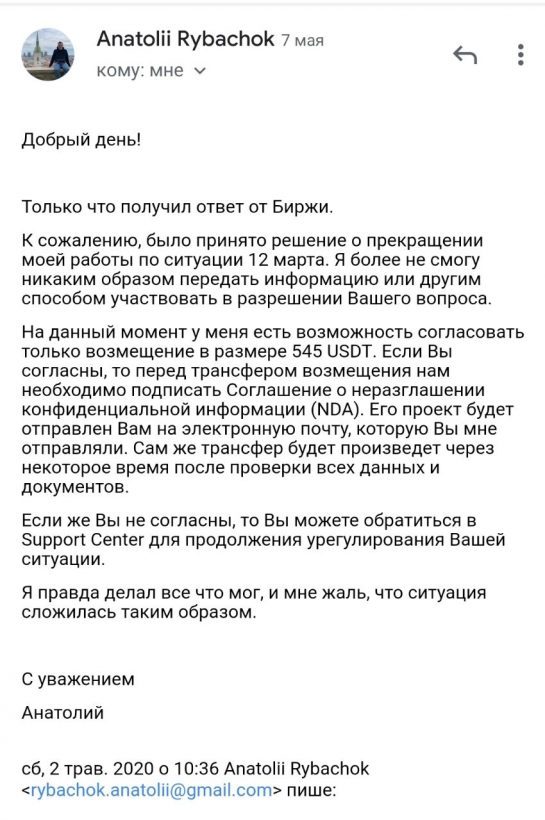

User originally received an email froma representative of the exchange with a proposal to compensate him for 5,000 USDT, but subsequently this amount was reduced by 10 times - to 545 USDT. The total damage to the user from improper rebalancing of credit tokens, according to him, amounted to about $ 30 thousand.

Screen of the letter from the representative of Binance to the exchange customer

Screenshot of a letter from a Binance representative to an exchange client — 2

At the moment, the client has not received any compensation:

«There are and were many cases in the group: people first accepted such an interim gift, and then they were sent away. I have not received anything: if I accept, I will lose the right to demand the entire amount.

Lena Jess