Non-fungible tokens (Non-fungible orNFTs are unique digital items with ownership rights toblockchain. Examples include collectibles, game items, digital art, event tickets, domain names, and even physical asset ownership records. If you have been spinning in cryptocurrency space for some time, then you probably heard about the term “non-interchangeable token” or “NFT. " And it doesn’t matter whether you believe in it, whether you are skeptical or don’t know what it is - this post is, in any case, for you.

</p>The founders worked on this material.OpenSea platforms - the largest digital market for NFT. They saw almost every project related to NFT - launched since the end of 2017, the time when the first NFT standard appeared. Anyone who tells them about the new NFT project - they will send a Gods Unchained game card. Indeed, they will hear about this project in this way, and perhaps at some point they will contact its developers.

NFT ecosystem is a close-knit groupincredible innovators: from enthusiasts to developers, from entrepreneurs to artists. And for OpenSea representatives, it is a great honor to be part of this community.

This post is a detailed review.non-interchangeable tokens: the technical anatomy of ERC721, the history of NFT, as well as common misconceptions regarding NFT. It is hoped that this will be relevant, both for beginners and those who already know about NFT, but want to better understand the nuances of their internal work.

What is a non-interchangeable token?

Non-interchangeable tokens are a completely normal thing. Replaced assets, in turn, are no longer cool!

Most discussions regardingnon-interchangeable tokens tend to spin around the concept of interchangeability as “the ability to replace something with an identical object. Perhaps this only complicates the understanding of the topic.

To get a better idea of a non-fungible asset, just think about the things you own.The chair you're sitting in, your smartphone, your laptop, and anything else you can buy or sell on eBay all getUnder the category of non-interchangeable[or semi- interchangeable]Things.

Interchangeable, semi-interchangeable, and non-interchangeable assets

As it turned out, interchangeable assets ontoday, lose relevance. And the classic example of an interchangeable asset is currency. Five dollars is always five dollars, regardless of the serial number on a particular banknote or the fact that these five dollars are in your bank account. The ability to replace a five-dollar bill with another five-dollar bill, and even with five one-dollar bills, makes the currency a fungible asset.

Although, interchangeability is relative, and that’sonly works when comparing several things at once. As an example - business class, economy class and first class tickets. Each ticket in its class is, in principle, interchangeable, but you cannot just exchange a first-class ticket for a second-class ticket. Yes, even the chair on which you are sitting can be replaced with a chair of the same model, but only if, for example, you have not developed a special fastening specifically for your chair.

Interestingly, interchangeability may wellto be subjective. It is worth returning to the example with tickets: a person who takes care of sitting near the window or, conversely, the aisle, may not consider two identical tickets to the economy class interchangeable. A rare penny of one cent, which for someone will cost the same one cent - in the eyes of a collector becomes much more expensive.

In the future, it will become clear that some of these nuances become important when presenting items on the blockchain.

Blockchain-based non-interchangeable tokens

Digital assets existed beforecryptocurrencies since the advent of the Internet: airline points, game currencies, etc. Domain names, event tickets, game items, and even descriptors on social networks such as Twitter or Facebook are all non-interchangeable digital assets. They only differ in their attractiveness, liquidity and compatibility.

And many of them are incredibly valuable. For example, only in 2018, Epic Games earned $ 2.4 billion in the sale of costumes for its free Fortnite game. In turn, according to some forecasts, the ticket market for events will reach $ 68 billion by 2025, and the domain name market continues to see steady growth.

Yes, we have tons of digital things, but essentiallywe almost never owned them. Indeed, to what extent do we “own” these digital things? Yes, if digital ownership only means that the item is officially yours, not someone else, then, in a sense, you own it. But, even if digital ownership is like owning something in the physical world (freedom of ownership and the right to transfer for an indefinite period), then for some digital assets this does not always work. Try selling Fortnite's game skin on eBay, and you will realize how difficult it is to transfer digital assets from one person to another.

And this is where the blockchain enters the scene! It provides a coordination level for digital assets, giving users the right to own and manage. Blockchain adds several unique properties to non-interchangeable items, which changes the experience of users and developers interacting with these assets.

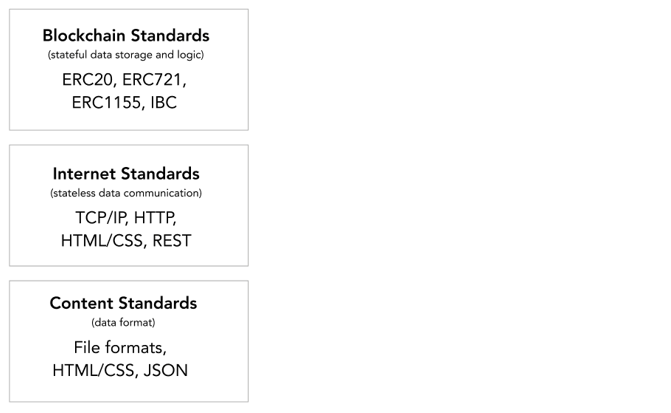

Standardization

Traditional digital assets like tickets forevents or domain names do not have a single implementation system in the digital world. In addition, games are likely to require a different approach to the implementation of in-game items than the ticketing system. By placing non-interchangeable tokens in a public blockchain, developers have the opportunity to use common, reusable and inherited standards that will apply to all non-interchangeable tokens. This includes basic functionality such as ownership, transfer, and easy access control. Also, on top of existing ones, you can use additional standards, for example, specifications for a richer display of NFT inside applications.

This is similar to other “building blocks” inthe digital world, such as JPEG / PNG for images, HTTP for requests between computers, or HTML / CSS for displaying content on the Internet. Blockchain allows you to add a “layer on top", providing developers with a new set of flexible primitives on which you can create applications.

For today, NFT standards allow freemove these tokens between different ecosystems. When a developer launches a new NFT project, tokens can be immediately displayed on dozens of wallets from various companies, sold on different trading platforms, and, more recently, displayed on virtual worlds. This is made possible because open standards provide a clear, consistent, reliable, and enabled API for reading and writing data.

Trade

The most attractive feature based on productive interaction is free trade on open trading platforms.For the first time, users have the ability to move goods freely outside of their original environment and on thata marketplace where they can take advantage of additional benefits such as eBay-style auctions, bidding[at own price]Packaging[combining several products into one package], and receiving payment in any currency, for example, in stablecoins or the domestic currency of any application.

So for game developers, suchthe effective sale of assets represents the transition from a closed economy to an open market economy. Game developers no longer need to independently manage each part of their economic system: from the supply of resources to pricing and capital control. Instead, they can let free markets do the hard work for them.

Liquidity

The ability to instantly sell NFT tokensleads to a general increase in liquidity. NFT trading floors can serve a wide variety of audiences: from hardcore traders to more novice players, which allows you to expand access to assets to a wider range of customers.

Just as the 2017 ICO boom spawned a new asset class based on instant liquidity tokens, NFT is expanding the market for unique digital assets.

Consistency and Proven Deficit

Smart contracts allow developersestablish strict restrictions on the supply of NFT tokens and provide them with permanent properties that cannot be changed after the release of assets. For example, a developer can programmatically ensure that only a certain amount of a specific rare asset is created, while keeping the number of other, more common assets, infinite.

Also, developers can code inblockchain specific properties so that they do not change over time. This is especially important for art, which relies heavily on the provable deficit of the original work.

Programmability

Of course, like traditional digital assets,NFTs are fully programmable. The breeding mechanics in CryptoKitties (which we will talk about below) were “baked” directly into the smart contract, which is responsible for introducing digital cats. Many of the modern NFTs have more complex mechanics such as forging, crafting, buyback, random generation, etc. The design space is full of possibilities.

NFT Token Standards

Standards are what NFT tokens do.really powerful. This gives developers a guarantee that the assets will behave in a special way, and allows you to accurately describe the features of interaction with the main functions.

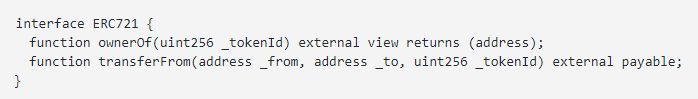

ERC721

ERC721, first created by developersCryptoKitties, became the first standard for non-interchangeable digital assets. ERC721 is the legacy Solidity smart contract standard, making it easy for developers to create new ERC721-compliant contracts by simply importing them from the OpenZeppelin library.

The OpenSea website has a useful guide for those wishing to create their first ERC721 contract.

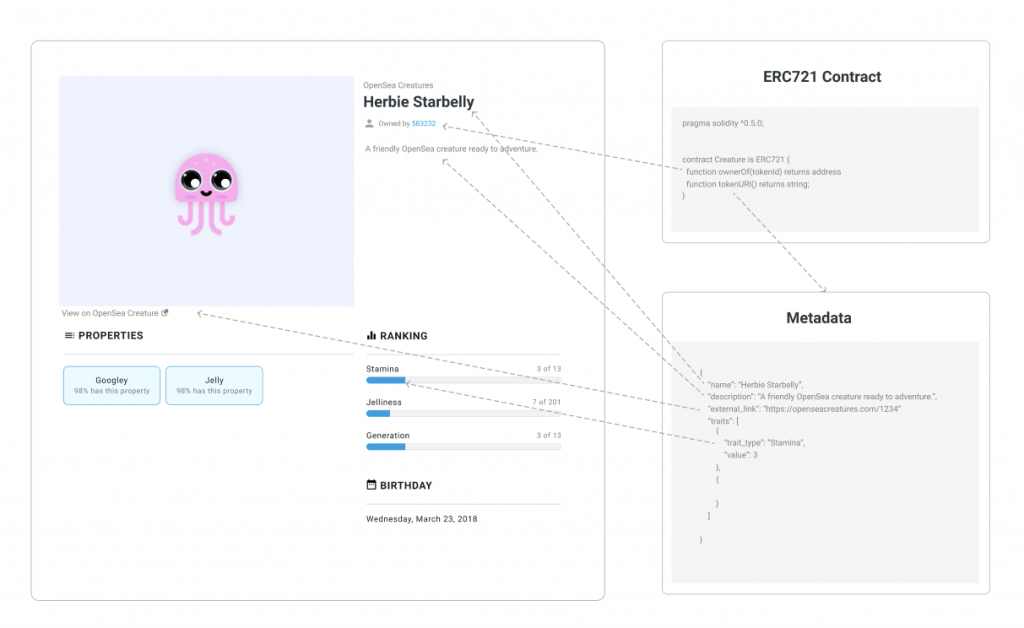

In fact, the ERC721 standard is relatively simple: it provides a mapping of unique identifiers (each of which is associated with a single asset) with addresses, which, in turn, are associated with the owner of these identifiers. Also, ERC721 allows you to transfer assets using the TransferFrom method.

By and large, these two methods are all thatyou will need to work with NFT: the ability to check who owns what and what, and the ability to move an asset. Also, the standard provides additional functions, some of which are extremely important for NFT trading floors, but, in itself, the NFT core is quite simple.

Anatomy ERC721

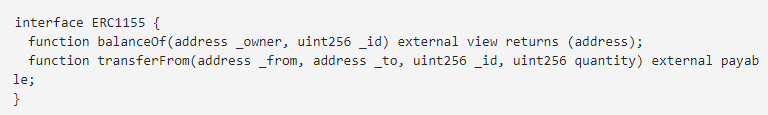

ERC1155

ERC1155, was implemented by the Enjin team, and bringsinto the NFT world the idea of semi-interchangeability. In ERC1155, identifiers are not associated with individual assets, but with entire classes of assets. For example, an identifier might represent the “swords” class, and a wallet owns 1,000 units of these swords. In this case, the balanceOf method will display the number of swords belonging to a particular wallet, and the user will be able to transfer any number of swords using the TransferFrom method.

An important advantage of such a system is itsefficiency: if with ERC721 the user wants to transfer 1000 swords, then he will need to change the state of the smart contract for each of the swords using the TransferFrom method, and in the case of ERC1155, he will only need to call the TransferFrom method for all swords at once. True, efficiency is fraught with loss of information: now you can not track the history of movement for each sword individually.

But, nevertheless, it is worth paying attention that ERC1155is an extended version of the ERC721 standard, which means that the ERC721 asset can be created using the functions of ERC1155. Thus, the user will simply have a separate identifier and an indication of the amount of “1” for each asset. Due to this advantage, we have recently become witnesses to the growing popularity of the ERC1155 standard.

Not so long ago, the OpenSea team created a repository on GitHub to get started with the ERC1155 standard.

Anatomy of ERC20, ERC721 and ERC1155 standards

ERC20 matches addresses with amounts, ERC721 matches unique identifiers with owners, and ERC1155 has a “nested match” with both identifiers and sums.

Composed NFT

Built-in NFT, based on the standardERC-998, are a template that combines both non-interchangeable assets and interchangeable assets. At the moment, there are only a few such integrated NFTs deployed, but there is reason to believe that there are many interesting possibilities for their application.

"In CryptoKitties, you can embed, for example, a scratching post and a saucer for food.A saucer can be worth a few ordinary fungible tokens.If I sell a cat, I will sell all of its possessions."

Non-Ethereum Standards

Yes, at the moment, NFT applies, inmainly on the Ethereum blockchain, but, on other blockchains, several similar standards also appeared. The DGoods project, developed by the Mythical Games team, aims to create a multi-functional standard for various blockchains, starting with EOS. The Cosmos project is also developing an NFT model that can be used as part of the Cosmos SDK.

Metadata for non-interchangeable tokens

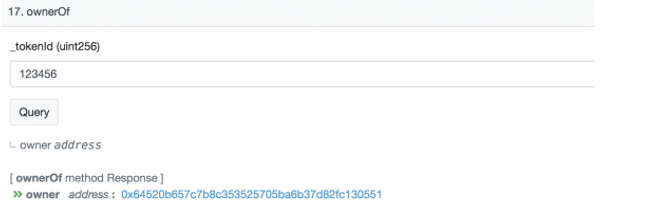

As already mentioned, the ownerOf method allowsfind the owner of the NFT. For example, using the ownerOf request (1500718) in the CryptoKitties smart contract - you can see that the owner of CryptoKitty # 1500718, on 01/10/2020, was an account with the address 0x6452 ... This can be verified by visiting the CryptoKitties account on OpenSea or their CryptoKitties website. .co.

But what does CryptoKitty # 1500718 look like? What about his name and unique attributes?

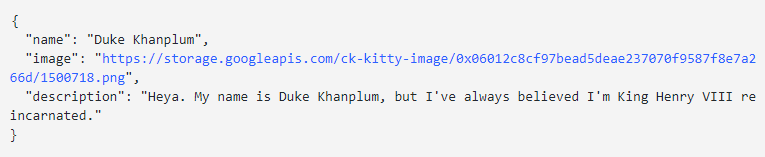

And here metadata is required, whichprovide descriptive information for each specific cat. In the case of CryptoKitty, this is the name of the cat, its image, description and any additional features that are also called cattributes.

In the case of creating a request for an event, the metadata may include the date of the event and the type of request, as well as a name and description.

The metadata for the cat above may look something like this:

But, the question arises: how and where to store this data so that applications that work with NFT can access it?

On-chain vs Off-chain

The initial task for developers is which metadata to place on the blockchain and which outside it. Those. Will metadata be “baked” directly into a smart contract or placed separately?

Blockchain metadata

Benefits of posting metadata on the blockchain:

- They are constantly next to the token, which allows them to continue to exist outside the work of any application.

- They can be changed in accordance with the logic of the blockchain itself.

The first point is important if it is assumed thatassets will have long-term value, and much more than the initial cost. For example, this is a work of digital art that will be stored “for centuries”, regardless of whether the original site that was used to create and host this item is preserved. Therefore, it is important that the metadata is stored along with the token.

Also for interacting with metadatablockchain logic may be required. For example, in the case of CryptoKitties, the “generation” of CryptoKitty affects how quickly cats breed (the process slows down from generation to generation). Thus, the logic inside the smart contract should be able to read metadata from its internal state.

Blockchain metadata

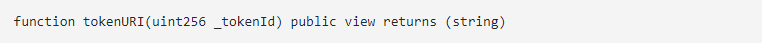

Despite these advantages, mostprojects store metadata outside the blockchain due to current restrictions in Ethereum. Therefore, the ERC721 standard includes a tokenURI method that developers can use to tell applications where to look for metadata for a given element.

The tokenURI method returns a public URL. This, in turn, returns a JSON data dictionary, something like a dictionary for CryptoKitty. This metadata must comply with the official ERC721 metadata standard so that projects such as OpenSea can use it.

OpenSea is trying to provide developersthe ability to create rich metadata that can be displayed in OpenSea itself, so extensions have been added to the ERC721 standard to allow developers to use things like strokes, animations, and background colors.

Blockchain Storage Solutions

If you decide to store metadata out of the chain, there are several options for this.

Centralized servers

The easiest way to store metadata is somewhere on a centralized server or in cloud storage such as AWS.

Although, of course, this has certain disadvantages:

- Developer can modify metadata as desired

- If hosting goes offline - metadata will become unavailable

To solve the second problem, there are severalservices (including OpenSea) that will cache metadata on their own servers to guarantee the availability of information, even if the original hosting fails.

IPFS

Today, more and more developers in the fieldDigital art uses the Interplanetary File System (IPFS) to store metadata off-chain. IPFS is a peer-to-peer file storage system that allows you to host content so that it is immediately replicated on different computers.

This ensures the following:

- The metadata will remain unchanged since it is uniquely addressed to the hash of the file.

- As long as there are nodes wishing to host this data, information will be available

Currently, there are services such asPinata, which simplify this process for developers by processing the infrastructure for deploying and managing IPFS hosts, and the expected Filecoin network (in theory) will add a layer on top of IPFS to encourage hosts to host files.

History of NFT Tokens

Now that we understand what non-interchangeable tokens are and how they are created - let's look at how they came about.

*** year BC: before CryptoKitties

NFT experiments began with the advent ofcolored coins on the Bitcoin network. Rare Pepes - illustrations of the character of the pepe the frog, created on created using Counterparty on the basis of the Bitcoin blockchain, were one of the first. Some of them are actually sold on eBay, and at auction in New York put up a whole set.

In turn, the first experiment based on Ethereum was the CryptoPunks project, which consists of 10,000 unique collectible punks, each of which has a set of its own characteristics.

Created by the Larva Labs team, the CryptoPunks projectIt was a marketplace that can be used with wallets such as MetaMask, which reduces the barrier to entry when working with NFT technology.

Today, given the limited offer and strong brand in the pioneer community, the CryptoPunks project is probably the best candidate for the title of true digital antiques.

In addition, the fact that punks live on the netEthereum makes them compatible with most trading floors and wallets. Although, in this regard, they are inferior to new assets, because precede the ERC721 standard.

0 AD: the birth of CryptoKitties

CryptoKitties was the first project thatmade NFT technology mainstream. Launched at the end of 2017 at the ETH Waterloo hackathon, the CryptoKitties team demonstrated a primitive online game that allowed users to jointly breed digital cats to produce new cats of varying degrees of rarity. Zero-generation cats were sold at a falling price from the Dutch auction, and new cats could be sold on the secondary market.

And, although, later some called CryptoKitties“Fake game”, the team really did a lot to become a pioneer of game mechanics, given the limitations of the blockchain. For example, they created an algorithm for breeding cats on the blockchain, “wired” inside a closed-source smart contract that determined the genetic code and, accordingly, the attributes of the cat.

Additionally, the CryptoKitties team has providedrandomness of breeding through a complex incentive system and prudently reserved some low-ID cats for future marketing use.

In addition, they are the creators of the Dutch auction mechanism, which, subsequently, became the fundamental method for determining the value of NFT assets.

The remarkable foresight of the CryptoKitties team gave NFT technology serious acceleration at the very beginning of the journey.

Presumably, the success of CryptoKitties can be explained by the following things.

Speculative mechanics

Breeding and trading mechanism in CryptoKittiesallowed to develop a clear algorithm for profit: buy a pair of cats, breed them to get a rarer individual, resell the cat, repeat. Or just buy a rare cat and wait for someone to come and buy it. In general, while new users come and play, prices will only rise.

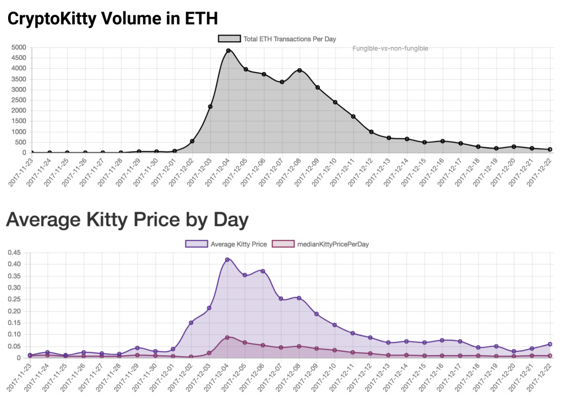

During the period of the main rush - the total volume of coins inCryptoKitties was worth ~5000 ETH, and the owner of Cat#18 sold it for 253 ETH ($110,000 at the time of sale). Later, this record was broken by the sale of the Dragon cat for 600 ETH ($140,000 as of September 2018). True, many believe that the deal was illegal. Thus, high prices attracted even more users to this “gold rush”.

Viral history

Another part of the success of CryptoKitties is the story. The CryptoKitties were amazing, accessible, and fun, and the idea of buying a digital cat for $ 1,000 was so absurd that it was great news.

CryptoKitties: Enchanting Cat Hype Story

In addition, regular users of the game “broke Ethereum”, which in itself was history.

Since Ethereum can only processlimited number of transactions (~15 transactions per second), then the load on network bandwidth led to an increase in the pool of pending transactions and an increase in gas prices. The average daily volume of pending transactions increased from 1,500 transactions to 11,000 transactions. New potential digital cat buyers were paying astronomical fees and waiting hours for their transactions to be confirmed.

All these factors naturally led to the appearance of“CryptoKitties bubble”: demand comes to the world of CryptoKitties, prices are rising, which contributes to even greater demand. But, of course, all the bubbles should eventually burst. In early December, the average price of cats began to fall, and the volume decreased significantly.

Many understood that the gameplay that wasquite primitive in relation to the "real games", will not hold a wide audience where speculators do not count. As soon as the hype has passed, the market has fallen, and, for today, CryptoKitties makes only about 50 ETH per week.

Total and average daily ETH turnover in CryptoKitty

2018: HYIP, Hot Potato Games and Level Two Layers

Despite the general market downturn - the first daysThe appearance of CryptoKitties on the market has provided for many a magical moment. For the first time, a certain team managed to deploy a blockchain-based non-financial application, which, albeit only for a few weeks, but became a technical mainstream. Already after the advent of CryptoKitties, in early 2018, NFT also pretty quickly went through the second cycle of hype, when investors and entrepreneurs drew attention to the prospects of a new way of owning digital assets.

Second level games and add-ons

Soon, on top of CryptoKitties, began to appearGames of the second level, which were created by third-party developers without any relation to the main CryptoKitties team. The magic of CryptoKitties was that these add-ons could be developed without special permission: the developers simply placed their own applications on top of the publicly available CryptoKitty smart contract.

Yes, in a way, CryptoKitties canwork outside of your original environment. For example, in the Kitty Race game, cat owners compete among themselves for an award in ETH, and KittyHats allows you to complement your pets with a hat and other elements.

Later, Wrapped Kitties merged CryptoKittieswith DeFiby technology, which allowed turning cats into functional ERC20 tokens that can be traded on decentralized exchanges. Of course, this had all sorts of interesting consequences for the CryptoKitties market.

Additionally, the newly created company Dapper Labs has integrated the features indicated in the KittyVerse project.

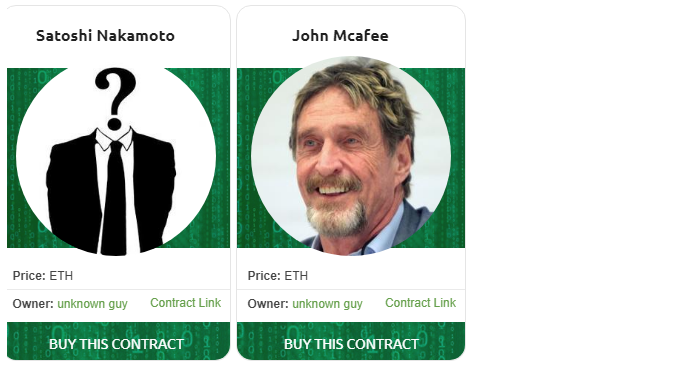

Hot potatoes

Also, this period is marked by the advent of games byhot potato principle. If you already know what hot potatoes are in NFT games, then you are a real oldfag. In January 2018, a game called CryptoCelebrity was launched, with fairly simple mechanics. At first it was required to purchase collectible NFT celebrities. After that, the celebrity immediately becomes purchased i.e. "Tear-off", and at a higher price than the initial cost. When someone buys your celebrity, you respectively receive a profit in the form of the difference between the purchase and sale prices (minus the commission for developers).

Thus, if there is someone who wants toBuy your celebrity - you will make a profit. However, if this does not happen, and you will be the last who wished to buy it, then, accordingly, you will lose.

CryptoCelebrity turned out to be incredibly viraldue to these speculative mechanics, and celebrities such as Donald Trump were sold at astronomically high prices - $123 ETH or 137,000 at the time. And while the CryptoCelebrity game probably did more damage to the NFT space back then, it's actually fair to think that experimenting with pricing and auction mechanisms is a pretty interesting part of the industry.

Interest for venture capital

Venture capital and cryptocurrency funds began to be interested in the NFT sphere at the beginning of 2018. CryptoKitties raised $ 12 million from leading investors earlier this year and $ 15 million in November.

Rare Bits project founded by co-foundersFarmville and blockchain studio Lucid Sight also raised $6 million each at the beginning of 2018. Later, Forte raised $100 million from gaming fund Ripple. Immutable, the company behind Gods Unchained, also raised $15 million from Naspers Ventures and Galaxy Digital, and Mythical Games, led by Javelin Venture Partners, raised $19 million for its flagship game Blankos Block Party on EOS.

In turn, the OpenSea project also collected modest initial and strategic investments to promote its own vision of creating a common open market, for which I am grateful to its investors.

2018-2019: continued work

After a little hype in early 2018 -everything calmed down, and NFT projects returned to work. Teams like Axie Infinity and Neon District, which appeared shortly after CryptoKitties, have doubled their communities. NonFungible.com launched the NFT Market Tracking Platform and adopted the term “non-interchangeable” as the primary term for describing a new asset class.

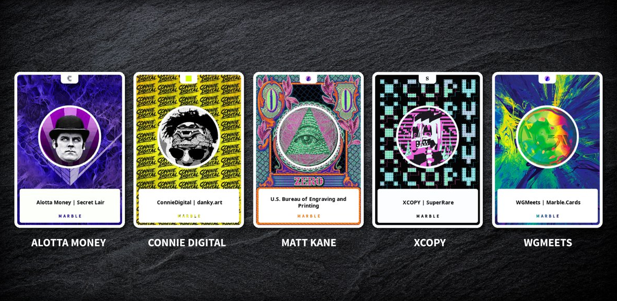

Digital art

In turn, the NFT was also interested in the art world. Yes, digital art has proven to be a natural tool for non-interchangeable tokens.

The core value of a physical art objectpresents an opportunity to prove the right to own it, and somewhere this subject will demonstrate that it is more than real in the digital world. Therefore, a group of interested digital artists immediately began to experiment.

There are platforms for publishing digitalarts: SuperRare, Known Origin, MakersPlace and Rare Art Labs, and artists such as JOY and Josie used smart contracts to create a real brand.

Cent, a social network with a unique micropayment system, has become a popular community where people can share and discuss digital art.

Josie's Tune In, which was sold on OpenSea for 6 ETH

Platforms for creating NFT

NFT creation platforms allow anyone“Mint” NFT, regardless of whether it has the skills to deploy smart contracts. The Mintbase and Mintable projects have provided ordinary people with tools to easily create their own NFTs.

In turn, the Kred platform allowed simplePeople create business cards, collectibles and coupons. Kred also partnered with the CoinDesk Consensus conference and created the Swag Bag digital NFT packages for visitors.

Additionally, it is worth mentioning the project undercalled Marble Cards, which added an interesting feature, allowing users to create unique digital cards from any URL through the marbling process. This allowed us to automatically generate an image and a unique design based on the content of the URL, which brought some opposition in the world of digital art in response to the “marbling” [static] nature of ordinary crypto-art.

The advent of traditional IP [Intellectual property]

Owners of IP – traditional intellectual property[as an example –sports cards]Following CryptoKitties, they also made several “attacks” into the crypto-collection space.

MLB project [Major League Baseball] concludeda partnership with game developer Lucid Sight to launch a new game in April 2018 called MLB Crypto Baseball, which sells blockchain-based collectibles.

Formula 1 also partnered with Animoca Brands to launch a blockchain game, F1DeltaTime, in which a $100,000 “1-1-1” car was sold on OpenSea.

Another example is Star Trek, which, jointlywith Lucid Sight, marked out a set of ships in the game Crypto Space Commanders. In the future, several more licensed football card companies joined here, including Stryking and SoRare.

Additionally, most recently Panini America,One of the largest sellers of collectibles, has issued a collection card based on blockchain. MotoGP also works with Animoca Brands to create a blockchain game.

Japan Leadership

Japanese games really marked the way forimplementation of a more advanced gameplay, which attracted early developers in various countries. My Crypto Heroes, a role-playing game with a developed in-game economy, has entered the scene and continues to lead the DappRadar ratings.

My Crypto Heroes was one of the first games whereThe concept of owning something on the blockchain and more elaborate gameplay outside the blockchain were implemented. Users can use their heroes inside the game, and then transfer them to Ethereum when they want to sell them on the secondary market.

https://twitter.com/marnold_mch/status/1195251156580106240

Virtual world expansion

New virtual worlds based on blockchainalso used NFTs to confirm ownership of land and internal assets. Decentraland, which raised $25 million for its MANA token during its ICO, sold land in its virtual universe for a total of $10 million. NFT assets in Decentraland had a much higher trading volume than any other NFT project in 2018.

Today, the Decentraland project has an open beta with some early developments, such as the Battle Racers racing game, which can be played all over the world.

https://twitter.com/NFTCrypto/status/1158087390814040064

Cryptovoxels is another virtual world project,used a slightly more subtle approach. CryptoVoxels, provides simple capabilities based on webVR technology, and was founded in mid-2018 by just one developer. The project gradually expanded its universe, trying not to sell more land than there was demand. Today, the total volume of transactions in CryptoVoxels amounted to more than 1700 ETH - while the average cost of land is growing steadily.

CryptoVoxels Universe Digital Art Museum

The most exciting aspect in CryptoVoxels andDecentraland is an opportunity to show your NFT inside the world. Collector enthusiasts have created CryptoKitty museums, cyberpunk art galleries, an NFT world calendar, towers filled with the best NFT projects, as well as shops where wearable items for your digital character can be purchased.

CryptoVoxels is becoming popular among digital artists, especially among users of Cent, a new crypto community-focused content platform.

Some artists even create their owncurrency or so-called “Social money” using the Roll application, which makes it easy to deploy a new ERC20 token and put up your works for sale in your own social currency.

Other virtual projects have entered the scene.world, including such as Somnium Space, as well as High Fidelity - a project from the creators of the famous Second Life. A Sandbox project using Roblox, a developer platform designed to empower content creators, has also recently begun selling land in its universe.

Enjin, which received 75,041 ETH in the ICO processat the end of 2017, expanded its “multiverse” platform to an entire ecosystem of games based on the ERC1155 standard. One of the key features of Enjin is the ability to transfer items from one game to another. For example, the Enjin team released a "universal" Oindrasdain ax that was added to Forgotten Artifacts as an equippable weapon, allowing players who previously owned it to try it out in that game.

Collectible card games

Trading card games from the startseemed like the most natural implementation for NFT. A physical card game such as Magic the Gathering is much more than just a game. This is a whole economy with dozens of related sites and trading platforms for buying, selling and exchanging.

And though, such digital equivalents of Magic theGathering, like Hearthstone could, theoretically, create a game market for their cards - such efforts could be too cumbersome and did not necessarily correspond to the business model for the implementation of new decks. In turn, the blockchain allows you to instantly create secondary trading floors that can work outside the game.

After its $ 5 million presale, Immutable launched the Gods Unchained game, possibly the most hyped blockchain game to date.

The first fame came to them after the Hearthstone card game forbade one of its players to participate in tournaments due to participation in political protests in Hong Kong:

https://twitter.com/Slasher/status/1181442535962632193

***

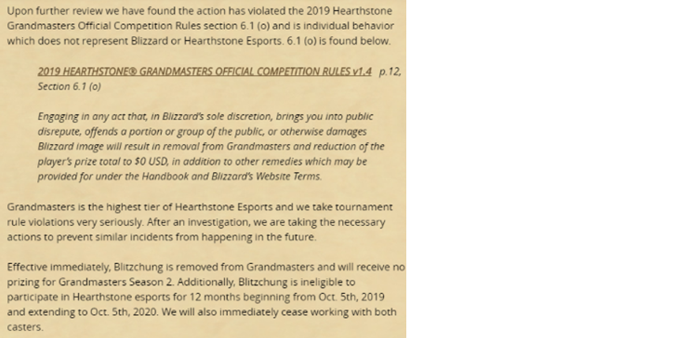

In reviewing the situation, we found thata player’s action violated the provisions of the Hearthstone Grandmasters Official Competition Rules 2019, section 6.1, and such behavior is not in accordance with the policies of Blizzard and Hearthstone.

Grandmasters Official Competition Rules 2019 v1.4

“Unauthorized participation in any actions thatdiscredit Blizzard, and also insult any public group or part of it, and thereby damage the reputation of Blizzard - leading to the removal of the player from the ranks of grandmasters and the complete deprivation of prize money. Additionally, other remedies may be available as provided in Blizzard's policies."

Grandmasters - the highest echelon of Hearthstone, and we take breaking the rules very seriously. Once the investigation is complete, we will take all necessary measures to prevent similar incidents in the future.

The decision takes effect immediately, so the Blitzchung player is expelled from the ranks of the grandmasters and will not receive prizes for the second season. In addition, he does not have the right to participate in Hearthston tournamentsethroughout the next year, starting October 5, 2019.

***

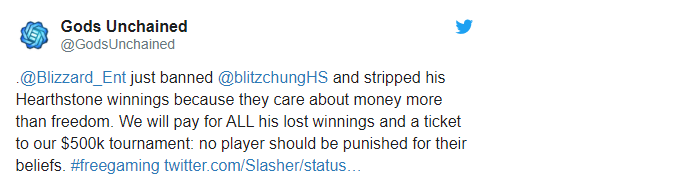

Then representatives of Gods Unchained made the following statement:

***

"Blizzard bannedBlitzchung to participate in tournaments and was deprived of himwinning at Hearthstone because they care about money more than freedom. We ourselves will pay him the remuneration due and provide him with a ticket to our tournament with a prize of $500,000: not a single player should be punished for his beliefs.”

***

Gods Unchained team “blocked” cards(tolerance in the core functionality of ERC721) for a long period before the game starts. During this period, third-party trading platforms allowed you to put up cards for sale, but, in fact, they could not be bought, because transfer was impossible. Therefore, when the cards were unlocked in November, the Gods Unchained market exploded, and the volume of secondary trade exceeded $ 1.3 million.

At this time, several other card games alsoquietly gathered dedicated fans. Horizon Games Skyweaver raised $ 3.75 million at the opening round and released a public beta.

In turn, the Epics game first enteredeSports is among blockchain-based collectible card games, while CryptoSpells is a card trading game from Japan and has taken a leading position in the Japanese market.

Decentralized Domain Name Services

Third largest "asset class" in NFTs (fieldgames and digital art) are domain name services similar to .com domain names, but based on decentralized technology. The Ethereum Domain Name Service, which launched in May 2017 and is funded by the Ethereum Foundation, ran between 2017 and 2018. has blocked 170,000 ETH in names - successful purchase orders are included in the smart contract for the period while the bidder owns the domain.

In May 2019, the team upgraded the ENS smart contract to become compatible with ERC721, which allows trading names on open NFT sites.

In October 2019, the OpenSea platformcollaborated with ENS to conduct auctions for 3-6 domain names using the English auction mechanism. The total value of the winning applications was 5,698 ETH. You can check out some interesting statistics here [English].

https://twitter.com/Flynnjamm/status/1212142551043575815

Additionally, the so-called “Unstoppable Domains” - domains with a more speculative approach to decentralized domain name services, as a result of which, Draper Associates and Boost VC received $ 4 million in the first round of financing. Subsequently, initially based on the Zilliqa blockchain, “indestructible domains” acquired the “.crypto” domain in the form of an ERC721 asset.

In turn, the Kred team is working on NFT,compatible with ENS and DNS. Storing the Kred token in your wallet gives you access to manage this name both in DNS (link to a website) and in ENS (link to a wallet or contract).

Other experiments

While most experiments in NFTheld in the field of games and collecting - gradually other options for using the technology appeared. So for the NFT.NYC and Token Summit events, tickets were sold as NFT, and the Coin.Kred team created a virtual “bag” for storing NFT items.

In turn, Binance also released NFT holiday collectibles, and Microsoft created Azure Heroes, badges for Azure members.

It is worth noting that the first major event inNorth America - NFT.NYC 2019 brought together more than 500 participants and more than 80 speakers at the famous Times Square in New York to discuss the development of the NFT ecosystem.

Crypto Stamp - Austrian Postal Service Projectalso offered buyers of official physical brands an “entry point” into the world of digital collectibles. Each physical brand has a section with an opaque protective coating, under which the buyer will find a private key with a small amount of ETH and a digital copy of the brand itself, which can then be put up for sale in OpenSea. The project was especially interesting, because linked scarce digital assets to a useful physical asset and attracted the existing community of collectors.

Additionally, Dapper Labs, creatorsCryptoKitties, launched the tournament game CheezeWizards. It is interesting that a hard fork occurred in the game, which led to the existence of both "non-pasteurized" and "pasteurized" wizards, and all because of the initial error in the smart contract. Having complex gameplay on the blockchain - the project emphasized the need to standardize the placement of NFT metadata, the ability to update a smart contract and ensure that the auction mechanism will change in accordance with the basic attributes of the items.

Loss and recovery

Yes, these years were not without casualties. Almost all games with the concept of “hot potato” that appeared in 2018 are already dead (although they are still available for viewing on OpenSea).

Surprisingly, some of these projects are allthey were brought back to life by members of their community. Both CryptoAssault and Etheremon (now Ethermon) have been restored. There was also an unsuccessful attempt to revive CryptoCelebrities by creating a game that allows you to engage in “breeding” of celebrities.

Myths about “non-interchangeable” tokens

Now that a general overview of the sphere has been given, it is worth talking about the misconceptions associated with it.

Demand stimulates only one deficit

At first, right after the emergence of the ecosystem of NFT tokens, it was believed that users would care about a proven shortage of NFT, and they would rush to buy NFT only because they were placed on the blockchain.

But, in fact, it is worth believing that demand is primarily driven by more traditional things: utility and origin.

The mechanism is obvious: I am ready to buy an NFT ticket because it allows me to participate in the conference, I am ready to buy a work of art if I can show it in the virtual world, I am ready to buy an item if it gives me special abilities in the game.

Additionally, the concept of origin, i.e. NFT asset history. Where is it from? Who owned it before? As the NFT sphere develops, stories of interesting NFT assets become more complex and begin to influence the value of the token.

Smart contracts make assets “eternal”

It is believed that only thanksNFT's smart contracted assets will last forever. Here, it is overlooked that there are other objects, such as websites and mobile applications, which serve as a portal for interacting with ordinary users. If such a “portal” fails, assets lose all value.

Of course, it is possible that in the future, decentralized applications will be able to be deployed in a fully distributed, “non-killable” way, but now we still live in a hybrid world.

Blockchain abstraction will solve all problems

In 2018-2019 in some projects, the so-called “Abstraction of the blockchain”, when all the internal mechanics of NFT were hidden from users who were provided with a wallet located on a remote server, with access by login and password.

Yes, it was an interesting approach as itimplied all the same principles of simplified adaptation as centralized applications. But, the problem was that, at the same time, full compatibility with the rest of the NFT ecosystem was lost: virtual worlds, wallets, trading floors, etc.

It is worth noting that the projects that are connecteddirectly to the existing NFT ecosystem, possibly sacrificing some usability in the short term, is usually more attractive to the current user community.

NFT Token Market

Current market volume

The NFT token market is still quite small, andmeasuring it is a little more difficult than the cryptocurrency market, given the lack of spot asset prices. This analysis focuses on secondary trading volume, i.e. on p2p token sales, which is used as an indicator of the market.

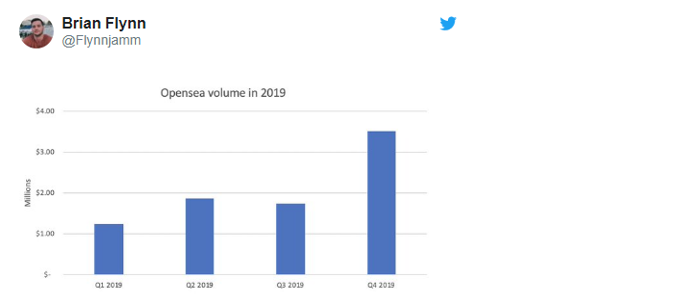

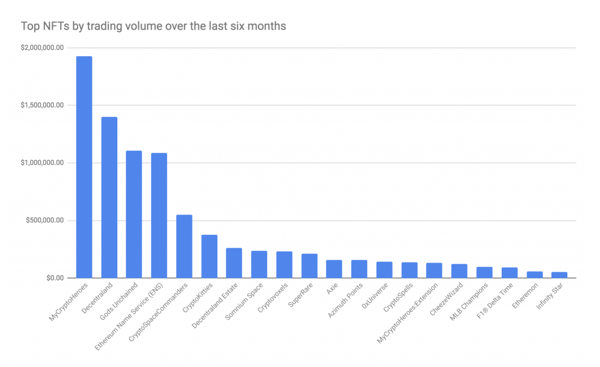

Today, the metric estimates the size of the secondary market at $ 2-3 million per month, and over the past six months, several specific projects have become the main ones.

Market growth

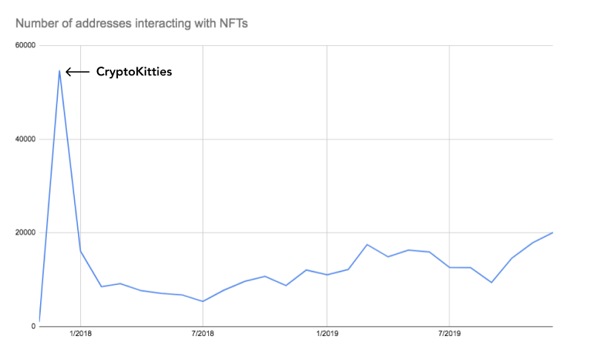

The number of users interacting with the NFT, which is determined by the volume of transfer, participation in tenders, as well as the number of purchases and sales. The market is slowly but steadily growing.

After the CryptoKitties bubble in late 2018The number of unique accounts interacting with the NFT ecosystem has slowly but steadily grown, from ~8,500 accounts in February 2018 to over 20,000 accounts in December 2019.

At the same time, it seems that the market is driven by the maingroup of experienced users. For example, on OpenSea, the average amount per seller is $ 71.96, while an individual seller can sell assets worth ~ $ 1178, which indicates a large number of active sellers.

Also, it is worth considering that large officialaccounts significantly increase the average value. For each buyer in OpenSea, on average, purchases are $ 42.72, while an individual buyer can spend ~ $ 943.81.

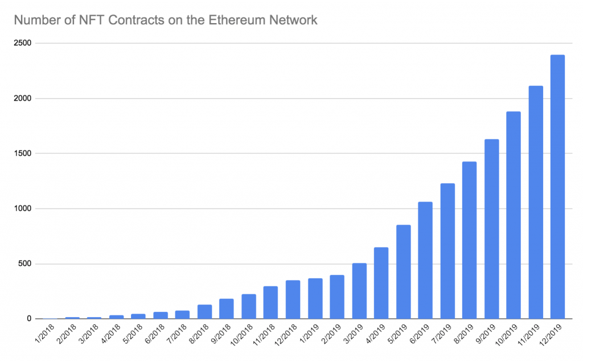

Additionally, given the growth rate of the NFT market,probably a good way to measure its growth is to study the interest of developers in this area, which is a kind of “leading indicator”. In the last year, the number of created ERC721 smart contracts on the network is growing exponentially - by June 2019, the number of new developers on the market has reached thousands.

***

Sale mechanisms

Currently, NFTs are mainly sold for ETH on decentralized exchanges. Surprisingly few trades in stablecoins like DAI or USDC, probably due to problems buying these coins.

For the sale of cheap assets are often usedmechanisms of Dutch auction and sale at a fixed price, while for more expensive assets, such as supervalued Gods Unchained cards or legendary game items, they use the English auction mechanism (in the eBay style). Bundles (collections) are also a very popular method of implementation, and the percentage of their sales since December 2019 has steadily increased to 20%.

NFT Intersection

Yes, such a question: Do the interests of participants in various NFT projects overlap? Are different communities relatively isolated from each other (players in Gods Unchained play only in Gods Unchained) or is there still communication between them? Can a CryptoKitties enthusiast own an ENS domain and, at the same time, additionally participate in any digital art project?

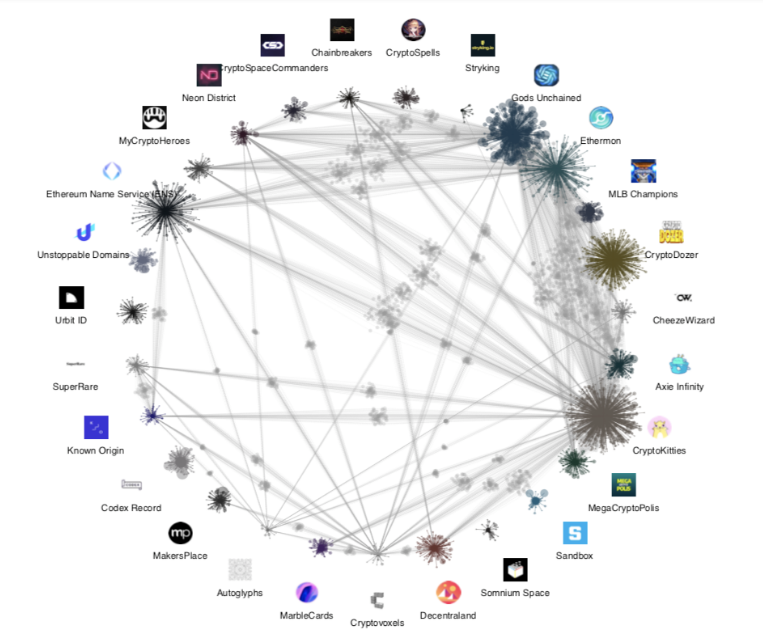

Raw Network NFT Network Diagram with ~ 400,000 Addresses in OpenSea

Takens Theorem, anonymous but very friendlyTwitter account with a fantastic analysis of the blockchain ecosystem (it is highly recommended to subscribe), conducted an analysis of intersections of interests between different NFT communities.

Above is a shared network diagram based onraw data from 400,000 addresses in OpenSea. On the outer ring, each LAN consists of addresses that own at least one type of NFT. The number of displayed nodes in the local network corresponds to the actual data, for example, thousands of addresses have only CryptoKitties. The size of each node depends on its balance.

In Gods Unchained, you can see that many addresseshave a lot of cards (deck!). The light gray nodes that connect the NFT projects are well-known co-ownership patterns. Also, there are thousands of addresses that own two different gaming NFTs - they are especially noticeable on the right. Additionally, there are other smaller co-ownership patterns — for example, between Cryptovoxels and Decentraland, as well as between ENS and many other projects, as indicated by the “forks” of connections between different projects.

What's next for NFT in 2020?

If you've read this far, acceptcongratulations! Hopefully, you’ve learned a lot about this funny and weird world of NFT, and be so inspired that you’ll take a closer look at at least a few of these projects, and perhaps create your own. In the next post, OpenSea representatives promise to discuss the future of NFT, and give predictions for the next couple of years.

Posted by DEVIN FINZER - CEO and co-founder of OpenSea

</p>