Update from Willy Woo. Yes, while the post was being translated and prepared for publication, there was a strong rebound,but this short-squeeze is unlikely to cancel out the pronounced selling wave from hodlers. Apparently, be careful there for now with this rebound.

The latest forecast came out just yesterday.Those who didn't miss out know that we were waiting for signs of a return of demand to the market, while the price, compared to fundamentals, was in an area from which a reversal can be expected.

But in the last 48 hours, there have been notable changes in on-chain supply and demand, so I decided to release this short update to keep readers updated.

Brief summary as of February 28, 2022 (current price ~$38.3 thousand):

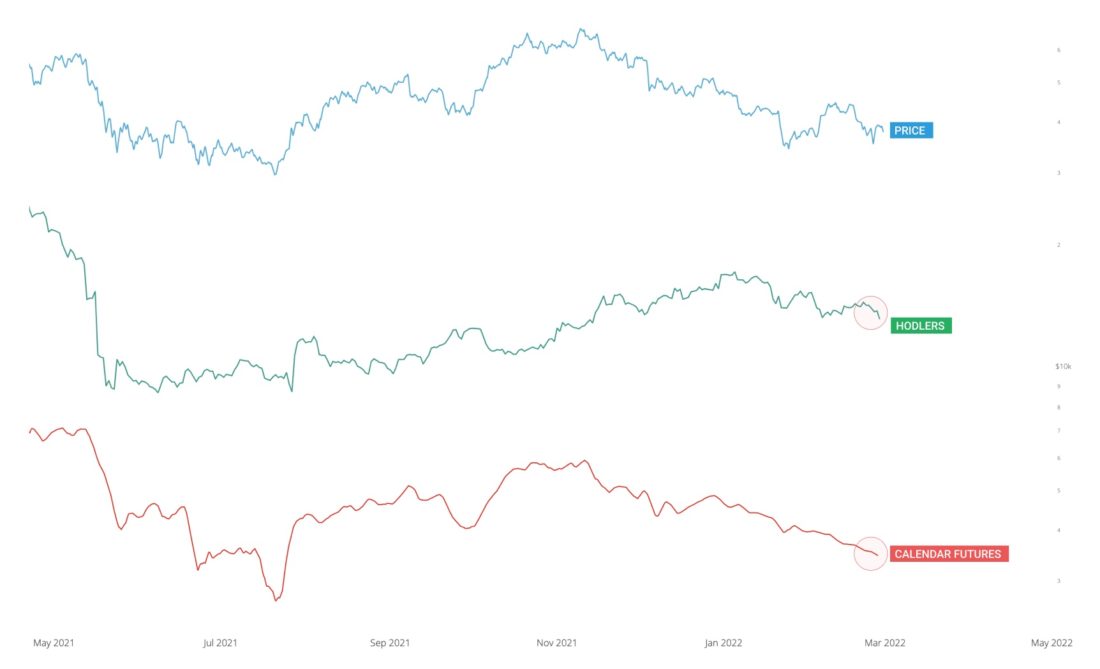

- Structural findings:in the last two days there has been another wavesales of hodlers, simultaneously with the sell-off in the futures markets. Although we are near extreme 'oversold' conditions, at the time of writing there is no sign of organic demand returning to the market. Reducing risks by selling off risky assets remains the prevailing line.

- Price Expectations:the bearish trend is in force until we see signs of demand returning to the market.

Be careful!

Please do not make trading decisions based on these forecasts and assume they are perfectly accurate. Allforecasts are probabilistic. Short-term market movements are subject to unpredictable events and market randomness.Manage risks accordingly.Longer-term forecasts are generally more reliable because it takes time for the fundamental effect to develop fully.

Hodlers started a new wave of sales

Over the past two days there has been another surgesales from hodlers, while sales have dominated the futures markets for three months now. There are currently no structural signs of the bear market easing. It is likely that the previous support at $34K will need to be tested again.

Supply and Demand in the Bitcoin Markets

And as for the area of extreme "oversold",in which the market is located: here is an update. The chart below compares the BTC market price and on-chain supply and demand. Apparently, due to selling by hodlers, this increase in the oscillator (now less "oversold") has not yet been reflected in the market. And now the market has room for further declines before the extreme oversold to mean reversion laws can take effect. In other words, there is more room for a new move down.

Supply Shock Oscillator for Liquid BTC Supply

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.