This is a short update on the previous prediction from Willy Wu, going beyond the usual format andcovering only the liquidity crisis that the bitcoin market experienced on Saturday.

This time I'll go straight to the graphs.

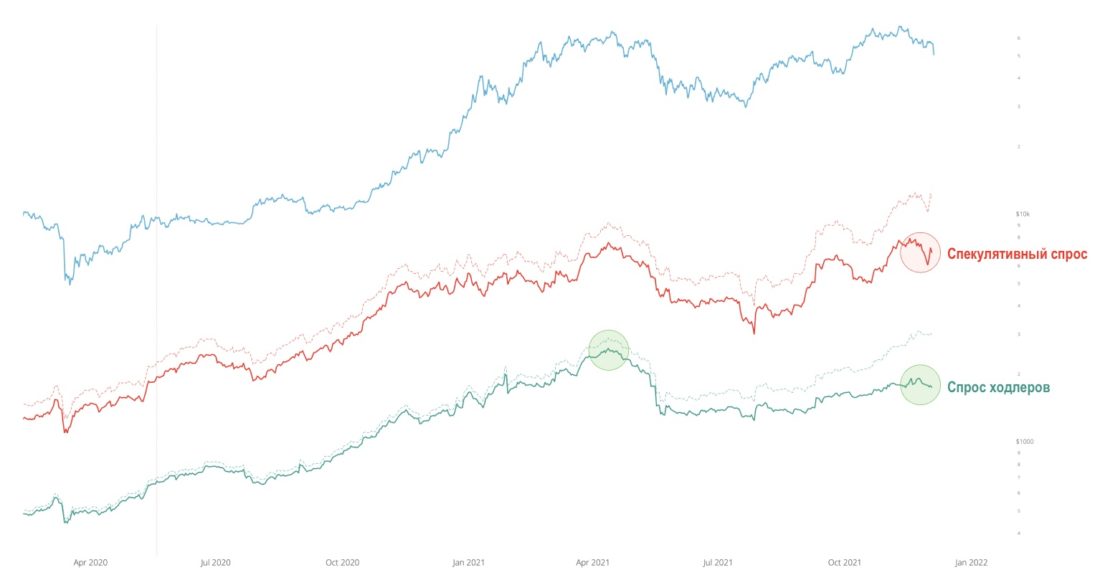

Hodler demand seen on-chain in recentwas weak for several days; hodlers were slowly selling BTC, while swing traders were buying more. At the same time, no pronounced sell-off from the Hodler side, which could herald the onset of a bearish phase, has not yet been seen. And I continue to follow this. I'm still waiting for tomorrow's on-chain data that will cover most of what is happening today, but at this point I can say that most of the activity has been liquidations on the futures exchanges.

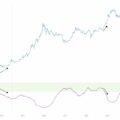

Bitcoin Supply Shock

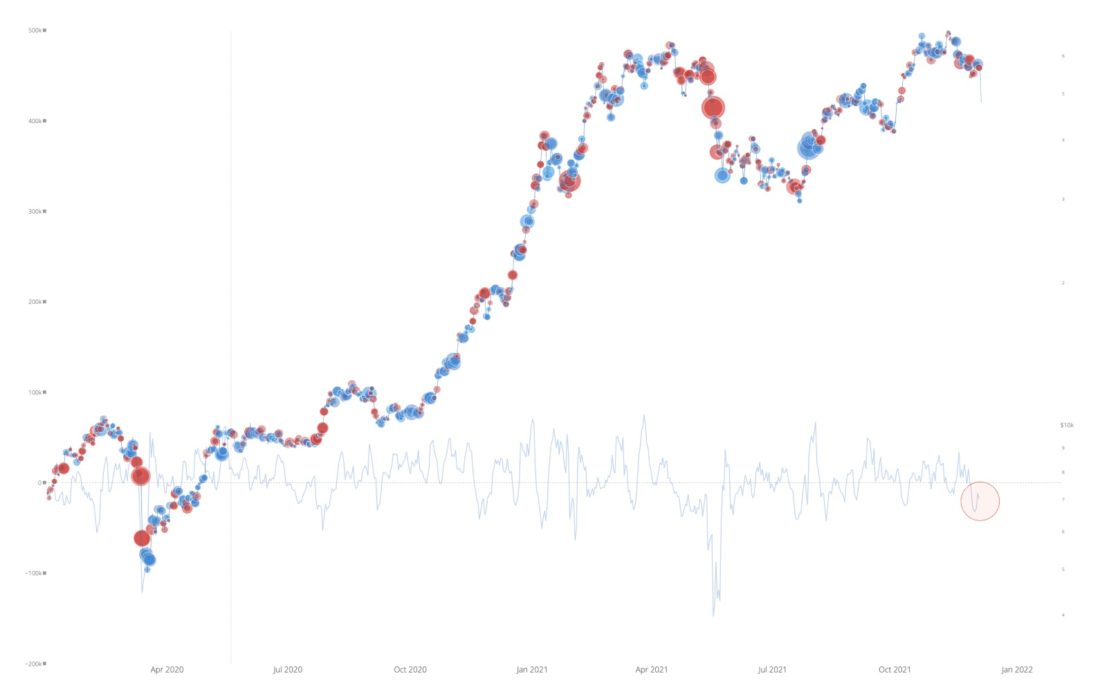

This is what it looks like in heatmap mode.The blue curve at the bottom is the flow of coins to and from hodlers' wallets. There were some small sell-offs, but nothing compared to a full-blown bearish sell-off like the one we saw in May. So far, most of the sales have been liquidations of traders in the futures markets, and now they are washed out of the market.

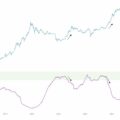

Heatmap of purchases / sales from the Hodler side

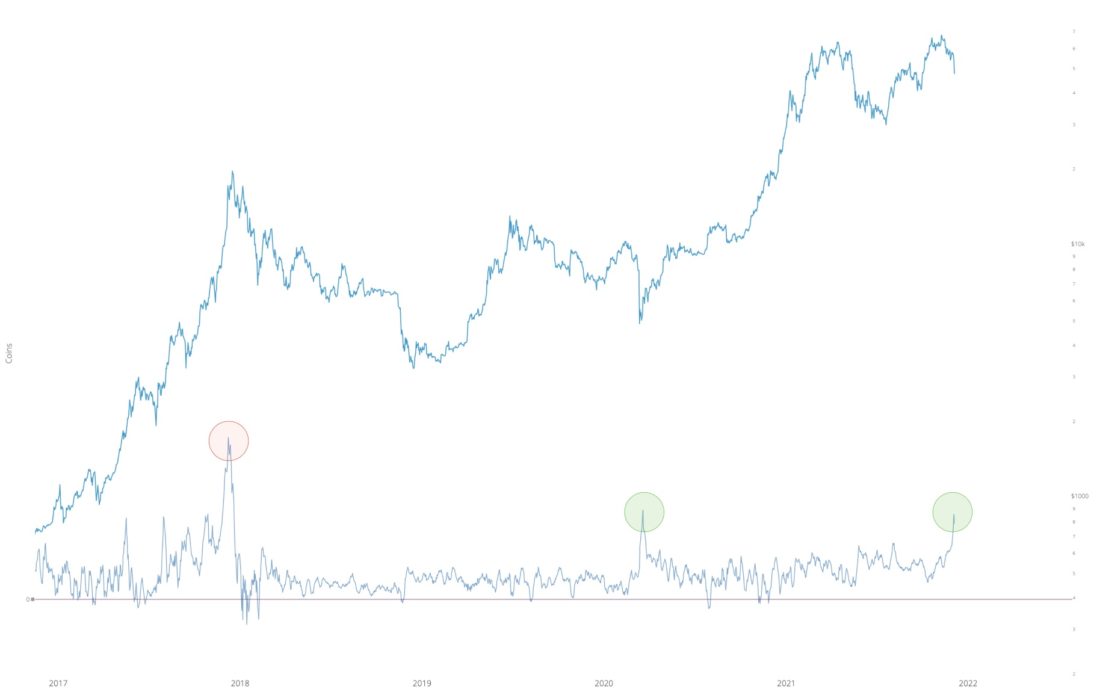

The last graph for today is behaviorsmall players (with a balance of less than 1 BTC). I like this metric because it gives insight into whether the market is truly structurally bearish. When this category of users (often called “shrimps”, by analogy with “whales” and other marine life) sells after a decline, as during the formation of the 2017 top, this is a bad sign that the bear market is accelerating. But for now, only strong buying momentum can be seen, similar to the COVID-2020 V-bottom.

Behavior of "shrimps", market players with a balance of less than 1 BTC

I will continue to monitor the situation and look forward to tomorrow's on-chain data as well. But for now, the situation tentatively looks favorable for a V-shaped recovery.

All the best. When I collect more data, there will be a full-fledged post and forecast.

All charts are made at charts.woobull.com

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.