The warnings of individual market participants about the onset of crypto winter have not yet subsided, as one ofpromising networks has moved up in capitalization to seventh place, and its coin is about to update ATH (all time high). We are talking about LUNA (Terra).

LUNA - a coin of the Terra project, has a floating rateand is algorithmically linked to network stablecoins, such as UST. If the demand for stablecoins grows, LUNA validators receive additional rewards. With a fall in demand and an excess of coins, some of them are burned by the system. There is an increased interest in algorithmic stablecoins, since their emission is not related to the will of the publisher, in other words, more cannot be printed for profit.

Image Source: Cryptocurrency ExchangeStormGain

The decrease in the cost of LUNA in winter was not due toonly with the general correction of the cryptocurrency market, but also with the problems of one of the project partners, Daniel Sestagalli. In January, it was revealed to the public that Sestagalli had hired McL Patrin (aka Omar Dhanani), who had been convicted of fraud many times, for the position of financial manager at Wonderland. We talked about the scandal in detail in our article. Because UST was indirectly affiliated with Wonderland, it was also sold off and tested for sustainability.

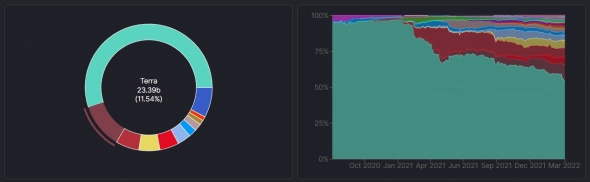

The current growth of LUNA is due to bothconfirmation of the network’s resilience, as well as increased interest in the Anchor DeFi platform. Anchor is built on the Terra blockchain and offers passive income (staking) for staking stablecoins. Over the past six months, Anchor’s user-locked amount (TVL) has risen from $2.5 billion to $11.7 billion, propelling Terra into second place in the overall DeFi standings this year, behind only Ethereum.

Image source: defillama.com

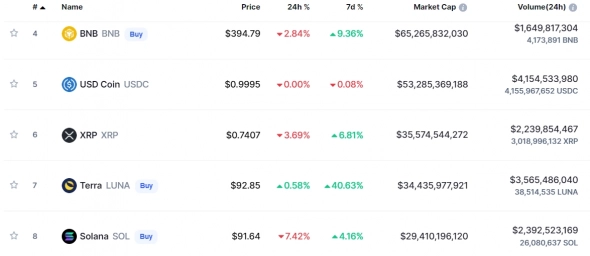

In terms of total capitalization, Terra rose in thisyear to seventh place, threatening to move Ripple in the coming days. At the same time, among algorithmic stablecoins, UST holds first place with a capitalization of $13.4 billion.

Image source: coinmarketcap.com

Ripple and Terra have the same goal - both projectsseek to become a key link between fiat and cryptocurrencies. The cardinal difference is that Ripple is a centralized network loaded with complaints from US regulators. Terra is a decentralized blockchain protocol with algorithmic stablecoins.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)