Before you dive into the article, pay attention to the fact thatthe fact that none of theis financial advice, please do your own research to make a more informed decision.

Today we are seeing multidirectionalmovements in this sector - on the one hand, protocols stop issuing unsecured loans (Maple, TrueFi) or are clearly not in the best shape (Goldfinch, Ribbon Lend). Maple representatives have publicly stated that unsecured loans do not work in current market conditions. On the other hand, the hype around RWA is gaining momentum, and private (including unsecured) loans are a significant part of the RWA sector.

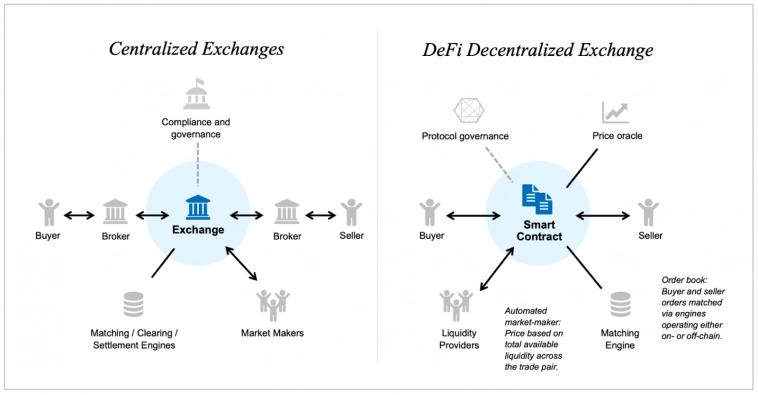

What might unsecured loans look like in web3. The four main approaches are:

⁃ Goldfinch approach - a protocol forissuing/receiving loans, large investors (bakers) underwrite loans (conduct due diligence on the borrower, determine loan terms, etc.), the system algorithmically distributes funds from retail investors;

⁃ Maple approach - a protocol for issuing/receiving loans, professional underwriters (pool originators) underwrite loans, retail investors themselves choose which pools to invest in;

⁃ Clearpool approach - a protocol for issuing/receiving loans with permissionless pools (available to everyone) and automatic underwriting from Credora;

⁃ Centrifuge approach is a protocol for “selling” issued IR loans (what is called securitization), in which crypto users can receive exposure to pools with private loans of their choice.

In all cases, the protocols also defineframeworks for collecting and distributing funds (breakdown into tranches, distribution of investments and payments, etc.), protective mechanisms (insurance pools, slashing, etc.) and provide the smart contracts necessary for this.

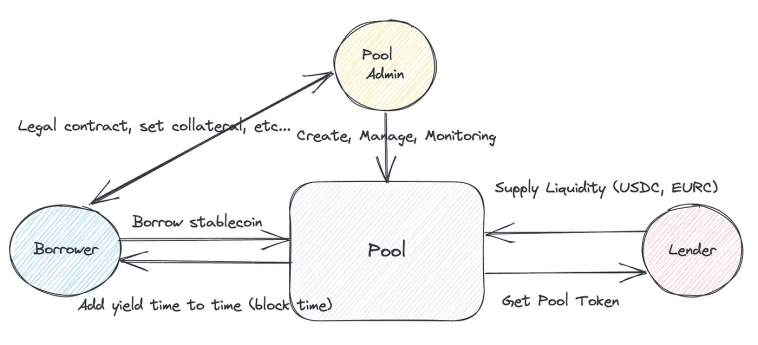

The concept of Perimeter Protocol is most similar to Maple (more precisely, its generalized version). The following key aspects of the protocol can be found in Whitepaper:

⁃ Perimeter Protocol is not a final product(Circle does not plan to deploy its contracts to the mainnet at all), but “public good utility infrastructure” (an open source set of smart contracts available for public use and forks), created primarily for developers;

⁃ main planned participants of landing stories- pool administrators (underwriters and loan managers - determine the conditions based on the results of the due diligence, enter into agreements with debtors, monitor them, resolve defaults, etc.), lenders and borrowers;

⁃ the protocol is as flexible as possible and can adapt to almost any needs of underwriters/lenders/investors (any types and conditions of loans, collateral, waterfall payment, DID, etc.);

⁃ there will be no token.

Thus, Circle is rolling out to the marketundewriter/creditor-agnostic infrastructure on top of which lending products can be created for any need from issuing microloans to Nigerians to building infrastructure projects. It would not be entirely correct to compare Perimeter with other protocols, but judging by what is written in the wiper, Goldfinch, Maple, and Centrifuge could well build their protocols on the basis of Perimeter contracts. Thus, Perimeter is more of a foundation that can be used for any purpose related to on-chain lending - be it permissionless pools with automatic underwriting based on analysis of the borrower’s on-chain history, issuance of microloans by a bank in compliance with KYC/AML policies, or securitization of loans for small business development for third world companies.

Judging by the document, Circle does not intendcompete with existing protocols, but the reality may be very different from what is written on paper. Will Circle, directly or through subsidiaries, create landing protocols on top of Permiter? Will Perimeter act as a shared infrastructure or will we see many forks of it? Will Circle try to attract trade underwriters? In general, it will be interesting to see who can be attracted to create products using Perimeter, and in what format the protocol will be used by builders.