Before you dive into the article, pay attention to the fact thatthe fact that none of theis financial advice, please do your own research to make a more informed decision.

Key points on cross-chain:

⁃ the inability of the Ethereum network to meet the needs of users and the growth of commissions to inadequate levels contributed to the active development of alternative blockchains in 2021-2022;

⁃ blockchains cannot communicate with each other “directly” (with the exception of chains within ecosystems such as Cosmos or Polkadot), their interaction requires the presence of a third party in one form or another;

⁃ despite Vitalik’s skeptical attitude towards the cross-chain future, dozens of different options for cross-chain solutions have appeared in the last year, hundreds of millions of dollars have been invested in this area;

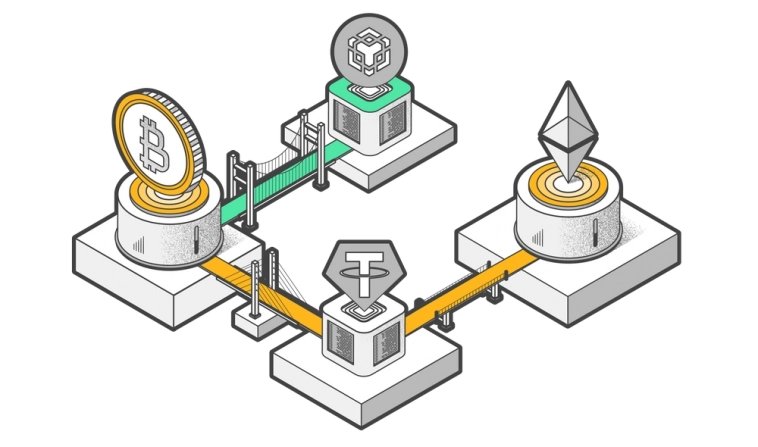

I. Bridges

Designed for moving between chains of messages with a certain structure, namely, tokens.

Bridges can be divided into three types:

⁃ using external validators, they are not doing well with security;

⁃ using light clients and relayers, they are quite difficult and expensive to implement in applications;

⁃ liquidity networks, they have limited functionality.

Some protocols use multiple approaches simultaneously.

Some examples of popular bridges with different architectures:

1. Multichain

The bridge with the largest TVL is about $2b, supports more than 50 networks. The basis of the protocol is its own set of validators.

2. cBridge from Celer

TVL is a little more than $200m, supports about 20 networks. The basis of the work is also its own set of validators. Works on the lock-mint model, as well as with pools of existing liquidity.

3. Hop Protocol

TVL about $50m, supports 5 EVM networks. The basis of the work is “intermediate” h-tokens and bonders, which provide liquidity (hToken-token).

II. Bridge aggregators

Their essence is to aggregate dexes and bridges: pack swap-bridge-swap into an interface convenient for the end user.

1. Li.fi and transferto.xyz

Raised $5.5m.

2. ChainSwap

Similarly, an aggregator of dexes and bridges raised $3m.

3.Atlas DEX

Aggregator from Solana, which raised $6m.

4. Rango exchange

Another aggregator with a creepy casino-style design, they planned to raise about $15m.

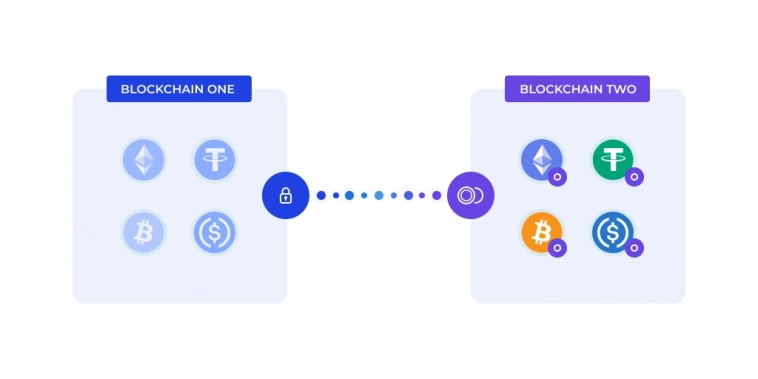

III. Cross-chain information exchange protocols

Designed for moving a wider range of information between networks.

1. IBC (inter-blockchain communication) protocol

This is a framework for interaction between different chains without involving any third party in the process.

2. Axelar

It is an independent PoS blockchain based on the Cosmos SDK. That is, Axelar has its own validators, tokenomics, etc..

3. Nomad

This is a form of implementation of the Optics protocol from Celo. It works on a model similar to optimistic rollups.

4. LayerZero and Chainlink CCIP

Architecturally similar models. For cross-chain communication, smart contracts are used in each of the networks, as well as a combination of an off-chain relayer and an oracle.

LayerZero positions itself as a protocol notrequiring trust to a third party, and therefore more secure, which is not entirely true. Information on CCIP is still minimal, the product is still in development. At the same time, the following are already working on the basis of LayerZero:

⁃ StarGate - bridge for stablecoins and ETH;

⁃ HashFlow, which offer cross-chain swaps in 6;

⁃ WooFi, which will use LayerZero for cross-chain swaps;

⁃ Vesta Finance, which uses LayerZero for cross-chain minting of its VST token.