Futures reports are a useful tool for traders and investors to help gauge sentiment amongmajor players and complement the vision of the market situation. What moods prevail in the camp of bitcoin whales?

Over the period of the last two futures reports (from June 30 to July 14), the Bitcoin (BTC) price continued to fall smoothly strictly within the descending triangle:

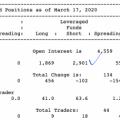

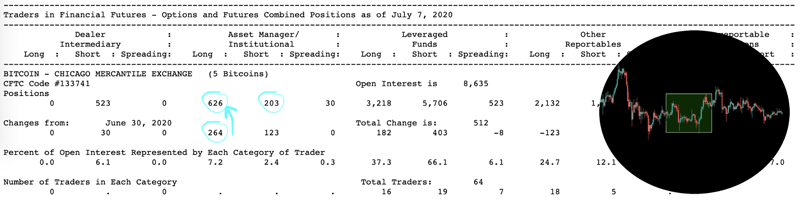

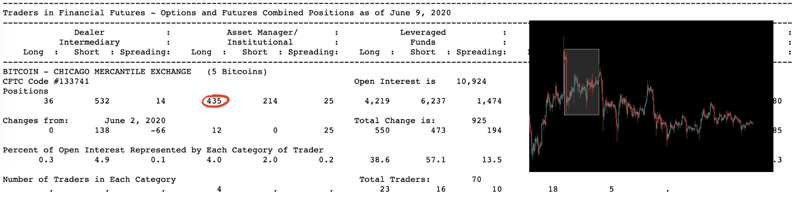

For the period from June 30 to July 7, the price of bitcoingrew within the "triangle" by 3%. We see a large gain in long positions in the Asset Managers section, where a total of 626 long contracts are valued for bullish sentiment. However, short positions rose by as much as 123 contracts, which is half of that of long holders.

In the Leveraged Funds section, the situation has remained virtually unchanged over the past two months. Holders of short contracts predominate, keeping the lead by about two times.

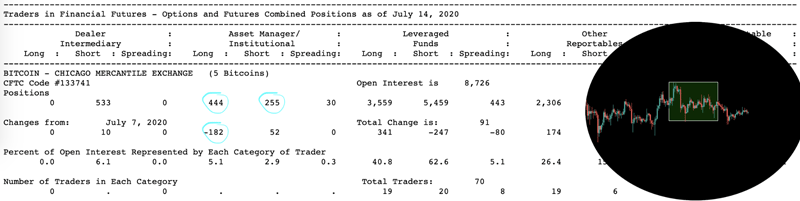

In the report for the period from 7 to 14 July in the section AssetManagers can see a decrease in long positions by 182 contracts. This may be due to the fact that the bitcoin price was unable to break through the local resistance level of $ 9450.

It is possible that a major player left the market in anticipation of a better entry point. The $ 8,900 support level is interesting - aggressive buying can start from it, which can move Bitcoin up.

In the Leveraged Funds section, the majority of short-contract holders remained almost twofold.

Retail traders on the Bitfinex exchange have shown no activity since June 15. The formed horizontal lines on the BTCUSDSHORTS vs BTCUSDLONGS indicator indicate zero dynamics.

Traders await a key denouement duringwhere the price either breaks the $ 8900 level, which will cause demand for short positions. Or Bitcoin will hold on to this level and, as a result, the price will exit the “descending triangle”. This will already be a signal for growth in terms of technical analysis.

In the report for the period from 7 to 14 July, whichis the most relevant, the number of long contracts (435) almost corresponds to the picture for the period from 2 to 9 June (444). Then Bitcoin could not gain a foothold above the key level of $ 10,000 and began to fall within the “descending triangle”.

Based on this alone, we can say that the mood of Asset Managers has remained unchanged for a whole month. All eyes on the $ 8900 level.

Futures analysis is only part ofcomplex analysis. In no case should you make trading decisions based on futures analysis. The bitcoin market is very volatile, don't forget about risk management, hedging and diversification.

</p> 5

/

5

(

1

voice

)