Futures reports are a useful tool for traders to help them capture sentiment among majorplayers and complement the vision of the market situation. Analyst Dmitry Perepelkin specifically told ForkLog about the mood that prevails in the camp of bitcoin whales.

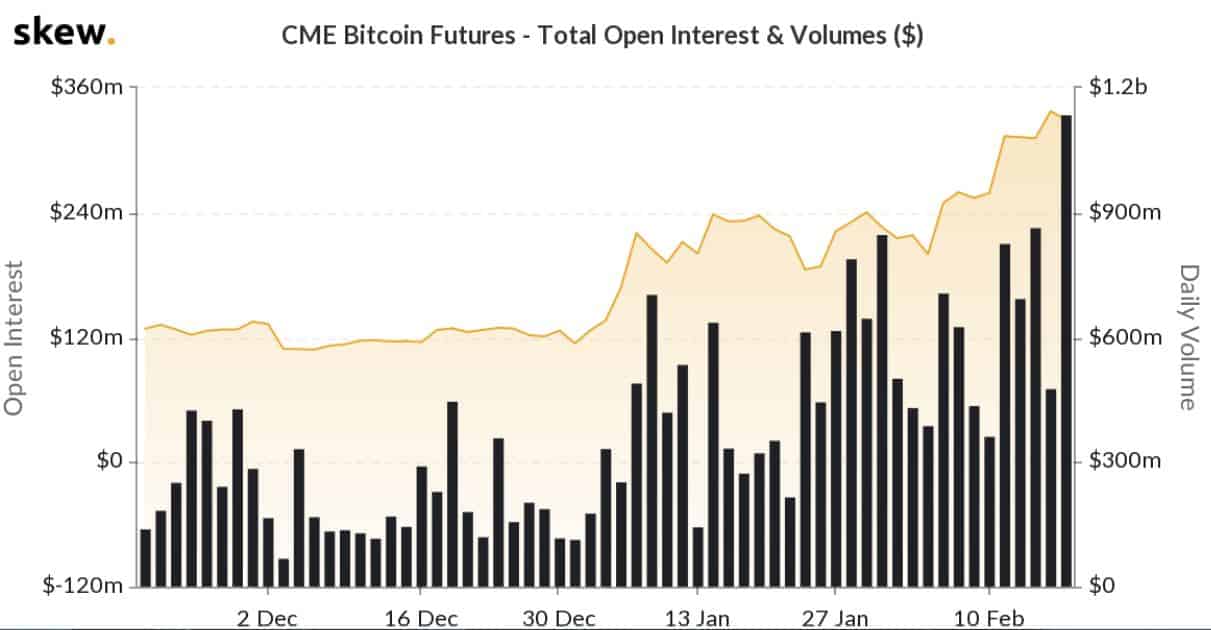

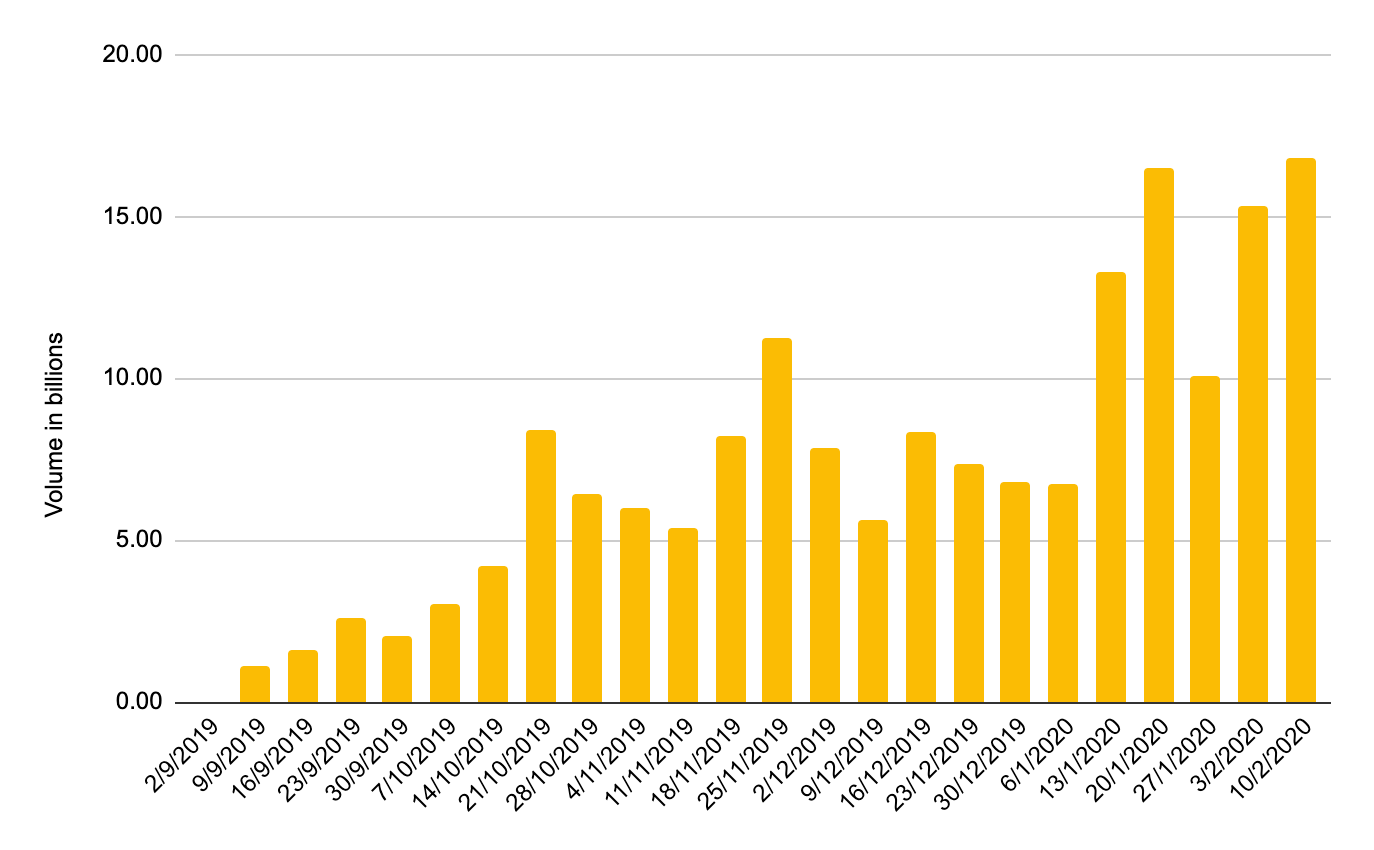

Market participants show high interest inBitcoin Futures. The main regulated platform for trading this instrument remains the Chicago Mercantile Exchange (CME), the trading volume on which last week exceeded the $ 1 billion mark (this happened only three times).

Other major players are BitMEX (trading volume in February - $ 1.43 billion), OKEx ($ 1.1 billion) and Binance Futures (weekly trading volume - $ 16 billion as of February 10).

Data: skew

Source: Binance Blog

We are primarily interested in the moods of largeprofessional market players that we value on futures reports. Thanks to futures analysis, we have the opportunity to evaluate the balance of power in the market and take this into account when making trading decisions.

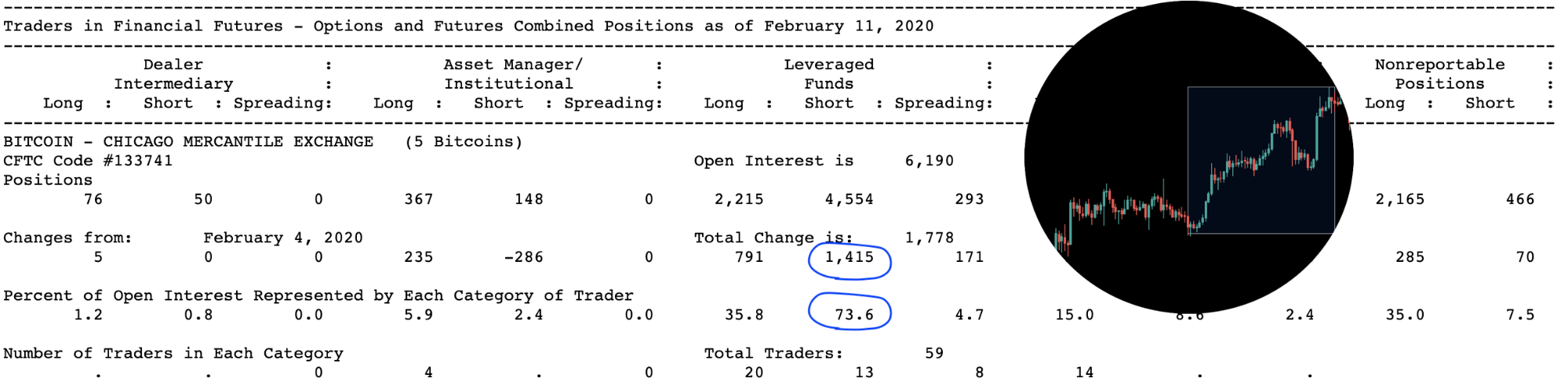

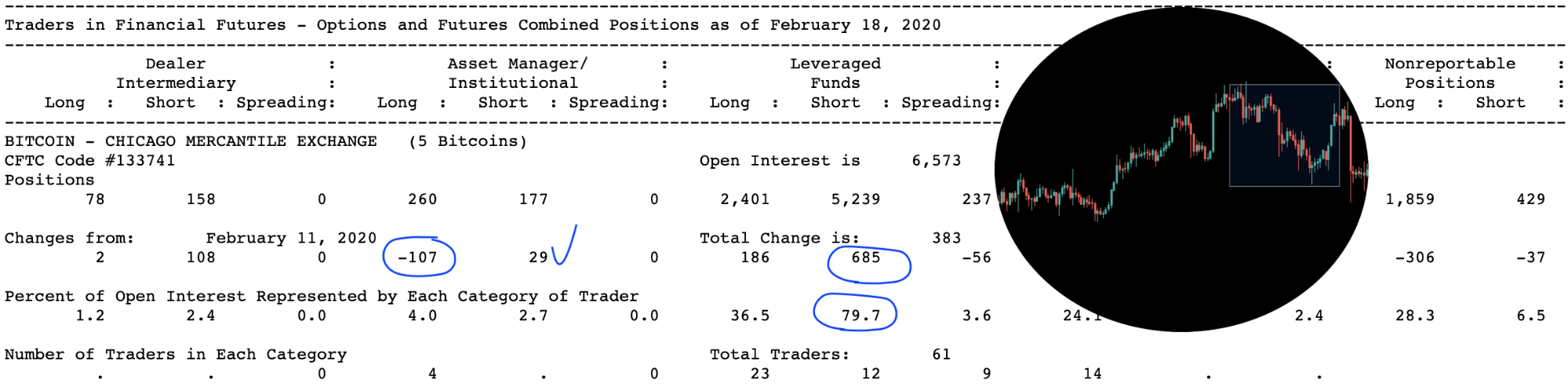

Let us turn to the reports “Traders in Financial Futures; Futures-and-Options-Combined ”for the period from February 4 to February 25 and evaluate the dynamics:

Most speculative market players, LeveragedFunds, actively increased short positions, despite market growth. During the period from February 4 to 11, they opened 1,415 short positions, thereby creating a serious gap with long positions (4,554 shorts / 2,215 long).

For the period from February 11 to February 18 in the price range$ 9,500- $ 10,450, Leveraged Funds opened another 685 short positions. This is a significant indicator that needs to be taken into account, since an active set of short positions took place precisely in the growing market from $ 9,100 to $ 10,450.

Note that Asset Managers for the same periodreduced long positions by 107 contracts. Probably, these actions are due to the fact that Bitcoin was not able to confidently break through the important price level of $ 10,500.

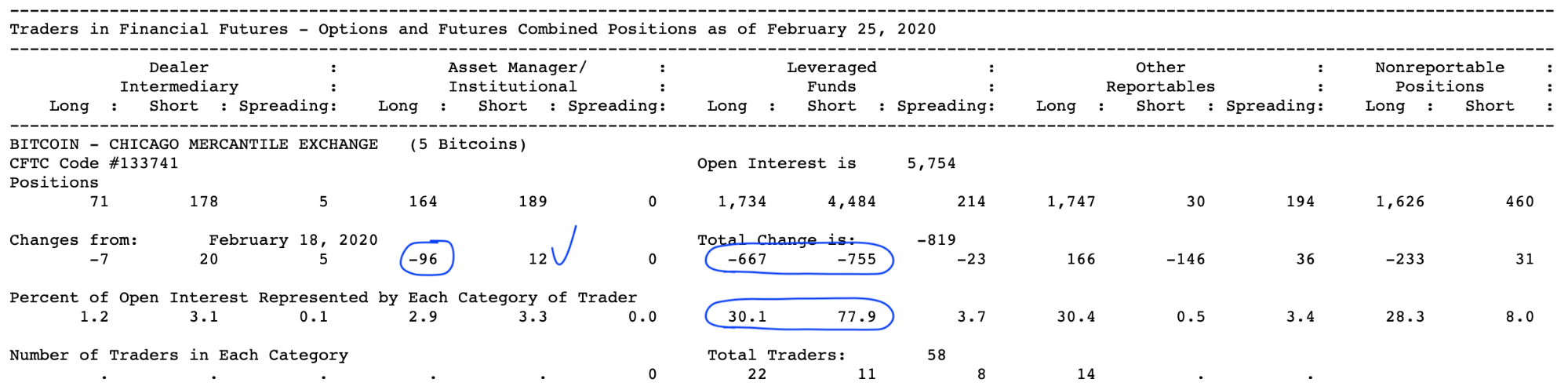

In the last report (the period from February 18 to February 25) wewe observe that BTC has left the upward channel and at the moment continues to fall, approaching the important price range of $ 7700- $ 8300, where $ 8300 is the level of support.

Summing up, we can say that the advantage in the marketclearly in favor of bearish sentiment in the camp of CME futures speculators. Leveraged Funds are in no hurry to take their profits, while maintaining 4484 short versus 1734 long positions.

In February, the price was unable to gain a foothold overlevel of $ 9400. Now we are between support at $ 8300 and resistance at $ 9100. Bitcoin may be stuck in this price range for some time before an attempt is made to break through the upper or lower border.

One of the most important rules in any market: we need to trade, taking into account the arguments that the market gives us, and in no case rely solely on luck. Otherwise, the adjustment of the facts to your expectations begins.

Futures analysis is only partintegrated analysis. In no case can you make trading decisions based on futures analysis only. This review is analytical and not a forecast or trading recommendation. The bitcoin market is very volatile, so do not forget about risk management, hedging and diversification.