Futures reports are a useful tool for traders to help them capture sentiment among majorplayers and complement the vision of the market situation. Analyst Dmitry Perepelkin specifically told ForkLog about the mood that prevails in the camp of bitcoin whales.

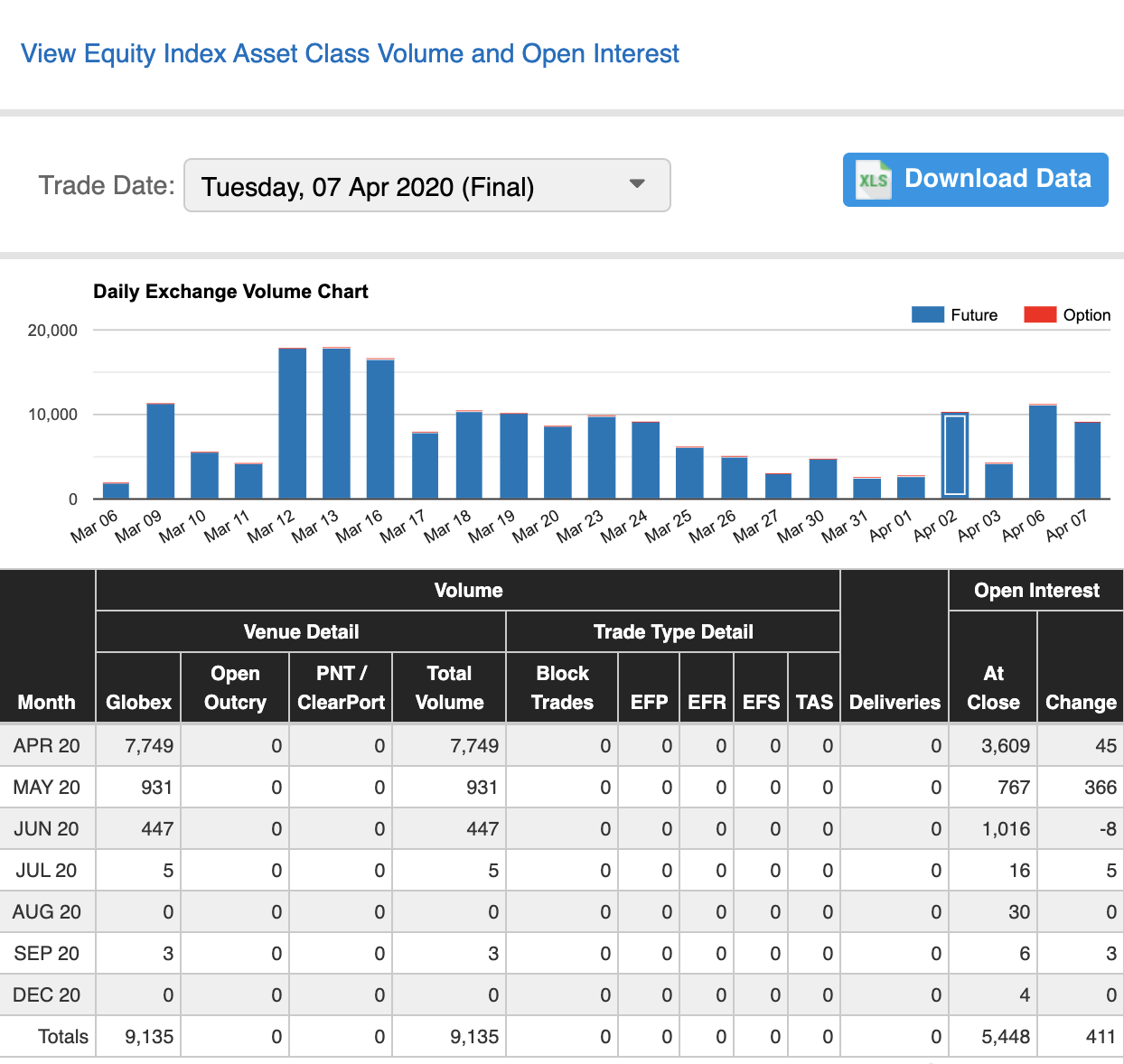

An interesting situation has developed in the Bitcoin futures market.situation. As BTC grew from $6,700 to $7,450 over the period from March 24 to April 7, there was a decrease in open interest in futures contracts on the CME. On March 23, open interest was 9,757, the figure for April 7 — 5448.

Daily exchange volume data

Generally, a reduction in open interest andvolume in a growing market is an argument that the market is still weak. On the graph, you can clearly see how the volume every day went downhill.

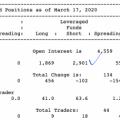

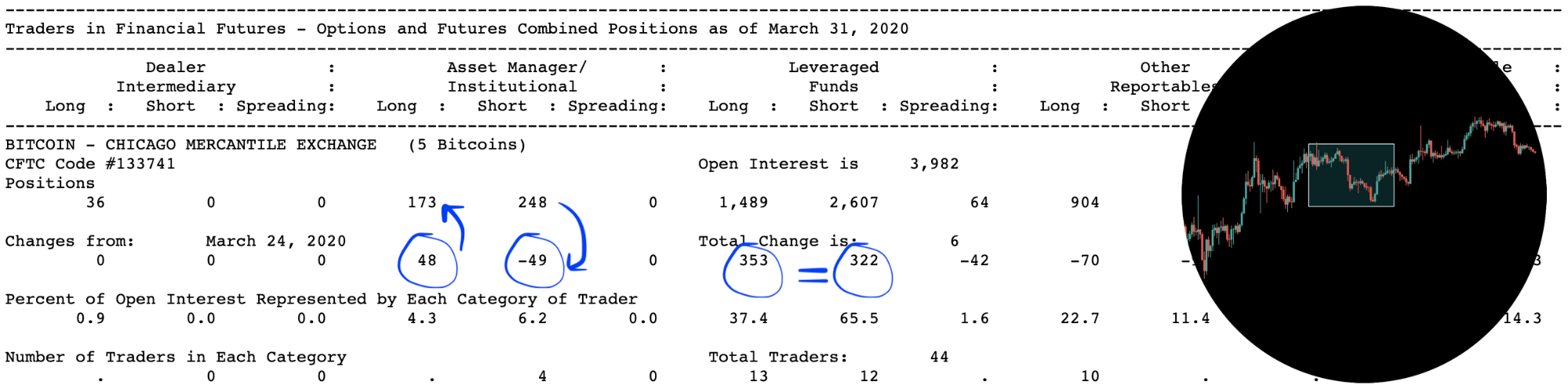

Now let's turn to the COT reports. From March 24 to March 31 Asset Managers began to close short contracts (-49) and gain long positions (+48). We can say that they changed their shoes.

The Leveraged Funds section has opened 353 newlong contract and 322 short contract. This suggests that in the camp of Leveraged Funds there is no change of the bearish mood to the bullish one. The advantage is in favor of the bears.

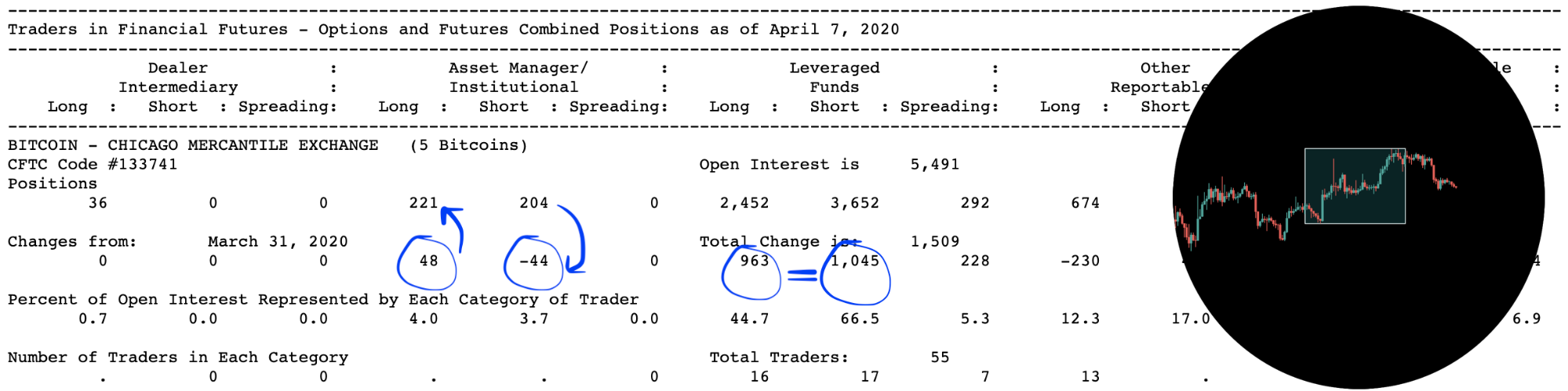

In the COT report for the period from March 31 to April 7the picture has not changed. Asset Managers closed 44 short contracts and increased long positions by 48 contracts. Leveraged Funds increased both short positions (+1045) and long positions by 963 new contracts. The advantage in the camp of Leveraged Funds still remains in favor of the bearish mood.

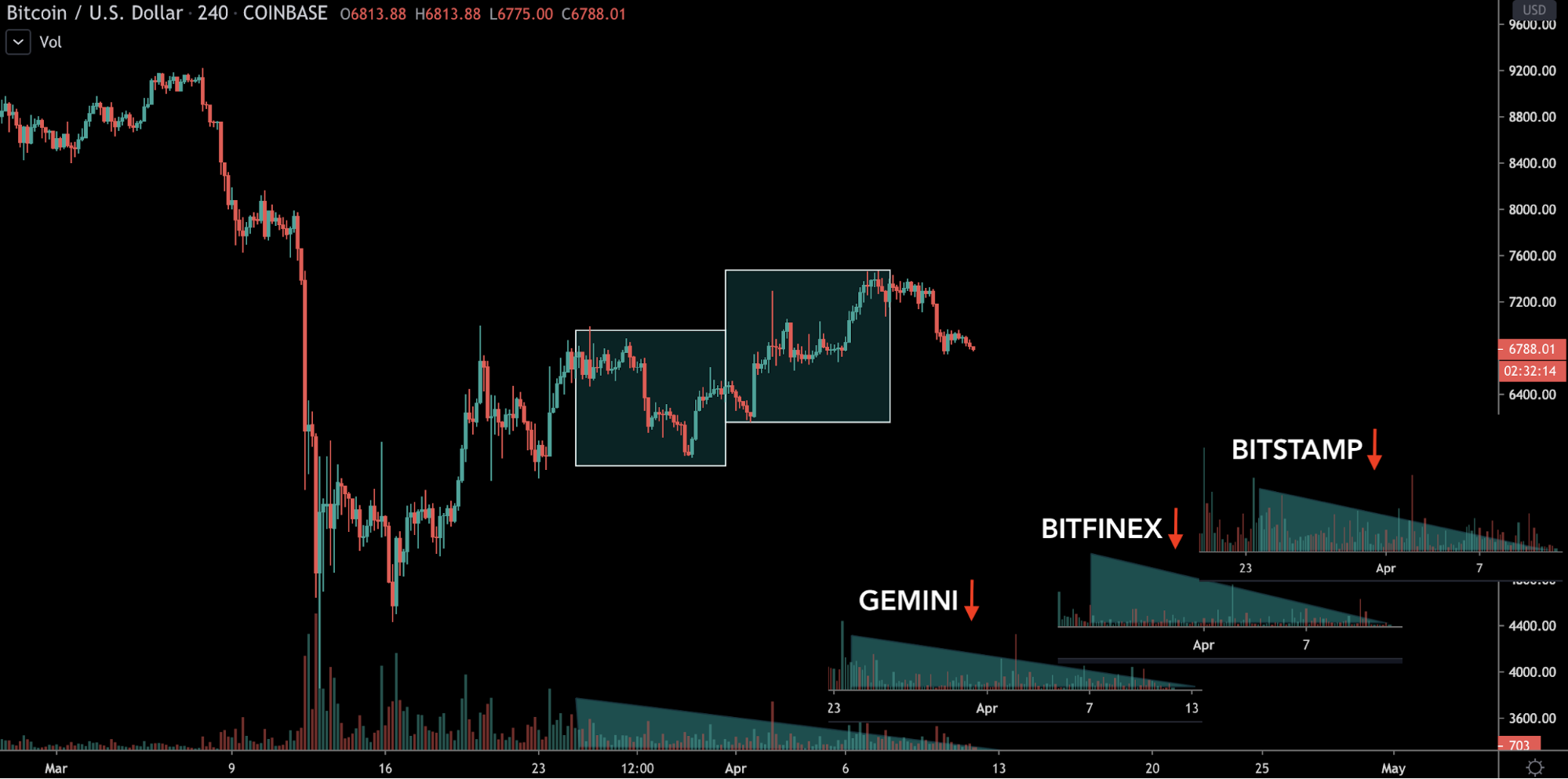

Based on data on open interest, volumeson Coinbase, Bitfinex, Gemini and Bitstamp, and also taking into account the general preponderance of short positions on CME, according to futures analysis, the market is dominated by a bearish mood.

In addition to this, pay attention to the emerging “rising wedge” pattern, which is a bearish signal.

One of the most important rules in any market: we need to trade, taking into account the arguments that the market gives us, and in no case rely solely on luck. Otherwise, the adjustment of the facts to your expectations begins.

Futures analysis is only partintegrated analysis. In no case can you make trading decisions based on futures analysis only. This review is analytical and not a forecast or trading recommendation. The bitcoin market is very volatile, so do not forget about risk management, hedging and diversification.