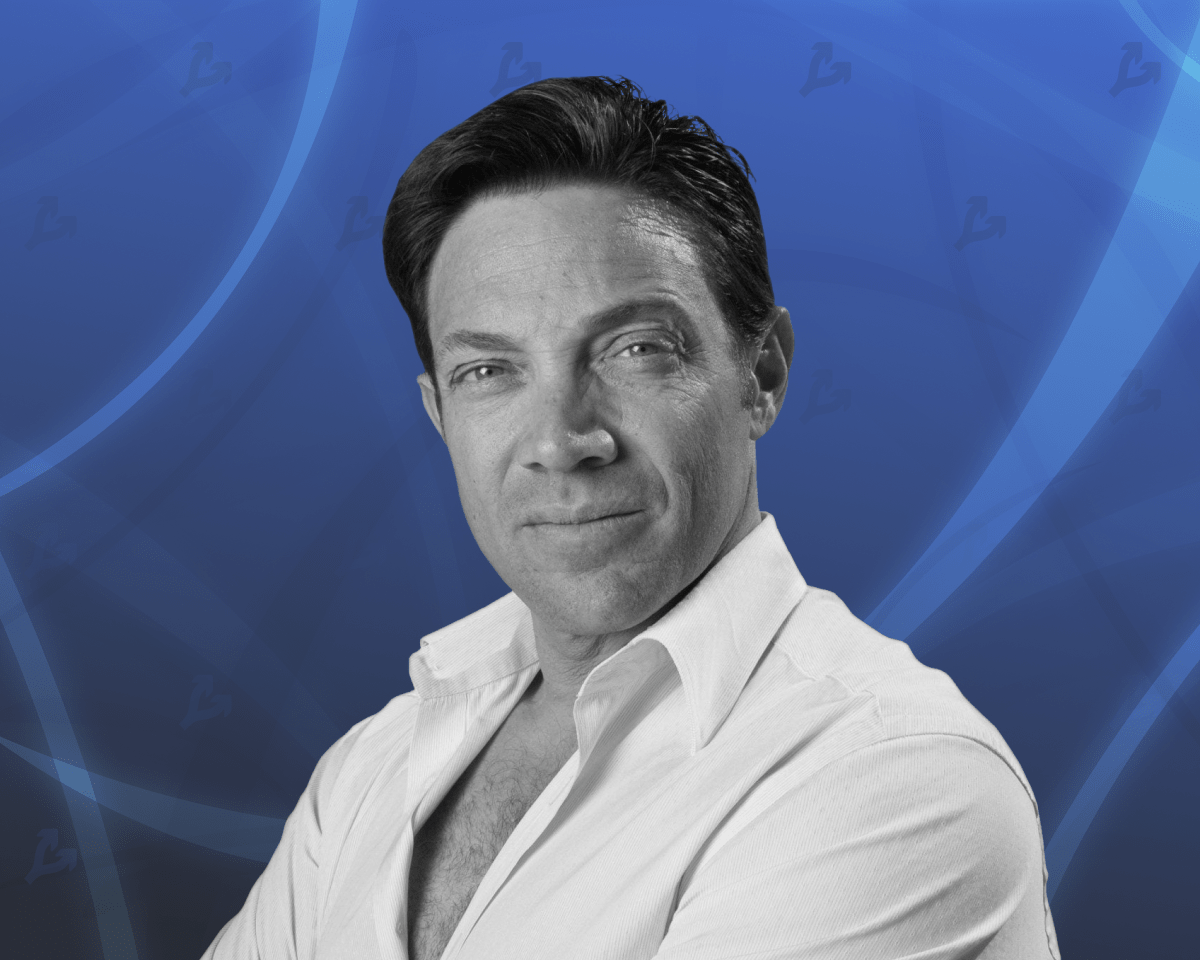

Former American broker Jordan Belfort, known as the “Wolf of Wall Street,” comparedlow-cap digital assets with junk stocks.

“I don’t think there is any research you can do to protect yourself against these ultra-low-cap assets, except for a very early entry,” he said.

There is a lot of money to be made in this segment, Belfort said, but most buyers of junk stocks will lose their money.

He warned investors against acquiring such assets only if they are not willing to commit a certain amount of their portfolio to gambling.

The “Wolf of Wall Street” said that he considers Bitcoin and Ethereum primarily as reliable digital assets due to their strong foundation.

“I think it’s only a matter of time before […] bitcoin reaches maturity for it to start trading more as a store of value than as a growth stock,” he explained.

</p>

In 2018, Belfort said that retail investors in the first cryptocurrency were brainwashed. A few years later, he changed his mind, like many other investors and financiers.

From denial to acceptance: how billionaires are moving to the side of cryptocurrencies

Recall that in July 2022, The Wolf of Wall Street called Bitcoin a long-term hedge against inflation.

Previously, he criticized meme-cryptocurrencies Shiba Inu and Dogecoin for lack of value. In his opinion, the creators of these projects use an unregulated market and should go to jail.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.