When can you expect bitcoin to be worth more than any publicly traded company?

let's tryestimate approximately:

- Where is Bitcoin growing now?

- What's the next step?

- What is the ultimate goal?

It works like this: when you know what your current state is (1) and which direction you would like to move (3), you only need to worry about what your next step is.

It's a good thinking system to help you focus on what's most important at a given moment in time.

Sometimes I write about what would mean forBitcoin, if it grows to the size of, say, a bond market share. But the truth is, at its current valuation, it is already equal to the size of large-cap stocks.

So while it’s nice to think of gold, real estate, or the bond market as long-term goals, there’s definitely a closer and more achievable goal for item number 2.

Bitcoin is now the equivalent of something like the sixth-largest company by market cap: depending on the day, Bitcoin sits somewhere between Facebook and Tesla.

In my opinion, getting out of this large-cap range and increasing Bitcoin's market capitalization above the value of any publicly traded company can be seen as a reasonable goal:

- It’s quite real. After all, Apple's capitalization is only about 3 times different from Bitcoin's current capitalization.

- On a psychological level, it would be really difficult to give up Bitcoin if it managed to rise to that level.

So what is required for this?

Honestly, anything can happen. So it might not be worth spending too much time developing complex pricing models or anything like that.

But let's do some quick calculations: it will only take 5 minutes, but it will be enough to get an idea of the scale.

So here's a hypothesis:

- Apple is a moving target.But we will assume that it is moving at a constant speed. Over the past 5 years, its market capitalization has grown at an average of 22% per year. We expect this to continue over the next five years.

- For Bitcoin we can consider a number of scenarios:

- …Bitcoin continues to grow at the same CAGR over the next 5 years, i.e. 118% per year;

- …Bitcoin is growing 25% slower over the next 5 years, i.e. 89% per year;

- …Bitcoin is growing 50% slower over the next 5 years, or 59% per year.

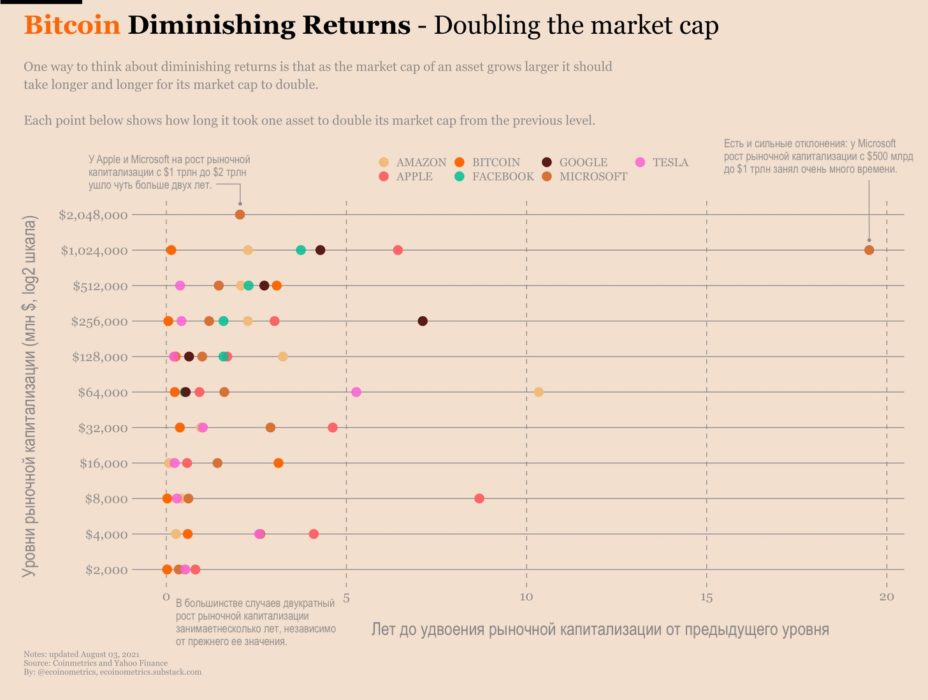

However, I have great doubts about the applicability of the law of diminishing returns to Bitcoin.

Last week, we did not find any clear evidence that large-cap stocks are trending downward in performance as the company's capitalization rises.

Thus, there is no reason to believe that Bitcoin will automatically suffer from this phenomenon.

However, a decline in earnings is possible, which is why I included two slower growth scenarios.

So, running the numbers according to various scenarios(by applying the cumulative rate to the initial market cap) we get the following predictions (note the log2 scale is used on the vertical axis).

At current growth rates, Bitcoin will surpasscapitalization of Apple somewhere in 2023. At 75% of the current growth rate - in 2024. And in the worst scenario under consideration, this should happen in 2026!

So even the supposed decreasing profitability, I think, we can easily survive.

Of course, this is just a hypothesis.Historically, Bitcoin has been quite volatile, so a change in market leader can happen earlier if a parabolic move occurs, or a little later if a bearish phase occurs.

However, unless something completely unexpected happens, Bitcoin will be able to reach the next level much sooner than many expect.

BitNewsdisclaim liability for anyinvestment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

</p>