Key:

- Indicators indicate the beginning of the second phase of the bull market.

- Risk associated with reservesdropped below 0.008.

- Long-term hodlers sold only 9% of their assets.

Let's look at the key indicators thatlaying a solid foundation for the continuation of the bullish trend in the crypto market in the second quarter of 2021. Long-term HODLers have been selling off their BTC lately, but the coin has not yet exhausted its upside potential.

Bitcoin price dynamics

Bitcoin ended its sixth month in a row with growth,confirming the development of a bull market. On-chain analyst @WClementeIII, aka William Clement III, noted that in 2017, the leading cryptocurrency managed to generate no more than five green candles in a row on the monthly chart. And yet, this sequence has already occurred twice in the history of Bitcoin:

- from April to September 2012,

- from October 2012 to April 2013.

Tonight #Bitcoin closed its 6th green monthly candle in a row, the most in 2017 was 5… pic.twitter.com/rokzwu2R1x

- William Clemente III (@WClementeIII) April 1, 2021

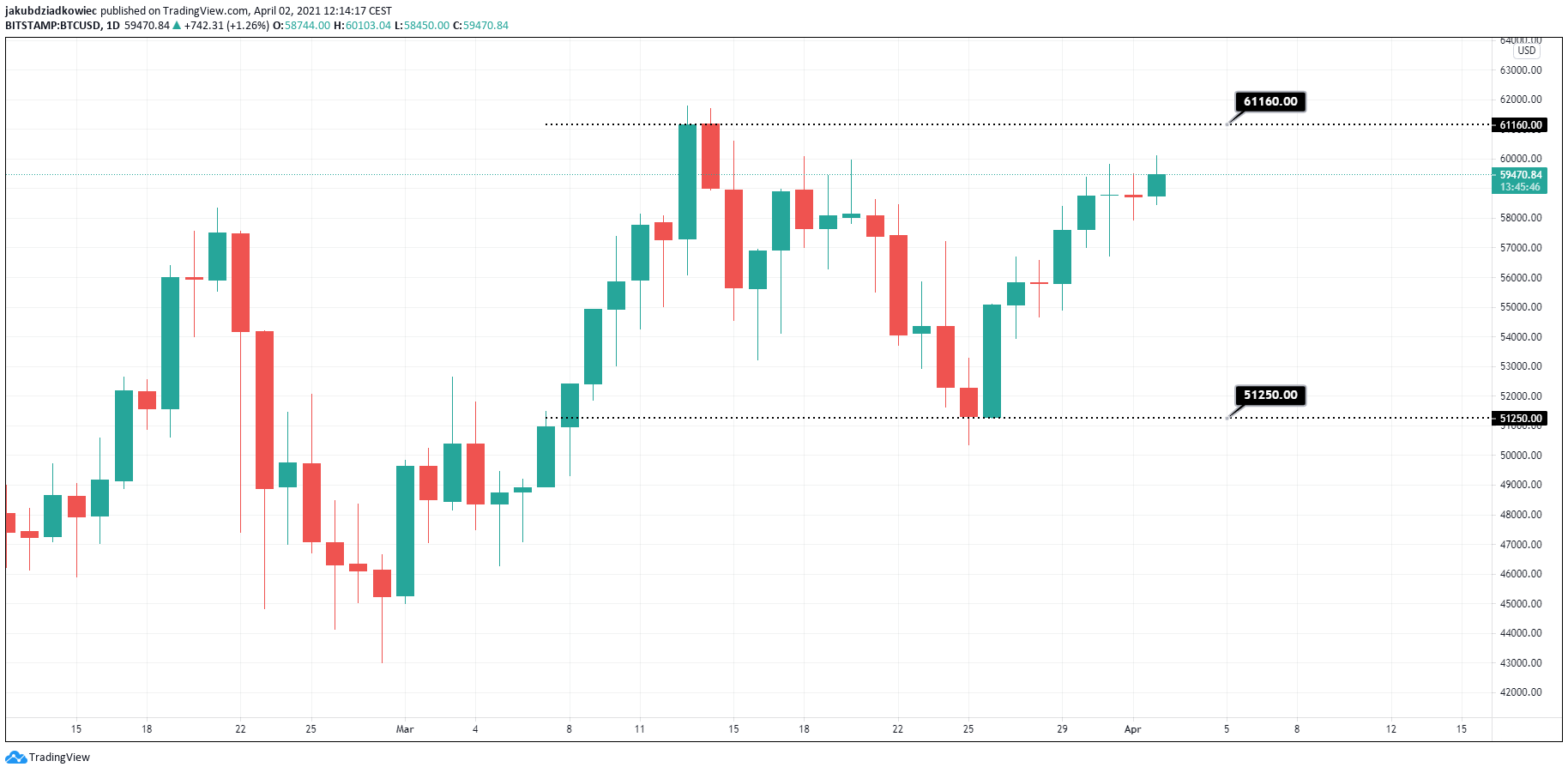

BTC is consolidating on the daily chartin the range of $51,250-$61,160 from March 13. On this day, the cryptocurrency reached a new historical high. Approaching the upper limit of the range, Bitcoin completes a 20% correction. A successful breakout of $60,000 will give the market a strong bullish signal.

A springboard for growth

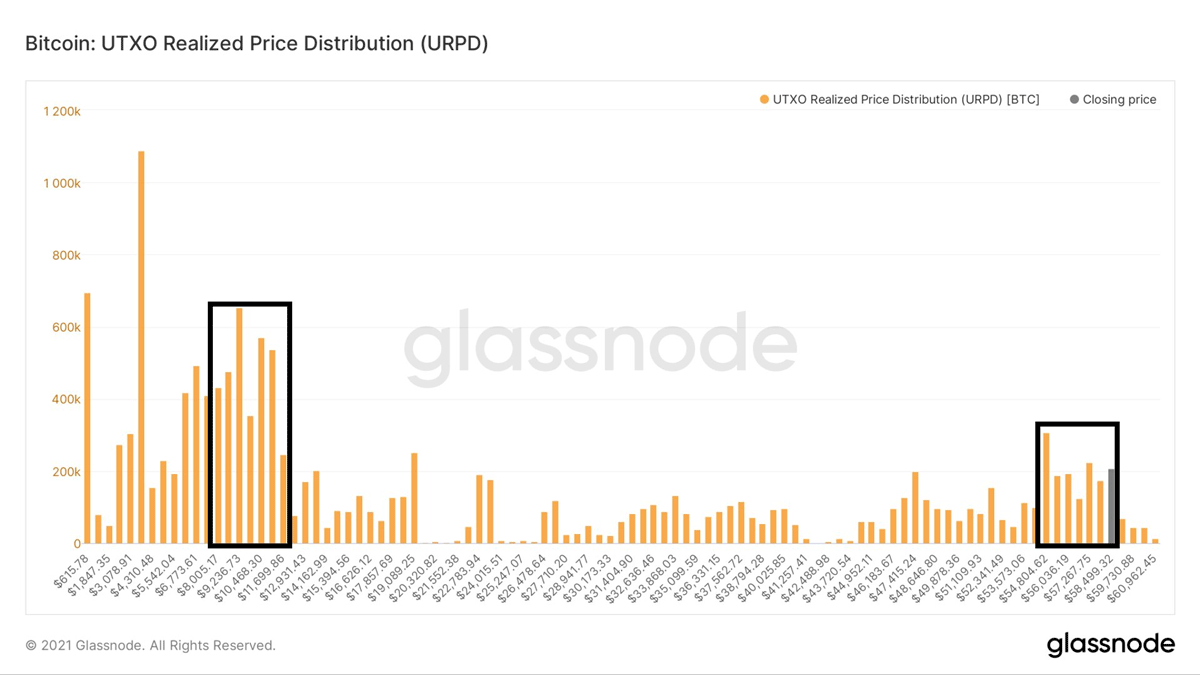

Meanwhile, on-chain indicators confirm thatThe cryptocurrency market is entering the second phase of the bull market. @WClementeIII tweeted a URPD (UTXO Realized Price Distribution) chart that shows price ranges based on the increase in new UTXO generation (unspent transaction output).

We see a clear increase in volume in the rangefrom $55,000 to $60,000. The last time such volumes were observed was in the area of $9,000–$12,000. Last year, this became the basis for long-term growth. @WClementeIII explains that this is a bullish signal indicating that Bitcoin will not stay in its current range for long.

Risks for the second phase of the bull market

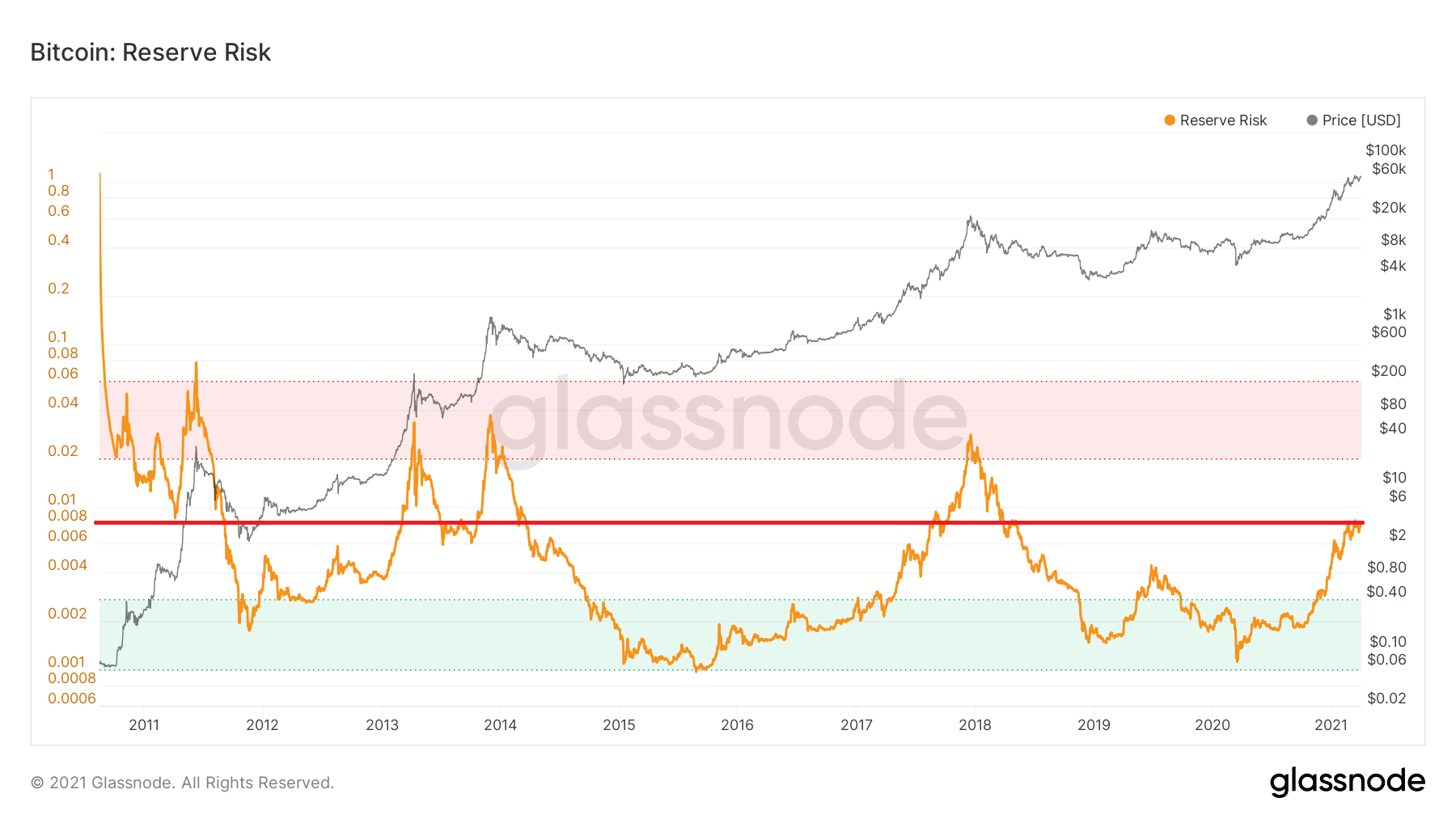

Another indicator that signalsabout the formation of a bull market - the risk associated with reserves. It shows how confident long-term hodlers are in the current BTC price. The stronger their position, the more risk-tolerant they are. When the indicator goes up, they sell.

When investors are confident in their long positions,and the price is low, the risk/reward ratio becomes attractive. Against this background, the reserve risk parameter is reduced. When investors lose confidence and the price rises, the risk/reward ratio worsens. This increases the risk of reserves.

It is now just below 0.008 (red line). During previous cycles it peaked above 0.02. So this cycle still has room to grow.

It is also worth adding that as prices risehodlers begin to sell off their assets. Thus, the reserve risk parameter indirectly indicates that bitcoins are flowing from the wallets of long-term investors into the pockets of new buyers.

Top and support

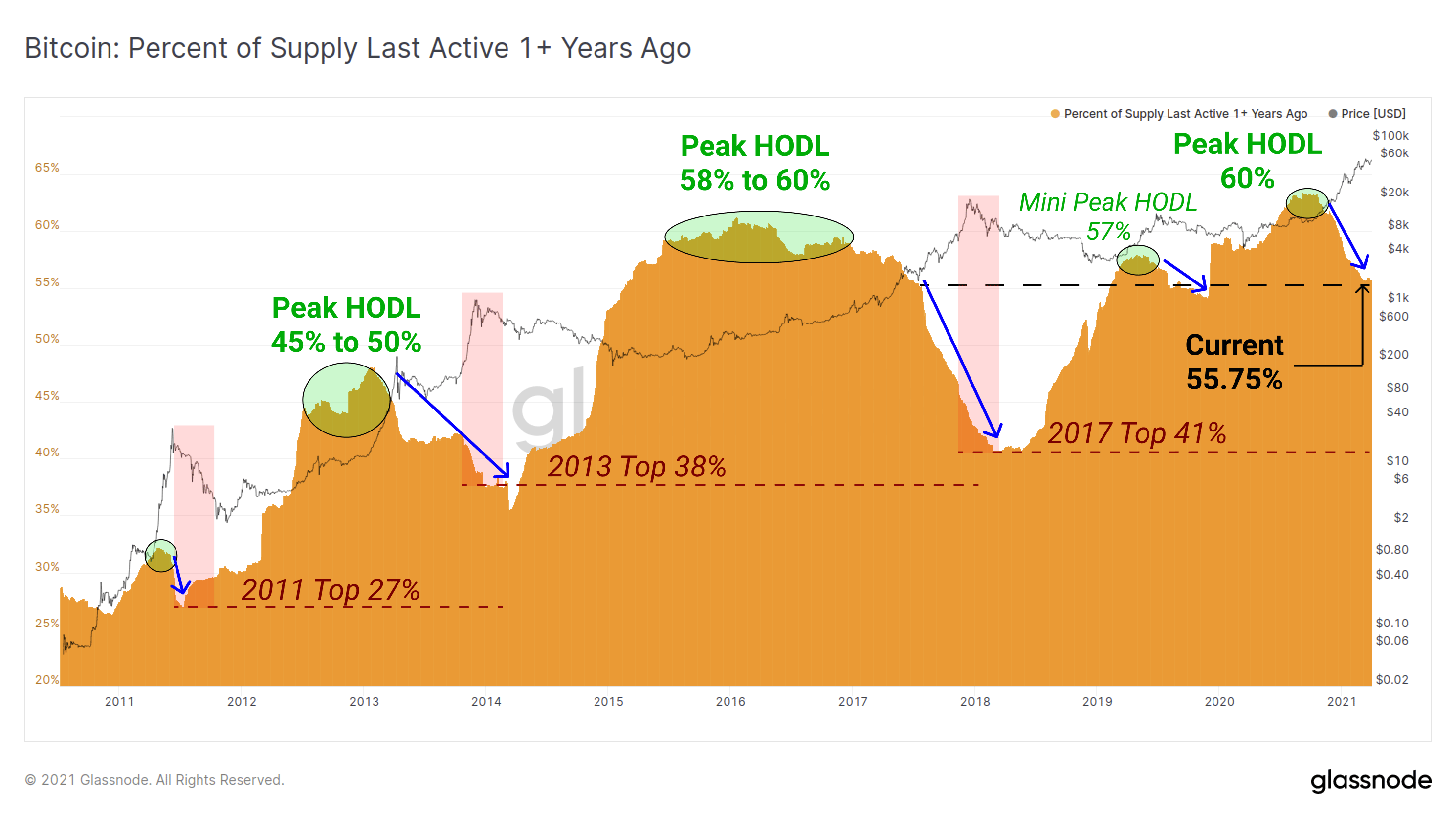

Another sign that in the near futureBTC will continue to grow, appeared on the active supply chart. The chart shows the accumulation of BTC in the early stages of a bull market (green areas), but as prices rise, these stocks begin to sell off (blue arrows).

Commenting on this graph, Willy Wu emphasized thatOld investors tend to sell BTC in the early stages of a bull market. He then emphasized that each successive HODL support level moves higher (dashed lines). This means investors are cutting back on sales even as prices rise.

Willy Woo predicted the next areaHODL support throughout this cycle. He believes the next bottom will be higher than the previous one by about 45%. Now this figure is at the level of 55.75%. Thus, in the short term, there remains the possibility of a further BTC sell-off.

Hodlers take profits

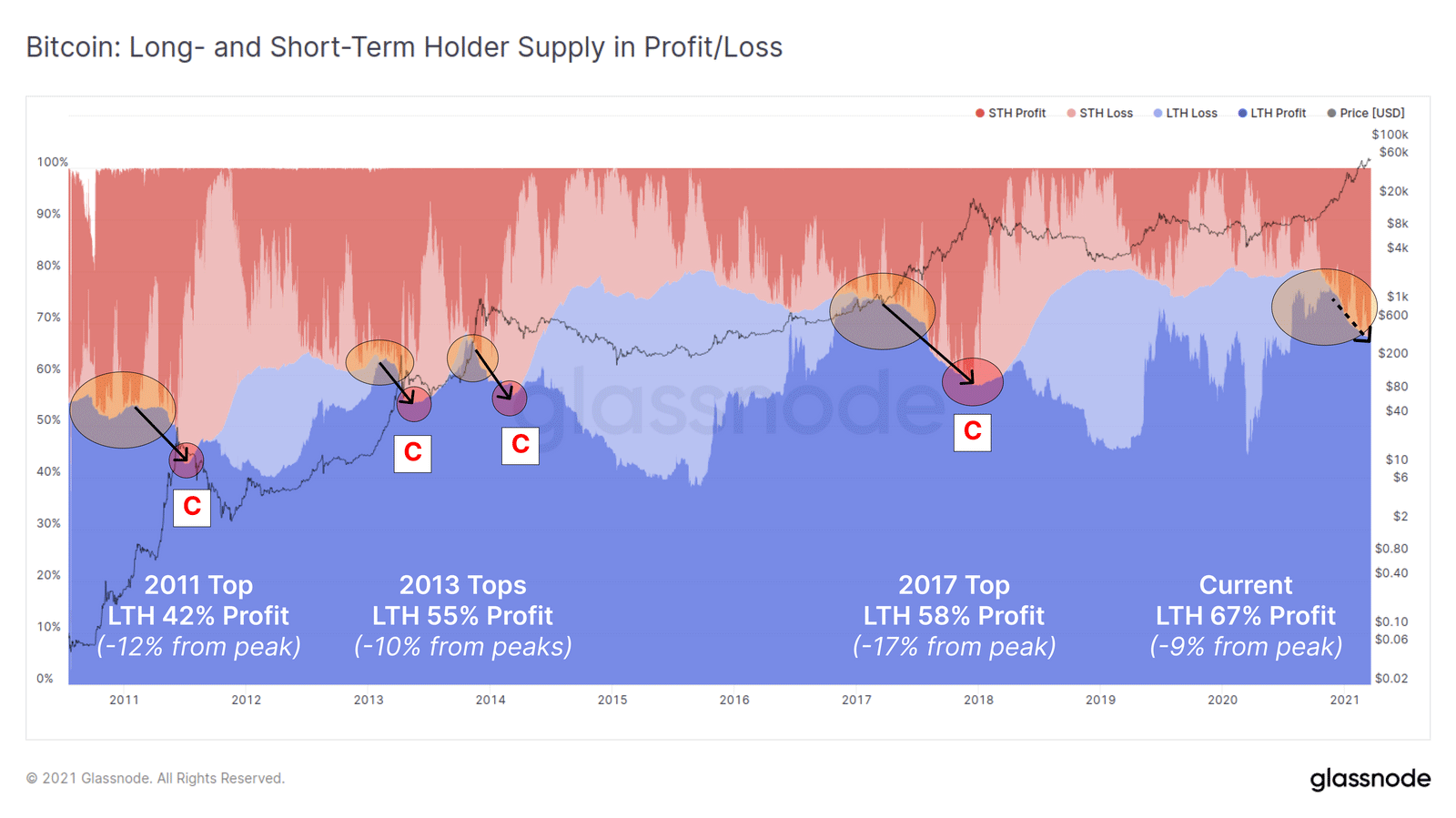

Last week, the analytics companyGlassnode published very interesting statistics on hodlers with profitable positions. Without going into detail, it turns out that all cycles to date have been characterized by three phases of “wealth transfer” between market participants:

- Maximum pain (A): Most investors suffer losses and long-term hodlers start accumulating coins.

- Hold Peak (B): the initial phase of a bullish trend, in which more and more investors become profitable; most often this corresponds to a breakout of the previous all-time high (ATH).

- Top of cycle (C): The market is in a state of euphoria, and many long-term holders are selling their coins to new speculators.

Glassnode analysis allows us to conclude that long-term hodlers are currently in a sell-off and profit-taking phase, which corresponds to the second half of the bull market.

After HODL peaks, about 9% of supply is spent. During the previous bull market, this value reached 17%, so we still have room to grow in this indicator as well.

The regiment of Ethereum fans has arrived

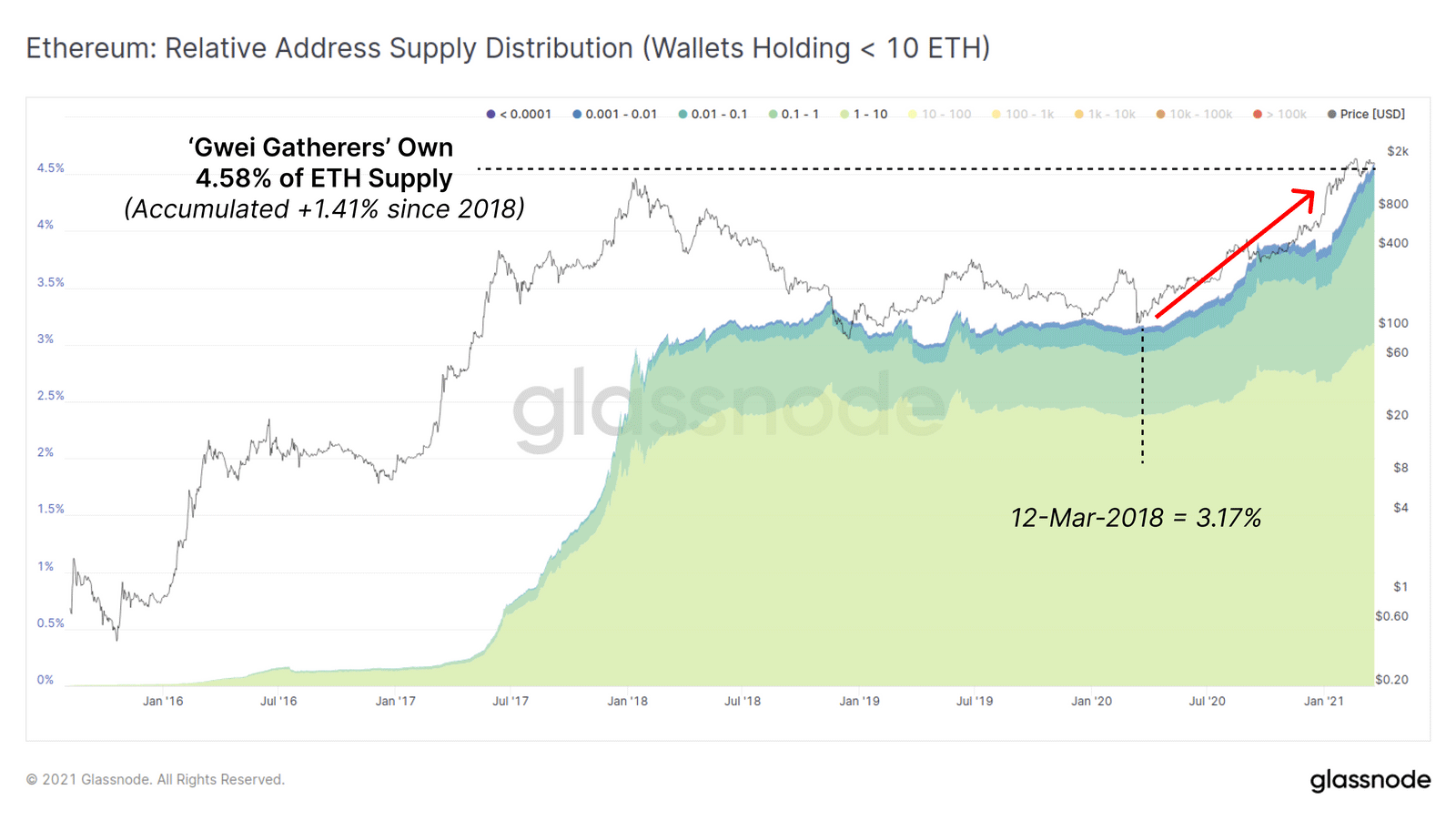

It’s not just Bitcoin investors who accumulate assets.Since March 2020, there has been a constant increase in the number of Ethereum (ETH) wallets with a balance of less than 10 ETH. In the Relative Address Supply Distribution (RASD) indicator, Gwei collectors currently hold 4.58% of the total ETH in circulation.

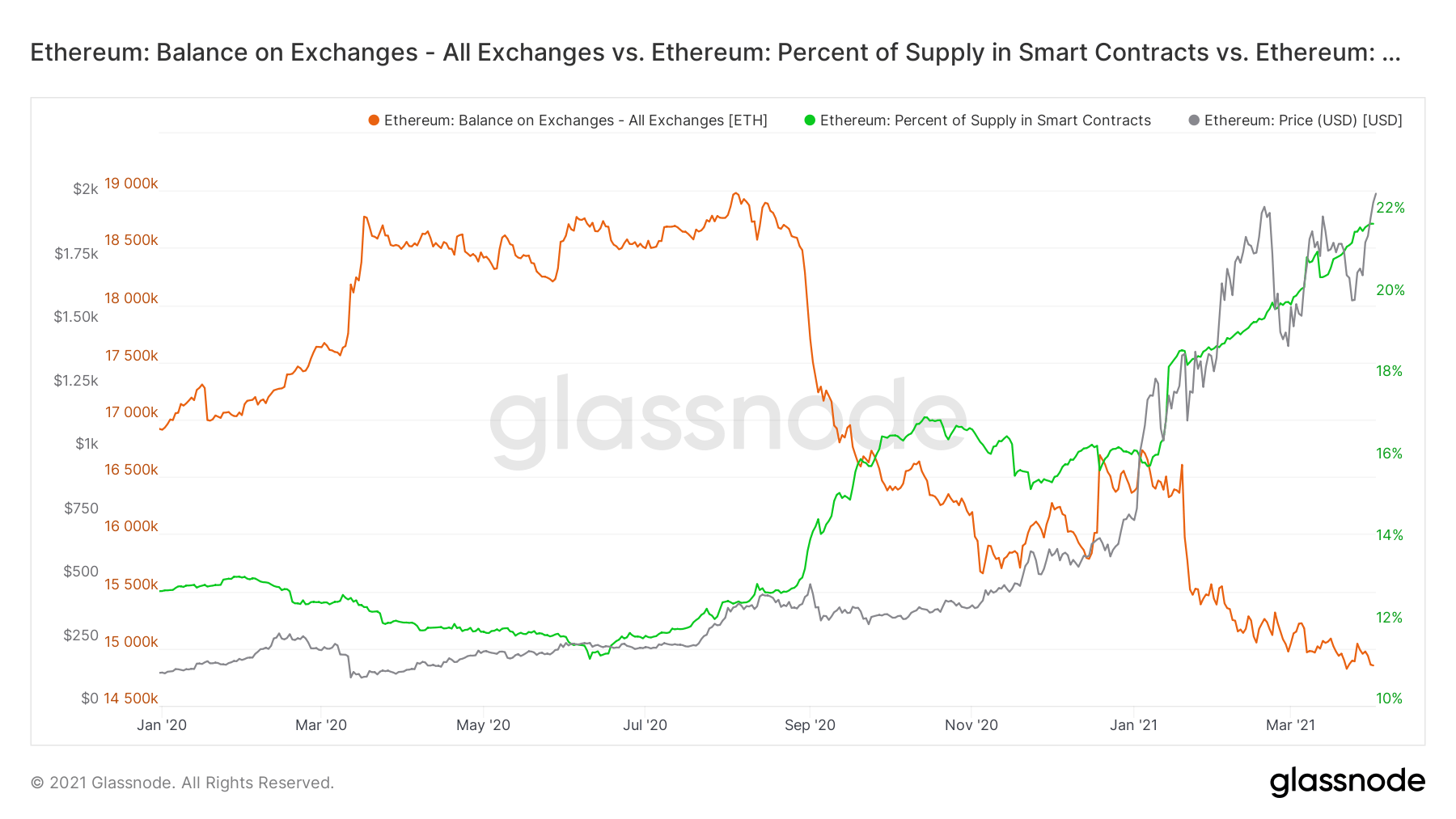

The HODL Waves indicator shows that the quantityETH sitting idle for more than six months has been declining since May 2020. This may be due to the dynamic growth of the DeFi space and the transition of ETH to smart contracts, as well as the emergence of staking for ETH at the end of last year.

This is confirmed by the chart of ETH locked in smart contracts compared to ETH on exchanges. Over the past year, the relationship between these indicators has completely changed.

Only 14.8% of available cryptocurrencies are on crypto exchanges.ETH, and their value locked in smart contracts reaches 21.8%. The turning point came in the late summer of 2020, the year at the peak of last year's DeFi bubble.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication