Paul Krugman doesn't like Bitcoin. Over the past few years, he has repeatedly spoken negatively about thistechnology on my blog.Yesterday, he devoted an entire article to “exposing” cryptocurrency. He argues that bitcoin mining - the process of creating bitcoins through cyclic mathematical calculations - is a waste of public resources. After that, he talks about the "uselessness" of bitcoin from a more general perspective.

However, Krugman forgets that mining is not required.just to create bitcoins. The creation of bitcoins is only a reasonable mechanism for rewarding miners for participating in the process, which is necessary to ensure the security of the payment network and the processing of bitcoin transactions. Without this, the Bitcoin network would not be able to function at all. By avoiding mentioning this fact, Krugman is misleading his readers rather than informing them.

Unfortunately, one-way lighting has already becomethe norm in public discussions of bitcoin. Bitcoin has a dual nature - it is both a currency and a payment network. It is this latter quality that makes bitcoin useful and potentially important. However, bitcoin attracts media attention only as a currency.

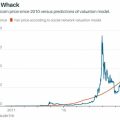

This is partly due to the fact thatmost informational messages are devoted only to sharp fluctuations in the bitcoin rate. It is very easy to report that in a matter of weeks the exchange rate has increased tenfold. It is much more difficult to explain how the payment network works and how it can be useful.

However, the defenders of bitcoin are also to blame for the fact thatthe press covers bitcoin only in the "narrow" quality of the currency. Bitcoin supporters are vying with each other to criticize the Federal Reserve for too loose monetary policy, leading to inflation. They highlight the fact that bitcoin issuance is capped at 21 million and contrast it with currencies regulated by the central bank printing press.

Naturally, all this causes only skepticism.attitudes towards bitcoin technology among people with more traditional economic views on monetary policy. They believe that replacing the dollar with bitcoin could lead to a deflationary spiral, a Great Depression, or worse.

Perhaps in some ways the skeptics are right.However, replacing the dollar is by no means the optimal use case for bitcoin. Rather, Bitcoin can be seen as an alternative or complement to traditional payment systems such as Visa, PayPal or Western Union.

Leading operators for accepting payments in bitcoins,such as BitPay and Coinbase are already giving merchants the ability to price their products in conventional currencies. Prices in dollars or euros are automatically converted into bitcoins at the time of purchase. Thus, thousands of online stores that accept payments in bitcoin today can enjoy the benefits of bitcoin payments without paying attention to the fluctuations in the bitcoin rate.

Will the Bitcoin payment network be able to borrowa significant niche among the currently dominant payment technologies? It's difficult to answer this question. Bitcoin is a technology platform with state-of-the-art capabilities that earlier payment systems do not have, so it could prove to be a very successful project. However, the Bitcoin community will have to overcome a number of technical and regulatory hurdles to make paying in Bitcoin convenient for everyday consumers.

However, the long-term prospects for bitcoinassociated with his unusual monetary policy. The technical and legal issues that determine the future success or failure of bitcoin receive very little attention in public discussions of this currency. In the minds of the masses, bitcoin is either the “second coming” of the gold standard or a repeat of the “Dutch tulip mania.” Discussing these extremes obscures everything that makes bitcoin interesting and potentially important.

: Washington Post