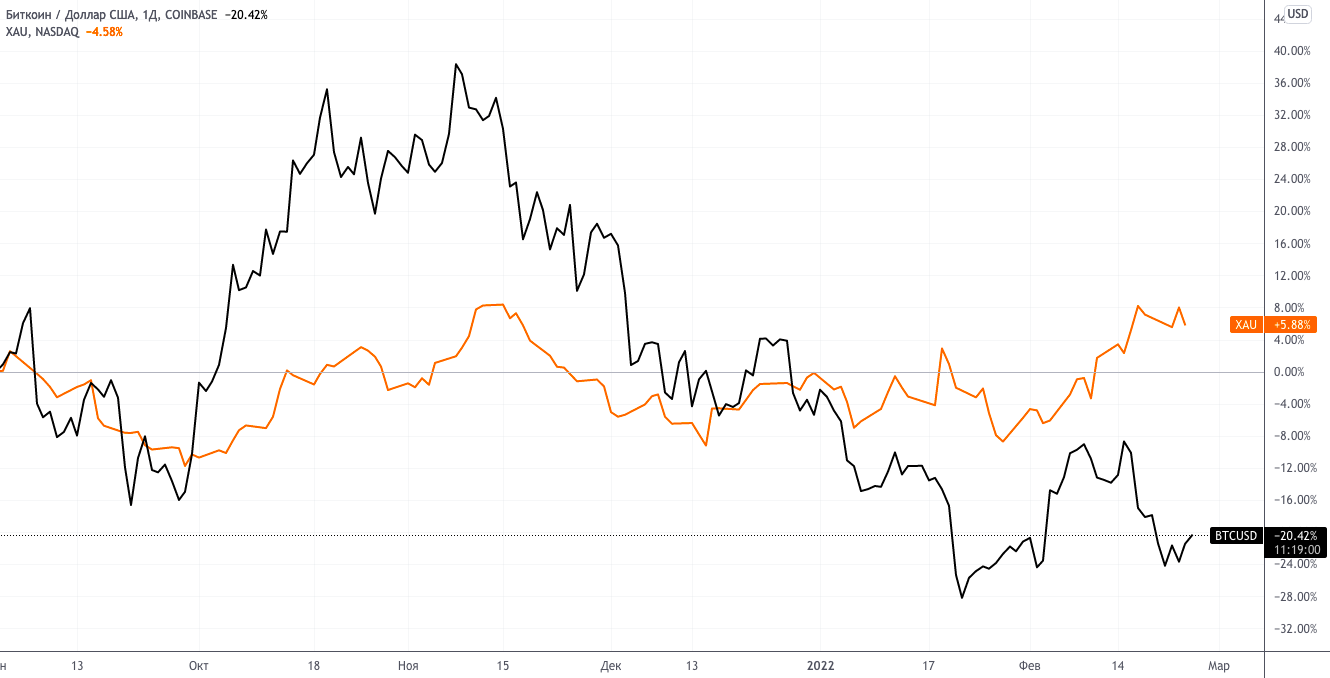

The market reaction suggests that investors do not yet view the leading cryptocurrency as saferefuge in times of crisis.

On the news about the crossing by Russian troopsborders of Ukraine on the morning of February 24, the bitcoin rate reacted with a sharp drop. Gold, meanwhile, steadily rose in price, although the day before the previous growth was replaced by a slight pullback.

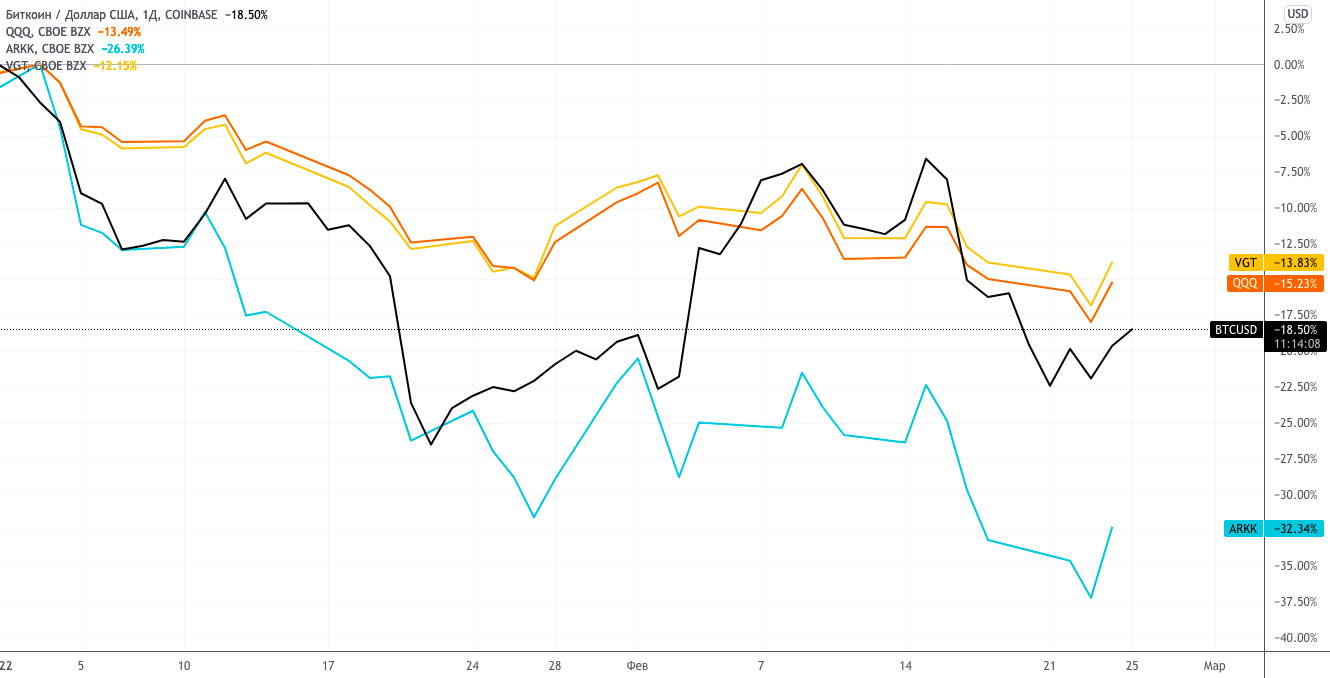

Sharp divergence echoing movementsmarkets against the backdrop of other recent news — such as the Fed's potential rate hike — shows that bitcoin has a stronger correlation with the stock market, especially tech stocks, than with gold or other safe-haven assets.

Safe-haven assets have always been viewed asinstruments for hedging risks of market shocks or currency devaluation. One of the strongest arguments of bitcoin advocates is that it can be a much better hedge against inflation or market uncertainty than gold. But how and why?

Arguments for bitcoin as digital gold

Thesis on Bitcoin as a Digital Version of Goldbased on its limited supply and disinflationary nature. Those who keep the Bitcoin network running are rewarded with BTC for their efforts and resources, and these rewards are halved every four years. This means that the rate of new coins entering circulation is steadily decreasing until all 21 million BTC are minted.

Bitcoin proponents say the proposalgold is not provably finite—it could be mined from asteroids in the future—and gold is also less divisible, easier to counterfeit, harder to authenticate, harder to transport and transfer, and easier to seize.

Although we cannot yet be sure thathumanity will indeed mine gold and other precious metals from asteroids, it is true that bitcoin is more divisible, easier to transport and transfer, harder to withdraw and apparently harder to counterfeit than gold. Although this is mainly due to its intangible digital nature.

Bitcoin's effectiveness as a safe-haven asset

While gold surged amid market turmoil, bitcoin responded lower, prompting many to question the narrative of bitcoin as a gold substitute and safe-haven asset.

The weakness of bitcoin amid record inflation also did not help reinforce this narrative.

Bitcoin and gold in 2022

Bitcoin and gold since September 2021

Bitcoin continued to decline on the news thatRussia is increasing the presence of its armed forces on the border with Ukraine. Record inflation and geopolitical tensions in Eastern Europe certainly fit into the range of events that safe-haven assets should protect against market reactions. However, although bitcoin is often described as one of these assets – perhaps even the best of them – it did not provide the expected protection.

So why doesn't bitcoin behave like gold?

As more investors addedbitcoin into their portfolios, the psychology around the asset seems to have shifted from a libertarian "censor-resistant hedge against inflation" to a purely speculative technology game.

Although it has always been a speculative investment, itthe correlation with risky technology stocks and exchange-traded funds has recently become much more pronounced than the correlation with safe-haven assets.

Bitcoin and the Biggest Tech ETFs in 2022

Many public supporters of bitcoin are stillargue that cryptocurrencies should provide a hedge against inflation and social upheaval due to its scarcity and censorship-resistant qualities. However, bitcoin is becoming less and less like a safe-haven asset.

What I simply don't understand is the fact that #Bitcoin is dropping in these times, actually.

— Michael van de Poppe (@CryptoMichNL) February 24, 2022

@CryptoMichNL: What I just don't understand is why bitcoin is going down now.

Potential reasons for this deviation fromAnticipated responses include concerns about over-regulation and a general lack of understanding of this asset class. By some estimates, a third of all investors in cryptoassets know next to nothing about what cryptocurrencies are and how they function. Until this changes and the regulation of cryptocurrencies by the largest countries, primarily the United States, is clarified, the role of bitcoin as a safe haven asset will most likely remain only a potential possibility in some future.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>