For 10 years now, debates about the legal status of cryptocurrencies in general and Bitcoin, as the main cryptocurrency, have not subsided.particular. What is it: money, goods, assets, property or something else? Do you allow the free trade of crypto assets or prohibit any cryptocurrency circulation?

It would seem that there is no problem for a long time -Bitcoin derivatives are traded on classic exchanges, regulators are issuing legislation for the cryptocurrency market, and central banks are about to launch their own cryptocurrencies.

However, even a cursory glance at the problem showsHow much understanding of cryptocurrencies and regulation of their turnover differs in each country. So, only in the last month in France, Germany and Australia, authorities made decisions with three different interpretations of the nature of bitcoin: as a currency, financial instrument and security.

Meanwhile, the classification of cryptocurrencies dependstax system, the complexity of regulation and reporting. Thus, commodity markets operate under relatively weak regulatory oversight. Securities, by contrast, are usually subject to more onerous rules regarding price transparency, trade reporting and market abuse.

Mining-Cryptocurrency.ru understood the main legal regimes for cryptocurrencies and what they mean to holders of such assets.

Why regulators do not have a common understanding of the nature of cryptocurrencies

Consider the basic interpretations of the nature of bitcoin and other cryptocurrencies.

Currency

Satoshi himself clearly conceived Bitcoin as a currency. Most of his supporters adhere to the same point of view.

Arguments for:Bitcoin and other cryptocurrencies are accepted inquality of payment. For example, you can pay with them in online retailers such as Overstock and Amazon, as well as in the Microsoft Store. Cryptocurrencies partially have the traditional criteria of currencies: a medium of exchange, a unit of account and a means of saving, and they are also interchangeable, divisible, transferable, transferable and scarce.

Arguments against:digital assets correspond to traditional onescurrency criteria not completely. They are not backed by the Central Bank, which means that no one is responsible for them. In addition, their exchange rate is too unstable (high volatility makes it inconvenient and impractical to denominate goods or services in Bitcoin), the transaction processing speed is too slow, and conducting the transactions themselves is inconvenient. In addition, the same Bitcoin is energy-consuming, uncontrollable, its emission is limited - and the “gold standard” is no longer suitable for the modern economy. Therefore, for 10 years it has not become widespread as a means of payment. Most holders take it only in the hope that the price will rise.

Product

Another popular approach to cryptocurrencies is to consider them as goods that can be traded on the market or exchange (as they trade, for example, in precious metals).

Arguments for:cryptocurrencies have a market price, theyThey are interchangeable and can be traded, which means they are digital goods. For example, Goldman Sachs head of commodities research Jeff Curry has qualified Bitcoin as a commodity because it has “no liabilities.” In this regard, Bitcoin is similar to gold or oil, which can be bought and sold on markets or through derivatives such as futures. The US Commodity Futures Trading Commission (CFTC) stated back in 2015 that cryptocurrencies are “an underlying commodity used in trading that is fungible with other commodities of the same type.” This approach to the nature of Bitcoin has been consolidated in Bitcoin futures.

Arguments against:cryptocurrencies are not goods because they do not haveconsumer value (for example, a product such as steel is used in industry, and Bitcoin cannot be used anywhere) and physical embodiment. He has only a price. Proponents of this position believe that people buy crypto assets in the hope of a rising rate or access to some services (utility-tokens), and not because of its internal properties - no one needs bitcoin in itself.

Security, asset or financial instrument

Cryptocurrencies can also be regarded as valuable.paper, financial instrument or asset. The broadest definition of a financial instrument is a document on the right to tangible or intangible assets that can be sold. It includes securities, futures, options, the Dow Jones index and the MICEX index, among others.

Arguments for:cryptocurrencies are an analogue of securities, as theyare interchangeable, negotiable financial instruments with monetary value. The tokens of the companies that launched the ICO and security tokens meet the criteria for securities: they are issued by one company and function similarly to stocks. This point of view is shared by most regulators. Therefore, they require ICO organizers to comply with the disclosure rules applicable to securities.

Arguments against:An asset involves income generating property. Most cryptocurrencies do not create some kind of stable cash flow. Decentralized coins have no guarantee of future income. Even traders do not invest in bitcoin, but only trade it.

In this regard, decentralized coins likeBTC and ETH, of course, are not securities or financial assets - there is no single issuer that can be obliged to comply with the rules, because these cryptocurrencies are not supported by anything other than the trust of the crypto community. This point of view is shared, for example, by the US Securities and Exchange Commission (SEC), which loves to find signs of securities in crypto projects (hello, Libra and Gram). In October 2019, she officially stated that Bitcoin is not a security. The SEC staff argued against it - Bitcoin does not meet the criteria for a security under the Howey Test and the 2019 Digital Asset Analysis Guide. The main one is that Bitcoin holders “do not rely on the management skills and entrepreneurial efforts of third parties” to make a profit.

Property and Digital Rights

Since cryptocurrencies are difficult to unambiguously be attributed to any class of assets, but they still exist, it means this property or property.

Arguments for:such an interpretation of Bitcoin back in 2014year given by the US Internal Revenue Service (IRS). The position of the Russian court in 2018 is also indicative: Bitcoin cannot be classified as electronic money, since its holder does not have the opportunity to contact the Bitcoin issuer. But cryptocurrency can be classified as an object of civil rights, since it is “capable of isolation and has a property value recognized by circulation,” and also “can be the subject of obligations, ... the object of protection by the rules of tort law. In this regard, cryptocurrency can be classified as “other property.”

Arguments against:In some jurisdictions, such as the UK, the law does not recognize ownership of intangible assets.

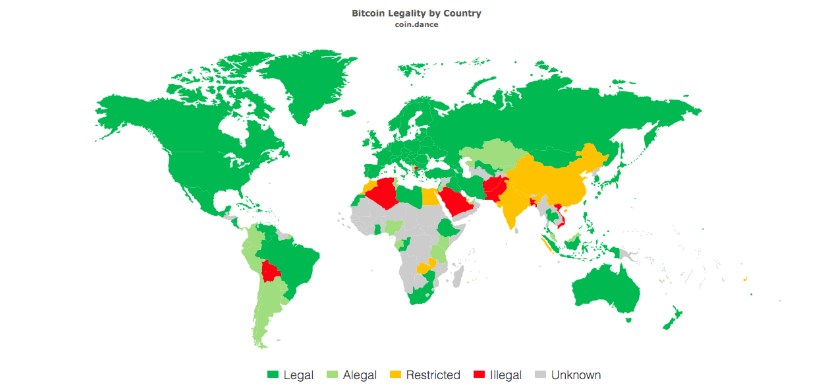

Countries by level of legalization of Bitcoin transactions:

- green - completely legal, light green - status not defined by law,

- orange - limited permission,

- red - prohibited,

- gray - status unknown

- Countries where Bitcoin and other cryptocurrencies are prohibited: Afghanistan, Algeria, Bangladesh, Bolivia, Pakistan, Qatar, the Republic of Macedonia, Saudi Arabia, Vanuatu and Vietnam. A source.

USA and Canada

USA.The US approach to cryptocurrencies is no differentsequence. Laws governing the crypto industry vary by state, and the five federal governments also interpret and regulate them differently. The Financial Crimes Enforcement Network (FinCEN) does not consider cryptocurrencies to be legal tender, but since 2013 has viewed exchanges as operators of financial services and tokens as “other property” that replaces currency. For the same reason, exchanges must comply with the FATF recommendations and comply with the Bank Secrecy Act. The IRS, on the other hand, views cryptocurrencies as property and has issued tax guidance accordingly.

Several federal regulators are also fightingfor supervision of crypto exchanges. The Securities and Exchange Commission (SEC) considers cryptocurrencies to be securities. And the Commodity Futures Trading Commission (CFTC) views Bitcoin as a commodity and supports the cryptocurrency derivatives market.

Canada.The Canada Revenue Agency (CRA) determinesBitcoin as a commodity, cryptocurrency trading is regulated as a barter transaction, and the income generated is treated as business income. Therefore, taxation is appropriate - on the share of profit. However, the Canadian securities regulator (CSA) and the head of the country’s Central Bank consider cryptocurrencies to be securities. However, crypto exchanges are largely regulated in the same way as money services businesses - in addition to meeting FATF requirements, as of June 1, 2020, they will also be required to register with Canada's Financial Crime Analysis Center (FinTRAC).

The European Union

Cryptocurrencies are legal throughout the territoryEuropean Union, but specific regulations and taxation vary greatly. In matters of taxes, most EU countries are guided by the 2015 decision of the Court of Justice of the European Union, according to which cryptocurrency exchanges should be exempt from VAT, and the holder of coins should pay capital gains tax.

Gradually, all countries are adjusting their standardsregulation under the FATF recommendations on regulation of cryptocurrencies dated June 21, 2019. According to them, by June of this year, crypto-platforms must begin to comply with strict KYC/AML standards, as well as exchange data of users who have made transactions with each other and the regulator. In January 2020, the EU's Fifth Anti-Money Laundering Directive (AMLD5) came into force, mandating that crypto exchanges must register with financial regulators and provide them with customer wallet addresses. In general, the EU is gradually tightening regulation of the crypto market.

Malta.Malta has taken a very progressive approach tocryptocurrencies, positioning itself as a global leader in crypto regulation. Although cryptocurrencies are not legal tender in the country, they are recognized by the government as a “medium of exchange, unit of account, or store of value.” This sounds similar to the definition of a currency, but VAT does not apply to fiat and cryptocurrency exchange transactions, meaning that crypto assets are not actually recognized as currencies. In the Financial Services Authority's (MFSA) strategic plan for 2019-2021, the regulator views cryptocurrencies as virtual assets.

France.One of the few EU countries in which up toThere is still no direct legislative regulation of cryptocurrencies. Bitcoin is not banned in the country. Additionally, this year more than 25,000 merchants across the country will begin accepting Bitcoin as payment. However, its legal status is unclear. Therefore, the circulation of both Bitcoin and all cryptocurrencies in general is not regulated by law, and citizens bear all the risks of owning them. Previously, representatives of regulators have repeatedly stated that Bitcoin is not a currency. At the same time, France adhered to the 2015 advisory decision of the European Court of Justice on the abolition of VAT on exchange transactions between BTC and fiat currencies.

Against this background, it becomes clear that the media attention toIn a recent decision - on February 26, the Nanterre Arbitration Court recognized the military-technical cooperation as a currency. According to the court, Bitcoin is a fungible intangible (digital) asset - all coins are created the same, but they can be identified. This allows it to be defined as a form of currency. Although there is no case law in the country, the court's decision can serve as an example for other courts.

The decision was made in a dispute betweenFrench cryptocurrency exchange Paymium and alternative asset investment company BitSpread. In 2014, Paymium lent 1,000 BTC (about $ 400,000 at the 2014 average exchange rate and $ 9.1 million at today's price) BitSpread. However, in August 2017, Bitcoin Cash (BCH) hard fork occurred. All MTC holders, including BitSpread, received a similar number of BCH coins - in this case, 1,000 BCH ($ 350,000 at the then exchange rate). Paymium decided that BCH should also belong to her and went to court.

To resolve the dispute, the court had to considerthe legal nature of bitcoin. As a result, he established that the first cryptocurrency is an interchangeable asset - the same as fiat money. And if so, then it obeys the general principles of lending and loans. Based on this, the court ruled that BitSpread will retain the resulting BCH, just like borrowers keep a profit from credit funds - they are obliged to return only what they borrowed.

Germany.Federal Financial Supervisory AuthorityGermany (BaFin) considers cryptocurrencies to be financial instruments. Therefore, exchanges and coin issuers must obtain permission from BaFin to operate in advance. At the same time, ICO tokens and similar projects can be considered as securities and subject to appropriate regulation. The country's tax department believes that cryptocurrency should be subject to VAT as well as capital gains tax. The first tax may not be paid if cryptocurrencies are used as a means of payment. The second is if the user sold the asset for less than €600 or earlier than a year after purchase.

March 2 Federal Financial AdministrationThe supervisory authority (BaFin) of Germany issued a statement in which it officially once again defined cryptocurrencies as financial instruments. The text notes that in this regard the agency’s position coincides with other regulators in the country and FATF recommendations. According to the regulator’s definition, cryptocurrencies as a financial instrument meet five characteristics:

- Not issued or provided by any Central Bank or government agency;

- They do not have the legal status of currency or money;

- Can be used by individuals or legal entities as a means of exchange or payment;

- May serve investment purposes;

- They may be transmitted, stored and sold electronically.

Such a broad definition was adopted in order toto account for all crypto-assets relevant to the financial market, including digital coins that are not considered units of account. BaFin also emphasized that cryptocurrencies should not be confused with different types of electronic money - they are regulated by separate legislation. Let us recall that in November last year, the German authorities passed a law allowing banks to buy and sell cryptocurrencies on behalf of their clients. 40 financial institutions have already become interested in the offer.

Great Britain.There is no specific legislation in the country regardingcryptocurrencies, however they are not prohibited. Crypto exchanges must register with the Financial Conduct Authority (FCA) and comply with FATF and 5AMLD regulations. The British Revenue Authority (HMRC) believes that cryptocurrencies are a unique type of asset that are not analogous to traditional investments or means of payment. Gains or losses from cryptocurrencies are, however, subject to capital gains tax.

Switzerland.In Switzerland, cryptocurrencies and exchanges are legal, and the country has taken a surprisingly progressive stance on cryptocurrency regulation: authorities are planning to make the country a “crypto-nation.”

Swiss Federal Tax Administration(SFTA) treats cryptocurrencies as assets: they are subject to the Swiss wealth tax and must be indicated in annual tax returns. To get started, cryptocurrency exchanges must be licensed by the Financial Market Supervisory Authority (FINMA). Similar rules apply to ICOs.

Estonia.Estonia is also among the crypto leaders.Authorities view cryptocurrencies as digital assets that can be used as a payment instrument, but are not legal tender. As in other European countries, crypto exchanges in Estonia must obtain two licenses: from a virtual currency exchange operator and from a virtual currency wallet operator. In January 2020, the country's authorities announced that virtual currency service providers would be treated the same as financial institutions under Estonia's Anti-Money Laundering and Anti-Terrorism Financing Law.

Russia and Ukraine

Russia.In our country they still can’t decidewith what cryptocurrency is. So far, the courts consider it other property. Thus, for the first time, the Ninth Arbitration Court of Appeal recognized cryptocurrency as “other property” in May 2018. Then he obliged the debtor to transfer access to the crypto-wallet to the bankruptcy trustee.

In February this year, the court repeated its decision,again by recognizing Bitcoin as “other property” in a different case. Since cryptocurrency is property, it means that you can conduct transactions with it, sell/buy, and even impose penalties in cryptocoins. True, a property deduction cannot be applied to cryptocurrencies. However, in the adopted law on crowdfunding and in the upcoming bill “On Digital Financial Assets” there is a different interpretation of the nature of cryptocurrencies - “digital rights”, close in meaning to securities.

Ukraine.In November 2017, the country's regulators said thatCryptocurrencies cannot be classified as money, foreign currency, means of payment, electronic money, securities or a money substitute. Until now, cryptocoins as an asset class are not defined by Ukrainian legislation.

At the end of December 2019, the SupremeThe Rada adopted a law on the implementation of FATF recommendations. And finally, in March of this year, the Ukrainian National Agency for the Prevention of Corruption (NACP) published rules for the declaration of cryptocurrencies, which define them as one of the “intangible assets”, similar to intellectual property or licenses for the extraction of natural resources (a definition copied from FATF regulations). At the same time, since the end of January, the Ukrainian Financial Service has been monitoring crypto transactions worth over $1,200.

Asia and Australia

China.After several years of de facto banning, in JulyIn 2019, a Chinese court recognized Bitcoin as digital property. This is an important milestone for a country where cryptocurrencies have been effectively banned since 2017. The court's decision marked a shift in the adoption of cryptocurrencies. In October, Chinese President Xi Jinping called for increased efforts in blockchain development, and the National Bank of China is rumored to be set to launch its national cryptocurrency as early as this year.

Singapore.Cryptocurrency exchanges and crypto trading in the countryare legal, and the city-state has taken a friendlier position on this issue than its neighboring countries. The tax department considers cryptocurrencies as goods and applies the local equivalent of VAT to them. Crypto exchanges are under the jurisdiction of the Monetary Authority of Singapore (MAS), which takes a relatively lax approach to regulating them, applying existing legal frameworks where possible.

Japan.One of the most progressive crypto countries.Cryptocurrencies are considered property in the country; taxes on income from cryptocurrencies are classified as “other income” and are subject to rates of 15-55%. Cryptocurrency exchanges must register with the Financial Services Agency (FSA). In May 2019, amendments to the laws “On Payment Services” and “On Financial Instruments and Exchanges” were adopted, which will come into force in April this year. They introduce the term “crypto-assets”, which places more restrictions on the management of cryptocurrencies and cryptocurrency derivatives.

South Korea.Cryptocurrencies are not prohibited in the country, but theyturnover and regulation are taken seriously. You can legally trade cryptocurrencies only from bank accounts. Therefore, crypto platforms enter into agreements with them. Financial institutions are prohibited from trading Bitcoin futures. The status of cryptocurrencies in the country has not been determined. Therefore, cryptocurrency transactions are not yet subject to tax. However, this year the authorities are considering introducing a tax on income from crypto transactions.

Australia.Australia is one of the leading countries in terms ofto cryptocurrencies. Over the next 5 years, the country's government has developed a roadmap for integrating blockchain into the economy. Since 2017, cryptocurrencies like Bitcoin have been treated as property in Australia and are subject to capital gains tax (previously they were subject to VAT - a change in the tax regime indicates the progressive approach of the Australian authorities to the industry). Exchanges must register with the local regulator - AUSTRAC, exchange user data and comply with KYC-AML requirements.

Let's look at a recent case in point.In late February this year, Judge Judith Gibson in New South Wales allowed a plaintiff to use a cryptocurrency account as security for legal costs in a libel case. If the plaintiff loses the case or facilitates withdrawal, those funds will be used to cover some of the defendant's legal costs. When the defendant's lawyer argued that the price of BTC was too volatile, the judge noted that the volatile nature of decentralized digital assets does not change the fact that cryptocurrency is an accepted form of investment in these uncertain financial times. In an attempt to mitigate asset concerns, she also accepted the plaintiff's undertaking to provide the defendant's attorney with monthly crypto account statements. The plaintiff will also be required to notify the defendant's lawyer if the account's crypto balance falls below the equivalent of 20,000 Australian dollars (about $13,000). The local crypto community is confident that this incident will contribute to even greater acceptance of cryptocurrency in the country.

Latin America

In Latin America, there is no single approach to regulating cryptocurrencies.

Bolivia and Ecuador:in these countries, the circulation of cryptocurrencies and the operation of cryptocurrency exchanges is prohibited.

In other countries there is no ban, crypto coinsthey are regarded primarily as assets and are taxed on capital gains throughout the region, while Brazil, Argentina and Chile are also taxed on income taxes.

Mexico, Argentina, Venezuela, Colombia.In Mexico, cryptocurrencies were initially consideredas commodities, although now classified as virtual assets, in Venezuela - financial assets, in Colombia - as “high-risk investments”, in Argentina, the Civil Code defines them as goods, and the tax department - as an analogue of securities. Crypto exchanges in the region are almost unregulated: only in Mexico the legislation on financial technology companies obliges crypto platforms to register and submit reports. The Central Bank of Mexico may prohibit the circulation of a particular cryptocurrency in the country, as well as set conditions and restrictions on transactions with cryptocurrencies.

To summarize

Cryptocurrencies are universal. They can act as money in transfers, as a security or product for an investor, as a simple code for a programmer.

The experience of regulators around the world shows thatcryptocurrencies are difficult to attribute to any existing asset class. The mechanical transfer of the norms of traditional regulation to cryptocurrencies does not work well.

More and more regulators are tending to the obvious.thoughts that they should be considered as a unique alternative class of assets that differs from all others, with its advantages, risks and its own legal base. And given that cryptocurrencies are very different from each other - take at least decentralized and centralized projects - then, most likely, they need to be divided into several categories. Ultimately, the way cryptocurrencies are classified largely determines the fate of the market.

How do you define cryptocurrencies? Can they be attributed to one of the traditional asset classes or is it something fundamentally different? How should they be regulated? Share your thoughts in the comments section below!

</p> 5

/

5

(

1

voice

)