Hype Around Binance Smart Chain (BSC) Alternative DeFi Ecosystem Is Gaining Momentum Amid Record-High Feeson the Ethereum network.

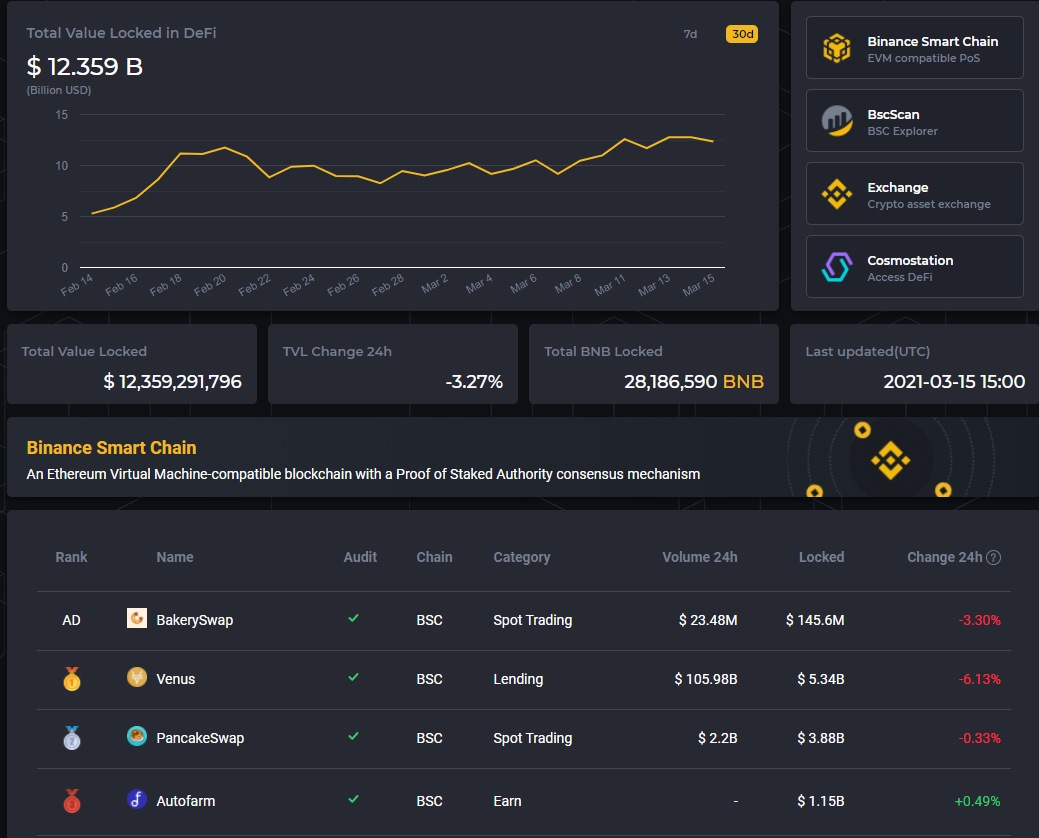

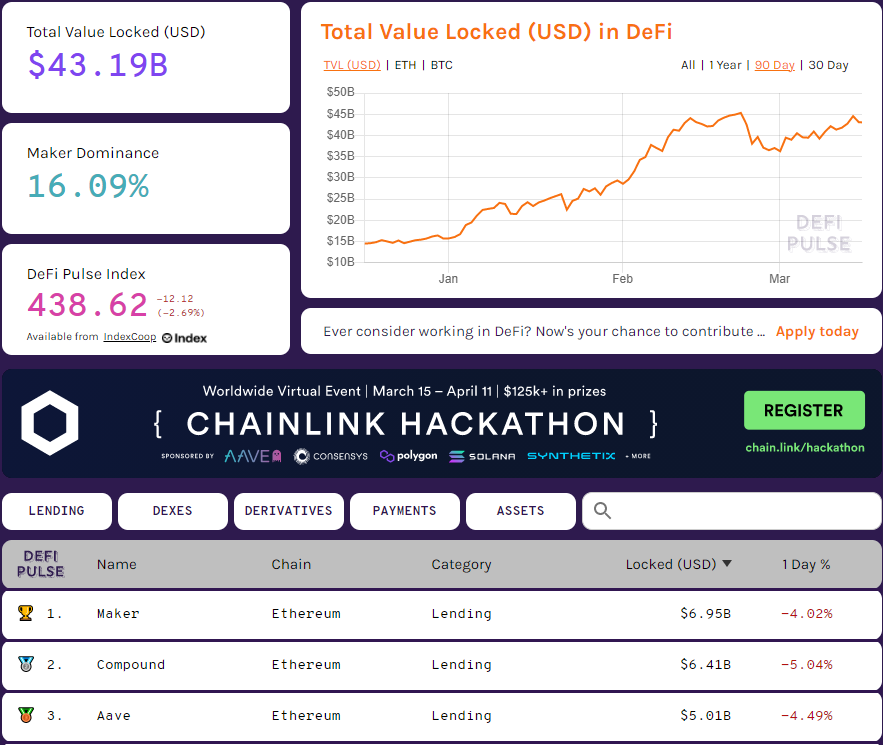

Total value blocked in BSC platformsfunds (TVL) exceeded $12 billion as of March 15, 2021. The top projects of the DeFi ecosystem from Binance are already comparable in scale to Compound, Maker, Aave and other well-known dApps based on the second largest cryptocurrency by capitalization.

If this growth rate continues, the value locked in BSC apps will surpass that of Ethereum within a few months.

We figured out why there was excitement around the new DeFi ecosystem, what are its pros and cons, and most importantly, whether BSC has any prospects after scaling Ethereum.

Key:

- Amid problems with the scalability of Ethereum, the BSC ecosystem quickly gained popularity thanks to low-cost transactions.

- The main disadvantage of Binance Smart Chain is its high degree of centralization.

- Some experts are confident that BSC will not be able to surpass Ethereum in the long run.

Binance Official Website https://binance.com

Brief Introduction: Binance Smart Chain Key Features

In April 2018, popular crypto exchange Binance launched the main network Binance Chain. The main idea of this initiative is to create a high-speed blockchain with significant throughput.

To implement the plan, the developerschose the Tendermint BFT consensus model. The result was a system tailored primarily to the network’s main application—the Binance DEX trading platform.

Early 2020 Ethereum-based DeFi sectorbegan to grow and develop at an accelerated rate. On the eve of a new boom, Binance realized what exactly Binance Chain is missing - support for smart contracts and the ability to launch its own applications by various projects.

The developers did not try to add smart contract capabilities to Binance Chain at the expense of its performance. They cut the Gordian knot by launching the parallel Binance Smart Chain.

Launched in September 2020, the BSC platformbecame fully programmable and ready to work with smart contracts thanks to compatibility with the Ethereum Virtual Machine [Ethereum Virtual Machine, EVM]. This approach made it possible for developers to easily transfer projects originally launched on Ethereum to the new system.

Interaction with BSC applications will not be difficult for users familiar with “classic” DeFi and the MetaMask wallet. The latter is easy to configure to work with Binance Smart Chain.

The BSC system uses a hybrid Proof of Staked Authority (PoSA) model, obtained by crossing the Delegated Proof of Stake and Proof of Authority algorithms.

Small spacing between blocks makes processingfast transactions - about 3 seconds. The higher gas limit compared to Ethereum also has a positive effect on throughput, allowing more transactions to be included in blocks.

At the time of writing, gas limit per block in Ethereumis 12.5 million, Binance Smart Chain has 30 million. With an average block size of 40,000 bytes, the size of the new blockchain is growing approximately 10 times faster compared to Ethereum - about 1.15 GB per day or 420 GB per year. This means that after a few years, someone who wants to become a Binance Smart Chain validator will need an entire data center.

Moreover, a candidate Binance validator needshave at least 10,000 BNB ($2.55 million at the exchange rate as of March 15, 2021). From the candidates that meet this criterion, those with more coins (own and delegated) are selected. Ultimately, a kind of oligopoly of 21 validators is formed. The list of participants is reviewed once a day.

To pay transaction fees on the new networkBinance Coin (BNB) is used. With BSC, the latter has gone well beyond an exchange token for discounts on trading fees and access to initial coin offerings. BNB has become central to yield farming.

The excitement around the new ecosystem

In the second half of February, the TVL of the Binance Smart Chain ecosystem crossed the $ 10 billion milestone.

Leading projects based on BSC:

- Venus landing protocol - an analogue of Compound based on Ethereum;

- PancakeSwap - DEX is akin to Uniswap;

- Autofarm is a project similar in essence to Yearn Finance.

The TVL of the above protocols is $5.34billion, $3.88 billion and $1.15 billion, respectively. By comparison, the top three Ethereum-based DeFi projects—Maker, Compound, and Aave—have $6.95 billion, $6.41 billion, and $5.01 billion (as of 3/15/2021).

In the context of the value of blocked funds, the ecosystem based on Binance Smart Chain is gradually becoming comparable in scale to Ethereum.

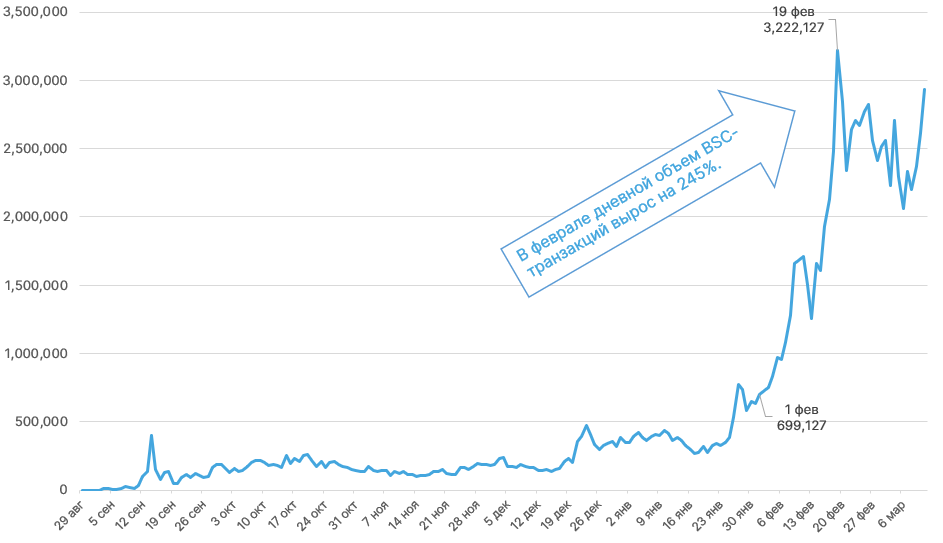

If we consider on-chain activity, then the daily volume of BSC transactions is more than double that of Ethereum.

On March 11, the BSC network processed 2,930,895 transactions. For Ethereum, this figure was 1,284,767.

Significant activity on the new network is also evidenced by the rapid growth in the number of unique addresses.

BSC is popular despite its low degree of decentralization. Retail investors are clearly attracted by the high transaction speed and low network fees.

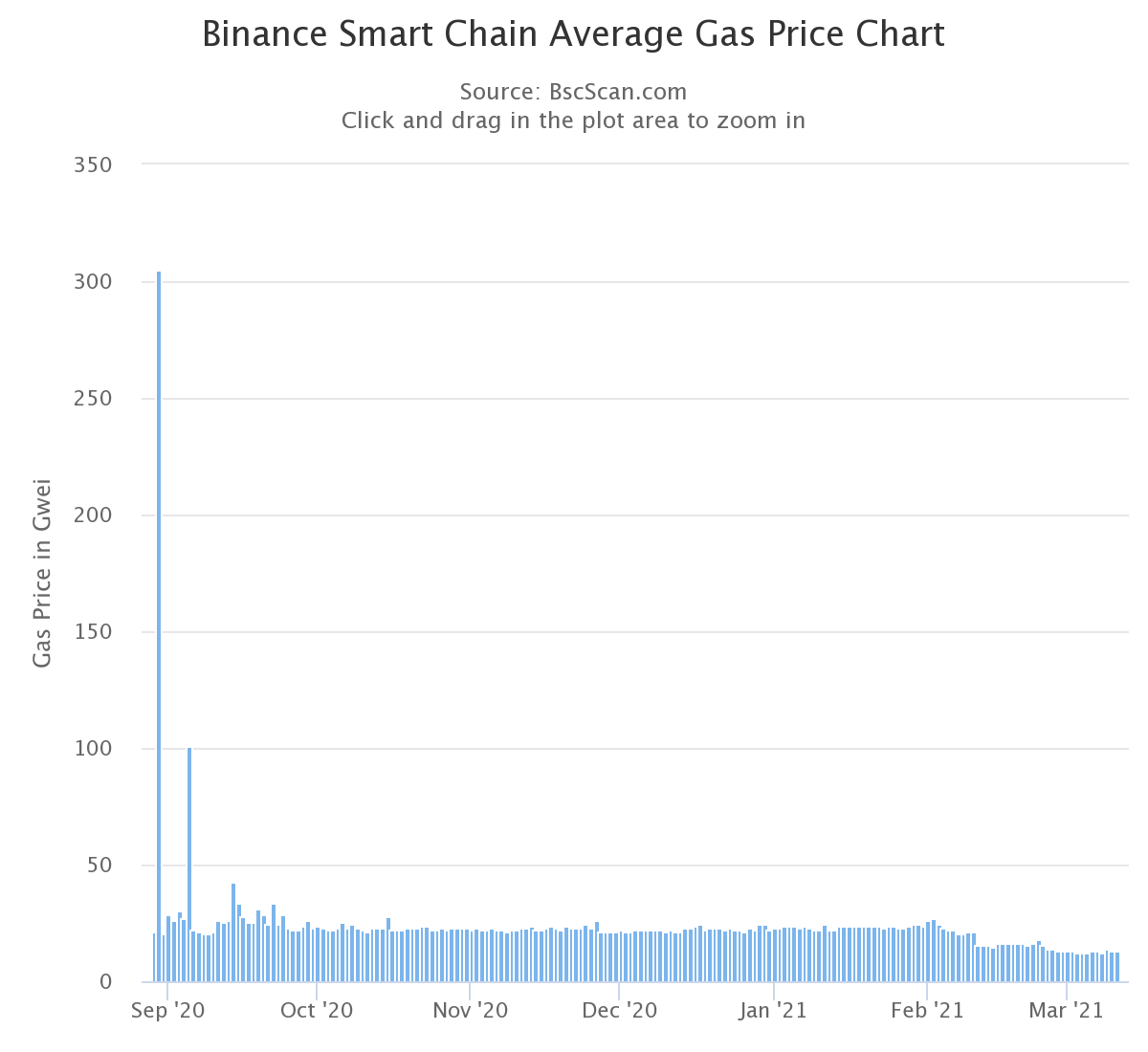

Below is a graph of the average gas price that Binance Smart Chain users pay for transactions.

With a BNB price around $ 250 and a gas price of 13gwei a simple transfer of tokens will cost the user about $ 0.10. Interaction with a smart contract, usually involving several transactions at once, can exceed $ 1.

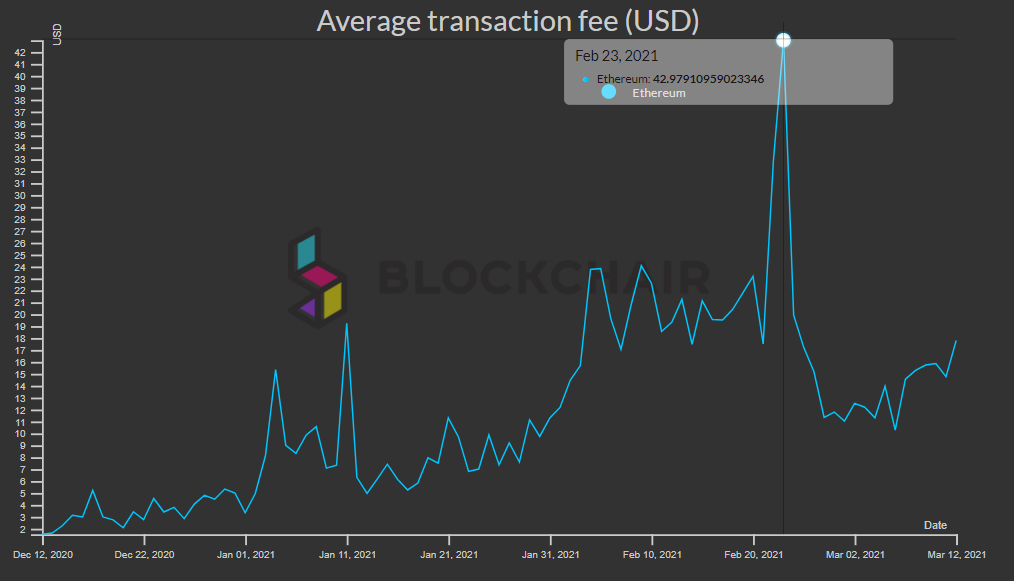

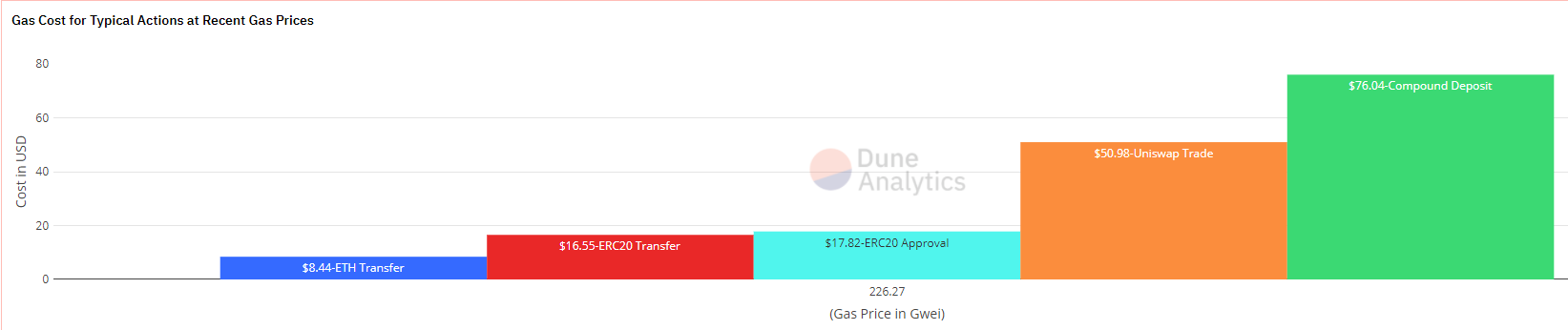

Ethereum's fees are much higher - a simple ETH transfer sometimes costs users $ 30 or more.

Interaction with Ethereum smart contractsimplies even more significant costs. During periods of significant on-chain activity and high ETH prices, the cost of exchanging tokens on Uniswap or depositing funds on Compound can reach $ 100 or more.

Fees attractive to most retail users and high transaction speeds have been the main reasons for the growing popularity of BSC-based applications.

Demand creates supply: the new DeFi ecosystem grows with projects, infrastructure develops. This is not happening without support from Binance.

As of mid-March 2021the range of BSC applications is not as rich as that of Ethereum. However, new projects are constantly appearing. Also, on the other hand, hacker attacks and exit scams have become more frequent.

CeDeFi and associated risks

Late last year, Binance CEO Changpeng Zhao proposed the term CeDeFi, meaning something between centralized and decentralized finance.

BSC is a typical example of CeDeFi. According to Zhao, Binance Smart Chain is more of an add-on than a competitor to "classic" DeFi, designed to drive the massive adoption of cryptoassets and dapps.

TOadvantagesCeDeFi can be credited with low fees.Along with high speed, they motivate users to try different protocols - decentralized exchanges, landing applications, yield farming tools and liquidity aggregators.

Thanks to CeDeFi, some newbies are getting their first taste of MetaMask and block explorers, plunging into the diversity of the crypto industry.

Low gas costs allow projectsreduce costs when deploying smart contracts and testing the ecosystem in real conditions. Architectural features make it easier for developers to interact with the new ecosystem. Some well-known projects have already opened “bridges” between Ethereum and BSC, allowing switching between these networks.

Similar to Ethereum with its popular ERC-20 standard, Binance Smart Chain users can create BEP-20 tokens. The Binance Chain network has its own standard - BEP2.

One of the maindisadvantagesCeDeFi is highly centralized. Controlled by Binance and supported by 21 validators, the system can hardly be called decentralized. This is the downside of low fees and fast transactions.

The high entry threshold for validators is also significant. The latter, as already mentioned, need approval from Binance, an impressive amount in BNB and a considerable disk space.

Binance is investing heavily indevelopment of an ecosystem, the success and popularity of which determines the price prospects of BNB. The latter is the native BSC token; transaction fees are paid with it.

On the other hand, there is no emphasis on serious innovation like in Ethereum. The Binance ecosystem's value proposition is essentially limited to a cheap alternative for profitable farming.

The BSC infrastructure is also inferior in the development of the Ethereum-based DeFi ecosystem. However, given the frequency of emergence of new analytical services and wallets, the situation has improved over time.

Expert opinions on BSC

Head of Alameda Research and FTX crypto derivatives exchangeSam Bankman-Freedin a series of tweets, he shared his opinion on the Binance Smart Chain ecosystem and its prospects.

1) A while ago I wrote a post on Sushiswap: https: //t.co/tcvJXJTrNY

- SBF (@SBF_Alameda) March 8, 2021

“They haven't created a completely new network; they essentially forked Ethereum ", - the expert emphasized.

Bankman-Fried added that not even a wallet for the new ecosystem was originally created. The developers "made BSC work with MetaMask."

“I would be very sad if BSC becomesthe future of blockchain technology. But again, I don’t think there’s any desire for this. A completely new product has not been created, which implies scaling in the context of decentralization. A cheap product has been created that is easy to switch to. "

According to Bankman-Fried, most users are interested in profitable farming, not a decentralized autonomous organization.

He is confident that Binance has managed to create the "perfect" platform for pharming income.

The expert is convinced that BSC has brought competition to decentralized finance, without at all depriving this area of the future.

Bankman-Freed concluded by identifying the inherent characteristics of a "winning" DeFi ecosystem.

“It cannot be decentralized orfast, or cheap, or mature, or innovative, or well-made, or have a significant user base. She must have all of the above. "

Analyst at The BlockLarry CermakI am convinced that BSC does not pose a threat to Ethereum in the long term.

We all know BSC is not going to threaten Ethereumlong term but it absolutely amuses me when Ethereum people start sounding just like Bitcoiners bitching about Ethereum. Just chill, take a breather and let the incentives play out?

- Larry Cermak (@lawmaster) February 19, 2021

"It really amuses me when Ethereum apologists are like Bitcoin maximalists complaining about the second largest cryptocurrency by capitalization."

Among the main disadvantages of BSC, the analyst noted"Fuck what" centralization and that "everything is funded by Binance." Cermak attributed the significant resources of Changpeng Zhao's company to the benefits of the new ecosystem. The main reason for the hype around BSC is the wide opportunities for maximizing profits.

Why is this happening?In retrospect, it was inevitable. Retail wants to gamble in DeFi and the vast majority of newcomers are priced out of Ethereum. Do they care about decentralization? Nope https://t.co/SqWOcgM9Q1

- Larry Cermak (@lawmaster) February 19, 2021

According to Chermak, the emergence of a platform for "DeFi-gambling" was inevitable, as many newcomers to the industry were put off by the high transaction costs of Ethereum.

“Are they concerned about decentralization? Nope ", - the researcher emphasized.

findings

Binance Smart Chain succeeded in a short timeachieve impressive results considering the number of users, trading volumes and TVL. The decision to build a system in the image and likeness of Ethereum, with similar tools and protocols, seems quite reasonable.

BSC came into being in a timely manner - growing popularityEthereum, with its still pressing scaling problem, has turned into extremely high transaction fees. High costs have pushed many retail users away from the ecosystem, prompting them to seek alternative options for interacting with DeFi.

As one of the largest crypto exchanges, Binanceopened the possibility for many users to withdraw BNB and other cryptoassets directly into the BSC ecosystem. The BEP-20 standard, cross-chain communication and network effect have done their job.

PoSA model enables fast transactions andlow commissions. The price for this is the low level of decentralization and network security. However, few people are worried about this - for most, profitable farming with low transaction costs is important.

High growth rate of the BSC ecosystem with a largewill likely continue to positively affect the price of Binance Coin. The ecosystem's native asset is required to pay transaction fees and is widely used in applications that promise a high percentage of the investment.

It is unlikely that this trend will reverse in the short and medium term. However, the question remains: will BSC manage to become the leading DeFi ecosystem in the long term?

Level 2 scaling solutions are equal toas well as a full-scale transition to the second version, can significantly reduce costs when interacting with Ethereum, without compromising decentralization and security.

The intrigue is growing as technologies like Optimism, Plasma and Rollups develop and become widespread. Time will tell who will win the DeFi vs CeDeFi confrontation.

You can learn more about Binance Smart Chain on the official Binance website https://binance.com

Rate this publication