Forming a profitable crypto-portfolio and managing it competently is difficult and troublesome. I have to constantlycontrol the market situation and in accordancewith the current picture, diversify risks correctly. Therefore, traders and investors turn to automated services - cryptocurrency index funds, which facilitate the work.

How are index crypto funds arranged, which of them are leading the market today and how to launch such a fund on their own are the answers in our material.

What is a cryptocurrency index fund?

The cryptocurrency index fund isan automated service that offers a ready-made investment portfolio, which presents several digital assets at once. The selection of these assets takes place according to a number of criteria: market capitalization, price, volatility, liquidity, and so on.

Service takes care ofautomated monitoring and market analysis, diversification of risks and other factors. Such a tool is equally suitable for both beginner and experienced players - and this versatility has a positive effect on the rapid growth of its popularity. Among the most famous crypto-index funds, we note the following:

Crypto20 (C20).Autonomous crypto index fund based onEthereum blockchain, works 24/7 and offers users low commissions. One of the first index funds with its own token is C20. The token can be exchanged for cryptocurrency or withdrawn to ETH at any time using the liquidation function built into the smart contract.

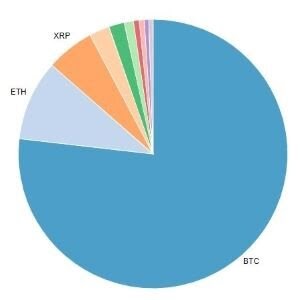

Crypto20 offers a portfolio of 20 populardigital assets that are determined in advance by a special algorithm - the user cannot make changes. The strategy for managing the distribution and rebalancing of the portfolio also follows a specific algorithm.

Bitwise.In 2017, the company of the same name created the firstin the world cryptocurrency index fund “Bitwise 10 Private Index Fund”. The service offers a portfolio of the 10 largest digital assets selected based on several criteria, including five-year inflation-adjusted market capitalization.

There are other cryptocurrency indexes in the Bitwise arsenal.funds with tracking of 20, 70 and 100 digital assets. The company pays due attention to security and confidentiality - user funds are concentrated in a cold storage where multi-signature technology is used. The resource is primarily aimed at large market players - the minimum investment amount is $ 25,000.

CryptoIndex (CIX100).Cryptocurrency index fund offeringportfolio of 100 digital assets. Its technology is based on the Zorax neural network algorithm. The algorithm is based on artificial intelligence and uses over 200 criteria to select digital assets, and also has a built-in function to detect coins with artificially inflated values.

Like Crypto20, CryptoIndex is based onEthereum blockchain: uses a smart contract and has its own CIX100 token. However, unlike Crypto20, here you can create a portfolio yourself, and this makes the resource more attractive to users.

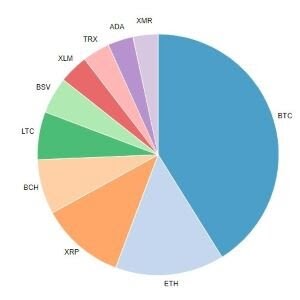

Bloomberg Galaxy Crypto Index (BGCI).This fund is launched by Bloomberg in conjunction withGalaxy Digital Management cryptocurrency bank in 2018. It tracks the 10 most liquid digital assets: Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, Litecoin, Dash, Monero, Ethereum Classic and Zcash. The weight components of the portfolio are distributed based on several criteria of coins that take into account average exchange rates, protocols of smart contracts and the degree of confidentiality.

BGCI is designed primarily for large investors, including institutional ones. Creating your own portfolio is not provided.

Shrimpy. One of the leading services allowing investorsor a trader to create and manage his own crypto-index fund. The service integrates many useful innovative features that distinguish it from other similar products. When creating a portfolio, various criteria of digital assets are taken into account: weighting, minimum and maximum distribution, and so on. Shrimpy also uses API integration with crypto exchanges specified by the user in the account settings.

Experts advise taking into account a number of aspects,which play a critical role in building a high-performing portfolio. Below I figured out what you need to know to create your own crypto index fund and how to launch it.

Asset selection

First of all, you need to define the contentportfolio. From this, its effectiveness will depend to a greater extent. A common way to select assets is to add a few coins with the highest capitalization and combine them with coins from the top 10, 20 and 30 by capitalization on CoinMarketCap.

- Turning on. It is not necessary to create a crypto index fundтолько из монет топ-10. Есть криптовалюты со скрытым потенциалом, которые могут «стрельнуть» в ближайшем будущем. Если вы анализировали рынок и твердо уверены в том, что какая-то из монет в скором времени прокачается — включайте ее в портфель, даже если сейчас она находится на 15, 25 или 30 месте.

- An exception. Often traders and investors refuseinclusion of stablecoins such as USDT, TUSD and USDC in the crypto index precisely because of their stability. Why keep an asset in your portfolio that, in principle, does not generate income? In addition, you can exclude forks from the list if you are skeptical about them.

- Buffer zone. Since the cryptocurrency market is quiteis volatile, you need to monitor its condition and, if necessary, adjust the contents of the crypto-index fund. For this purpose, a five percent “buffer zone” is usually created. If an asset appears on the market, the capitalization of which is 5% higher than that of any asset in the portfolio, automatic replacement occurs - the increased asset enters the portfolio, knocking out its predecessor.

Asset allocation

After choosing coins, you need to correctly distribute them as a percentage. This can be done in accordance with the following principles.

- Weighing by market capitalization.Percentage of coins in the portfoliodetermined taking into account their market capitalization. For example, you select coins A, B and C with capitalizations of $4 billion, $3 billion and $1 billion respectively. To determine the percentage for each coin, the total capitalization is calculated - $8 billion. Then the percentage distribution coefficient is calculated: dividing 100% by 8 we get 12.5. Now this coefficient is applied to each coin separately: A - $4 billion x 12.5 = 50%, B - $3 billion x 12.5 = 37.5% and C - $1 billion x 12.5 = 12.5%.

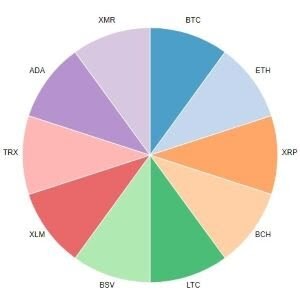

- The square root of market capitalization.This calculation principle allows us to reduce the shareassets with higher capitalization and, accordingly, increase the share of assets with lower capitalization. Using it, you can reduce the percentage of Bitcoin, which with the first distribution method takes up more than half of the entire portfolio. The calculations themselves are performed according to the same scheme, only instead of the market capitalization value its square root is taken, that is, in this case these are the numbers 2; 1.73 and 1. As a result, we get the following ratio: A - 42.26%, B - 36.6%, C - 21.14%.

- Uniform weighing.This is the simplest principle of coin distribution -when each of them accounts for an equal share of the total fund budget. This strategy is used less frequently than the previous two, however, recent research shows that there is an upward trend in its use. For example, if your portfolio contains 10 assets, and your total investments are $500, then each asset will account for 10% of this amount, that is, $50.

- Minimum weight.The crypto market is dominated by a few assets witha big gap from the rest. Thus, only the first two from the CoinMarketCap list account for about 75% of the total market capitalization, and all the others - much less. This situation can lead to insufficient diversification of the crypto-index fund if the principle of distributing coins by market capitalization was used during its formation. Therefore, it is necessary to additionally use the principle of minimum weight - for example, you can set a lower threshold of 5% for each asset. If a coin accounts for less than 5% of the entire portfolio, its quantity is automatically raised to the set limit, and the remaining assets are recalculated in accordance with the distribution method you have chosen.

- Weight Limit.This principle is used to fixupper threshold for each asset. This solution is ideal for monitoring coins with high market capitalization, such as Bitcoin. For example, you set a maximum threshold of 25%, and none of the coins in your portfolio will be able to exceed this value - its share is automatically reduced to the set limit, and the remaining assets are again recalculated in accordance with the distribution method you have chosen.

Rebalancing

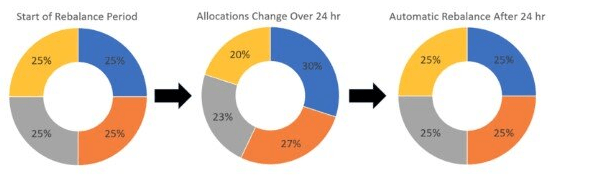

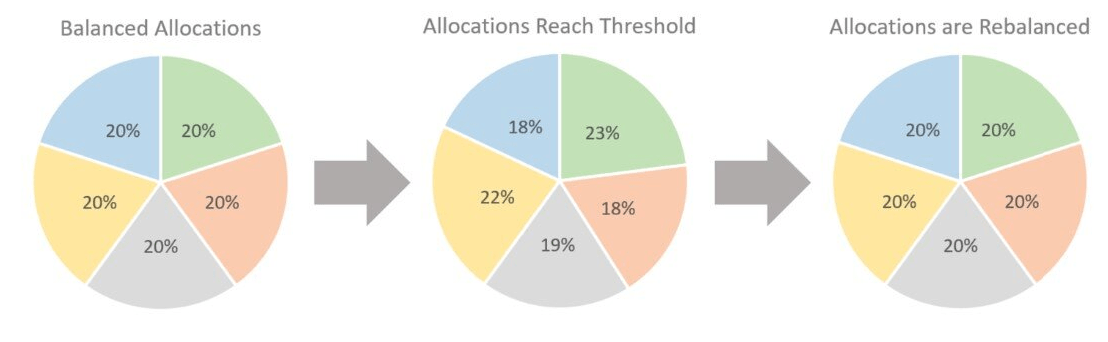

The crypto market fluctuates all the time, as a result of whichthe percentage of assets in the portfolio changes, which leads to an imbalance. Rebalancing allows you to restore balance and thereby increase efficiency. The process can be performed in two ways.

- Periodic rebalancing.This is the most common method thatimplies adjustment of assets at a certain time interval: once a day, week, month. According to recent studies, due to market instability, short intervals prevail over long ones.

- Threshold rebalancing.This procedure is carried out when at least oneof the assets deviates from the share allocated to him by a certain percentage. The deviation level is chosen by the creator of the crypto index independently and can be +/- 10%; +/- 20% and so on. Example: if the share of an asset in the portfolio is 70%, and the set deviation threshold is 10%, then rebalancing will begin when its value decreases to 63% or increases to 77%. Research in this area shows that threshold rebalancing is more effective than periodic rebalancing.

Dollar value averaging

This strategy is abbreviated as DCA (dollar cost averaging) and consists in periodically injecting additional investments into the fund. Its essence is portfolio adjustment without rebalancing.

Example: you have two assets A and B. The distributed share of asset A is 70%, but is currently reduced to 65%. The distributed share of Asset B is 30%, but is currently increased to 35%. After making a deposit, the funds will be placed so that the assets reach the established values.

How to launch a crypto-index fund using an automatic service?

Once you have decided on the strategy, you can begin to implement it. To do this, you will need to register with any of the crypto-index funds existing in the market.

- Step 1. Register. The registration process on such services is simple and fast.

- Step 2 Select a cryptocurrency exchange from the list and specify the API keys that you will use in conjunction with your account. As a rule, automatic services support integration with several top exchanges.

- Step 3. Create your own crypto-index fund. Go to the portfolio tab and select the necessary parameters, guided by the system prompts.

The crypto-index fund is ready to use. We hope this material will help you establish fruitful work in the field of crypto trading and investing. We wish you success in creating effective strategies and earning profits.

</p>Rate this publication