On Monday, March 9, the price of a barrel of oil fell30% to $ 31. Two days before, Russia had withdrawn from the OPEC + deal, refusing to cut production. The ruble followed the oil and in pairs with the dollar / euro returned to the values of 2016. Due to the volatility of world markets, the Central Bank of the Russian Federation suspended purchases of currency for 30 days.

The price shock affected European and Asian indices: the FTSE 100 lost 5.98%, Stoxx600 - 5.5%, Nikkei 225 - 5%.

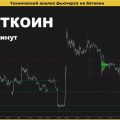

The price of bitcoin fell below $ 7900, and the market capitalization decreased by 10%.

ForkLog asked experts if the collapse is the beginning of another deep bearish phase and what will affect bitcoin more strongly - the fall of stock markets or the upcoming halving.

Dmitry Gurkovsky, leading analyst at RoboForex:

Whatbitcoinwill not grow, it became clear from that moment,when the rise in gold prices was not accompanied by a rise in cryptocurrency. As stock indices fell, investors began to move away from risk and buy safe-haven assets, which traditionally include gold, the Japanese yen, the Swiss franc and the dollar.

At some point, one would think that andBitcoin will become an asset for preserving capital in the face of market instability. But, as you can see, money does not go to the cryptocurrency market. Investors do not consider it safe to keep their capital in cryptocurrency. In the current situation, a fall in stock indices may be accompanied by a further fall in cryptocurrencies.

You can note a key level of support -$ 7800, which is the last obstacle before the price drops to the next level at $ 6700. As long as the price is above the level of $ 7800, we can only expect a correction to the level of $ 8450.

Many traders and analysts really expectBTC cost growth, however, not before halving, but after it, as it was before. It can be assumed that by the end of May the market will be sandwiched between strong levels of $ 10,400 and $ 6,400.

Magnitude of declinestock indicesat the moment it is very difficult to assess.It should be taken into account that only in April companies will begin to provide financial reports for the first quarter, in which you can see how negatively the coronavirus epidemic has affected them. Possible bankruptcies of airlines cannot be ruled out; this could also have a negative impact on stock indices and increase panic. Looking for a turning point now, in my opinion, is not entirely correct.

Need to wait for stock indicesstop declining. In this regard, I believe that May will be a good time to buy shares, but this is subject to the fact that the impact of the coronavirus epidemic is minimized and the Chinese economy starts up again, that is, quarantine ends and enterprises return to their previous capacity.

Otherwise, we can expect an already protracted slow decline in stock indices.

Alongoilreally strong area of supportthe level was $50 per barrel. Here, an ascending pattern was even formed within the framework of technical analysis, which indicated the likely start of growth in the event of a successful rebound from the specified area. However, as soon as prices fell below $48, the pattern was canceled and the target for the fall was the $34 area.

Of course, in this situation a lot of pressurefailure in the negotiations of OPEC + countries, which was planned to reduce production due to the difficult situation around the coronavirus. April 1 ends current arrangements and restrictions.

Against the reduction in production, Russia andKazakhstan, indicating the lack of interest in the current transaction and the loss of potential for the development of the industry due to the fact that the volumes were still replaced by other participants, bypassing the agreement. Following this, Saudi Arabia announced its readiness to increase production to record levels, if necessary.

The current fall and completion of the goal does not meanU-Turn. Here, rather, prices can test the lows of 2016 near the level of $ 27. The aggressive goal of the decline may be the level of $ 20, where the key area of support is located. From these values, an upward trend can begin to develop with a high probability.

Mansur Huseynov, an independent cryptocurrency expert:

I did not expect such a sharp drop in bitcoin. Now the level of $ 7800- $ 7900 - good support. If we break through, then we can wait for $ 5300, although not immediately. I hope that we will turn around.

The S&P 500 could fall another 30%, but if the situation with the virus stabilizes, it will grow back very quickly, as leading central banks are pouring money.

Oil, I suppose, will stop here. In 2014-2015, the minimum was at $ 27. Below is already a complete absurdity for manufacturers.

OPEC decision purely political - an attemptkill US shale producers amid falling stock markets and declining economic activity due to coronavirus. In the end, none of this will come of it.

Alexey Kirienko, Exante Managing Partner:

Everything falls andbitcoinno exception - people close margin calls atall assets. Bitcoin has become a reflection of risk aversion as problems in the global economy have been brewing for a long time. The fragile balance was maintained only thanks to incentive measures. This applies to both stocks and oil. Recent events surrounding the epidemic have become a trigger for the exacerbation of all global diseases.

The reason was the fall in oil prices, todayit reached 30%. Following this, all world markets began to fall: European indices have been losing about 8% since the beginning of the day on Monday, the American S&P500 has fallen by 5%, the Japanese Nikkei is losing 6%.

Bitcoin will probably recover soonafter a stock market reversal. However, at the moment, an attempt to rebound can only be a temporary respite before a further decline. Bitcoin has broken through a number of support levels. Given the fact that institutional investors closely monitor technical indicators and configure bots in accordance with them, difficult times in the short term can wait for it.

Depth of fallstock markets and oilIt is impossible to predict at this time.Any day the situation can change dramatically. While the markets are waiting for support from global central banks, however, given that the US Federal Reserve lowered the rate by 0.5 bp last week, it is very likely that one of the most influential central banks in the world will limit itself to verbal interventions.

However, market sentiment is extremely negative. Everyone understood that the stock was deeply overbought, and sooner or later the correction was to begin.

Perhaps coming out ofOPEC transactions +, the Russian government planned to take away a share from the American shale companies, which invariably outperformed previous cuts in production.

Another reason is possible: This time, Russia did not agree to resort to the usual measure to reduce production amid a global decline, because it believes that oil demand should return soon after at some point the coronavirus begins to decline and fears recede from the market.

If sharp oil movements continue andfurther, it is likely that both parties will again sit down at the negotiating table. Cheap raw materials will help to restore the global market by participating in the process of balancing the global economy.

Anton Kravchenko, CEO of Xena.Exchange:

It is impossible to predict sharp drops or a sharp increase in bitcoin, we see only a long-term picture and it remains the same - $ 12-13 thousand by the end of the year.

There is no support that could be broken at current levels, there’s no point in talking about the bearish phase, bitcoin is in the growth phase from $ 3,500 to levels of $ 12-13 thousand.

Oil has already fallen by more than 30%; most likely, a rebound awaits us.

The exit from the OPEC + deal is due to the fact that, given the available volumes, Russia was satisfied with the price of oil for budget purposes, while OPEC wanted to reduce production and increase the price, which was not profitable for Russia.

As a result, there was a way out of the transaction, which ledto the fact that OPEC began to move to another equilibrium point - large oil supplies at a low price. For the whole world this, of course, is unexpected. What will come of this and whether Russia will return to the negotiations - we'll see.

The current bitcoin levels (~ $ 8000) are almost the cost of mining before halving, we expect a drop to the level of $ 6000. You should not expect that due to halving everything will grow sharply.

Gleb Kostarev, official representative of the Binance exchange in the Russian Federation:

Despite some features, cryptocurrencythe market is closely connected with global financial markets, and today's collapse could not but affect it. In conditions of turbulence, investors try to get out of high-risk assets and use more stable and less risky instruments, for example, gold or bonds. In addition, amid the collapse, many investors go into the cache to go into assets, including digital ones, at a more attractive price.

At the same time, in some local markets, demandon cryptocurrency can even increase, for example, in Russia, where the dollar is growing rapidly. Earlier, with the depreciation of local currencies in Argentina, Venezuela, Iran, Turkey and other countries, we have repeatedly seen how the local population not only actively bought dollars, but also cryptocurrency.