WELTRADE company offers analytics of the latest news in financial markets. In this article we will look atpossible scenarios on major trading assets.

Today we have the last day of the month and quarter, traditionally the market activity of such days is devoted to fixing positions and formatting the results of the reporting period.

Thus, we cannot expect any serious fluctuations today. Let's look at what is happening on the main trading instruments at the moment.

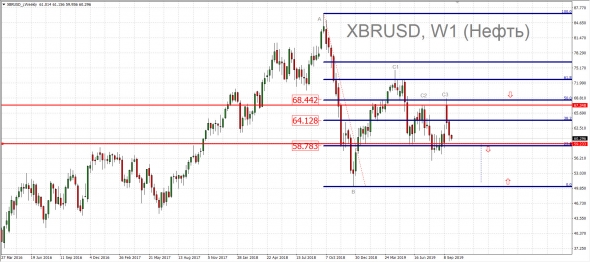

Brent Oil

</strong>

Last week Brent oil fell no lower thanmark of $60 and, in fact, we can say that the gap that formed after the drone attack on oil refineries in Saudi Arabia is closed. Thus, the entire upward movement was fully reversed.

By and large, we are in the same price range as we were before. That is, at the moment the levels are $60-63. This range is very unstable, but also without much direction.

As we can see, recent events did not causeno enthusiasm in the oil market. There is reason to believe that oil will continue to remain under pressure, slowly moving to new lows. That is, if we steadily break below the $ 60 mark, the target will be the $ 58 mark.

GBP / USD

Let's look at the pound/dollar pair. The pound fell below 1.23. Last week and tonight 1.2270 tested the lows in this pair.

As we can see, there are no serious fluctuations here,despite the fact that reports have emerged about the possible impeachment of British Prime Minister Boris Johnson. Naturally, the fact itself is very negative, but the market apparently absorbed all the negativity so much that it did not pay specific attention to this factor.

Here Brexit continues to steer dynamics and inin general, significant positive on the horizon is not observed. Staying in such a moderately negative background, the pound will continue to remain under pressure. Apparently there is some stabilization today, as part of such short positions will be fixed.

XAU / USD

Interesting situation in gold. The metal has again approached its critical support zone of $1480-1485 - this zone is being tested. It is clear that the demand is still there.

From a technical point of view, the dip is lower – $1480looks quite negative. As we have already noted, a head and shoulders pattern has formed on the daily chart. We mentioned the right shoulder - $1535. Now it has done its job, the shoulder has been formed and now the price is hitting the base of the head and shoulders figure. In case of a breakdown below, the target will be $1,450. That is, about $35 below, the movement itself can be quite fast. By the way, the long positions accumulated here are quite serious and fixing positions on the eve of the end of the reporting period may well provoke a selling movement below the $1,480 mark. Formally, the upward trend continues, the target will remain $1535 and then, if we pass it, then $1550-1560, etc.

The reasons for the growth of gold again remaingeopolitics, risk situation. If everything remains tense, then gold will again act as a defensive asset and interest will naturally return to it. But today we see that pressure remains and sales remain.

Here, speculators will try to push the level of $ 1480 to see how large these stop sales orders are. If we break below, it is likely a powerful downward movement.

EUR / USD

If we look at the euro/dollar pair, there are no major changes, the pressure remains. Last week the pair almost reached 1.09, but there is no continuation.

The pair is trading in a fairly narrow range1.0900-1.0950. No major changes in the situation are expected yet, despite the negative news. Growth in the eurozone has slowed to the point of danger of recession. While officials remain optimistic, economic statistics indicate otherwise.

Thus, if a break below 1.09 occurs,then the downward movement at one speed or another will continue to the area of 1.0800-1.0850. You should not expect a strong movement, liquidity is high and all sharp impulses inevitably get bogged down in the opposite direction. High liquidity dampens any rapid movements.

BTC / USD

We also turn our attention to the situation in the markets.cryptocurrencies, namely on BTC / USD. A break below the $ 9,000 mark last week. That is, an important technical mark has been passed, Bitcoin has fallen.

Currently it is trading below $8,000, today it was even $7,700, and while significant optimism is not expected here, the pressure will continue.

The launch of the Bakkt trading platform (futures trading with the possibility of physical delivery) did not have a significant impact, and interest in Bitcoin materialized.

The liquidation of long positions is all we are seeing here so far and the activity of speculators, large players who will try to push the price even lower.

The purpose of moving down is the mark of $ 7000-7100. This zone may become the next level of support. As for the top level, this is the mark of $ 8000, then it will be $ 8300-8400 and even higher - $ 8750. But while these goals do not seem to be achievable, to resume the growth of bitcoin, you will have to climb above $ 9400 and gain a foothold there. Only then will the technical picture unfold in the direction of a new wave of growth. While we note the consolidation of $ 7700-8000, with a very high risk of falling to the level of $ 7500.