Friends, good day!

In many previous publications we have repeatedly paid attentionintermarket analysis, since there isthe relationship between various assets, especially within the Risk-ON and Risk-OFF groups. I hope that it is not difficult for you to guess which group of assets the cryptocurrency market belongs to, and bitcoin in particular.

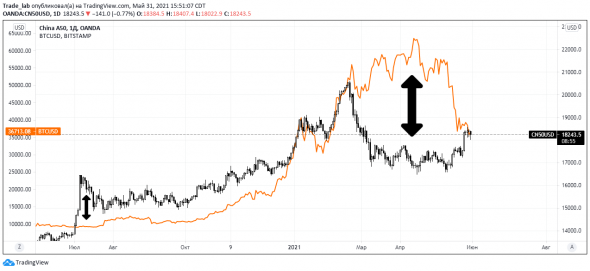

I would like to remind you that in one of the previously published posts, when Bitcoin was trading above $50k,testing of the year's minimums was determined as guidelines for BTCUSDT(what actually happened), due to the fact that the assets with which the cue ballpositively correlated, at that time had already decreased to the January lows, the Chinese stock market in particular, with which we will once again compare in this post.

It is easy to see that especially these assetsdiverged from March to mid-April, the Bitcoin rate stormed to new highs, when CN50USD completely neutralized the growth of the current year, falling from the high by more than 20%. Perhaps, it was precisely due to the placement of shares of the largest crypto exchange in the United States - Coinbase on the Nasdaq stock exchange, which occurred on April 14 and pulled up the main cryptocurrency. Such thoughts are suggested by the fact that it was on April 14 that the maximum for BTC was formed. Now, the discrepancy has collapsed... BUT, I would like to draw your attention to the following point:

After the fall of the Chinese stock market, almostFor three months, range trading of CN50USD was observed near the minimums. Drawing parallels, it is quite possible that Bitcoin in the summer will also be in a flat, the range of which we increasingly voice in published posts - 27/30k$ – $40/42k .

CN50USD broke out of theupward consolidation, which may provide local support for the crypt to reach the upper limit of the designated range - that is, return to $40,000 - $42,000 before falling back to the lows of the year.