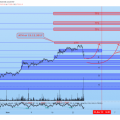

The main newsmaker of today's trading day and the current month is the shares of a popular video game operatorGameStop (ticker: GME, chart on the right)

For those who are not in the subject:

In today's trading, GME stock is trendingrose by +115%, and in less than a month, a total of > +800%!!! The initial information for the growth in January was a strong financial report, and then the coordinated actions of members of the Reddit community called r/wallstreetbets, who decided to accelerate the company’s price contrary to the forecasts of analysts who promised a fall.

What's instructive about this story, especially for beginners:

1) Open positions of participants, andnamely imbalances. The number of shorts in relation to the GME free float was 144%, that is, there were 1.4 times more people willing to profit from the decline than there were free floats! Confirmation that the majority cannot be right in the market, the minority always earns at the expense of the majority, this is the basic law of the stock market

2) A common misconception, the essence of which isis that the actions of hedge funds/management companies/banks are always correct. Not at all, in this particular story, the share of hedge funds was the main one among open bearish positions, and as you know, the strongest buyer today is yesterday’s short seller. It is especially common to take a corner against such big players, as happened in this situation.

3) Opinions/forecasts of major analytical agencies,Media, high-ranking people/officials. On the eve of the rise in GameStop shares, the well-known company Citron published a forecast according to which shares would fall to $20 (remember the meme about the director of the Center for Macroeconomic Research of Sberbank - Yulia Tseplyaeva and her pity for buyers of dollars for 35 rubles)

4) “Free and quick money.”This is definitely not about stock trading. When the story with GME shares gained popularity of unprecedented proportions, I am sure that against this background a lot of “hamsters” rushed to buy today from the opening of trading, when the shares immediately rose to +115% relative to the closing price of the previous day, and by now there was euphoria deflated to +9%, it’s easy to imagine what happened to their intentions of easy money)))

What do BIGC stocks (graph on the left) and GME stocks have in common?

These two companies have one important factor in common.– number of shorts (potential fuel for a reverse move). For shares of BigCommerce Holdings (ticker BIGC), the ratio of short positions to free float = 74%, is in the TOP 3 for this indicator! A prolonged downtrend (low base effect) + an overhang of shorts can lead to a similar story as with GME shares. An upward breakout of $87 will increase the probability of a growth scenario to $160, potential similarity with the period of August 2020 (highlighted in yellow rectangles).

What does bitcoin have to do with it?

The fact is that many participants in the cryptocurrencyThe market, as the main argument in favor of continued growth, states that purchases from funds will not allow the Bitcoin rate to fall below $30,000. Not only does the GameStop stock example show the opposite, but there are plenty of other stories: the maximum short of the non-commercial group on Volatility Index (VIX) futures early last year led to the fastest rate of decline in the American stock market since 1929! and Vicks itself increased in price many times over or huge bullish positions on the part of hedge funds in oil led to negative prices!

The conclusion is as follows:

The asset price chart is PRIMARY - those analysis is our everything!

We follow the trading system, despite the opinions/statements of many other participants

We control risks, emotions and competently manage open positions!

Good luck to all!