From July to November 2019, the price of bitcoin fell from $14,000 to $7,000, causing many to panic and frustrate.Swept overa new wave of commentators arguing that Bitcoin is dead and blockchains are worthless.Even some of the hodlers gave up at that moment.And yet, the price of bitcoin has risen by about 100 percent over the past year.Many remain hopeful that this latest drop representsa short-term "correction" after an excessively parabolic rally, a healthy downward movement in search of liquidity for a new, even more powerful momentum that will throwWe went straight to the moon, without even transfers.

</p>No one can know for sure, but if this rally happens at all, it will becomethe first in history when ordinary people will havesimple and legalways to acquire your Bitcoin.

They can buy it directly ata regulated exchange, use services like Bisq or LocalBitcoin, purchase Bitcoin-provided financial products, get rewards in BTC from Lolli or other similar providers, or use your satoshi for staking in applications like Cash, MetalPay, or Crypterium.

Among other things, by this point, manycountries have adopted new laws or clarified existing legislation taking into account crypto assets, which means that owning and using cryptocurrencies has become less risky.

As a result, the next Bitcoin boom could be truly attractivemanyPeople.

And that means a lot of money.

(Unless, of course, it will happen.)

The picture is cleaner

Most of the life of Bitcoinremained a favorite pet project of cipherpunk and geeks. The largest figures in his community were coders, anarcho-capitalists, or outright scammers like these guys:

Bitconnect-guy stoking behind a scam, and John McAfee lighting a cigarette from a hundred-dollar bill.

Since then, the cryptosphere has become much more professional and commercial.

Wall Street entered it. It is illuminated by CNBC. Regulators talk about it everyday and openly.

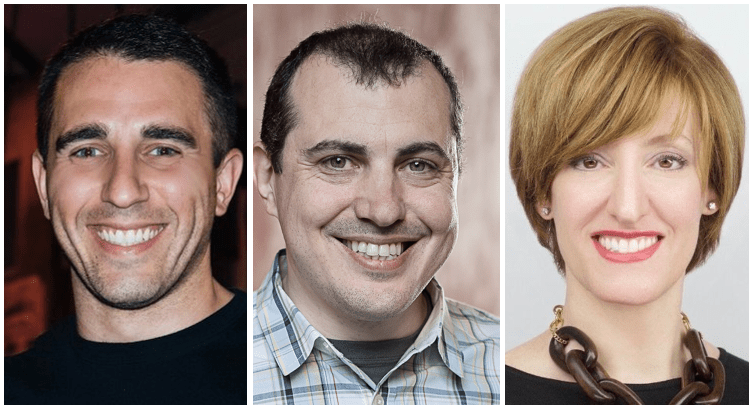

The most notable cryptosphere advocates now look something like this:

From left to right: Anthony Pompliano, Andreas Antonopoulos and Caitlin Long.

Decently. Friendly. Fine.

Not scary.

Much easier.

In 2017, people had to wait weeks to open a crypto account. The design of bitcoin wallets was terrible and only a few exchanges were licensed for professional activities.

In addition, registered in the USAinvestment funds (totaling $ 22 trillion) there was no legal way to buy bitcoins in the interests of their clients. The almost complete absence of rules and the dubious custodians forced them to stay away from this market.

Now the KYC procedure takes 5 minutes and there ismany legal regulated exchanges - regular and distributed - trusts, mobile platforms and services for people who want to exchange ordinary money for cryptocurrencies.

Large investment funds have acquired derivatives, trading platforms and financial instruments to access the Bitcoin market. Or they can simply store bitcoins with a reliable custodian.

Corporate players are ready to enter this market

During the mania of 2017, only a few companies were ready to capitalize on such an early stage.

At the time of the boom, there were not many months of marketing campaigns, advertising, and educational initiatives to encourage ordinary people to treat cryptocurrencies as a "normal" phenomenon.

Today, thousands of stores already have bitcoin "ATMs" installed. Bakkt and Starbucks are going to release a Bitcoin-based payment app.Here and there, advertising campaigns are held, in one way or another related to the cryptosphere.Altcoins and non-Bitcoin blockchain projects are starting to gain traction and user base.

Fidelity has launched a platform for digital assets, and TD Ameritrade has bought a stake in ErisX, a crypto exchange.Meanwhile, Bakkt (a subsidiary of the New York Stock Exchange), Circle Invest (a subsidiary of Goldman Sachs) and other well-funded startups have already opened their offices in the crypto market.

After the next local wave of bitcoin growth, investors will overcome their disbelief in the beginning of a new bull market. And then the new wave of FOMO will take effect. Altcoins will rush up like rockets.

And do you think this time will Wall Street keep its crypto initiatives in the shade?

I think not.

Well, when is the moon?

But, even taking into account all of the above, will makeIs it all to forget about the fraudulent ICOs and the 85% drop from the peak of the last bull rally? Does a mass buyer suddenly realize that Bitcoin has real use cases and potential, that it’s not just surrogate and meaningless Internet money?

Attention:Yes!

"This time is different" is a very powerful narrative.

Especially if it comes from Wall Street and is delivered to millions of people who already own some of the traditional financial assets.

Coming to the Crypto Sphere Wall Street Literally ChangesallAmazon sells one very short e-book, Bitcoin or Bust: Wall Street's Entry Into CryptocurrencyIf you know English, read it – it would be interesting to hear your thoughts on this matter.

In the meantime, let's see if we get the bull rally that everyone here so hopes for. No rally - there is no massive FOMO, and therefore no influx of new retail investors.

Relax and have fun! (And the translator is still popcorn.)

</p>