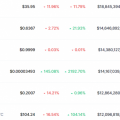

Last Wednesday we talked about the reasons for investor concern and refusal of risky assets. Againthere were forecasts about the collapse of cryptocurrencies andstock market. For example, Robert Kiyosaki (author of the bestseller Rich Dad Poor Dad) predicts a full-blown financial crisis this month. Due to the heightened passions in late September, the fear and greed indicator almost dropped to 2021 lows, when Bitcoin was trading around $30,000.

Image source: alternative.me

However, over the past five days, fears have receded, and Bitcoin is up 16%.

Image Source: Cryptocurrency ExchangeStormGain

First, President Biden did not aggravatesituation and signed a decree allowing parliamentarians to settle the budget until December 3. The shutdown was delayed and the government received the necessary funding.

Second, Fed Chairman Jerome Powell said,that the regulator does not intend to ban cryptocurrencies. Another thing is the regulation of stablecoins, the issue and provision of which should be supervised. The same is true for the DeFi market. But Bitcoin, being a decentralized and non-affiliated asset with any company, does not need such trusteeship.

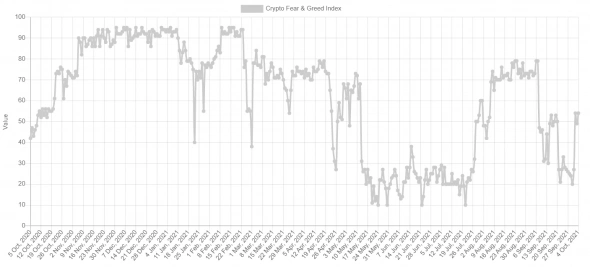

Thirdly, the Iranian authorities lifted the restriction onmining for licensed market participants. The ban was introduced due to the increased load on the electricity grid, and many were concerned that this was just an excuse. However, now electricity is once again available to miners at one of the lowest tariffs in the world. The hashrate of the Bitcoin network has already surpassed September highs.

Image source: bitinfocharts.com

Of course, the above factors do not remove the riskthe onset of a new financial crisis and the collapse of most assets, as prophesied by Kiyosaki. However, the recent surge in the value of Bitcoin has led to the liquidation of short positions in futures for only $ 35 million on Friday. At the moment, the probability of the coin rising to $ 50 thousand is higher than the onset of the financial crisis in October.

What do you think? Drop us a line about this comment!

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)