Latin America is a region of developing countries. It accounts for only 5–9% of allcrypto transactions in the world, but cryptocurrencies mean more to locals than to many Western users.

In the region, cryptocurrencies help not only simplepeople, but also businesses to protect their savings from hyperinflation, and migrants are given access to faster and cheaper money transfers than traditional payment services.

All of this creates the potential for truly massive adoption of cryptocurrencies in this region. We figured out what are the features of the Latin American crypto sector and what are the prospects for its development.

Volume of the crypto market in Latin America

First, let’s look at the volume of the crypto market inLatin America, based on data from last year's Geography of Cryptocurrency Report by research firm Chainalysis. According to him:

- Between 2017 and 2020, 7% of allcrypto transactions accounted for Latin American countries (for comparison: North America accounted for 15%, while Asian countries accounted for 31%). On average, this figure ranges from 5% to 9%.

- $ 49 billion - this is the total volume of crypto transactionsin Latin America between July 2019 and June 2020. Of these, $ 24 billion came to the region, $ 25 billion was withdrawn from it. According to this indicator, Latin America is ahead only of Africa and the Middle East.

- South America ranked second in terms of growth in volume and number of transactions in 2019-2020.

- A significant part of crypto transactions areretail transactions - according to this indicator, the region took the second place. At the same time, the average amount of such transactions exceeds $ 10,000 in cryptocurrency - we are talking about large and commercial transfers.

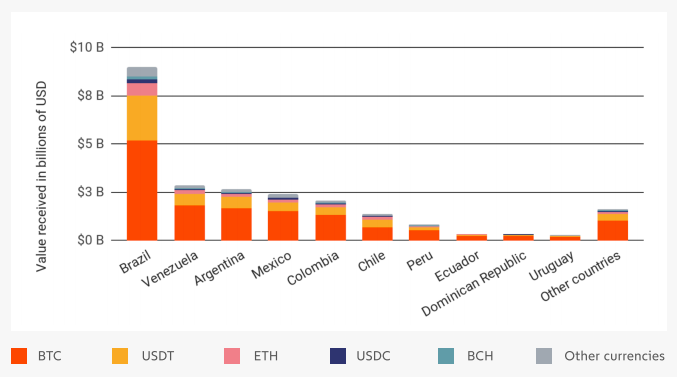

- The first place in crypto transactions in the region belongs to Brazil, followed by Venezuela, Argentina, Mexico, Colombia and Chile with almost three times lagging behind.

The volume of crypto transactions by country and currency, according to Chainalysis.

- In 2020, Venezuela and Colombia entered the top 10countries in the Chainalysis Cryptocurrency Adoption Index. This ranking shows the countries with the highest level of cryptocurrency distribution among locals. Venezuela and Colombia ranked third and ninth, respectively. It is noteworthy that Ukraine is in first place, and Russia is in second.

- Latin America's share of Bitcoin mining is only a fraction of a percent.

According to the findings of Chainalysis, the popularity ofcryptocurrencies in Latin America are due to factors such as the lack of access to banking services for a wide part of the population, the popularity of cryptocurrencies in international transfers, as well as the devaluation of local fiat currencies and, as a result, hyperinflation.

Features of the crypto market in Latin America

Let us highlight the main features of the Latin American crypto market.

Using Bitcoin to protect against hyperinflation and during crises.Countries such as Argentina, Uruguay, Colombia,Chile and Venezuela have been struggling for decades with hyperinflation, a situation in which the national currency depreciates by tens or hundreds of percent per year. For example, last year inflation in Argentina was 42%, and in 2019 it was 53%. In Venezuela, inflation last year was 6,500%, and in 2018 it reached 1,300,000%.

Against this background, even high volatilitycryptocurrency is no longer so scary - if the value of Bitcoin falls several times, the holder of the coin will lose much less than when investing in the Venezuelan bolivar. For residents of countries with hyperinflation, cryptocurrencies and, above all, Bitcoin and stablecoins, have become a real salvation - they allow you not only to save, but even increase your savings.

It is characteristic that not only ordinary people, but also large investors hedge inflation risks in cryptocurrencies - they account for about 80% of the total volume of monthly crypto transactions.

The popularity of cryptocurrencies for international transfers.The region occupies one of the leading places inthe number of remittances in the world. According to the World Bank, the remittance market in Latin American countries is about $96 billion a year - that's 1.7% of their total GDP. The volume of remittances from the US to Mexico alone last year was $40 billion (the United States is the largest source of remittances to Latin America in fiat currency). However, traditional payment companies, such as Western Union, impose high fees on their services, and also have limits and long terms for receiving transfers.

Every year cryptocurrencies are becoming more and morepopular tool for international transfers. This is not surprising, given the advantages of digital currencies - high transfer speed and lack of high fees. As a result, 90% of all cryptocurrencies come to Latin America from other countries.

For translations, Latin Americans are mainlyuse stablecoins such as DAI and USDC. Most often, cryptocurrencies are transferred to residents of Mexico and Venezuela. These countries rank third in the number of transfers on LocalBitcoins and Paxful, two of the world's most popular P2P platforms. Local P2P platforms, such as Valiu, Reserve or La PlataForma, are also in great demand.

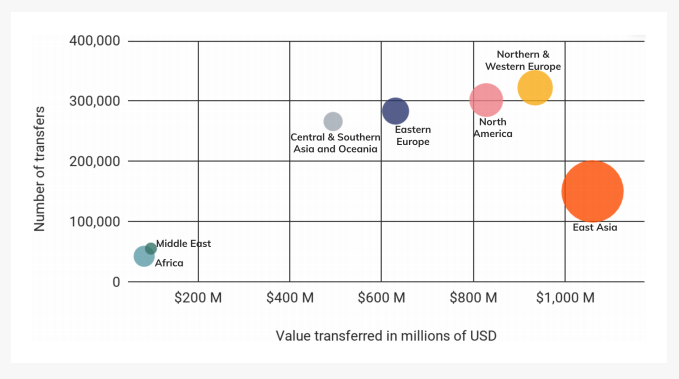

Cryptocurrency transfers are used not onlymigrant workers, but also local businesses. According to Chainalysis, East Asia is one of the main regions to which cryptocurrencies are transferred from Latin America. Many of these payments are actually commercial transactions between Asian exporters and Latin American companies buying goods for retail sale. Local firms use Bitcoin for payments because transactions with it are faster and easier than bank payments, which also must be accompanied by supporting documents.

The number and volume of crypto transfers sent from Latin America to other regions, according to Chainalysis.

Improving people's access to financial services.About half of Latin America's population is nothave bank accounts because they do not have a stable income, sufficient savings, or in some cases, even access to a bank branch. Moreover, over 55% of adults own smartphones. Thus, through cryptocurrencies they gain access to a new, decentralized financial system.

Traders prefer foreign exchanges.Most Latin American Crypto Tradersprefer to work on large international exchanges such as Binance, Huobi, OKEx, Coinbase and Bitstamp. Many of them use fiat to buy BTC or USDT on local crypto services or P2P platforms, and then transfer them to larger exchanges where they gain access to more trading pairs and liquidity. Also popular in the region are Bitso, registered in Europe, and Argentinean Ripio.

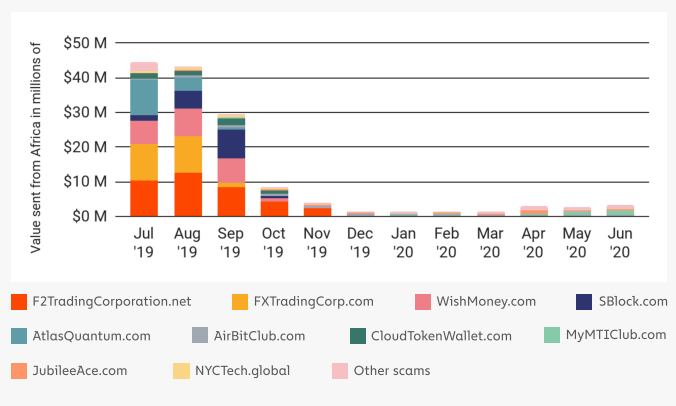

High level of crypto-crime.2.4% of all crypto transactions in the region are criminal operations. Last year, the global average was 0.34%. Over 60% of all criminal transactions are scam projects, the largest of which are F2TradingCorp, FXTradingCorp and WishMoney.

However, now the share of cryptocurrencies used by criminals is sharply declining. We've previously covered why criminals don't like cryptocurrencies and prefer cash and bank transfers.

10 largest South American scam projects, according to Chainalysis.

Regulation of cryptocurrencies

Cryptocurrency regulation in Latin Americavaries greatly from country to country—there is no uniform approach across the region. Many jurisdictions (for example, Colombia, Chile, Peru, Uruguay) have not yet adopted specific legislation on digital currencies.

In Bolivia and Ecuador, the use of cryptocurrencies andCrypto exchanges are prohibited, and violators face prison sentences. Ecuadorian authorities only allow the use of the government's SDE token, a form of electronic money pegged to the US dollar (the country's official currency). SDE users can pay for a number of services and make transfers.

In other countries in the region, the crypto sector is legal. For example, in Mexico, Argentina, Brazil, Venezuela and Chile, cryptocurrencies are freely accepted as payment by retailers.

Cryptocurrencies in the region are mainly consideredas assets and are subject to capital gains tax. The exception is Argentina, in which cryptocurrencies are defined by different departments as a commodity or an analogue of securities. The authorities in Brazil, Argentina and Chile also levy income tax on profits from crypto operations.

Crypto exchanges are not regulated everywhere.Thus, in 2018, Mexico became the first country in the region to pass a law regulating crypto companies, obliging them to register and conduct KYC/AML checks of users. Later, similar laws were adopted by the authorities of Brazil and Argentina. In these countries, marketplaces are required to provide regulators with user and transaction data.

In Brazil and Colombia, regulatory sandboxes for cryptocurrencies were launched in 2020 and 2021 - these are special legal regimes that allow crypto startups to legally engage in this activity.

Argentina

Argentina's economic problems (from hugedebt obligations to high inflation), also aggravated by the COVID-19 pandemic, a ban on the purchase of dollar amounts over $ 200 and another default, motivate residents of the country to use cryptocurrencies more often.

In 2020, the country's crypto market experienced a realboom: the number of users of the most popular crypto exchanges Ripio and Bitso grew several times over the year and exceeded 1 million people. At the same time, the trading volume on P2P platforms LocalBitcoins and Paxful also increased many times.

The Latin American variant appeared in the country as follows:The so-called “kimchi premium” is the difference between the price of BTC on national and global exchanges. Thus, at the end of May, the cost of Bitcoin on local exchanges reached $62,000 (5.9 million Argentine pesos) versus $35,900 on international exchanges (3.4 million pesos).

Things are shaping up amazingly in the country right now.favorable conditions for mining. The government subsidizes residential electricity. Thanks to this, Bitcoin mining is very profitable in Argentina - mining the first cryptocurrency costs about half as much as in other countries in the region. Taking advantage of the situation, the Canadian company Bitfarms plans to open the largest mining farm in Latin America in the country.

Regarding regulation, the Argentine authoritiesrequire local crypto exchanges to report monthly user transaction information, as well as income and account balances. In the fall of 2020, two coalitions of deputies introduced projects to regulate cryptocurrencies into the country’s parliament, but they were not adopted.

Brazil

Unlike Venezuela and Argentina, whose economieshave been suffering from constant crises for many years; in Brazil, before the COVID-19 pandemic, the popularity of cryptocurrencies was much lower. Many residents associated digital currencies with fraud and pyramid schemes.

But over the past year, more and more people have becomeconsider cryptocurrencies (and especially Bitcoin) as a long-term savings option or as a tool for international transfers. As a result, Brazil is among the countries with the largest number of cryptocurrency investors, proportional to its population.

Over the past 2 years the country has also experienced a boominstitutional and venture investments in the local crypto sector. For example, at the beginning of the year, the country's largest crypto exchange, Mercado Bitcoin, raised $38 million in funding and announced expansion into Chile, Mexico and Argentina. Traditional financial companies are also showing interest in storing cryptocurrencies and using stablecoins. For example, Uzzo, Zro Bank, Alterbank, Bancryp, and Nexo banks began to offer crypto services.

There are currently about 60 crypto exchanges operating in Brazil,Of which, Bitrawr, the country's leading exchange, has opened 1.5 million accounts so far. Platforms must report to the regulator about the actions of users, and residents of the country are required to report their crypto transactions. Brazil, along with Canada, is one of two countries that allow Bitcoin ETFs.

The Central Bank of Brazil has spoken several times about the possible launch of a digital real, and at the end of May even published principles for a future CBDC. But the regulator does not yet have specific plans in this regard.

Authorities are also looking into practical useblockchain - several government agencies, for example, customs and notary offices, are already using the technology to certify documents, and large companies are introducing blockchain to certify production.

Venezuela

Venezuela stands out on the list of Latin American countries because of its experiment with the digital bolivar, the national cryptocurrency PETRO.

Fiat bolivar practically depreciated - currencymanaged to lose millions of percent a year. In the 70s and 80s, Venezuela was one of the richest countries in Latin America. But due to the socialist economic reforms of the country's former President Hugo Chavez (as well as their continuation by the current President Nicholas Maduro), the country's economy was thrown back to the level of the middle of the last century.

Therefore, despite the largest production volumesoil, the country lacks water, food, electricity, gasoline and medicine. Everyone who could have left Venezuela long ago or is working abroad—out of the country’s 30 million residents, 5 million have emigrated. And there are no signs that the situation will improve in the near future.

In these conditions, cryptoassets have taken on an importantrole in the Venezuelan economy - many residents use them for international transfers and protection of savings from hyperinflation. As a result, the country has achieved one of the highest usage rates of cryptocurrencies in the world.

Venezuelan authorities launched PETRO in 2018.stating that the coin was backed by oil, gold and diamond reserves, but no evidence was provided for this. PETRO is based on the Ethereum blockchain, so it is effectively a token.

The launch of PETRO had several goals:the fight against currency devaluation and crisis, as well as the possibility of circumventing US sanctions imposed on the country. The authorities hoped that the token would be in demand on the international market. But this did not happen. Even within the country, PETRO is not popular - the local population prefers other cryptocurrencies. Therefore, Venezuela ranks third in terms of the number of users of the P2P exchange LocalBitcoins.

The government sets the PETRO rate as well asIt pays salaries to civil servants and pensions, and pays for government contracts. PETRO can also be used to pay large retailers and even street vendors, but this is not profitable for them - the country’s Central Bank exchanges the token for fiat currency at a greatly reduced rate.

After the launch of PETRO, the Maduro regime allowedcountry, the operation of seven cryptocurrency exchanges - their goal was to facilitate the exchange of PETRO on the international market. You can also buy other cryptocurrencies on these sites.

According to Chainalysis, more than 75% of crypto transactionsthey exceed $1,000. And given that the average income of an ordinary Venezuelan is $0.72 per day, then most likely the majority of the country’s crypto users are people close to the Maduro regime. For them, cryptocurrency is an opportunity to avoid sanctions (most high-ranking Venezuelans cannot open bank accounts in other countries) and withdraw capital from the country.

Latin America is the ideal region for mass adoption of cryptocurrencies

The Latin American crypto market may seem too small - there are no breakthrough projects in the region operating around the world and setting the direction for the development of the sector.

But this is where cryptocurrencies can become much moremore popular than in the West or East. Residents of Latin America perceive them as a serious and viable alternative to traditional currencies. With appropriate regulation, the region can become one of the world leaders in the use and integration of crypto assets into the real economy.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication