Over the past few months, we have faced a growing financial, trade and politicalinstability, which has led to growing concerns about the onset of a major global economic downturn.U.S.-China trade dispute, Brexit and other European political turmoil, another sovereign defaultand the imposition of government capital controls in Argentina, as well as problems related to the role of central banks and their independence, have all roiled markets.

While you are trying to sort things outThese events and the myriad of explanations and opinions that various indicators, such as the inverted yield curve and negative interest rates on mortgages, can mean for the future economy, you will definitely hear recommendations on converting your investment portfolio into “solid assets”.

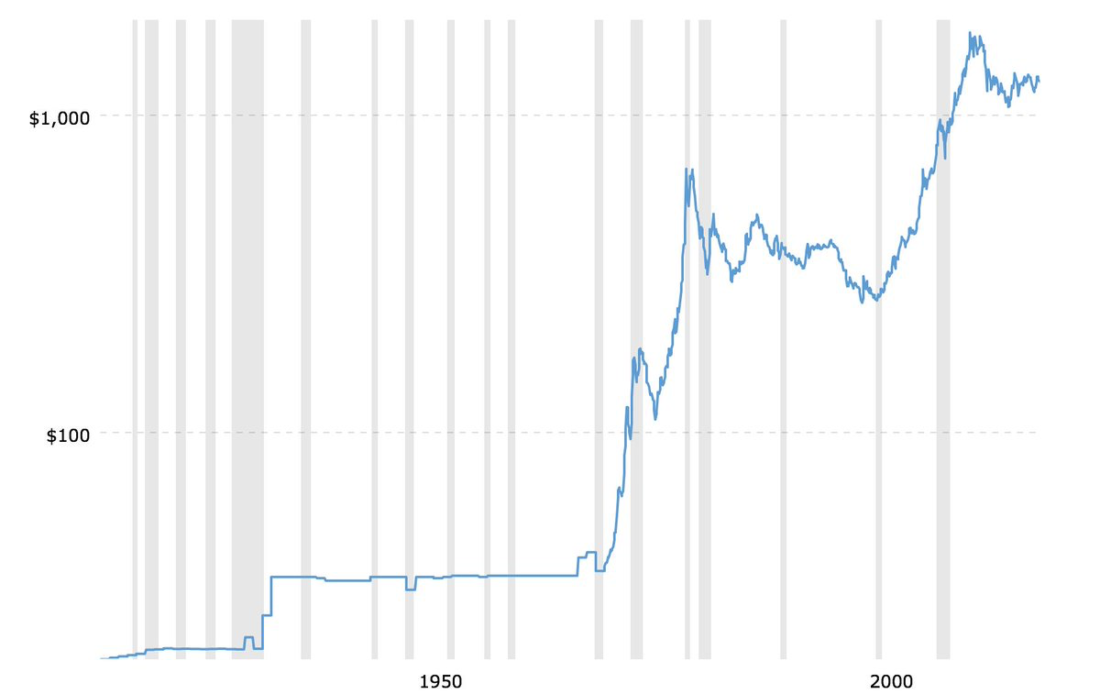

And, not without reason, since solid assets, such as gold, show good results in a period of economic and financial instability (Figure 1).

Figure 1: Gold prices often rose during economic downturns *

The gray bars represent economic downturns in the United States; the price of gold is denominated in U.S. dollars.: Twitter @obiwankenobit

But what is a solid asset? And why is Bitcoin (BTC), in spite of the fact that it is completely virtual, and transactions with it are carried out via the Internet, perhaps the most “solid” asset in the world?

Hard (tangible) and soft (intangible) assets

Solid assets have traditionally been defined astangible property or physical goods, such as gold, that are valued for their reliably limited supply. They contrast with “soft assets,” such as fiat currencies, stocks and bonds, whose supply can be quickly increased with just the click of a button on a computer keyboard. Soft financial assets can also be restructured or defaulted, reduced dividends and profits, or other changes (sometimes arbitrary) that undermine long-term value.

Experienced Investors Throughout Historyrelied on solid assets to manage risks and protect long-term value in conditions of instability and economic downturns, when the supply of many soft assets traditionally increases and thereby puts downward pressure on their value.

What makes Bitcoin more scarce than real estate or gold?

Solid assets are back in fashion sincecentral banks in countries such as China, Russia, India and Turkey buy large quantities of gold. According to estimates, only in the first quarter of this year, central banks acquired 145.5 metric tons of gold, which is 68% more than in the same period in 2018.

We have also seen legendary investors suchlike Ray Dalio, founder of the world's largest hedge fund, recently recommended that people invest in gold (increase investment in gold). Not surprisingly, the price of gold has risen 16% over the past five months.

We have centuries-old data on the value of goldand its traditional role as a repository of values and a safe haven. Its physical nature and countless proven ways to use gold, in addition to serving only as a means of preserving value (for example, jewelry, industrial products), make it, in our opinion, complementary to Bitcoin and not competing with it.

In other words, we do not consider bullish sentiments regarding gold and Bitcoin as mutually exclusive.

We do not consider bullish sentiments regarding gold and Bitcoin to be mutually exclusive.

However, it is important to emphasize the key difference between Bitcoin and gold, which is that the dynamics of gold supply is not fixed.

If, for example, earlier gold mining wasunprofitable, then as the price of it increases, the supply of gold to the market may increase. As a result, an increase in the supply of gold in the market may be a deterrent to the further growth of its price.

Traditional solid assets vulnerable to deflationary supply shocks

The same dynamics of gold supply (higher price = > increase in supply = > decreasing effect on prices) are at workBoth silver and any other traditional hard asset.Even the available supply of residential real estate can be increased, with examples ranging fromthe conversion of single-family homes into apartment buildings, which regularly happenstoday, to more exotic and futuristic schemes.

Physical goods have also historically been exposed.an unexpected increase in supply (sometimes called a “shock”), leading to lower prices. Examples include the discovery of large amounts of gold at the end of the 19th century in South Africa and the European studies and conquests in South America in the 1500s that put downward pressure on the price of gold.

Looking much further, we can say that withsuch innovations as mining on asteroids, stuffed with precious minerals, and gold in particular, can cause a severe supply shock.

Unlimited gold supply, but a finite amount of bitcoins

Match the ever-increasing availablegold supply with Bitcoin, which has an upper emission limit of 21 million units (“coins”). The Bitcoin software protocol, first publicly introduced 11 years ago, controls a fixed and algorithmically determined total supply volume, which, in stark contrast to gold, is independent of price changes.

Bitcoin's ultimate offering means that ifsomeone owns a certain percentage of the total amount of bitcoins, this person will always own at least this percentage. Bitcoin is the only significant asset in history with this property, and its reliably limited offer is the reason Bitcoin is the hardest asset in the world.

Bitcoin's ultimate offering is its incrediblepowerful feature. If someone owns a certain percentage of the total amount of bitcoins, that person will always own at least that percentage.

Halving, or why there are fewer new bitcoins over time

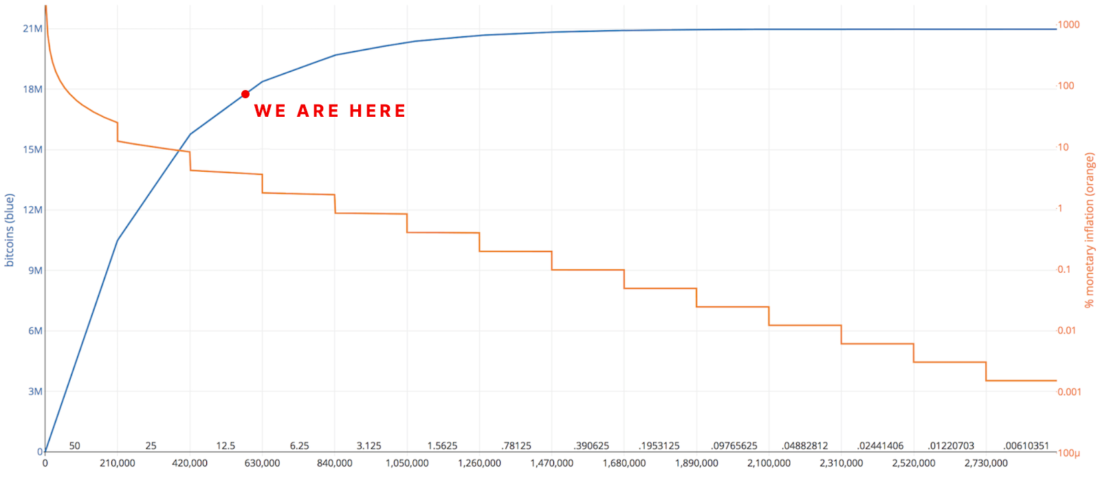

Although the number of existing bitcoins continuesgrow at present, approximately 86% of all bitcoins that will ever exist have already been created (18 million out of 21 million coins already exist today). Today, the current supply of bitcoins is growing at less than 4% per year, and over the next decade, the growth rate will continue to decline and fall below 1%.

This is a slowdown in the creation of new bitcoins.occurs due to a fundamental rule sewn into Bitcoin software called halving (or “halving”), where approximately every four years the number of new bitcoins mined every 10 minutes on average is halved.

The next such “halving” is predicted to bewill happen next year in mid-May, when the reward for each block found (“mining”) will be even more limited from the current 12.5 new bitcoins created approximately every 10 minutes to just 6.25 new bitcoins (Fig. 2) .

Figure 2: The supply of new bitcoins slows down over time and is limited to 21 million coins *

The numbers above and below the X-axis represent the mining reward and the number of "blocks" mined (batches of bitcoin transactions that are created approximately every 10 minutes) when occursAs indicated in the Y-axis legend, the blue line displaysThe total existing supply of bitcoin over time (i.e., the supply of bitcoin increases as new blocks are mined).The orange line shows the approximate decrease over time in the annual percentage increase in the existing supply of Bitcoin.:Bitcoin clock

Then, around May 2024, orapproximately four years after the previous halving, the following will happen. And again, the mining reward will be halved, this time to 3.125 new bitcoins mined every 10 minutes. And then again, around May 2028, to 1.5625 new bitcoins.

And so on and so forth…

Until around 2140, when a hard limit of 21 million bitcoins is reached, further mining of new bitcoins will become impossible.

The next “halving", when every 4 years the supply of new bitcoins decreases, should happen around May 2020.

While Bitcoin mining will continueover the next 100-plus years, over the next decade, by 2030, more than 98% of all possible bitcoins will be mined. In other words, over time, new bitcoins will become smaller and smaller until the final limit of 21 million coins, programmed into the Bitcoin protocol, is ultimately reached, and the creation of a new bitcoin will completely stop there.

More Than Just Digital Gold

Already more than ten years as algorithmicallyBitcoin’s specific offer created the predictability and clarity that investors so desired and needed to maintain value over a long period of time. Combine this dynamic with the portability, security and usefulness of Bitcoin as a payment mechanism, and you have an irresistibly attractive value proposition for investors seeking to manage various macroeconomic, political and other forms of risk. Indeed, over the past decade, Bitcoin has already attracted tens of millions of owners and users, and the growth rate of its distribution exceeds that of the Internet and personal computers combined (slide on page 94).

Although this post was about Bitcoin's function asA scarce and solid asset, it is worth noting its growing role as a broad technological platform for digital identification and other non-monetary use cases. As we discuss in our recently published investment thesis, the notion that Bitcoin is only “digital gold” underestimates its full potential and the total size of the target market.

* Notes:

Figure 1: Twitter @obiwankenobit

Figure 2:The numbers above and below the X-axis represent the mining reward and the number of "blocks" (batch of Bitcoin transactions that are created approximately every 10 minutes) mined when each halving event occurs, respectively. As stated in the Y-axis legend, the blue line represents the total existing supply of Bitcoin over time (i.e., the supply of Bitcoin increases as new blocks are mined). The orange line shows the approximate decline over time in the annual percentage growth of the existing supply of Bitcoin. :Bitcoin clock

</p>