Despite community objections, validators voted for a second chain. New “luntiks”will be available to owners based on two snapshots taken before and after the collapse of the UST stablecoin. Most of the major crypto exchanges supported the emergence of a new branch.

Image Source: Cryptocurrency ExchangeStormGain

Terra is a cryptocurrency project that releasedalgorithmic stablecoin UST pegged to the US dollar. The LUNA internal coin was used to maintain the rate, however, the lack of liquidity led to the decoupling of the UST rate and the depreciation of LUNA.

For the cryptocurrency market, the collapse of a stablecoin is notrare case. But Terra made a lot of noise, as UST was in the top 3 in terms of capitalization, and the network held the second place in the decentralized finance sector right after Ethereum. Such heights were impossible to achieve without a development team and the support of a multimillion-dollar community. For this reason, the validators voted to revive the blockchain and keep the Terra (LUNA) brand.

Image source: station.terra.money

The new chain is not a fork in the classicform, since it will be built from the genesis block and will not inherit the transaction history. As a result of the restart, the stablecoin will disappear, the old LUNA will be renamed to Terra Classic (LUNC), and the new branch will receive its former name. The development team is migrating to the new network, Spectrum, Nebula, Prism, Astroport and other partners have already expressed their desire to support the new branch.

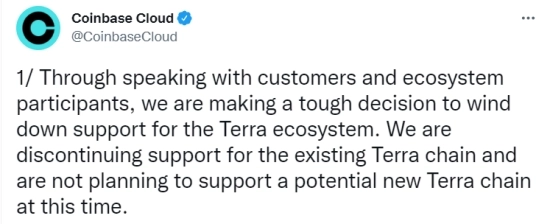

Among the cryptocurrency exchanges that supportedthe revival of the blockchain, Huobi and Binance can be singled out, while the Coinbase Cloud division, on the contrary, announced the suspension of support for Terra and any related chains. BitMEX has taken a wait-and-see attitude, as the new branch must first gain the necessary reliability and liquidity.

Image source: twitter.com/CoinbaseCloud

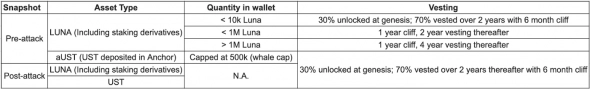

LUNC holders will receive new LUNAs based on two shots:

Image source: medium.com/terra-money

Depending on the amount of UST and/or LUNA ownershipthe amount of the refund and the timing of the accrual of the remaining amount are changed. At the initial stage, no more than 30% of the initial amount will be transferred to the owners, and the receipt of the remaining amount will be extended over a period of six months to four years.

Refunds are the main stumbling blockdue to which the community did not support the emergence of a new branch in the polls conducted, calling for the purchase of LUNA and subsequent burning. Thus, speculators who bought UST for 10 cents will receive the same return as investors who bought UST for $1 before the collapse of the stablecoin.

Cross on the fast recovery Terra putsabandoning the UST stablecoin. Last year, the main driving force for LUNA was the desire of investors to receive a return of 20% per annum from UST staking on the Anchor site. At its peak, the amount of blocked funds exceeded $17 billion, of which 75% were investments in UST.

A series of controversies and the pain of investors due to the lossinvestments impose doubts on the successful restart of the project and the return of Terra to the lost performance. Do you think Terra has a chance? Write about it in the comments!

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)