Last week, we talked about the dramatic fall of the Terra blockchain, which was in the TOP-10 back in Aprilrating with a capitalization of $40 billion.The network was unable to maintain the rate of the algorithmic stablecoin UST, which is why the LUNA balance coin depreciated in a few days. At the same time, it is still unknown whether the team fully used the available $3.5 billion cryptocurrency reserve to save the system.

Image Source: Cryptocurrency ExchangeStormGain

The parity of UST and USD was supported byreduction or increase in the LUNA offer. As demand for UST remained high due to the promised 20% annual return on staking, LUNA saw growth and became the only coin in the top 10 to hit a new high in 2022.

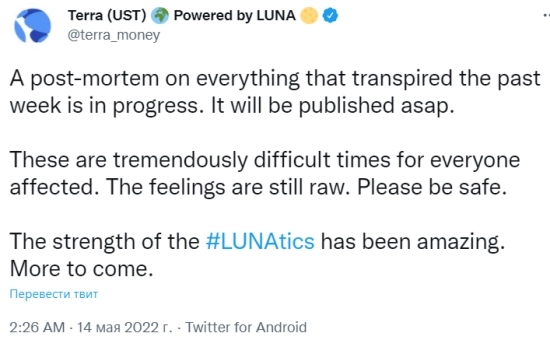

The company promises to make a detailed report on the causes of the ensuing collapse in the near future.

Image source: twitter.com/terra_money

A number of analysts believe that the prerequisites were ripe much earlier than the May crisis, and the linking of UST to the company's reserves is one of the signs of a crisis in the system.

UST is an algorithmic stablecoin whose emissioninitially associated only with the price of LUNA. This distinguishes it from centralized stablecoins (for example, Tether), where reserves in bank accounts are responsible for the stability of the exchange rate. Terra took the unusual step of adding a $3.5 billion cryptocurrency reserve to the algorithmic UST.

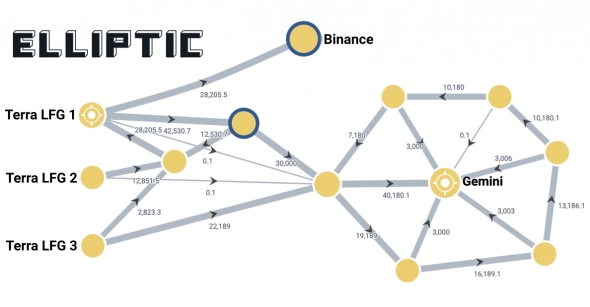

Selling Bitcoin, Terra had to hold the courseUST when the value of LUNA falls. Either the volume of the reserve was simply not enough, or it was not used in full. Analytical agency Elliptic followed the path of the coins and found out that 28,000 BTC were sent to the Binance cryptocurrency exchange account, and 52,000 BTC to the Gemini account.

Image Source:elliptic.co

However, they cannot trace the further fate of the assets.succeeded. Terra could use the funds to support the UST or transfer them to unidentified individuals. If the company has kept its reserve, this creates an opportunity to restart the project.

On May 13, Do Kwon proposed a recovery plan withthe formation of a new branch in the Terra blockchain and the distribution of 1 billion tokens between LUNA and UST holders based on a snapshot taken before UST lost its peg to the US dollar.

This option was criticized byBinance Changpeng Zhao and Terra Lead Validator Jiyun Kim. Zhao noted that "the fork will not create new value," urging the company to buy back the coins to be burned later. And Kim, whose pool has been reduced from $1 billion to $3 million, even offers the community to unite to create a completely new blockchain.

The lack of consensus within the Terra team is significantreduces the chances of restarting the network. In addition, a legal investigation may soon begin against Do Kwon, since some investors have already filed a complaint with law enforcement agencies.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)