Since the advent of cryptocurrencies, we have seen a number of significant changes in the crowdfunding space.Initially ICO(initial coin offerings)seemed an ideal way to attract funding for new projects, as they allowed anyone to get involved at an early stage of fundraising. The process was fast and profitable.

</p>1. ICO as the first version of cryptocurrency crowdfunding

ICOs have many disadvantages. They did not have clear regulation, which created opportunities for various fraudulent activities, such as exaggerated promises of results, pyramids, poor reporting and investor manipulation.

After the peak of the ICO market at the end of 2017 at the beginning of next year, regulators around the world began to closely monitor the industry. The U.S. Securities and Exchange Commission (SEC) has stepped in the lead, accusing a number of projects involved in fraudulent behavior.

2. The emergence of STO

When regulators around the world began to apply tostrict industry standards, projects that want to attract financing, realized that they have no choice but to comply with the requirements of the SEC and the like.

The result was the emergence of STO (proposalstokenized securities), where companies began to focus their proposals on the investment rather than on the utilitarian aspect of tokens. STOs offered a number of perspectives, including giving the markets liquidity and greater accessibility and transparency of markets, which made possible 24-hour instant trading and helped projects attract new categories of investors.

A recent report from Inwara shows that Q1 2019 saw a remarkable 130% increase in the number of STOs. Interestingly, the same report indicates a significant decline in the number of ICOs during the same period.

3. The advent of IEO

In 2019, there was an increase not only in STOs, but also in IEO (initial exchange offerings), a new type of fundraising where tokens are offered through exchanges.

IEO offers new projects a number of benefits,including a guarantee that their tokens will be immediately listed on exchanges. The project also gets access to millions of investors using the exchange, and most importantly, investors are protected, since the exchange carries out a due diligence before conducting an IEO.

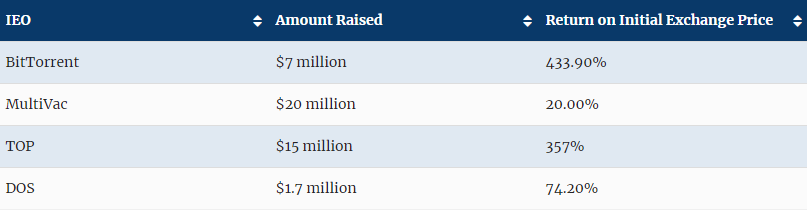

At the beginning of the year, the Binance exchangeinitiated a launch pad that promised to support at least one good project per month. Currently, 6 projects have successfully raised funds through the platform, includingBitTorrent, Fetch.AI, Celer Network, Matic, Harmony and Elrond.

The IEO table with the best payback at the moment. : Hackernoon

The success of the launch site inspired other exchanges to launch their own similar platforms in order not to miss the opportunity to take advantage of IEO, including an injection of liquidity.

In crypto space, attention is drawn tohow fast things change. When ICOs appeared, they seemed like the perfect solution for fundraising, but their multiple flaws led to STO and now IEO.

However, perhaps the ideal fundraising solution in the industry would be a combination of STO and IEO.

4. What if you combine STO and IEO?

If the above evolution tells us anything, it is that we are moving in this direction, and there are already hints that a number of projects will soon offer their tokens in the STEO format(stock offers of tokenized securities), and soon we can make sure that this idea is effective.

Let me briefly describe the advantages of the STEO format:

Imagine a fundraiser that includesSTO advantages, such as compliance with the law, which is important for quotation of tokens in the USA and in the international market. By submitting an application for tax benefits, the project can protect itself from future orders to suspend payments.

In addition, since STO can be programmed to authenticate those who are allowed to buy and sell tokens, their holders will not be able to trade using unconfirmed addresses.

STO also offer transparency, allowinginvestors to get all the necessary information about the company behind the proposal. The fact that tokens offered through STOs have their own value is an additional plus.

If you add to this the benefits of IEO, such assafety and convenience, which is guaranteed as the exchanges conduct customer identification procedures and prevent money laundering. As exchanges conduct checks, it also makes legitimate projects accessible. If you also take into account the guarantee of fast quotation of tokens on platforms, you can see why STEO will become the standard of crowdfunding as the crypto industry matures.

Who will be the first?

So far, only the dream-oriented social network and crowdfunding platform Dreamr has announced STEO on the IDCM exchange, and it looks like it will be the first to meet all the criteria.

Chris Adams, CEO of Dreamr Inc., said:

“IEO works well as a way to attracttools and community building for startups. It seemed very logical to us to apply the same method to STO, and we are happy to give the Dreamr community access to an early investment round, usually open only to wealthy accredited investors. ”

5. Fourteen opinions on the STEO fundraising format

Kevin Hobbs, CEO of Vanbex Labs:

“STO on exchanges is a necessary evolution onmodern markets. Traders want round-the-clock access to the global market with lower fees and reliable law enforcement. Companies want the same access to raise capital to grow their business. Many traditional exchanges have been thinking about this for years. In 2020, we will see fundraising and trading of tokenized securities on verified regulated exchanges. ”

Sean McBride, CIO McBride For Business:

“I think the use of an exchange platform forFinding a market for STO is logical. Now everyone is looking for an effective way to bring coins and tokens to the market. STEO seems like a good way to get people interested in the token and quickly bring it to the market. Interestingly, we see more and more innovations in all securities offerings. Coins / tokens are newer, so they only test a lot. And I think this is a wonderful strategy that should be tested, as it seems to help more people know about the existence of coins. ”

Lee Hills, CEO SolutionsHub:

“STEO is a very intriguing, natural evolution in the financing of the blockchain business. IEOs are somewhat doubtful, as these are just ICOs presented to the public on exchanges.

Customer advantage is warranty.market for their tokens instead of trying to organize a listing on the exchange with reasonable volumes after the ICO. Most altcoins found it difficult to find liquidity during the bear market, and it will be the same with IEO, while the STEO price is supported by substantive “real” considerations, which offers the buyer much better protection. ”

Eric Benz, CEO Changelly:

“When considering the potential of STEO it is necessarytake into account legislative aspects, and, based on my experience, everything is not easy here, but with smart and effective structuring, this can reveal great value and pose a serious challenge to traditional securities laws around the world. ”

Marketing expert Raghav Sawhney asked me for the opinion of the 1XBit spokesperson:

“According to a survey conducted by the 1XBit platform,Most cryptocurrency users find investing in STO through the exchange safe. Perhaps this is due to the fact that STO comply with all legal norms, so that the exchange conducting IEO of tokenized securities must also comply with them, which includes a detailed study of the project applying for listing its tokens, data exchange with others, as well as the corresponding registration procedure users. So tokenized securities will inevitably be able to be traded only on such fully regulated exchanges, which eliminates the risk of fraud, which is very common in the ecosystem in which we operate. ”

Kyle Esman, BX3 Capital Partner:

“I don’t think the market is ready fortokenized securities. While there is no completed infrastructure, and there is not enough liquidity to take full advantage of them. Exchanges do not have proper licenses, and regulation is still too vague for, say, a company like Airbnb to withdraw its IPO in favor of STO. Until some company of this kind chooses the STO path, I do not think that this model is effective. ”

Henry Stanley, CEO of ICOaxiom:

“I think STEO is a good idea and, in some ways,sense, natural progress in the industry. Although utilitarian tokens were a natural idea, ultimately, investors prefer to have a share of ownership in their enterprises or projects.

I also believe that this will help the industry, solike those investors who might not have been able to purchase utility tokens, will now be able to own tokenized securities. This is great for the industry. ”

As well as the opinions of some users from the largest cryptocurrency forum Bitcointalk:

khiholangkang with bitcointalk:

“STEO is no different from IEO - just a slightly different name. I don’t think the project will be successful just because it changes the name IEO to STEO. ”

Buntel168 with Bitcointalk:

“I think it looks like IEO. Eager to see this new way to raise funds. I hope STEO will be as popular as IEO. "

guoyu78 with bitcointalk:

“This is serious, and God alone knows what elsecrowdfunding method will appear next. We have not fully developed the previous ones, and this starts to confuse investors again and looks like just another trick used by some projects to get investor money. I heard about Latoken, but it seemed to me that it was either an ICO or IEO; I don’t remember which platform I found out about it.

For tokenized securities already existsSTO, and I see no reason why another method is needed, such as STEO. We have IEO and STO, and so far they have successfully managed to guarantee security for investors and provided them with a sufficient return on their investments. I think STEO is just a wrong prioritization, and it will be another platform where it will be difficult to buy project tokens, as in the case of IEO. ”

maldini from Bitcointalk:

“IEO is the new version of ICO, and STEO is the newSTO version. STEO is the same concept as IEO, but only for tokenized securities. I don't know too many recent fundraising developments. I hope this will satisfy investors and bring back the glorious days of the end of 2017. "

CryptoTrue from Bitcointalk:

“The STEO format seems to be a better solution than STO and IEO separately.”

Barracuda from Bitcointalk:

“I think only the name is different; the main goalstill attracting investor funds. I do not think that STEO will be successful if the project and the exchange are bad. If the project is bad, then it will not attract people too much and they will not invest in STEO. ”

bttmember from Bitcointalk:

“I think we need more firstproven STO platforms, because tokenized securities are the future when large companies will begin tokenize their shares, but we have not yet seen a fully compliant token legislation and functioning exchange for tokenized securities. ”

In conclusion

One thing is clear: those golden times when projects like NXT arranged an ICO and those few lucky ones who bought tokens who saw a crazy increase in their value will not come back. The period when Blockchain Capital arranged an STO with a payback of 161% at the moment is also left behind, which is not so much compared to 433% of BitTorrent after last year's IEO.

However, investors will benefit from the comingwaves of the next way to raise funds in the industry. It would be wise for all investors to pay attention to STEO so that it is not too late, as was the case with ICO, STO and IEO.

</p>