Chinese scientists published the results of an experiment according to which they managed to create «almostidentical to natural» gold from coppercould potentially affect the precious metals market and attract investors to other markets, including cryptocurrency, the Toshi Times reported.

</p>Transforming various materials into gold for centurieswas an alchemists' dream, which may have come true: in the scientific journal Science Advances on December 22, an article was published by Chinese scientists about a successful experiment to transform copper into «almost identical to natural» gold.

Such scientific advances can have a serious impact on the precious metals market, which is positioned as the most stable and reliable for long-term investments.

Despite the fact that the material is only «almostidentical» gold, it could replace the precious metal in areas where it is used most frequently, such as electronics, significantly lowering gold prices.

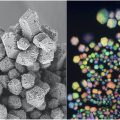

Scientist Song Jian and his colleagues at the Dalian Institute of Chemical Physics at the Academy of Sciences described the experimental process in detail, reporting that as a result:

«Copper nanoparticles have achieved a crystalline structure incredibly similar to the structure of gold and silver»

Using gold as an investmentopportunities for long-term preservation of the state is one of the pillars of human civilization. After the collapse of the gold standard in the 1970s, the gold market reeled.

Bitcoin is often called “digital”.gold»: many experts have repeatedly noted the similarity of assets, which is especially pronounced during periods of crisis, since both assets are reserve units and effective tools for hedging risks against the backdrop of the volatility of traditional fiat currencies.

Even the historical indicators of bothassets demonstrate identical market behavior. At the same time, there is no inverse correlation between these assets—the rise in gold price will not negatively affect the Bitcoin rate. Rather, on the contrary, it may indicate the further direction of movement of the Bitcoin price trend.

However, in a situation where gold ceases to bean exceptionally rare and limited supply of precious metal, while the supply of Bitcoin remains strictly mathematically determined, that of «digital gold» there are chances to replace the gold standard with a digital one and become a new global reserve unit of calculation and storage of value.

Recall that the largest North American marketfinancial derivatives CME Group, on the contrary, predicts a weakening of the US dollar and, as a result, an increase in the investment attractiveness of gold. There is a possibility that if such a scenario is realized, digital gold may go on a rally following the real one.

</p></p>