I’m working on writing a tester for rollbacks on reverse, I’ve done all the logic, filling, calculations, outputs,statistics, etc., but only for 1 buffer i.e. there can only be 1 position at a time. I will expand further, but before that I came across one thing that was not obvious to me.

When trading in BTC par value, the BTCUSD pair, the calculation of risk and p/l is calculated differently for any pair like ETHBTC (BTC is not at the beginning, but at the end of the name).

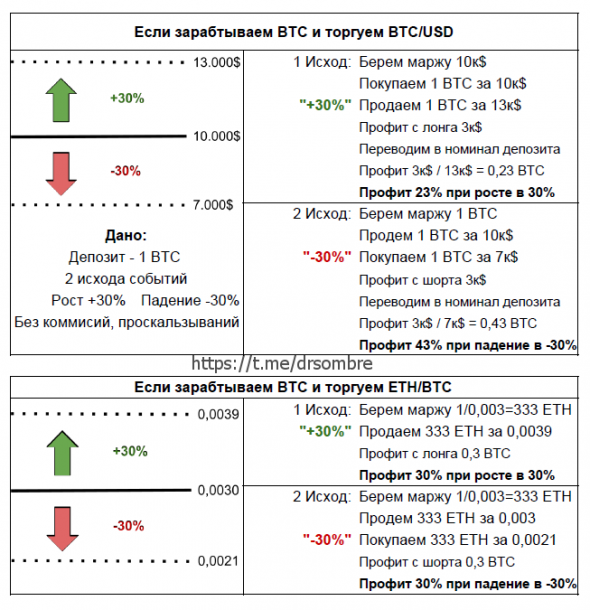

The point is the depreciation or revaluation of the asset at the par value of the deposit in this case. I give an example in the picture.

Those. conclusions, price increase by +30%, if for the whole cutlet, then this is not a fig, not +30%, but 23% to the depot.

If we put a risk that we will close at -30% when going long and want to lose 30% of the balance, we will lose 43%. And this is without commissions and slippages!

And the larger the size%, the greater the error. -1% / + 2% is not so noticeable.

Those. in such cases, trading BTCUSD shorts is less risky due to the bias of the expectation, and it is better not to go into long with big stops. In short, you also do not need to use margin, which makes a long position even more dangerous.

Now I’ve sat down to think how to gain a formula for calculating risk and the logic of trading in such a situation.

I wonder how many people who trade on the bitmex exchange (nomination in BTC, the main pair of BTCUSD) do not know about it and grab it in long from the market like me♂️

I will be glad of you plus sign and subscription!

I also keep a diary about developments, transactions and steps in building my hedge fund here - t.me/drsombre