In 2018, Bitcoin apostle, investor, and Bitcoin Knowledge podcast host Trace Mayer called forto celebrate the tenth anniversary of Bitcoin's first block, generated on January 3, 2009. To do this, he launched the Proof of Keys campaign on Twitter.

Users had to transfer their bitcoinsfrom exchanges and hot wallets to your own cold wallets. This should demonstrate the liquidity of bitcoin, user control over their assets, and also show whether cryptocurrency exchanges have the declared volumes of coins.

Despite the fact that the Proof of Keys campaign did not become mass, it revealed problems in the operation of such trading platforms as Poloniex, Bitfinex, HitBTC, Purse and Robinhood among others.

In November 2019, Mayer calledcrypto investors repeat the action on January 3, 2020. What were the results of the last Proof of Keys, how the event will take place in 2020, and whether users of trading floors should expect technical problems because of it, Mining-Cryptocurrency.ru figured out.

Not your keys, not your bitcoins!

American Trace Mayer is one of the earlyBitcoin investors. He purchased BTC when the first crypto coin was still worth a few cents, invested in crypto exchanges, and helped Caitlin Long develop Wyoming cryptocurrency legislation.

But the idea of Proof of Keys (RoK) does not belong toMyers. The concept of the promotion first appeared on December 7 on Reddit - user sotashi suggested that users withdraw their bitcoins from exchanges on January 3, 2019, and then return them back. This was to show whether all assets were in place and expose sites that could not be trusted. A few days later, Myers left a comment under the post supporting the idea and a link to Proof of Keys, a site that collects basic information about the promotion: its concept, exchanges that supported the promotion, and sites that were not verified on January 3, 2019.

The action is based on a popular idea expressed by bitcoin guru Andreas Antonopoulos: “Not your keys, not your bitcoin". Its meaning is simple - if the user does not hold bitcoins on his wallet, but on a third-party site, then in fact he does not own them. These coins belong to the exchange, which can freeze his wallet, become insolvent, turn out to be a scam project, use customer funds, overestimate trading volumes or be hacked. All this has already happened repeatedly.

According to an early investor, initially SatoshiNakamoto, the creator of Bitcoin, called for the creation of an electronic payment system between two users without intermediaries. Modern crypto-infrastructure has given rise to intermediaries in the form of exchanges and wallets, which, in essence, differ little from traditional financial organizations.

The RoK promotion is a stress test of reliabilitycrypto platforms, because unscrupulous exchanges cannot withdraw clients’ funds upon request. It should remind users that they must control their own private keys so that they can have “financial sovereignty,” the true owners of their coins, and the “hodlers of last resort” supporting the market. The action will also help verify whether exchanges actually have the assets they claim or are inflating trading volumes.

Who supported Proof of Keys in 2019?

Last year's event was supported by many famouscrypto enthusiasts and several large companies: Bitcoin developer Nick Szabo, trader and presenter Max Kaiser, blockchain investor Plan฿, trader and legislator Caitlin Long, as well as sites BTC.com, Bitcoin Art Gallery, Binance, iCE3X, Coinbase CTO, The Rock Trading, Shakepay, Crypto Cast Network, XMR Wallet, Atomic Wallet, Digital Asset Wallet, Bitfi, Bitspark, Shyft, Quppy Pay, SmartCash, BTC.com, Bitreon, Abra, Coindelta, Bitcoin SOV, Coinpulse, Keep Key. The website also lists several hundred private investors who have joined the action.

The initiative also had many critics.Basically, they noted that the campaign missed the target audience. Real hodlers don’t hold bitcoins on exchanges anyway, and unscrupulous investors don’t care where their keys and assets are stored, they may not even know how to withdraw funds from the exchange - the action will not change anything. People value convenience rather than principles. That's why they use cards instead of cash, and store their bitcoins on exchanges rather than in cold or hardware wallets.

2019 Proof of Keys Results

In general, the performance of the trading floors did not significantly affect the performance of trading floors. The exact number of its participants and the amount of funds withdrawn are unknown, but it is unlikely that there were many.

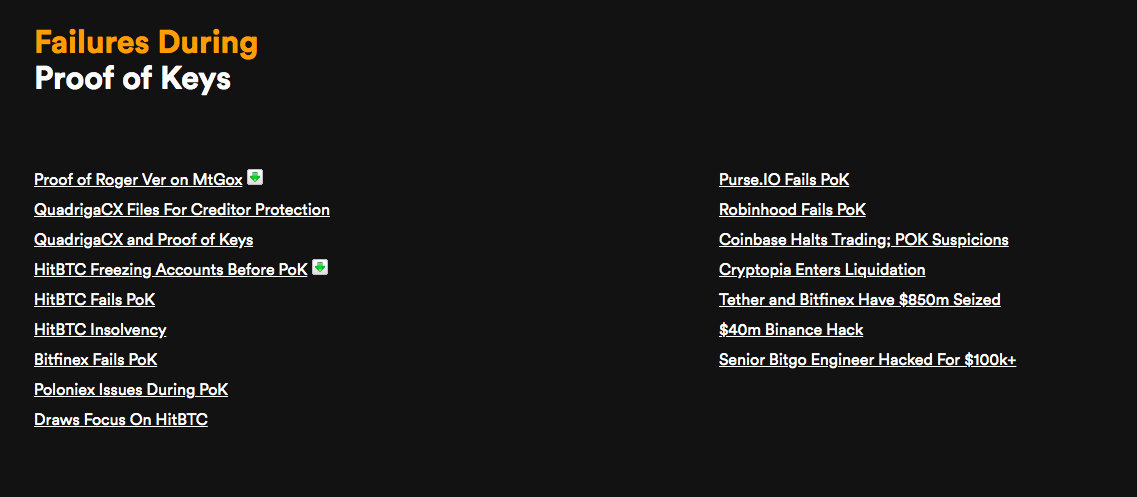

Mayer collected the main complaints of users ondifficulties with withdrawing funds on the eve or on the day of the promotion in the Failures section on the Proof of Keys project website. Most of these cases were insignificant, and there is no evidence that the problems were caused precisely by Proof of Keys - this could be a simple coincidence. It seems that if it were not for the proximity of the action, they would not have been paid attention to at all. Consider the most striking of these cases.

- HitBTC.The exchange began to freeze client accounts withoutwarnings and blocking their accounts at the end of December 2018, and support did not respond. The exchange had previously been accused of delaying the withdrawal of funds, so users suspected it of insolvency. A few days later, the exchange explained the problems with overlapping payment gateways and KYC checks in accordance with internal security rules. However, problems with the withdrawal of funds have not stopped to this day - there have already been rumors about the bankruptcy of the site.

- Bitfinex.The Bitfinex platform reported technical problems with withdrawals, but they were resolved within an hour. In the comments under the company’s tweet about the problems, users did not believe the site.

- Coinbase.The exchange also did not work for several hours, after which it reported that the problem was resolved.

- Poloniex.One of the users noted a problem with withdrawing funds and the exchange’s sudden demands for additional identity verification. But commentators on Twitter noted that these are private disadvantages of the platform.

- Purse. A little-known wallet also suspended withdrawals without giving a reason.

- Robinhood.The platform had the same problem - it suspended the withdrawal of funds without explanation.

- BiteBTC.The Singapore Exchange ranked 35th in terms of volumetrading - it attracted clients with a more favorable exchange rate and high trading volumes. On January 3, she also started having problems with withdrawing funds. On the same day, it announced that over 7% of its users’ coins were physically destroyed due to a fire in the data center that occurred on January 1, 2019. The company promised to restore all balances and trading history from earlier backups. It is noteworthy that before Proof of Keys, the exchange did not report the problem, did not provide any evidence of the fire, and difficulties with the withdrawal began only on January 3. A user wrote to the editors of the CCN.com portal and said that he lost 2 BTC on the exchange. The site simply blocked his access to the site, and the support was silent. The editors of the publication tried to contact the exchange, but also did not receive a response. Users, of course, accused BiteBTC of being a scam. In the winter and spring of 2019, users continued to complain about the blocking of funds, and in the summer they accused the platform of stealing cryptocurrencies and blocking accounts. The exchange tried to explain this with KYC checks, but no one believed it and, as it turned out, they were right. In July, the site closed, and the new Fidelio exchange, registered in the Seychelles, suddenly became available on the old website.

The Proof of Keys website lists all the sites that did not pass the action check:

So Proof of Keys helped identify the scam project. However, most of the problems users encountered turned out to be frivolous and quickly resolved. Exchanges have confirmed their reliability and consistency.

Most proudly noted in theirTwitter that passed the Proof of Keys test. Except for the case with BiteBTC, the rest of the projects completed the verification. And the problems with access and withdrawal of funds on January 3, even for such large exchanges as Coinbase, can be explained by the fact that exchanges usually store 90-95% of funds in cold crypto-wallets, and with more or less massive withdrawal, technical difficulties may indeed arise.

How will the Proof of Keys go in 2020?

Mayer urged Twitter users on November 5repeat Proof of Keys on January 3, 2020. The goals of the action are the same. To express support for the campaign, the investor suggested adding the signature “Jan / 3➞₿? ∎” to his account nickname.

Judging by Twitter this year, the action is supportedBinance crypto exchange, iCE3X, an anonymous PlanB investor, AtomicWallet.io wallet, and at least several hundred crypto enthusiasts. Most of the participants, like last year, are English-speaking or Western users. Mayer offers companies to fill out a special form so that their names appear on the site.

Less than 60 days until #ProofOfKeys. Who is participating in 2020? Change your handle yet? [Jan / 3➞₿? ∎]?

Just recently «Einstein Crypto ExchangeSeized by Canadian Securities Regulator.» $850m of @Tether_to seized with Crypto Capital. QuadrigaCX last year. #MtGox, et. al. pic.twitter.com/nu4fqftQ1c

- Trace Mayer [Jan / 3➞₿? ∎] (@TraceMayer) November 5, 2019

«Less than 60 days left until #ProofOfKeys.Who will participate in 2020? Have you already added “Jan/3➞₿?∎” to your nickname? Just the other day, the Einstein Exchange was closed by the Canadian securities regulator.(it turned out that the site has almost no user funds and they lost $ 16 million. - Mining-Cryptocurrency.ru).Let's also remember $850 million, Tether and Crypto Capital(Mayer is referring to the incident when Bitfinex covered losses of $850 million in favor of Crypto Capital using Tether funds. - Mining-Cryptocurrency.ru),QuadrigaCX(the deceased owner of the exchange used client funds for trading and transferred to other sites. - Mining-Cryptocurrency.ru),Mt.Gox(the exchange closed with debts to users. - Mining-Cryptocurrency.ru)and others».

Good New Year tradition

Proof of Keys is good, though naiveundertaking. Of course, if all users of exchanges withdrew their funds in one day, this would reboot the network and could seriously shake the market. But this still will not happen - most users trust crypto-exchanges. However, the action makes sense even with a relatively small number of participants - this is enough to identify problem areas.

Despite its symbolic character, Proof of Keys is a great reminder to users about the meaning of cryptocurrencies. It would be great if the stock became a tradition, and the exchanges sought to pass the RoK test.

Write whether you support the Proof of Keys promotion or not?

</p> 5

/

5

(

1

vote

)