06/15/2020

Alex Kondratyuk

Decline of the first cryptocurrencymay turn out to be fleeting, but will become stable in the event of a new wave of decline in the stock market and growth of BTC stocks among miners. These conclusions were reached at CoinDesk.

On Monday, the price of bitcoin fell below the psychological level of $9,000, reaching a three-week low of $8,920 at the moment.In the late afternoon, the quotes recovered to $9,300.The U.S. stock market opened with a 1.5% drop on the S&P 500 index amid fears of a second wave of COVID-19 cases in China.

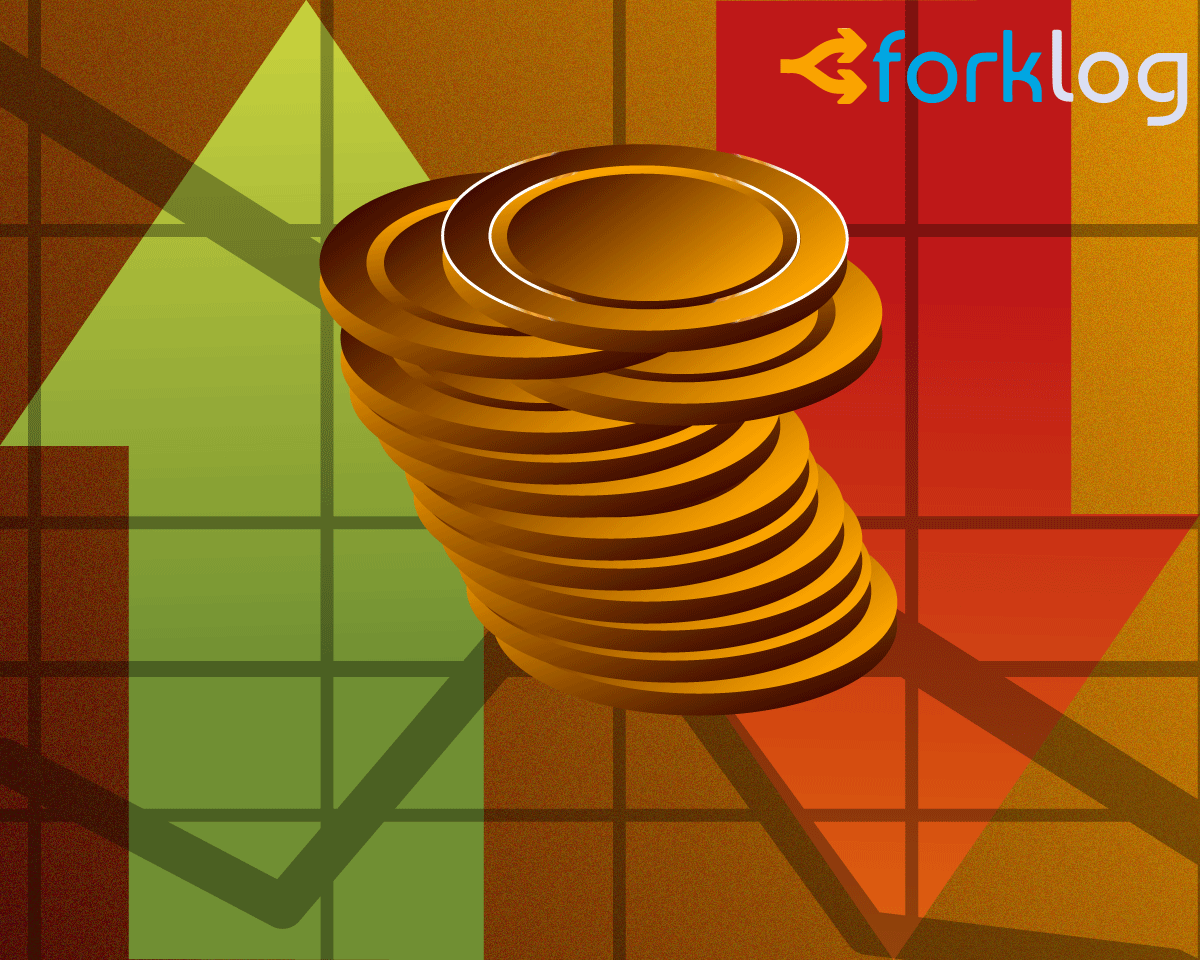

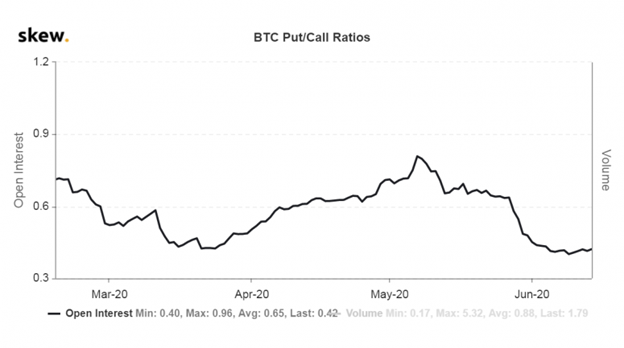

The publication notes the restoration of the correlation between the traditional and cryptocurrency markets and indicates the achievement of a put / call ratio of options for bitcoin to a maximum of 1.79 in three months.

According to the definition of this indicator: a value above one is considered a sell signal, while below this milestone is an opportunity to buy. However, a strong deviation of the indicator above unity can be considered as the willingness of the market to turn up, and below this mark - as an indicator of a possible maximum.

Put / Call Ratio. Data: Skew

With Bitcoin, an indicator above 1.7 is close to an extremum. Previously, only higher indicator marks were recorded only twice - in both cases the price reached a minimum on the same or the next day.

The last time a similar situation was observedshortly before the market crash on March 12, when bitcoin crashed from $ 7000 at the moment by 40%, to $ 3600. Earlier in mid-December, the indicator was 2, which coincided with the formation of the bottom slightly below $ 6500 and the subsequent increase to $ 10 500 over the next two months.

Having drawn parallels with today, analysts warn that at the moment, the formation of the so-called bear trap may go on.

At the same time, the open put-call interest ratio fell to its lowest level in 14 months at 0.40.

Open interest ratio in put / call options. Data: Skew

“Discrepancy between put / call volumes and decreaseThe open interest of put / call suggests that a large number of put positions were closed for profit, ”Chris Thomas, head of Swissquote's digital assets division, explained.

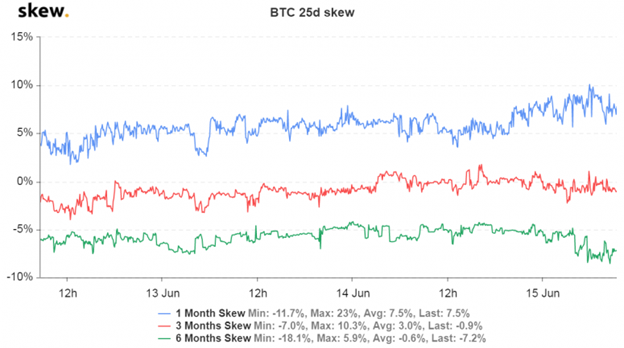

Confirms Thomas's words options price cutsput relative to calls on a monthly period from 9.4% to 6.3%. This indicates an increase in interest in the latter. Three- and six-month indicators are in the negative zone, signaling increased demand for call options with expiration in September and December.

It should be borne in mind that the options market has a tendency to quickly change its positioning. Bitcoin, analysts believe, is still vulnerable to a new round of stock market sales.

“Over the next weeks, you need to monitorcaused by fears of a new wave of COVID-19 stock market sales. If the market reacts extremely negatively, there may be a panic that will pull bitcoin down, ”Thomas explained.

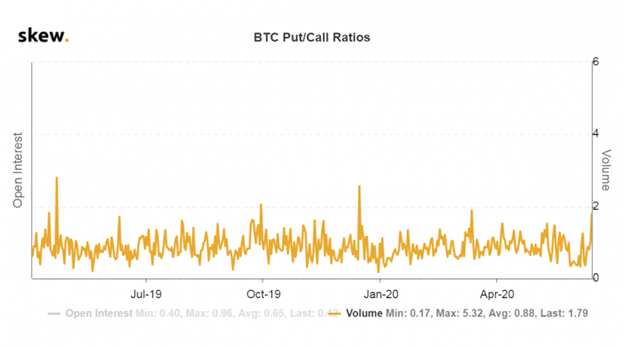

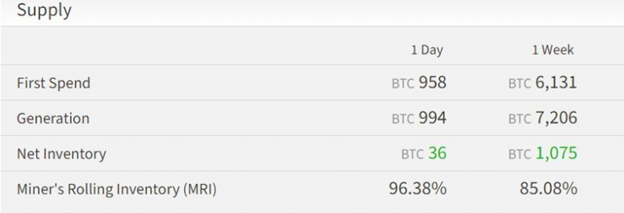

In the upcoming drawdown, Bitcoin prices are notdoubts the founder of ByteTree and the manager of the Atlantic House Charlie Morris. Based on the on-chain metrics, he estimated the “fair” value of BTC, which turned out to be less than $ 7,000.

</p>Miners also began to accumulate bitcoins inover the past seven days. This may indicate the uncertainty of market participants that the market is able to withstand their sales and not go to lower levels.

Miner stock data. Source: ByteTree

Recall, recently, Forklog published a special material on bitcoin options: