One of the most consistent trends over the past few years has been the constant sales pressure frombitcoin miners as they are forced tosell new bitcoins to cover costs. This selling pressure still exists today, however, in the last few months, it has significantly decreased as miners began to hold more "mined" BTC.

Today the profitability of miningis at its highest level in 2.5 years, plus miners have more access than ever to traditional equity and debt markets. The market cycle also looks poised for a new wave of growth, which motivates miners to keep as much mined bitcoin as possible in anticipation of higher prices.

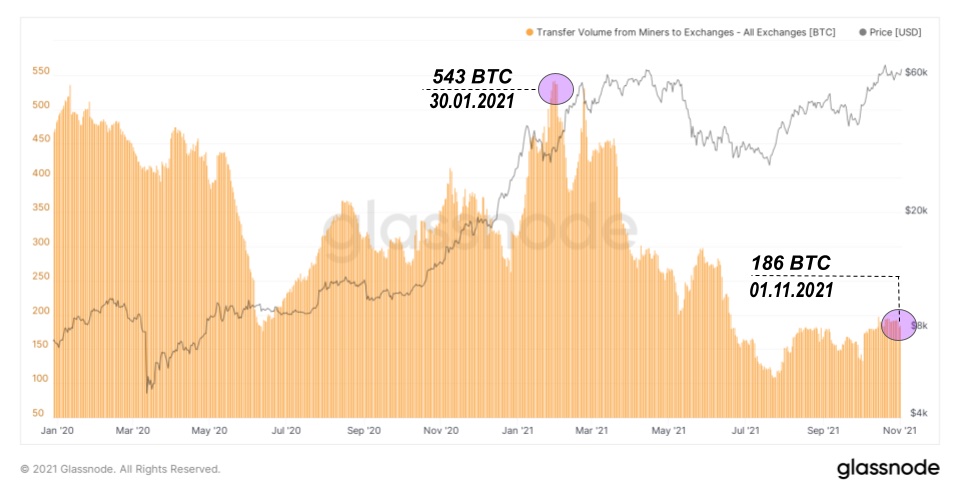

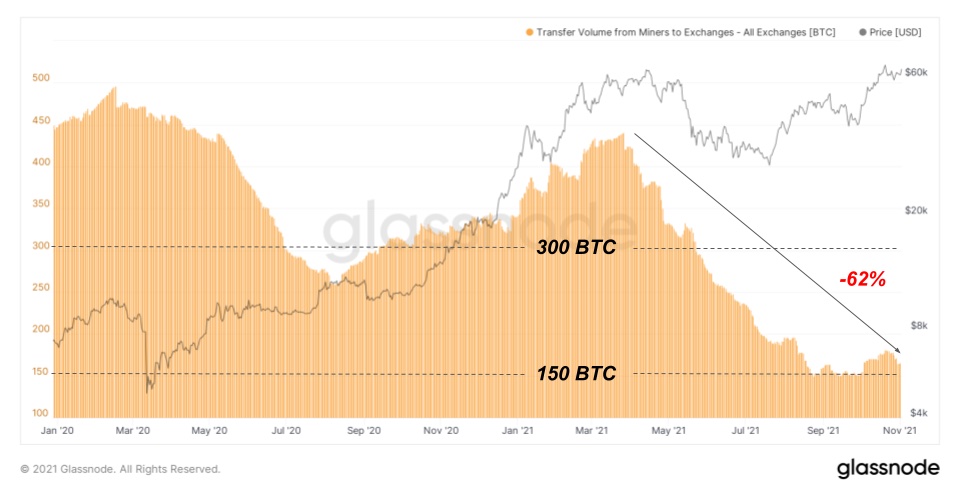

The chart below shows the volumetransfer of BTC from miners to exchanges, smoothed by a 30-day moving average. Before the rally to previous highs, the volume of transfers from miners to exchange wallets was the highest in the last two years. Miners are now sending 65% less BTC to exchanges than during the previous market peak. The 90-day average indicates the same trend, highlighting the decline in transfer volumes over the past six months.

BTC transfer volume from miners to exchanges, 30d MA

BTC transfer volume from miners to exchanges, 90d MA

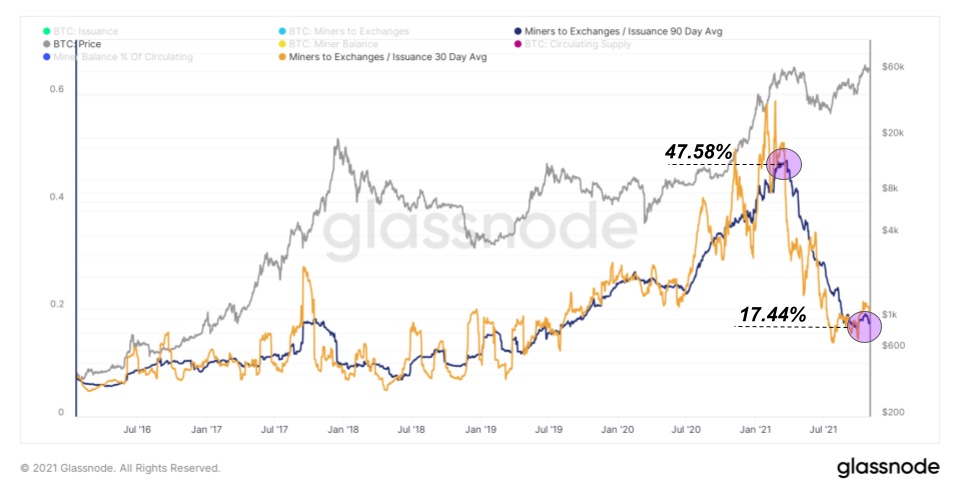

Another way to look at this trend isnormalize the volume of transfers from miners to exchanges by the number of newly released BTC. This is better for comparing transfer volumes between different halving cycles with different block rewards. If we use the ratio of the 90-day average transfer volume from miners to the 90-day average supply volume of new bitcoins, then the top of the previous all-time high coincides with when the miners sold the most BTC as a percentage of the newly released supply. Today, this percentage has dropped to two-year lows and continues to decline as the volume of transfers from miners to exchanges decreases.

BTC transfer volume from miners to exchanges divided by BTC issue volume in the same period

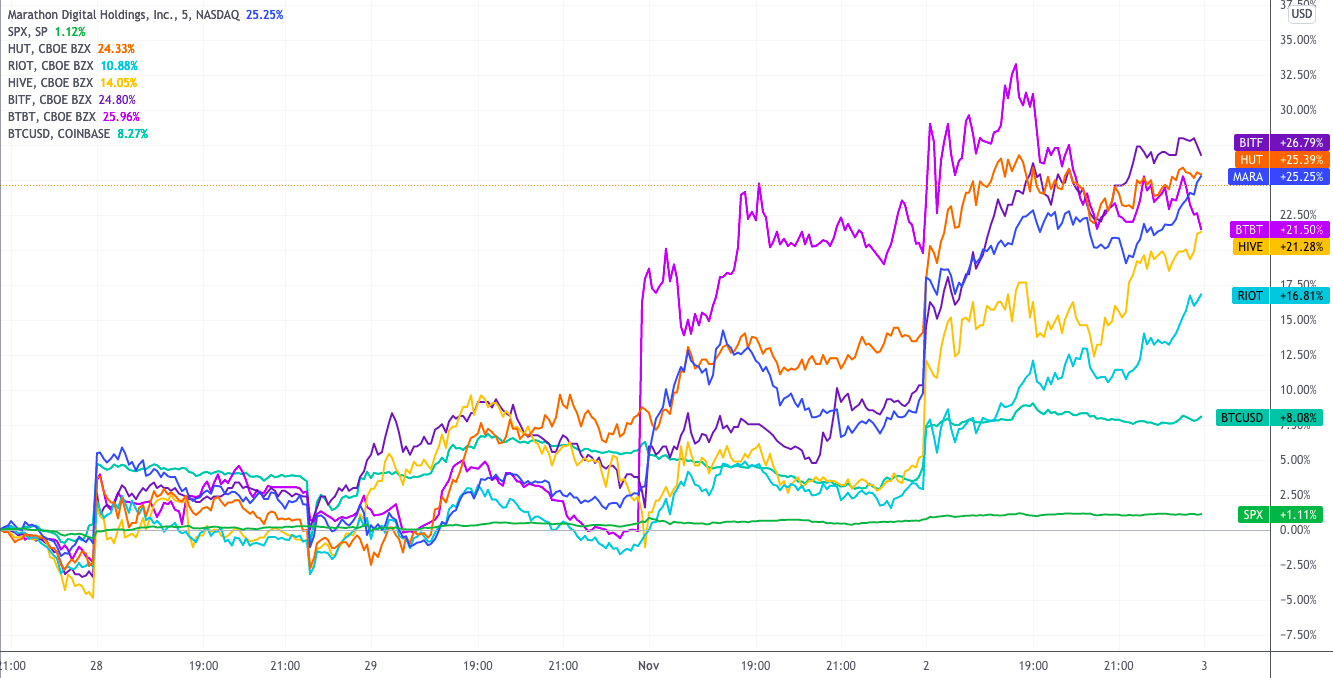

Public mining stocks continue to perform well

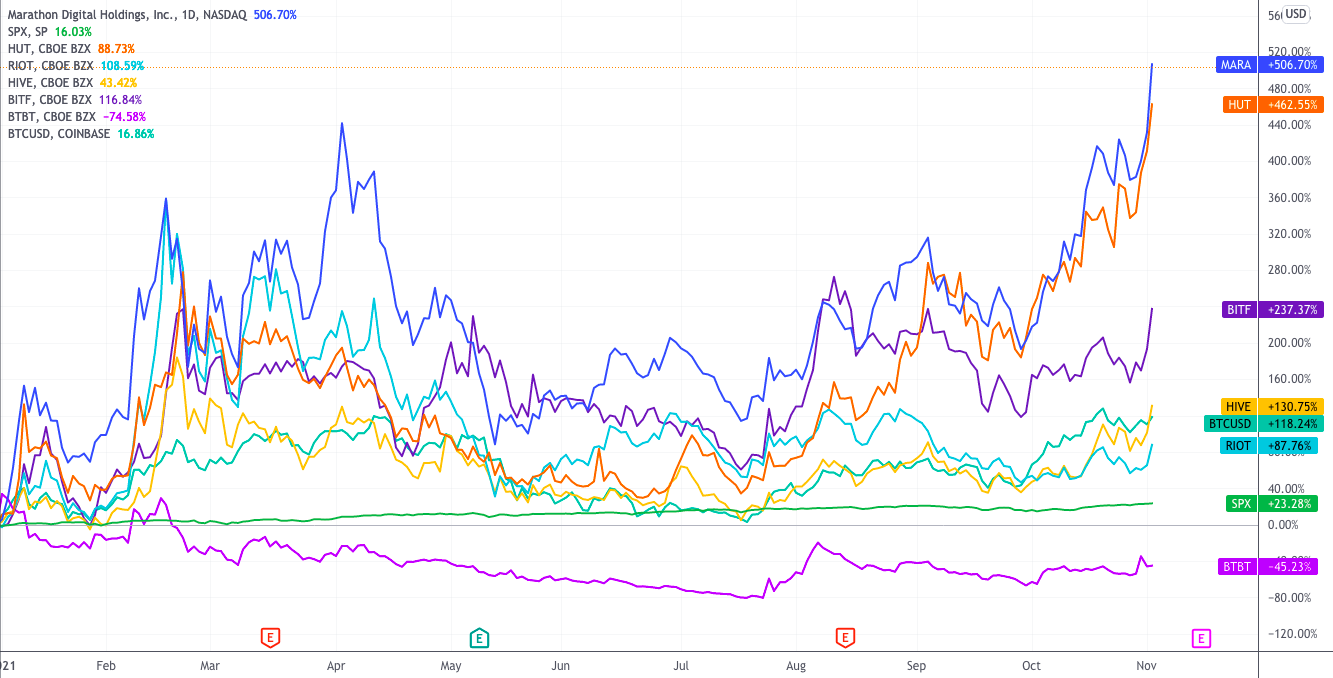

Shares of public miners have been aton the upswing, with five-day returns for most leading mining stocks at the time of writing exceeding 20%, compared with 7% for Bitcoin and 1.1% for the S&P 500. It's a similar story for some of these year-to-date returns: Marathon Digital Holdings, Hut 8 Mining, Bitfarms and Hive Technologies all outperform Bitcoin's 118% return and are trading well above the market's benchmark level of 23.30%.

The growth in short-term profits comes right before many public miners are due to report their October numbers over the next few days.

Income from shares of public mining companies in the last 5 days. Chart executed in TradingView

Income from shares of public mining companies since the beginning of the year. Chart executed in TradingView

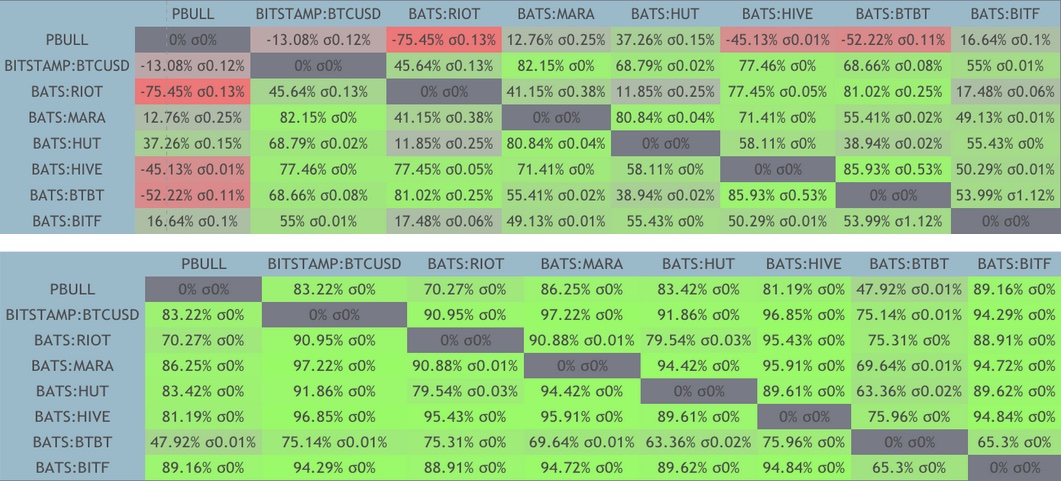

When comparing indicators for the last year, it can be seen thatthat the shares of mining companies are highly correlated with the bitcoin rate and with each other. Many strong correlations persist over the past six months, with miner stocks generally moving in line with bitcoin's performance, although Riot and Bitfarms have relatively weaker correlations in this group. It can be expected that this relationship will continue and that shares of public mining companies will rise and fall along with the performance of Bitcoin.

Correlation between the stock price of public mining companies for 6 months and 1 year (source:TradingView, Correlation Matrix Heatmap)

Block reward distribution

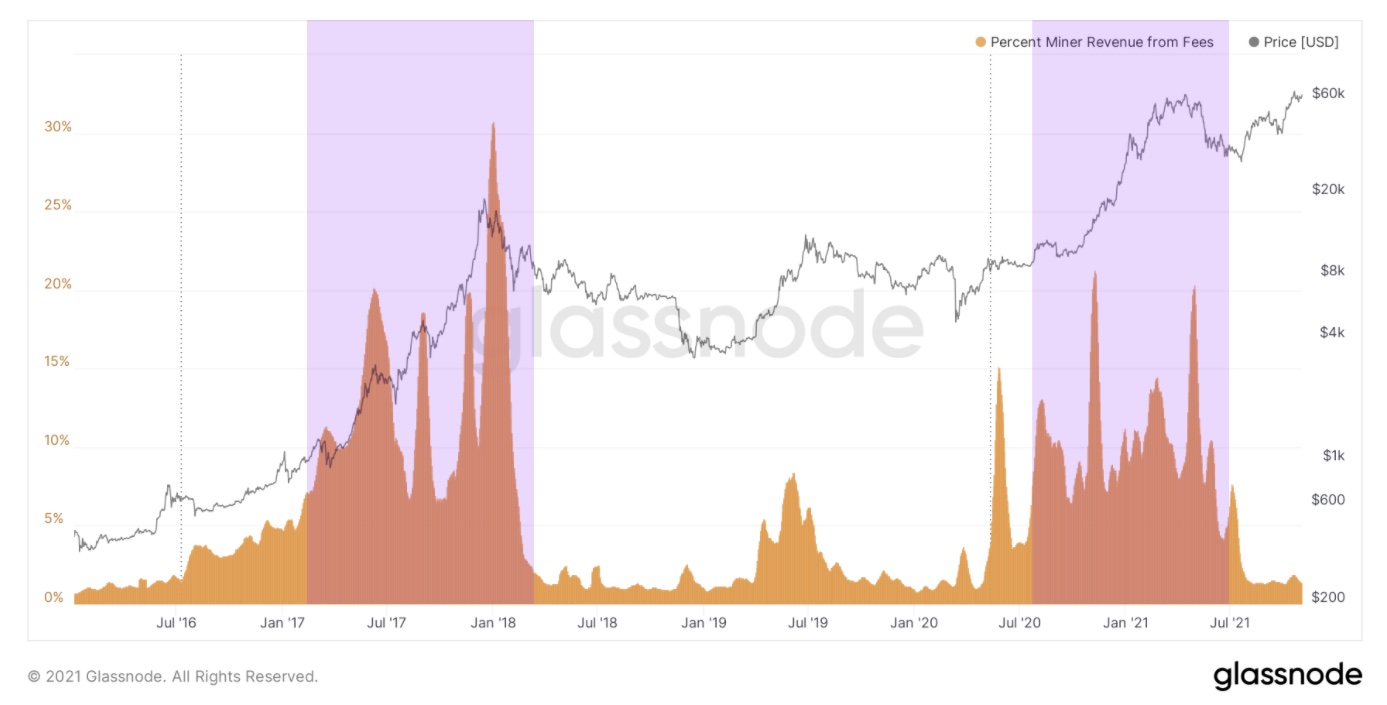

Significant growth in online transaction feesBitcoin hasn't happened yet, and over the past two weeks, their share of the total block reward is only 1.4%. While the low fees can certainly be attributed to the rapid growth of the Lightning Network, the increase in SegWit adoption, and the more hodling-friendly market in general, this also suggests that the retail mania phase in the bull market has not yet begun.

Percentage of commissions in the total income of miners (14d MA)

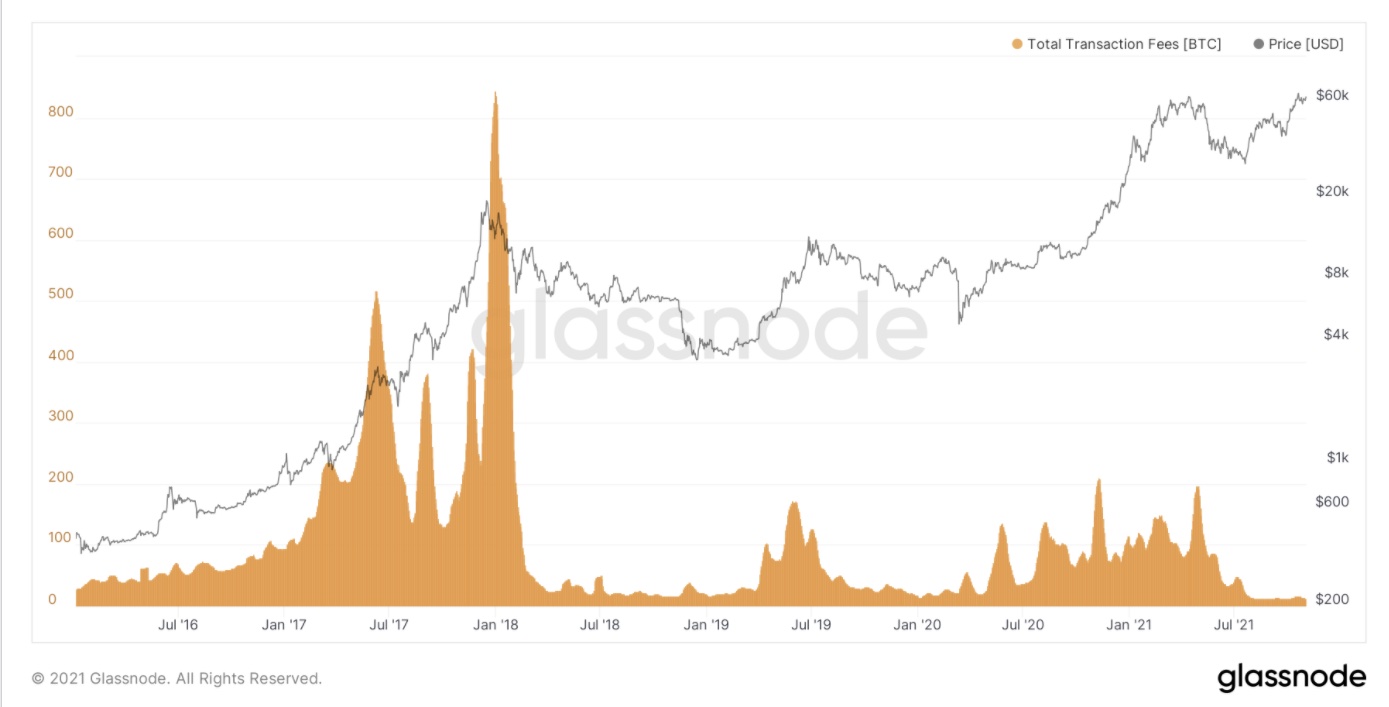

It is also important to note that although the percentagecommissions in miners' income remains approximately at the level of 2017, if you look at the numbers in BTC terms, the picture looks completely different. Why? Due to the built-in halving function, which is gradually reducing the subsidy per block, down to zero, which will be reached in the next 120 years.

Bitcoin is designed to grow (in value) forever, so it is likely that, in terms of BTC, miners' earnings will decline significantly in the long run.

Percentage of commissions in the total income of miners (14d MA)

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.