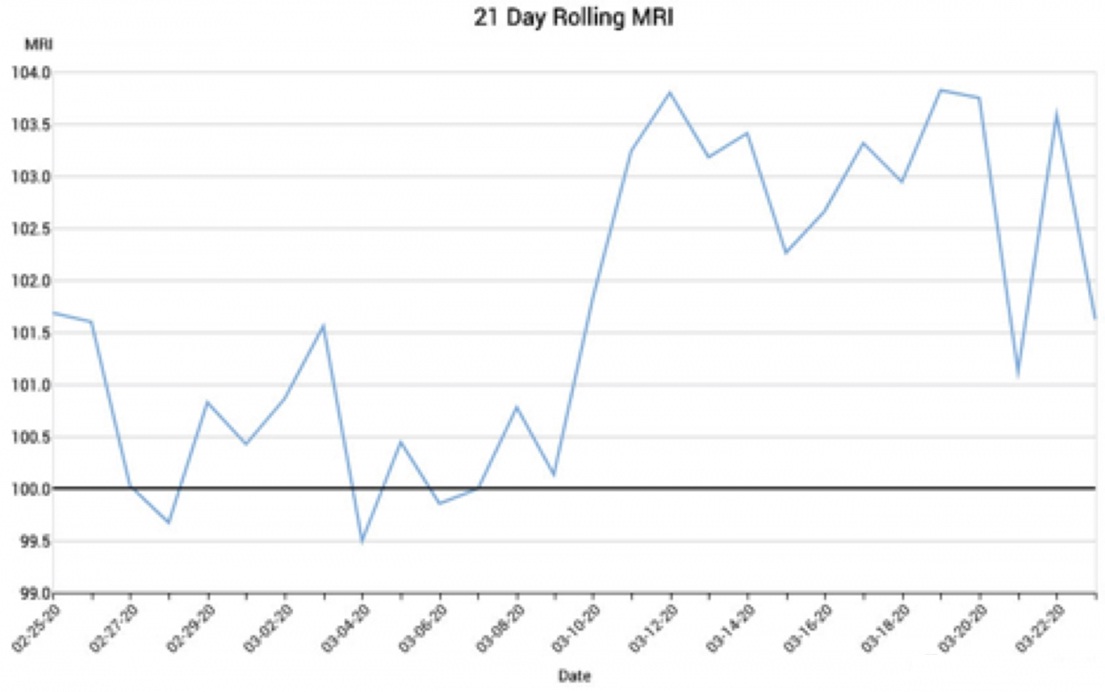

According to Digital Assets Data, miners are now selling more bitcoins than they are mining.

According to the 21-day moving average chartreserves (MRI), in recent weeks, significantly more coins have been entering the market than are being generated. The active sale is associated with the restoration of the BTC exchange rate and the receipt of working capital to continue the stable activities of mining pools, which waited out the panic and began to liquidate savings at more favorable prices.

Digital Assets Data analyst Connor Abendschein told CoinDesk that despite the large resetthe number of bitcoins, buyers quickly snapping up coins. This avoids a surplus and reflects the current strength of the cryptocurrency market.

For example, almost twice as many were sold on WednesdayMTC than mined (2788 and 1588, respectively). During this sale, the rate dropped by 3%, but then quickly returned to its previous level. Although this is a small number of additional coins compared to the overall trading volume, given the current market environment, this behavior indicates the potential for further growth.

According to analysts, the economic crisis after the end of the coronavirus pandemic can dramatically change the attitude of most people to cryptocurrency.

</p>