Mining company Marathon Digital Holdings will continue to accumulate reserves in the first cryptocurrency, despiteprice drop. This was stated by Vice President Charlie Schumacher to Cointelegraph.

According to him, although the company's activities «are not immune to the macroeconomic environment» she has «good opportunities» survive the current market downturn.

«For reference, in the first quarter of 2022The cost of producing 1 BTC for us was approximately $6200. We also have a fixed price for electricity, so we are not subject to changes in the energy market,” said Schumacher.

He emphasized that the price of bitcoin hassignificant impact on Marathon's financial results due to reporting in dollars. However, for an objective assessment of activities, the company prefers to focus on the production of cryptocurrency, Schumacher added.

«Of course, Bitcoin costs less inin terms of dollars at the time of mining, but if you believe in the ability of the asset price to grow in the long term, then earning more BTC is never a bad thing,” said Marathon’s vice president.

As of May 31, the company has accumulated 9941 BTC on its balance sheet. Marathon has not sold the mined cryptocurrency since October 2021.

During the first quarter of 2022, the company generated 1258.6 BTC and recorded a net loss of $13 million.

According to Schumacher, the decline in the price of bitcoinwill force inefficient miners out of the market and reduce the difficulty of mining new blocks. This will allow those who continue to operate to get more digital gold, he believes.

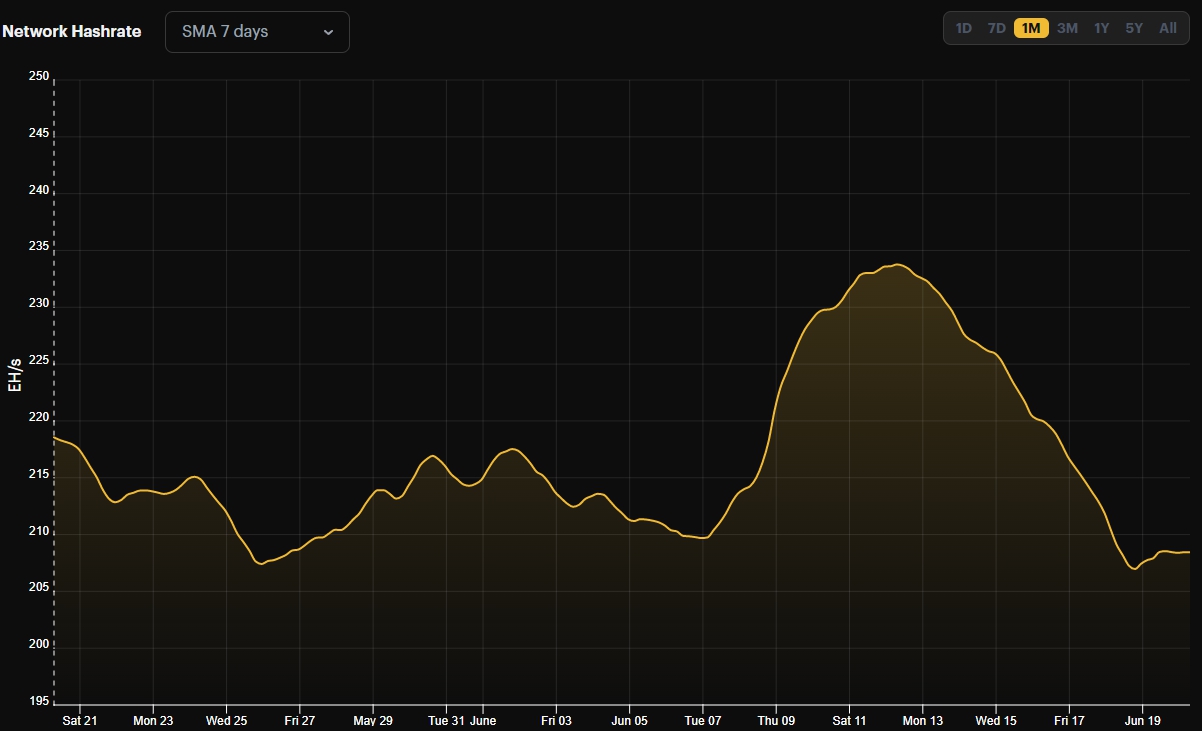

By June 18, the hashrate with which it correlatesthe difficulty of mining, fell by more than 10% in relation to the maximum reached a few days earlier. At the time of writing, the smoothed seven-day moving average is 208 EH/s, according to the Hashrate Index.

Data: Hashrate Index.

Already on June 16, the specialists of the analytical platformCryptoRank stated that the price of BTC has reached the average cost of mining. This meant that for a certain part of the cryptocurrency miners, the activity became unprofitable.

IDEG Singapore Investment Director MarkusThelen noted that most miners calculated their annual budgets at the end of 2022, when the market was in different conditions. Therefore, the company believes that some small enterprises in the industry that do not have economies of scale will turn off the equipment. According to IDEG Singapore, their breakeven level is $26,000-$28,000 per 1 BTC.

On June 18, the price of the first cryptocurrency fell below $18,000. After the recovery, Bitcoin is trading near the $20,000 level.

Recall that in April, Arcane Research analysts called Marathon shares the most overvalued among public mining companies.

In June, Marathon quotes were among the leaders in terms of falling in the cryptocurrency-related market sector.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.