The Bitcoin network began operating on January 3, 2009, which means the cryptocurrency has existed for more than 11 years. The deadline may seemdecent, but on the scale of the global financialsystems, stocks and the same gold are nothing. In addition, many learned about the blockchain industry in 2017 during the market growth. Therefore, it should come as no surprise that many still believe in myths about blockchain, cryptocurrencies, and mining. We will tell you which of these misconceptions are most common, what they are wrong, and how not to fall for the bait of erroneous knowledge at all.

Here are the most popular blockchain myths that many people still believe in.

Bitcoin mining is only available to a select few

It is worth starting to sort out misconceptions about cryptocurrencies with mining - the process by which most cryptocurrencies work. Among the latter, there is also Bitcoin (BTC).

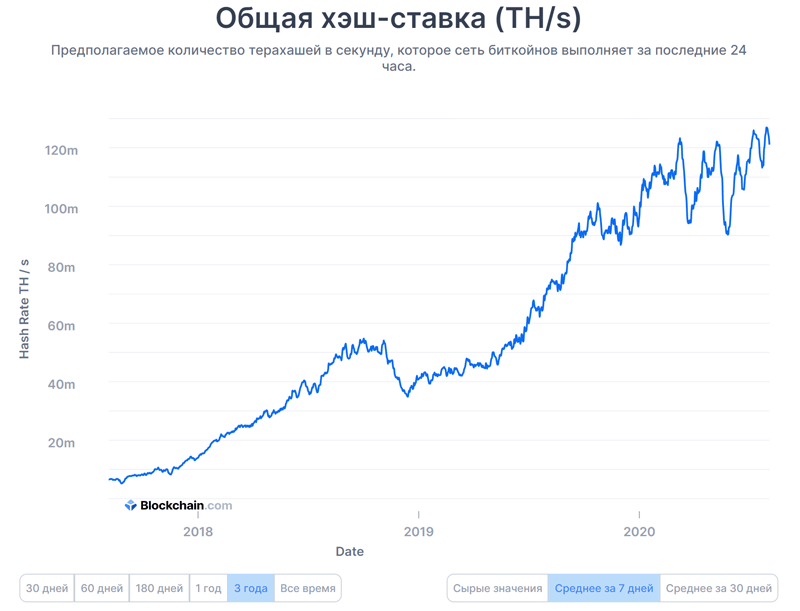

The myth says that to start mining Bitcoin alreadylate. Allegedly, it was worth contacting this at least five years ago, and now the chance has already been completely missed. As a confirmation, people usually give a graph of the hashrate of the cryptocurrency network - that is, its computing power. Here are the changes in the indicator over the past three years.

The power of the network is really growing - this can be seen fromgraphics. Accordingly, the competition for finding blocks is also increasing, it has become much more difficult to mine BTC in recent years, and the same equipment has begun to bring in several times less income in a couple of years.

All this is true, but the listed factors are notput an end to the prospects of mining in general. The fact is that in the Bitcoin network, every 210 thousand blocks (or approximately once every four years) occurs the so-called halving, that is, a halving of the block reward. If, due to the fall in the reward, it becomes unprofitable for miners to mine BTC, they will disconnect from the network, and the hashrate of the latter will drop. Next, difficulty comes into play - a parameter that makes it so that it takes about 10 minutes on average to extract one block.

If there are two miners after such a halvingtimes less, the complexity after regulation will fall by the same two times. This means that the remaining miners will be able to work twice as efficiently and receive twice as much money at the same rate. Whatever the case, this will be the perfect moment to enter the niche for those miners who no longer hoped to contact this lesson. If mining remains profitable for them, of course.

Bitcoin mining will die in 2140

The last Bitcoin will be mined in 120 years - in 2140. Since there will be no more new coins being created, some consider this year to be almost the date of the death of the cryptocurrency.

The myth says that without new coins, the cryptocurrency networkcannot exist. This is not so - everything is much simpler. It's just that over time, miners will earn more on commissions, and not on block rewards, that's all. Ideally, it is assumed that after years the Bitcoin rate will be significantly higher, so miners will not even notice the change in the components in their income.

By the way, according to representatives of the research company Intercharge, by 2030 the share of commissions in the earnings of Bitcoin miners will exceed the income from the block reward.

Note that the version with BTC rate growth in the futuremay be true—at least that’s what miners hope. As analysts have found out, they are not seeking to sell the mined bitcoins and are waiting for better times to do so.

Everyone in the cryptocurrency niche can be trusted

The blockchain space is relatively new and in additiondifficult to understand. As practice shows, this combination is more than enough to make beginners get confused and feel insecure. After that, they go for advice to other people who, as the myth says, supposedly know much more. For example, anonymous analysts, traders and other individuals who are usually easy to find on Twitter.

This path does not guarantee earnings and does noteliminates the risks of working with cryptocurrencies. On the contrary, the chances of making a wrong decision - whether to buy a cryptocurrency or choose a blockchain wallet - are even greater. For example, some people may be promoting unpromising projects whose developers have paid them to advertise. The second "experts" will speak negatively about some blockchain project because of personal hostility. And still others will try to deceive the seed phrase or private key, which will open them access to the user's cryptocurrency.

In general, take into account other people's opinions of anonymous people inthe blockchain world is risky. The exception is well-known personalities in the niche who have created some kind of cryptocurrency, blockchain company, or something similar. All of them are on the so-called list of crypto influencers, that is, people with many years of experience in the blockchain field. The whole world knows them, and behind them are real working projects that, in addition, change the lives of ordinary people. So you can definitely trust such figures.

For example, the most noticeable developer isVitalik Buterin stands out - the leader and co-founder of Ethereum, who is now scaling his project. Also worth mentioning is Andreas Antonopoulos. He is a renowned cryptocurrency enthusiast who has been educating the masses about blockchain, Bitcoin and other cryptocurrencies for years.

Cryptocurrency online wallets store coins

Financial applications and electronic servicespayments have taught people that money is really stored on their wallets - just like in safe deposit boxes. The myth says the same thing happens with cryptocurrency wallets.

This is not true. In essence, a cryptocurrency wallet is a tool for interacting with the blockchain network. There are no Bitcoin, Ethereum or other coins inside it. Usually, full-fledged wallets only store private keys from cryptocurrency addresses and collect balances of the latter. That is, it is like a user interface for working with cryptocurrency, but the cryptocurrency itself is not specifically in them.

Losing a hardware wallet is the end of cryptocurrency

In connection with the previous delusion, another thing has developed. The myth is that losing a hardware wallet like a Ledger or Trezor results in a loss of cryptocurrencies.

This thought is wrong. First, you need to know the password for any actions with a cryptocurrency wallet as a separate device. In particular, Ledger asks him every time the wallet is connected to the computer. Secondly, access to Bitcoin and other cryptocurrencies on the wallet is provided by a seed phrase - that is, a set of 24 special words in a specific order. The owners of the coins need to be more careful to protect it, and not the device itself.

Staking and mining are one and the same

Staking and mining brings cryptocurrencyusers. In this regard, some novice owners of Bitcoin and other coins consider these concepts to be equivalent. That is, the myth says that staking and mining are one and the same.

There is still a difference between these concepts. Mining is the process of finding solutions to add new blocks to the Proof-of-Work (PoW) blockchain. Miners support the cryptocurrency network and receive an award for this. Staking is participation in the process of confirming transactions in the Proof-of-Stake (PoS) blockchain. The owners of the steaks block a certain number of coins and also allow network users to make transfers, receiving a reward for this.

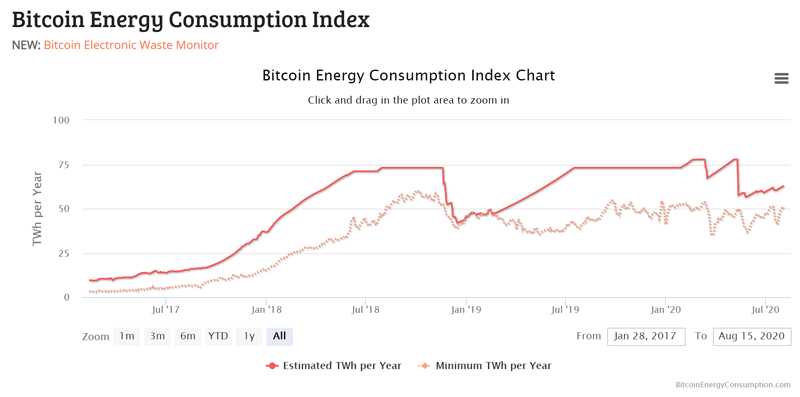

That is, the goal of the two processes is practically the same andthe same - to ensure the operation of the blockchain and make money on it. However, the difference between them is huge. For mining, you need equipment in the form of video cards or ASIC miners, which consume a lot of electricity. According to researchers of the analytical company Digiconomist, in 2020 the Bitcoin network consumes 61.85 terawatt hours, which is comparable to the electricity consumption of the whole Kuwait. No special equipment is needed for staking - a computer with a cryptocurrency wallet is enough.

In this regard, another difference is formed: to start mining, you need to spend money on equipment, while for staking you will have to spend money exclusively on buying cryptocurrency.

In addition, it is important to understand the motivation of the stakers andminers. The former do not want to get rid of the cryptocurrency, since their reserves bring them income. The second does not matter: some miners purposefully hunt for the most profitable cryptocurrencies, after which they sell them in exchange for Bitcoin, Ethereum or other popular coins.

findings

The blockchain and cryptocurrency industry reallyyoung. Many people continue to connect to it even today - especially considering the positive forecasts of analysts on the Bitcoin exchange rate. Therefore, in the niche there are enough misconceptions about the work of technology and enthusiasts who spread not entirely correct information.

With this in mind, it is important to contactsource, listen to the world's most popular crypto influencers and take the time to research. Still, in the blockchain niche we are talking about investments, and money should be handled with care.

</p> 5

/

5

(

2

vote

)