The Liechtenstein Parliament passed this week the Blockchain Law, designed to encourage furtherdevelopment of new financial technologies and increase the effectiveness of the so-called "tokenomics" - an economy based on cryptocurrency tokens.

According to Coin-Ratgeber, the preparationThe bill took three years, and after its adoption in the second reading, the document was sent to the Prince of Liechtenstein for signature. As the publication notes, the bill was adopted unanimously by parliamentarians.

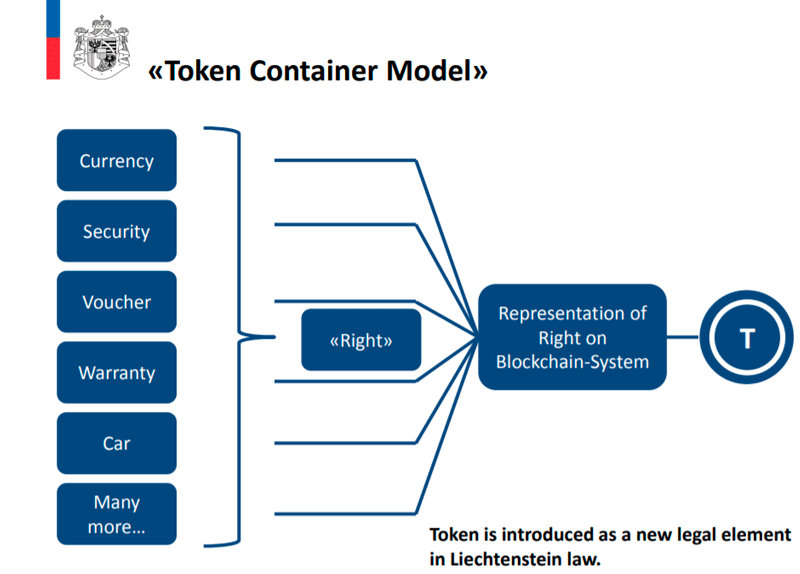

One of the key points of the new law has becomecreation of the so-called “Token Container Model” (TCM), combining transactions using tokens with civil law. In its framework, tokens are considered as containers displaying various rights - from real assets like real estate and shares (security tokens) to licenses or digital codes.

The purpose of the adoption of the Blockchain Law is calledcreating regulatory certainty for users and service providers, creating trust to improve process efficiency, and developing guidelines for service providers, including compliance with anti-money laundering legislation.

Note that despite its tiny size anda small population, Liechtenstein has long had a reputation for business-friendly jurisdiction, especially in the field of financial services. In this alpine country are the headquarters of a number of banks, financial and investment companies, trusts, law firms and auditors.

One of the factors that attract entrepreneursIn the Principality, there is an adequate taxation system: personal annual income of up to € 90,000 is taxed at 5%, the highest rate is 8% with an annual income of more than € 180,000. The tax for companies is at 12.5%.

Also Liechtenstein is probablythe only state in the world with a negative unemployment rate - in 2017, 38 600 people were officially employed here with a population of 38 114 people.

The country is closely related to Switzerland and ispart of the European Economic Area (EEA), which attracts many blockchain and crypto startups here. For example, Aeternity is based in Liechtenstein.

As a reminder, in 2018, based in LiechtensteinUnion Bank AG has announced the launch of its own security tokens, thus becoming the world's first licensed financial institution to issue blockchain assets.

Since February 2019, post offices in the Principality began selling bitcoins.

</p>