The focus of so many traders is now on the 50 MA on the weekly chart (blue rising curve) This is a key level for Bitcoin on this timeframe and has not been broken since the March 2020 COVID crash.

Chart executed in TradingView

So far the price continues to fluctuate after the falllast week. The key levels are $53k and $42k. Anything in between is essentially a haircut and uncertainty, but a close below the 50MA would mean the market is likely to test the bottom of that area.

So far it looks like a 39% correction (not a trend change) with the low point at ~$42k.

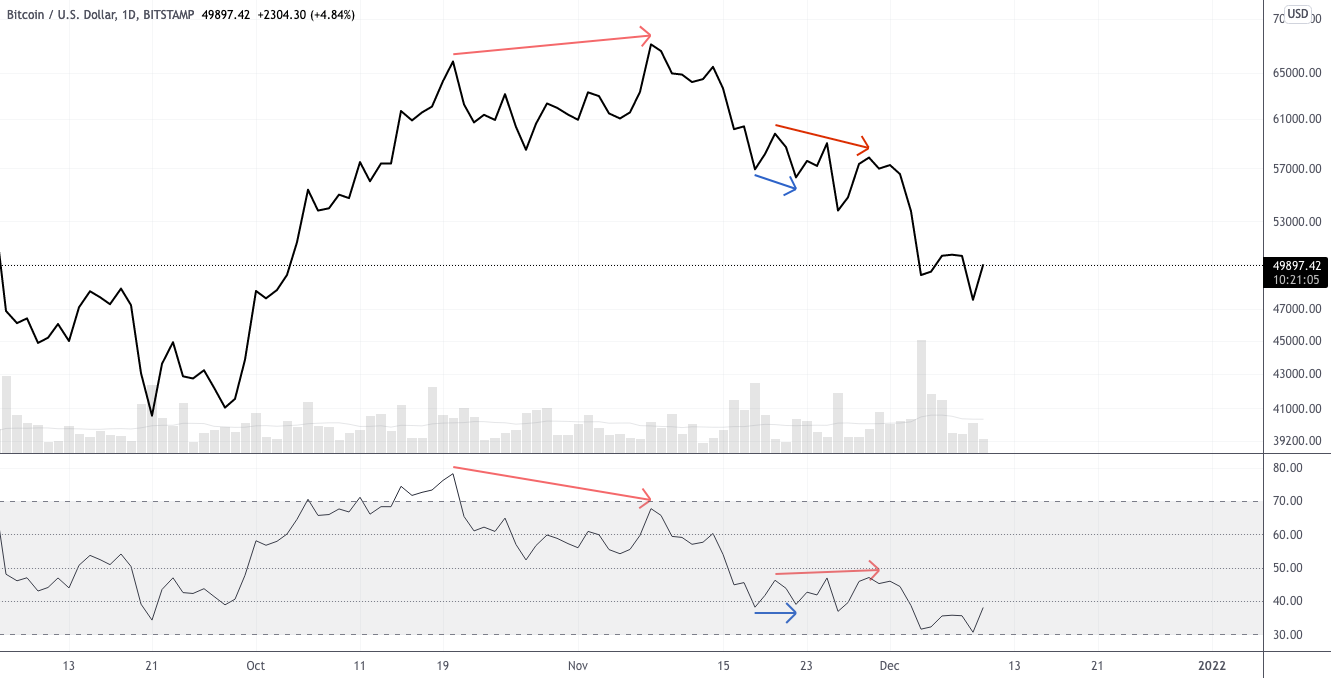

Daily chart

Chart executed in TradingView

Bitcoin tests demand cluster (read“support”, blue horizontal area) after breaking through it in the fall at the end of last week. The price is still trading above the 200 MA while the 50 MA is falling aggressively, which looks bearish in the short term. The chart highlights a fairly wide area between $42k and $39.6k or so. This is an important support area that has been home to local price highs and lows for a long time. If the market continues to decline, this will be a really key area. A fall below it would mean the formation of a smaller low (= a break in the bullish market structure), which would be highly undesirable.

Chart executed in TradingView

The close of yesterday was actually the mostlow in this correction as the lower wick was bought out last week and the daily candle closed higher. This happened with no apparent potential for bullish divergence as the RSI had already formed a smaller low. And the RSI is still not “oversold” on the daily timeframe, which would be nice to finally see, because after that, within my system, one could start looking for potential bullish divergences and look closely at the formation of a reversal.

That's all for today, the next update is on Monday.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.