Bitcoin rallied a bit over the weekend, but in my opinion, the price chart still looksI'm pretty weak.I still expect to see some bullish divergence, which could form in case of further decline.

Weekly schedule

Chart executed in TradingView

Unsightly bearish weekly candlecovering an entire month of price action. I am still waiting for a likely test of the $53k area as a key support that has not been tested so far. I highlighted a structure on the chart that was formed several months ago. It started with a similar weekly candle, followed by several weeks of declines before the bullish trend was resumed. Not that there is any reason to believe that this should happen again; It’s just that the initial candles are so similar that I decided to pay attention to what the development of a similar situation looked like in the recent past.

I am still inclined to believe that the level$53 thousand will be tested, which almost inevitably leads to the idea of a possible “wick” that will go significantly lower and could seriously frighten some part of the market. There are no guarantees that everything will happen exactly like this, I just think that the last weekly candle significantly increases this probability.

Daily chart

Chart executed in TradingView

Bitcoin still holds support at$56.4 thousand, but the situation looks precarious. Comparatively larger trading volume candles have recently been dominated by selling rather than buying. A break down of the 50MA looks like an important story. The price has been above it since October 1 and is now trading below it. The market also tested the breakout level as resistance. The last time this happened, Bitcoin was trading below the 50-day MA for several weeks. For many traders, the first sign of a reversal will be when it turns back into support.

RSI on the daily chart (did not show it here) has not yet reached the "oversold" zone, which will inevitably happen at some point.

Chart executed in TradingView

As a result of a hard reversal of the band priceThe Bollinger Bands seem to have begun to expand downward, and the price is following the lower border of the indicator, contrary to what could have been considered a more likely continuation until recently. These dynamics are noteworthy. To confirm the return to growth, we want to see the price exit from the lower band and consolidate it above the middle line.

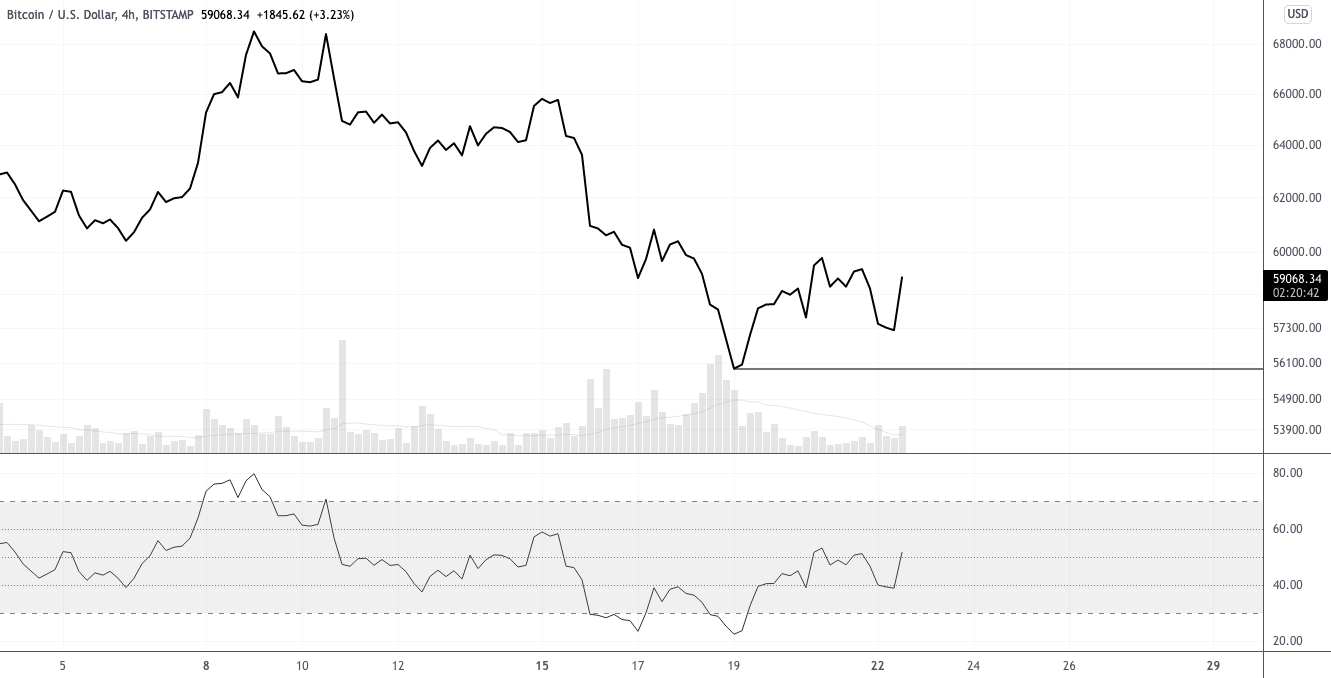

4-hour chart

Chart executed in TradingView

As you can see, the RSI for recent price movementshas risen, so any fall below $55.9k will likely be accompanied by the formation of a bullish divergence with the RSI originating from the “overbought” zone. The potential for such a setup can, in fact, be observed on any timeframe from the daily and below, albeit with different minimums for confirmation.

I still expect a slightly larger price decline to form these divergences, which could potentially be an excellent reversal signal and fuel for upward momentum.

Traditional Markets

AAPL (Apple)

Chart executed in TradingView

Apple's price over the past few monthsformed several setups, and they all worked great. Now the AAPL has entered new pricing territories again, breaking through the $ 157.26 resistance and testing it as support. This means new highs.

By the way, this is a great example of how the KISS rule works.(Keep It Stupidly Simple), which is best not to forget about when trading the markets. I see Apple as a long-term investment and use every opportunity to strengthen my position.

Buy the declines when and if you get the opportunity, and don't lose sight of the long term.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.